Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Rank: Elder Joined: 12/7/2012 Posts: 11,929

|

https://www.capitalfm.co...governance-ranking/amp/

Copy & paste!!! KCB, NSE and Safaricom top corporate governance ranking NAIROBI, Kenya, Oct 15 – KCB Group, Nairobi Securities Exchange (NSE), and Safaricom tied as the Top 3 companies with the best corporate governance practices among listed companies in Kenya in 2018. This is according to the annual Cytonn Corporate Governance Report – 2018, that indicates firms with higher levels of corporate governance, outperformed those with lower levels of corporate governance, by 15 percent when looking at share price performance over the last five years. The ranking is based on 24 metrics that consider different aspects of governance, including board composition, ethnic and gender diversity, board meeting attendance, board independence, remuneration, and overall transparency. KCB Group, NSE and Safaricom all tied at the 1st rank, each having attained a comprehensive score of 85.4 percent, supported by, among others; gender and ethnic diversity in the board composition, a good proportion of independent directors, defined tenures to accommodate rotation, and high level of exposure to of board members to global markets. Other Firms on the top ten best corporate governance practices include DTB Bank at fourth place, Standard Chartered Bank at fifth place, NIC Bank, Kenya Power, BAT Kenya, East African Breweries, Liberty and Jubilee Holdings. The most improved firm in the ranking was Limuru Tea, with a comprehensive score of 41.7 percent, ranking them at Position 46, from a score of 16.7 percent and Position 49 in the 2017 Report due to increase of board members to an odd number, introduction of a female board member, and better disclosure on board member details, work experience, and remuneration. The biggest decliner was ARM Cement, which recorded a decline to a comprehensive score of 58.3 percent, ranking them at Position 42, due to lack correlation between remuneration and earnings, a high shareholding level at the board, and evenness of the board. “The top 24 companies in the Cytonn Corporate Governance Report (CGR) have delivered an absolute return of approximately 2.1 percent over the last 5-years compared to the bottom 23 companies, which have delivered an absolute return of (13 percent) over the last 5-years, meaning that the advantage to better governance delivered 15.1 percent better returns to shareholders,” the report notes. Compared to last year’s ranking, there was an overall improvement in the comprehensive score, board attendance, proportion of non-executive directors as well as ethnic diversity in the 47 listed companies in the report “Corporate governance reporting standards continue to improve in the country. Earlier in the year, the Capital Markets Authority’s Code of Corporate Governance practices came into full effect and we have witnessed compliance as companies adopted the provisions of the code in their annual reports for the financial year 2017,” the report indicates. The survey was conducted on 47 companies listed on the Nairobi Securities Exchange with a market capitalization in excess of Sh1. billion. In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,064 Location: nairobi

