Wazua

»

Investor

»

Stocks

»

Centum half year results 2017/2018

Rank: Veteran Joined: 7/1/2014 Posts: 927 Location: sky

|

Total assets under this period have grown to KES 61.6 Bn as at 31 March 2017 to KES 62.5 Bn as at 30 Sep 2017 Our long term debt position has decreased by over KES 2Bn, with our long term debt at KES 11.1Bn as at HY 2018 The Company's total assets grew by 2% during this period,closing at KES 62.5bn while the Net Asset Value (NAV) per share increased to KES 69.7.

72% of the Gross Lettable Area (GLA) of @TwoRivers_KE is currently let, with 9% under negotiation. The target is to close December 2017 at 85% let

Full results link https://view.publitas.co...nded-30-september-2017/

There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,800 Location: NAIROBI

|

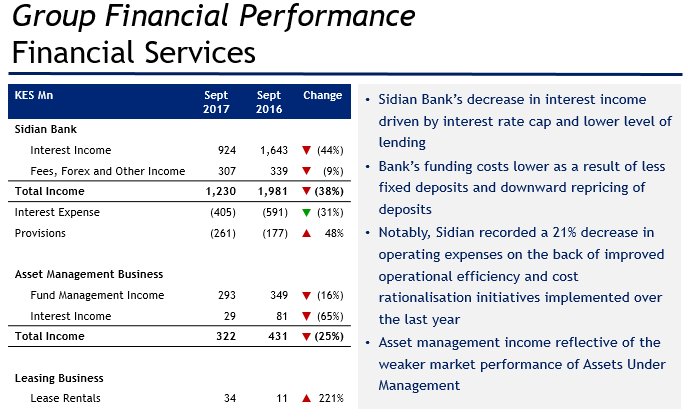

Centum reports 21% decline in Net Profit mainly attributed to the poor performance of its banking unit (Sidian) Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 9/15/2006 Posts: 3,907

|

Interesting arguments @Ericsson, but arguments nevertheless

|

|

|

Rank: Elder Joined: 5/25/2012 Posts: 4,105 Location: 08c

|

Pesa Nane plans to be shilingi when he grows up.

|

|

|

Rank: Elder Joined: 5/25/2012 Posts: 4,105 Location: 08c

|

Pesa Nane plans to be shilingi when he grows up.

|

|

|

Rank: Elder Joined: 5/25/2012 Posts: 4,105 Location: 08c

|

serikali saidia sidian  Pesa Nane plans to be shilingi when he grows up.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,103 Location: nairobi

|

littledove wrote: Total assets under this period have grown to KES 61.6 Bn as at 31 March 2017 to KES 62.5 Bn as at 30 Sep 2017 Our long term debt position has decreased by over KES 2Bn, with our long term debt at KES 11.1Bn as at HY 2018 The Company's total assets grew by 2% during this period,closing at KES 62.5bn while the Net Asset Value (NAV) per share increased to KES 69.7.

72% of the Gross Lettable Area (GLA) of @TwoRivers_KE is currently let, with 9% under negotiation. The target is to close December 2017 at 85% let

Full results link https://view.publitas.co...nded-30-september-2017/

Bad signs..

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,930

|

Who is the driver of this mbus? In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,800 Location: NAIROBI

|

Angelica _ann wrote:Who is the driver of this mbus? Haina driver hapa Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 927 Location: sky

|

Ericsson wrote:Angelica _ann wrote:Who is the driver of this mbus? Haina driver hapa last bull season it had many drivers, kwani they all left? Its been attracting foreign inflows for many weeks now.i believe market share price will catch up with nav per share There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Veteran Joined: 8/10/2014 Posts: 992 Location: Kenya

|

obiero wrote:littledove wrote: Total assets under this period have grown to KES 61.6 Bn as at 31 March 2017 to KES 62.5 Bn as at 30 Sep 2017 Our long term debt position has decreased by over KES 2Bn, with our long term debt at KES 11.1Bn as at HY 2018 The Company's total assets grew by 2% during this period,closing at KES 62.5bn while the Net Asset Value (NAV) per share increased to KES 69.7.

