Wazua

»

Investor

»

Stocks

»

Potential merger NIC + CBA

Rank: Veteran Joined: 8/30/2007 Posts: 1,558 Location: Nairobi

|

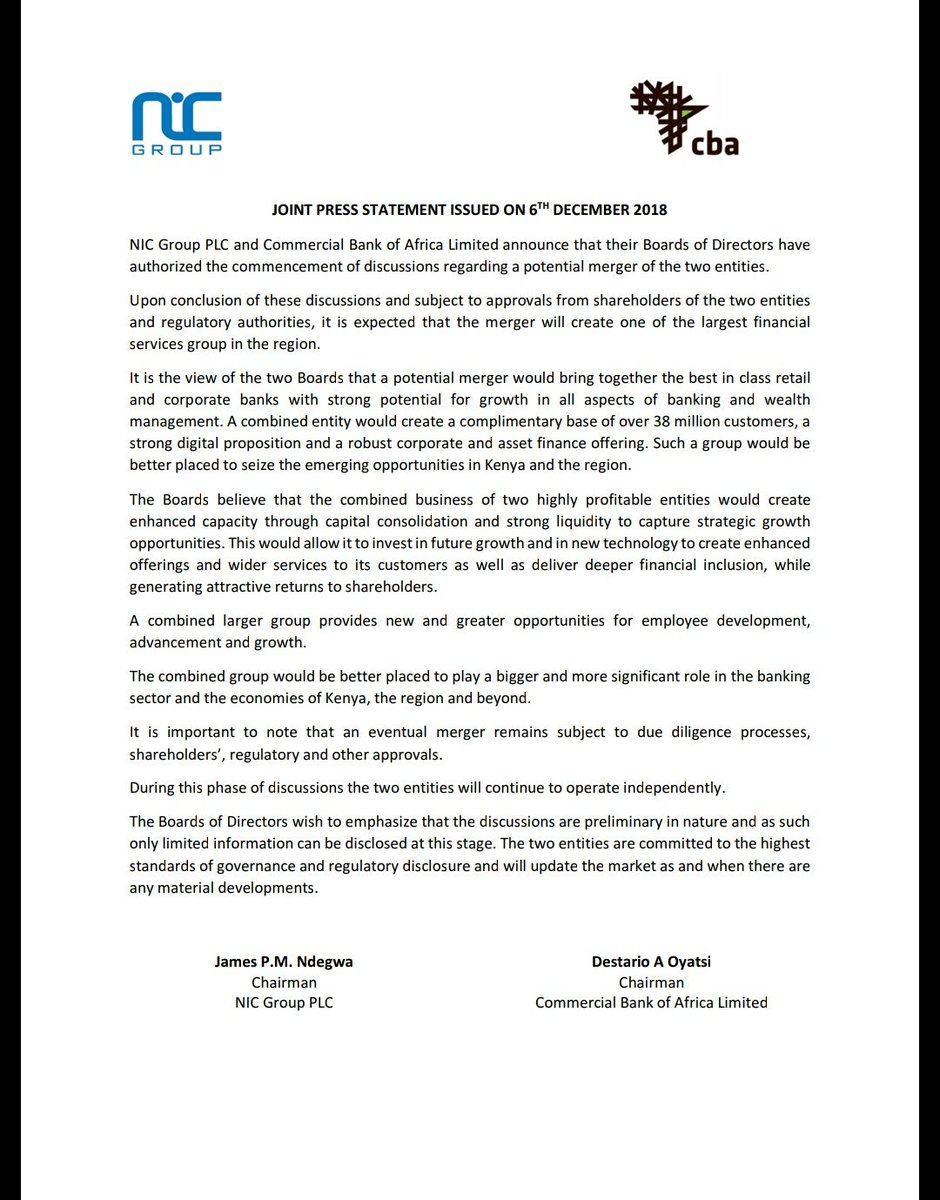

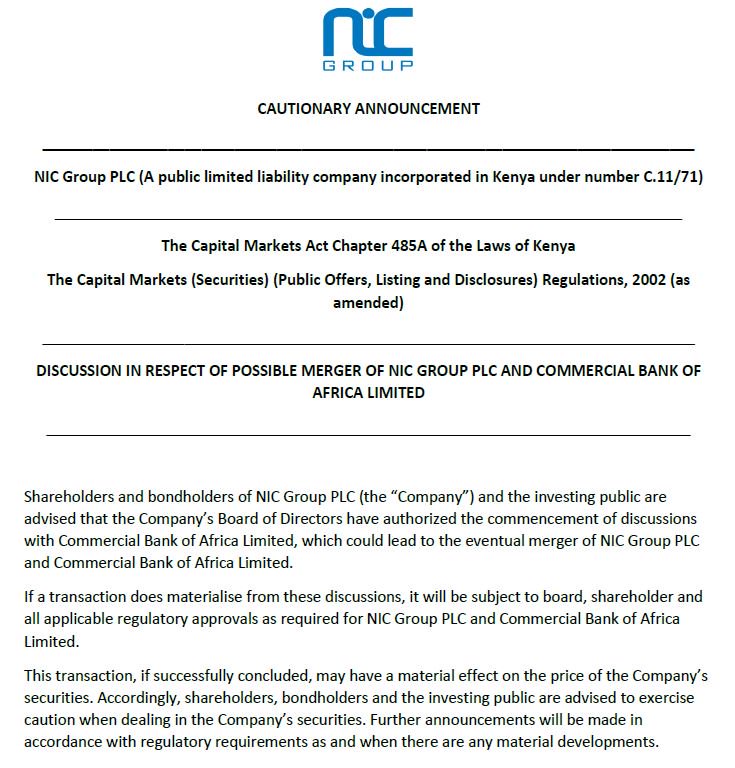

Just received a PDF talking about a potential merger between CBA & NIC it’s like a press statement