|

Angelica _ann wrote:https://www.capitalfm.co...governance-ranking/amp/

Copy & paste!!! KCB, NSE and Safaricom top corporate governance ranking NAIROBI, Kenya, Oct 15 – KCB Group, Nairobi Securities Exchange (NSE), and Safaricom tied as the Top 3 companies with the best corporate governance practices among listed companies in Kenya in 2018. This is according to the annual Cytonn Corporate Governance Report – 2018, that indicates firms with higher levels of corporate governance, outperformed those with lower levels of corporate governance, by 15 percent when looking at share price performance over the last five years. The ranking is based on 24 metrics that consider different aspects of governance, including board composition, ethnic and gender diversity, board meeting attendance, board independence, remuneration, and overall transparency. KCB Group, NSE and Safaricom all tied at the 1st rank, each having attained a comprehensive score of 85.4 percent, supported by, among others; gender and ethnic diversity in the board composition, a good proportion of independent directors, defined tenures to accommodate rotation, and high level of exposure to of board members to global markets. Other Firms on the top ten best corporate governance practices include DTB Bank at fourth place, Standard Chartered Bank at fifth place, NIC Bank, Kenya Power, BAT Kenya, East African Breweries, Liberty and Jubilee Holdings. The most improved firm in the ranking was Limuru Tea, with a comprehensive score of 41.7 percent, ranking them at Position 46, from a score of 16.7 percent and Position 49 in the 2017 Report due to increase of board members to an odd number, introduction of a female board member, and better disclosure on board member details, work experience, and remuneration. The biggest decliner was ARM Cement, which recorded a decline to a comprehensive score of 58.3 percent, ranking them at Position 42, due to lack correlation between remuneration and earnings, a high shareholding level at the board, and evenness of the board. “The top 24 companies in the Cytonn Corporate Governance Report (CGR) have delivered an absolute return of approximately 2.1 percent over the last 5-years compared to the bottom 23 companies, which have delivered an absolute return of (13 percent) over the last 5-years, meaning that the advantage to better governance delivered 15.1 percent better returns to shareholders,” the report notes. Compared to last year’s ranking, there was an overall improvement in the comprehensive score, board attendance, proportion of non-executive directors as well as ethnic diversity in the 47 listed companies in the report “Corporate governance reporting standards continue to improve in the country. Earlier in the year, the Capital Markets Authority’s Code of Corporate Governance practices came into full effect and we have witnessed compliance as companies adopted the provisions of the code in their annual reports for the financial year 2017,” the report indicates. The survey was conducted on 47 companies listed on the Nairobi Securities Exchange with a market capitalization in excess of Sh1. billion. I stopped reading when I got to Kenya Power

KQ ABP 4.26

|

|

|

Rank: Veteran Joined: 11/14/2006 Posts: 1,311

|

obiero wrote:Angelica _ann wrote:https://www.capitalfm.co...governance-ranking/amp/

Copy & paste!!! KCB, NSE and Safaricom top corporate governance ranking NAIROBI, Kenya, Oct 15 – KCB Group, Nairobi Securities Exchange (NSE), and Safaricom tied as the Top 3 companies with the best corporate governance practices among listed companies in Kenya in 2018. This is according to the annual Cytonn Corporate Governance Report – 2018, that indicates firms with higher levels of corporate governance, outperformed those with lower levels of corporate governance, by 15 percent when looking at share price performance over the last five years. The ranking is based on 24 metrics that consider different aspects of governance, including board composition, ethnic and gender diversity, board meeting attendance, board independence, remuneration, and overall transparency. KCB Group, NSE and Safaricom all tied at the 1st rank, each having attained a comprehensive score of 85.4 percent, supported by, among others; gender and ethnic diversity in the board composition, a good proportion of independent directors, defined tenures to accommodate rotation, and high level of exposure to of board members to global markets. Other Firms on the top ten best corporate governance practices include DTB Bank at fourth place, Standard Chartered Bank at fifth place, NIC Bank, Kenya Power, BAT Kenya, East African Breweries, Liberty and Jubilee Holdings. The most improved firm in the ranking was Limuru Tea, with a comprehensive score of 41.7 percent, ranking them at Position 46, from a score of 16.7 percent and Position 49 in the 2017 Report due to increase of board members to an odd number, introduction of a female board member, and better disclosure on board member details, work experience, and remuneration. The biggest decliner was ARM Cement, which recorded a decline to a comprehensive score of 58.3 percent, ranking them at Position 42, due to lack correlation between remuneration and earnings, a high shareholding level at the board, and evenness of the board. “The top 24 companies in the Cytonn Corporate Governance Report (CGR) have delivered an absolute return of approximately 2.1 percent over the last 5-years compared to the bottom 23 companies, which have delivered an absolute return of (13 percent) over the last 5-years, meaning that the advantage to better governance delivered 15.1 percent better returns to shareholders,” the report notes. Compared to last year’s ranking, there was an overall improvement in the comprehensive score, board attendance, proportion of non-executive directors as well as ethnic diversity in the 47 listed companies in the report “Corporate governance reporting standards continue to improve in the country. Earlier in the year, the Capital Markets Authority’s Code of Corporate Governance practices came into full effect and we have witnessed compliance as companies adopted the provisions of the code in their annual reports for the financial year 2017,” the report indicates. The survey was conducted on 47 companies listed on the Nairobi Securities Exchange with a market capitalization in excess of Sh1. billion. I stopped reading when I got to Kenya Power I stopped reading when I noted it's from Cytonn.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