72% of the Gross Lettable Area (GLA) of @TwoRivers_KE is currently let, with 9% under negotiation. The target is to close December 2017 at 85% let

Full results link https://view.publitas.co...nded-30-september-2017/

Bad signs.. Its just the top floors that are still empty....nothing attractive upstairs yet. The mall is huge though and it opened in an election year so uptake was bound to be slow. From my observation, foot traffic is great so far considering its targeting middle and upper class individuals

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,800 Location: NAIROBI

|

Sidian bank interest income declined by sh.980mn from sh.2.63bn to 1.65bn;a 37% decline. Centum has abandoned buying 14,000 acres of land in Uganda citing disagreements with the vendor Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,103 Location: nairobi

|

watesh wrote:obiero wrote:littledove wrote: Total assets under this period have grown to KES 61.6 Bn as at 31 March 2017 to KES 62.5 Bn as at 30 Sep 2017 Our long term debt position has decreased by over KES 2Bn, with our long term debt at KES 11.1Bn as at HY 2018 The Company's total assets grew by 2% during this period,closing at KES 62.5bn while the Net Asset Value (NAV) per share increased to KES 69.7.

72% of the Gross Lettable Area (GLA) of @TwoRivers_KE is currently let, with 9% under negotiation. The target is to close December 2017 at 85% let

Full results link https://view.publitas.co...nded-30-september-2017/

Bad signs.. Its just the top floors that are still empty....nothing attractive upstairs yet. The mall is huge though and it opened in an election year so uptake was bound to be slow. From my observation, foot traffic is great so far considering its targeting middle and upper class individuals Foot traffic and purchases are two different things

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

obiero wrote:watesh wrote:obiero wrote:littledove wrote: Total assets under this period have grown to KES 61.6 Bn as at 31 March 2017 to KES 62.5 Bn as at 30 Sep 2017 Our long term debt position has decreased by over KES 2Bn, with our long term debt at KES 11.1Bn as at HY 2018 The Company's total assets grew by 2% during this period,closing at KES 62.5bn while the Net Asset Value (NAV) per share increased to KES 69.7.

72% of the Gross Lettable Area (GLA) of @TwoRivers_KE is currently let, with 9% under negotiation. The target is to close December 2017 at 85% let

Full results link https://view.publitas.co...nded-30-september-2017/

Bad signs.. Its just the top floors that are still empty....nothing attractive upstairs yet. The mall is huge though and it opened in an election year so uptake was bound to be slow. From my observation, foot traffic is great so far considering its targeting middle and upper class individuals Foot traffic and purchases are two different things Spot on... possunt quia posse videntur

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,800 Location: NAIROBI

|

Ericsson wrote:Sidian bank interest income declined by sh.980mn from sh.2.63bn to 1.65bn;a 37% decline.

Centum has abandoned buying 14,000 acres of land in Uganda citing disagreements with the vendor http://www.businessdaily...07200-xb5du9z/index.htmlWealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Member Joined: 12/17/2007 Posts: 53

|

Ericsson wrote:[quote=Ericsson]Sidian bank interest income declined by sh.980mn from sh.2.63bn to 1.65bn;a 37% decline.

Centum has abandoned buying 14,000 acres of land in Uganda citing disagreements with the vendor http://www.businessdaily...7200-xb5du9z/index.html[/quote] Anyone with sidian Q3 results... Saidia, hapo ndio mchezo iko this time round. The fall guys. UG AG is a board member in centum, couldn't pull the Strings he was brought on board to pull. Environment CS sister (extremely qualified I must say) but brought on to make coal great again

|

|

|

Rank: Veteran Joined: 8/10/2014 Posts: 992 Location: Kenya

|

obiero wrote:watesh wrote:obiero wrote:littledove wrote: Total assets under this period have grown to KES 61.6 Bn as at 31 March 2017 to KES 62.5 Bn as at 30 Sep 2017 Our long term debt position has decreased by over KES 2Bn, with our long term debt at KES 11.1Bn as at HY 2018 The Company's total assets grew by 2% during this period,closing at KES 62.5bn while the Net Asset Value (NAV) per share increased to KES 69.7.

