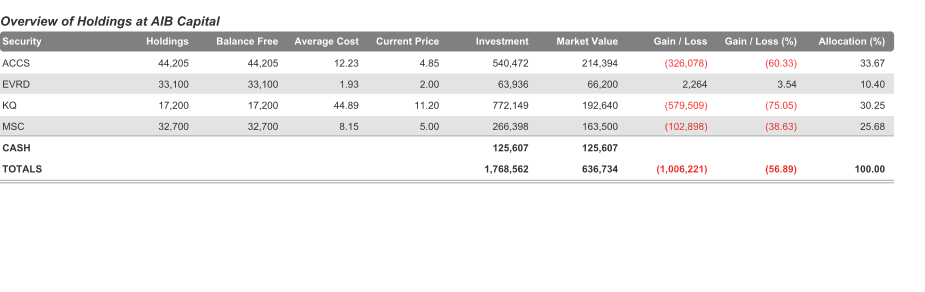

As the new year begins I am setting up a strategy for my portfolio which has gone off during the past 2 years. I have decided that I will only invest in 3 counters therefore I need to drop off one of the 4 or drop 2 and pick up a different one.

http://i1299.photobucket.com/al...iocharts_zps93fd6f07.png

http://i1299.photobucket.com/al...iocharts_zps93fd6f07.pngLooking at my portfolio I feel it is time to divest from Eveready even though I still have confidence that it will be recovering soon, KQ and MSC are definitely good counters into the foreseeable future especially with their good dividend payouts.

I wish I had the emotional strength to sell Access at the current loss position but I do not so my only choice will be to do the thing I did with Eveready, average down.

http://i1299.photobucket.com/al...mentERDY_zps07566b0e.pngWhat is more critical now that I have decided to sell off EVRD is where to put the proceeds;

1. Do I start averaging down ACCS?

2. Do I increase my position in MSC?

3. Do I increase my position in KQ?

4. Do I start diversification and add bonds to my portfolio?

I will deal with access in the second quarter of the year after the elections as well as the investment in bonds, so the only decision now is between 2 & 3.

In the current year I would like to add some fixed income instruments onto my portfolio so as to create a dependable income especially since I am getting closer to retirement.

Therefore it might make more sense to average down ACCS then sell off once it goes positive and use the funds to go into bonds instead of reinvesting in the equities market.

http://i1299.photobucket.com/al...siskqmsc_zpsb8de6bf9.png The graph above has sorted out the issue of which counter to grow as you can see MSC is actually a better buy than KQ. With the planned increase in power production expected and the recently approved increased rate for sell of power to KPLC this situation is likely to persist for a while longer.

MSC has also consistently paid out a dividend over the past number of years a policy I believe the board intends to continue pursuing into the future. The new devolved government is the icing on this cake.

With KRA on the neck of property owners, it seems time for me to sell off those rental units, but with elections round the corner, there is a stronger temptation to pick up more as the prices are very appealing with many looking for elective positions.

In addition, the confusing and alarming KRA messages concerning taxes on rent with the threat of a retrospective application has also increased the supply of rental units up for sale especially in the 3,000/- to 15,000/- per unit rental range of multi-dwelling properties.

As I start the new year all seems rosy and unless we do something stupid on 4th of March the rest should be academic.

Have a prosperous and sensible new year.