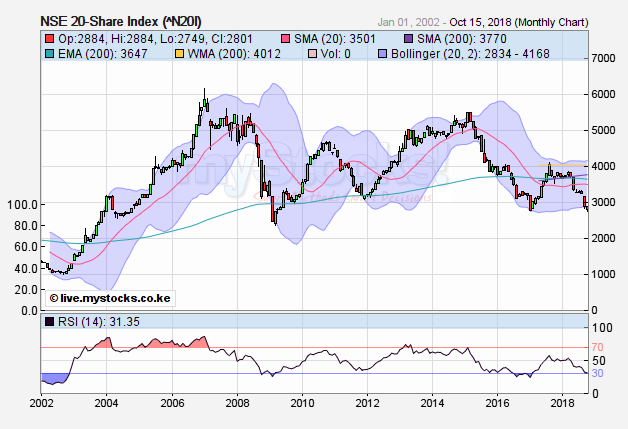

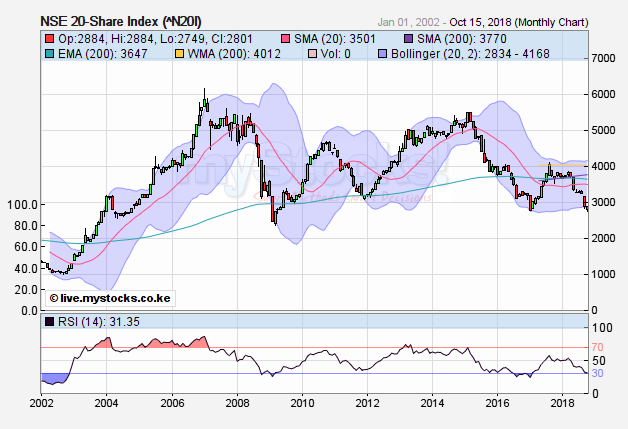

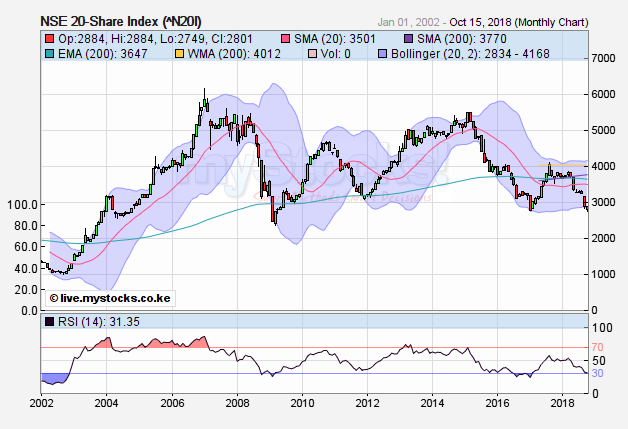

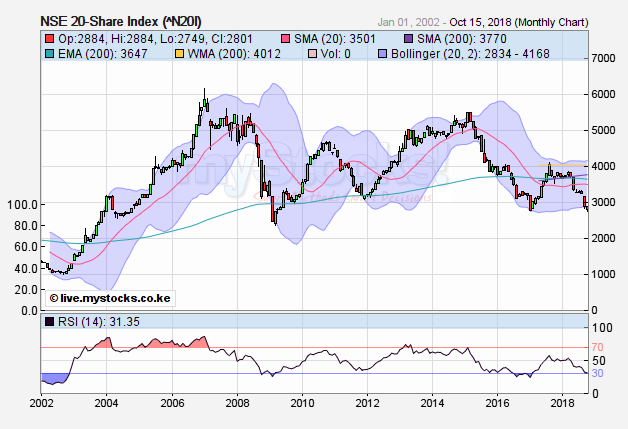

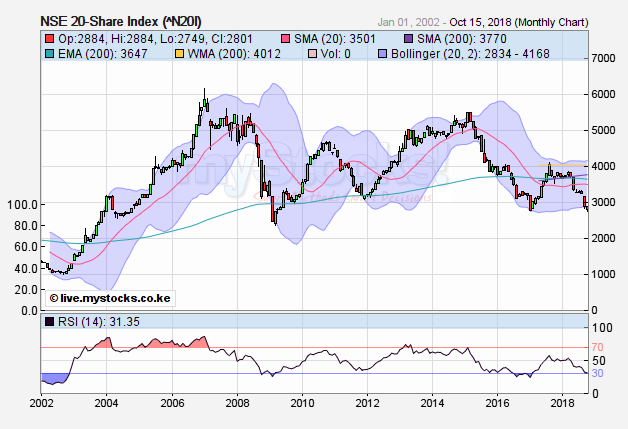

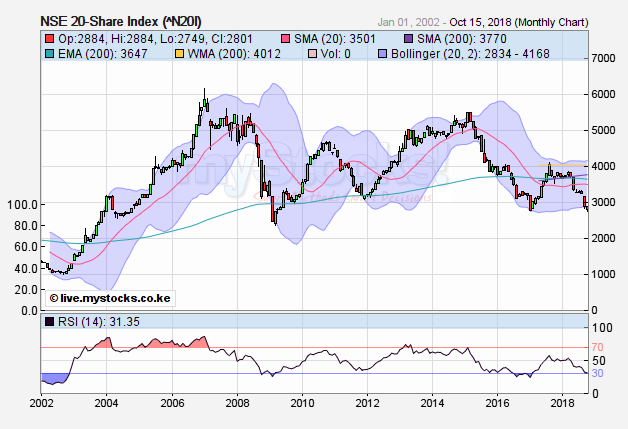

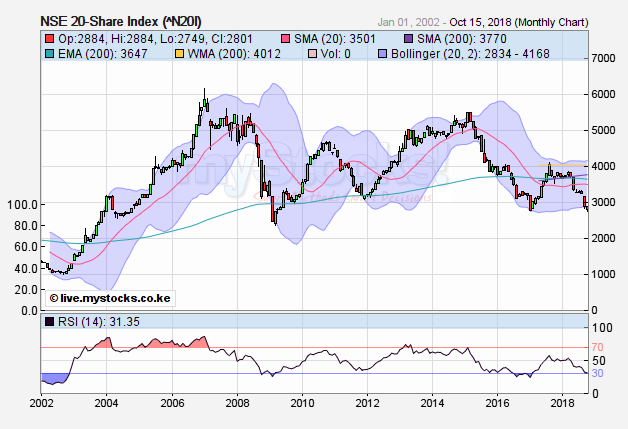

Cde Monomotapa wrote:cnn wrote:Sufficiently Philanga....thropic wrote:Finally the Jan 2017 low has been smashed and we are at levels never seen in this decade. NSE 20 currently at 2783. We were last here twice last decade, in October 2004, when Kibaki was still new in the Presidency, and April 2009 during the GFC. Yes 9 years of gains wiped out of the NSE. What separates us now from the Sept 2002 lows of 1005 is the 2360 GFC low of March 2009......more popcorns please   The GFC lows were a great buying time for some good dividend paying stocks .I have kept BAT since then . Another 15 to 20 percent fall in the indices and some great long term buys should present themselves . Indeed. Agreed. Awesome buy window coming up. However going through the various sentiments expressed here it would appear the majority have already thrown in the towel or are just about to. As earlier intimated the tricky bit this time round won't be in the buying but in the waiting as prices stagnate or continue to tumble. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,064 Location: nairobi

|

lochaz-index wrote:Cde Monomotapa wrote:cnn wrote:Sufficiently Philanga....thropic wrote:Finally the Jan 2017 low has been smashed and we are at levels never seen in this decade. NSE 20 currently at 2783. We were last here twice last decade, in October 2004, when Kibaki was still new in the Presidency, and April 2009 during the GFC. Yes 9 years of gains wiped out of the NSE. What separates us now from the Sept 2002 lows of 1005 is the 2360 GFC low of March 2009......more popcorns please   The GFC lows were a great buying time for some good dividend paying stocks .I have kept BAT since then . Another 15 to 20 percent fall in the indices and some great long term buys should present themselves . Indeed. Agreed. Awesome buy window coming up. However going through the various sentiments expressed here it would appear the majority have already thrown in the towel or are just about to. As earlier intimated the tricky bit this time round won't be in the buying but in the waiting as prices stagnate or continue to tumble. . Kenyan financials are your best bet at the moment. Look at the Q3 numbers coming up shortly