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Horton wrote:Just received a PDF talking about a potential merger between CBA & NIC it’s like a press statement Does that mean NIC will be de-listed? "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

murchr wrote:Horton wrote:Just received a PDF talking about a potential merger between CBA & NIC it’s like a press statement Does that mean NIC will be de-listed? I would say the other way round, CBA will be listed. Reverse listing

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

mwekez@ji wrote:murchr wrote:Horton wrote:Just received a PDF talking about a potential merger between CBA & NIC it’s like a press statement Does that mean NIC will be de-listed? I would say the other way round, CBA will be listed. Reverse listing So existing NIC shareholders own CBA? So how does that work? Asking from a very layman position. "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Member Joined: 4/21/2015 Posts: 151

|

murchr wrote:mwekez@ji wrote:murchr wrote:Horton wrote:Just received a PDF talking about a potential merger between CBA & NIC it’s like a press statement Does that mean NIC will be de-listed? I would say the other way round, CBA will be listed. Reverse listing So existing NIC shareholders own CBA? So how does that work? Asking from a very layman position. Kweli lisemwalo Lipo kama halipo laja...this was a rumour sometimes back.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Here is the doc   "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Veteran Joined: 8/30/2007 Posts: 1,558 Location: Nairobi

|

Seems like these 2 have been dating for a while 😆😆😆 Jan 2015 apparently https://businesstoday.co...and-nic-in-merger-talks/

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

murchr wrote:mwekez@ji wrote:murchr wrote:Horton wrote:Just received a PDF talking about a potential merger between CBA & NIC it’s like a press statement Does that mean NIC will be de-listed? I would say the other way round, CBA will be listed. Reverse listing So existing NIC shareholders own CBA? So how does that work? Asking from a very layman position. There will be a ratio of how shareholders of NIC will get ownership of CBA. The merger is similar to the cfc and Stanbic merger Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,164 Location: nairobi

|

Ericsson wrote:murchr wrote:mwekez@ji wrote:murchr wrote:Horton wrote:Just received a PDF talking about a potential merger between CBA & NIC it’s like a press statement Does that mean NIC will be de-listed? I would say the other way round, CBA will be listed. Reverse listing So existing NIC shareholders own CBA? So how does that work? Asking from a very layman position. There will be a ratio of how shareholders of NIC will get ownership of CBA. The merger is similar to the cfc and Stanbic merger Of course the buyer in this case is CBA and not the reverse

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,164 Location: nairobi

|

murchr wrote:Horton wrote:Just received a PDF talking about a potential merger between CBA & NIC it’s like a press statement Does that mean NIC will be de-listed? Yes. Its more than likely considering trends of other Kenyatta family enterprise

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,931

|

Poor Cytonn, poor networks sold at the wrong time. Cc class 5 dropout thinking!!! In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

obiero wrote:murchr wrote:Horton wrote:Just received a PDF talking about a potential merger between CBA & NIC it’s like a press statement Does that mean NIC will be de-listed? Yes. Its more than likely considering trends of other Kenyatta family enterprise This is a reverse meeger. An easy way for CBA to become listed. Just like CFC-Stanbic and IM-City Trust. Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,164 Location: nairobi

|

Angelica _ann wrote:Poor Cytonn, poor networks sold at the wrong time. Cc class 5 dropout thinking!!! Very bad timing but it's not over until it's over..

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,164 Location: nairobi

|

sparkly wrote:obiero wrote:murchr wrote:Horton wrote:Just received a PDF talking about a potential merger between CBA & NIC it’s like a press statement Does that mean NIC will be de-listed? Yes. Its more than likely considering trends of other Kenyatta family enterprise This is a reverse meeger. An easy way for CBA to become listed. Just like CFC-Stanbic and IM-City Trust. In those examples you mention, both partner firms were listed already before the merger.. Secondly, name only one Kenyatta family company which is at the NSE.. It's not by coincidence, but choice, for well known reasons

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

The merged entity will be third largest in terms of assets and 4th in terms of profitability as per 2018 Q3 results Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,164 Location: nairobi

|

Ericsson wrote:The merged entity will be third largest in terms of assets and 4th in terms of profitability as per 2018 Q3 results Largest in terms of customer count

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2008 Posts: 2,719

|

These are people who are thinking about wealth preservation for the next 100 years.

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

Kusadikika wrote:These are people who are thinking about wealth preservation for the next 100 years. You saw the recent volumes but didn't smell something. "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

mlennyma wrote:Kusadikika wrote:These are people who are thinking about wealth preservation for the next 100 years. You saw the recent volumes but didn't smell something. But the share price was falling Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

mlennyma wrote:Kusadikika wrote:These are people who are thinking about wealth preservation for the next 100 years. You saw the recent volumes but didn't smell something. Isn't such record volume a clue to insider trading? John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Wazua

»

Investor

»

Stocks

»

Potential merger NIC + CBA

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|