72% of the Gross Lettable Area (GLA) of @TwoRivers_KE is currently let, with 9% under negotiation. The target is to close December 2017 at 85% let

Full results link https://view.publitas.co...nded-30-september-2017/

Bad signs.. Its just the top floors that are still empty....nothing attractive upstairs yet. The mall is huge though and it opened in an election year so uptake was bound to be slow. From my observation, foot traffic is great so far considering its targeting middle and upper class individuals Foot traffic and purchases are two different things From my observations, anchor tenants such as LC Waikiki and Carrefour are enjoying splending sales. Restaurants such as Burger King, The Spur, are usually packed during the weekends. Last time I was there Chicken Inn and Urban Burger were set to be open soon. Magic Planet is way bigger than what we find at The Hub and can accommodate double the number of kids. The upcoming Cinema will definitely attract more clients from around the area who otherwise have to go all the way to Garden City. Carrefour there has waaaay more clients than Game at Garden City and Carrefour The Hub. Weekdays or weekends I always find more people there than any other mall. Upcoming projects such as the Theme Park will differentiate it from other malls if they do it well and not just focus on a kid's theme park but sth for the adults also. So far I think its doing well in less than a year since opening despite it not being near a densely populated area such as Garden City Mall or Thika Road Mall.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,800 Location: NAIROBI

|

watesh wrote:obiero wrote:watesh wrote:obiero wrote:littledove wrote: Total assets under this period have grown to KES 61.6 Bn as at 31 March 2017 to KES 62.5 Bn as at 30 Sep 2017 Our long term debt position has decreased by over KES 2Bn, with our long term debt at KES 11.1Bn as at HY 2018 The Company's total assets grew by 2% during this period,closing at KES 62.5bn while the Net Asset Value (NAV) per share increased to KES 69.7.

72% of the Gross Lettable Area (GLA) of @TwoRivers_KE is currently let, with 9% under negotiation. The target is to close December 2017 at 85% let

Full results link https://view.publitas.co...nded-30-september-2017/

Bad signs.. Its just the top floors that are still empty....nothing attractive upstairs yet. The mall is huge though and it opened in an election year so uptake was bound to be slow. From my observation, foot traffic is great so far considering its targeting middle and upper class individuals Foot traffic and purchases are two different things From my observations, anchor tenants such as LC Waikiki and Carrefour are enjoying splending sales. Restaurants such as Burger King, The Spur, are usually packed during the weekends. Last time I was there Chicken Inn and Urban Burger were set to be open soon. Magic Planet is way bigger than what we find at The Hub and can accommodate double the number of kids. The upcoming Cinema will definitely attract more clients from around the area who otherwise have to go all the way to Garden City. Carrefour there has waaaay more clients than Game at Garden City and Carrefour The Hub. Weekdays or weekends I always find more people there than any other mall. Upcoming projects such as the Theme Park will differentiate it from other malls if they do it well and not just focus on a kid's theme park but sth for the adults also. So far I think its doing well in less than a year since opening despite it not being near a densely populated area such as Garden City Mall or Thika Road Mall. Have you seen the population of Ruaka Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 927 Location: sky

|

The bus is slowly taking off There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 927 Location: sky

|

somebody predicted here - i dont remember in which thread "if jubilee wins buy centum in bucket loads" it seems he had some insight https://www.businessdailyafrica.com/news/Centum-to-lead-Sh25bn-railway-project/539546-4263206-4meqy5z/index.htmlThere are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Wazua

»

Investor

»

Stocks

»

Centum half year results 2017/2018

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|