KQ ABP 4.26

|

|

|

Rank: Member Joined: 9/14/2011 Posts: 864 Location: nairobi

|

lochaz-index wrote:Cde Monomotapa wrote:cnn wrote:Sufficiently Philanga....thropic wrote:Finally the Jan 2017 low has been smashed and we are at levels never seen in this decade. NSE 20 currently at 2783. We were last here twice last decade, in October 2004, when Kibaki was still new in the Presidency, and April 2009 during the GFC. Yes 9 years of gains wiped out of the NSE. What separates us now from the Sept 2002 lows of 1005 is the 2360 GFC low of March 2009......more popcorns please   The GFC lows were a great buying time for some good dividend paying stocks .I have kept BAT since then . Another 15 to 20 percent fall in the indices and some great long term buys should present themselves . Indeed. Agreed. Awesome buy window coming up. However going through the various sentiments expressed here it would appear the majority have already thrown in the towel or are just about to. As earlier intimated the tricky bit this time round won't be in the buying but in the waiting as prices stagnate or continue to tumble. Suicide watch!!! My portifolio is 25% and if it goes to more than 50% i think i need to be on suicide watch jameni, how much loss can we take though still paper losses And there are lunatics who think they will be a country to talk about if things continue this way with the 2 at the top

|

|

|

Rank: Member Joined: 4/21/2015 Posts: 151

|

heri wrote:lochaz-index wrote:Cde Monomotapa wrote:cnn wrote:Sufficiently Philanga....thropic wrote:Finally the Jan 2017 low has been smashed and we are at levels never seen in this decade. NSE 20 currently at 2783. We were last here twice last decade, in October 2004, when Kibaki was still new in the Presidency, and April 2009 during the GFC. Yes 9 years of gains wiped out of the NSE. What separates us now from the Sept 2002 lows of 1005 is the 2360 GFC low of March 2009......more popcorns please   The GFC lows were a great buying time for some good dividend paying stocks .I have kept BAT since then . Another 15 to 20 percent fall in the indices and some great long term buys should present themselves . Indeed. Agreed. Awesome buy window coming up. However going through the various sentiments expressed here it would appear the majority have already thrown in the towel or are just about to. As earlier intimated the tricky bit this time round won't be in the buying but in the waiting as prices stagnate or continue to tumble. Suicide watch!!! My portifolio is 25% and if it goes to more than 50% i think i need to be on suicide watch jameni, how much loss can we take though still paper losses And there are lunatics who think they will be a country to talk about if things continue this way with the 2 at the top Those who get angry enough are getting listened to. The maize farmers, SME's, sijui who is next.The two believe in kutendea wanaosema shida zao.

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

AndyC wrote:heri wrote:lochaz-index wrote:Cde Monomotapa wrote:cnn wrote:Sufficiently Philanga....thropic wrote:Finally the Jan 2017 low has been smashed and we are at levels never seen in this decade. NSE 20 currently at 2783. We were last here twice last decade, in October 2004, when Kibaki was still new in the Presidency, and April 2009 during the GFC. Yes 9 years of gains wiped out of the NSE. What separates us now from the Sept 2002 lows of 1005 is the 2360 GFC low of March 2009......more popcorns please   The GFC lows were a great buying time for some good dividend paying stocks .I have kept BAT since then . Another 15 to 20 percent fall in the indices and some great long term buys should present themselves . Indeed. Agreed. Awesome buy window coming up. However going through the various sentiments expressed here it would appear the majority have already thrown in the towel or are just about to. As earlier intimated the tricky bit this time round won't be in the buying but in the waiting as prices stagnate or continue to tumble. Suicide watch!!! My portifolio is 25% and if it goes to more than 50% i think i need to be on suicide watch jameni, how much loss can we take though still paper losses And there are lunatics who think they will be a country to talk about if things continue this way with the 2 at the top Those who get angry enough are getting listened to. The maize farmers, SME's, sijui who is next.The two believe in kutendea wanaosema shida zao. If you can't fix what measures your economic performance what are you for? "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Kenya made the biggest mistake electing those 2 fellows..... possunt quia posse videntur

|

|

|

Rank: Elder Joined: 1/8/2018 Posts: 2,212 Location: DC (Dustbowl County)

|

Kenyans just like to

cry cry cry

Wail wail wail

Ngweeh ngweeh ngweeh

About any and everything

Economy red hot at 6.3% last quarter, 5%+ for the previous 16 years

SGR huyooooo mpaka Naivasha by Madaraka day.. clean and spanking new with double stack Sasa.

Stima nywee to every village and public school over the past 6 years

Masomo freeeeee mpaka secondary

Title deeds hizooooo even in ticking time bombs like Embakasi caused by the two chaps who lived in the back room of their bars

Transmission lines hizoooo Lolongyani, Ethiopia, Suswa to Msa and much more

Barabara hizoooooo falling on Kenya like elephant dung

Corruption hiyooo big boys are heading to kamiti like flies

Jameni what more do you fellows want?

|

|

|

Rank: New-farer Joined: 5/19/2014 Posts: 68 Location: Migori

|

I could use your kind of optimism. But a good number of respected economists are pointing to doom and gloom. Or do listen to David Ndii and the likes too much Learning to sit on my hands

|

|

|

Rank: Member Joined: 2/20/2015 Posts: 468 Location: Nairobi

|

MugundaMan wrote:Kenyans just like to

cry cry cry

Wail wail wail

Ngweeh ngweeh ngweeh

About any and everything

Economy red hot at 6.3% last quarter, 5%+ for the previous 16 years

SGR huyooooo mpaka Naivasha by Madaraka day.. clean and spanking new with double stack Sasa.

Stima nywee to every village and public school over the past 6 years

Masomo freeeeee mpaka secondary

Title deeds hizooooo even in ticking time bombs like Embakasi caused by the two chaps who lived in the back room of their bars

Transmission lines hizoooo Lolongyani, Ethiopia, Suswa to Msa and much more

Barabara hizoooooo falling on Kenya like elephant dung

Corruption hiyooo big boys are heading to kamiti like flies

Jameni what more do you fellows want?

I used to think 'Utopia' was a country just like Ethiopia

|

|

|

Rank: New-farer Joined: 5/19/2014 Posts: 68 Location: Migori

|

heri wrote:lochaz-index wrote:Cde Monomotapa wrote:cnn wrote:Sufficiently Philanga....thropic wrote:Finally the Jan 2017 low has been smashed and we are at levels never seen in this decade. NSE 20 currently at 2783. We were last here twice last decade, in October 2004, when Kibaki was still new in the Presidency, and April 2009 during the GFC. Yes 9 years of gains wiped out of the NSE. What separates us now from the Sept 2002 lows of 1005 is the 2360 GFC low of March 2009......more popcorns please   The GFC lows were a great buying time for some good dividend paying stocks .I have kept BAT since then . Another 15 to 20 percent fall in the indices and some great long term buys should present themselves . Indeed. Agreed. Awesome buy window coming up. However going through the various sentiments expressed here it would appear the majority have already thrown in the towel or are just about to. As earlier intimated the tricky bit this time round won't be in the buying but in the waiting as prices stagnate or continue to tumble. Suicide watch!!! My portifolio is 25% and if it goes to more than 50% i think i need to be on suicide watch jameni, how much loss can we take though still paper losses And there are lunatics who think they will be a country to talk about if things continue this way with the 2 at the top At times like this the best you can do is buy more to lower ABP. But pesa imekosekana pia. 20% DOWN. Tuko Pamoja Learning to sit on my hands

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

ombaalbt wrote:heri wrote:lochaz-index wrote:Cde Monomotapa wrote:cnn wrote:Sufficiently Philanga....thropic wrote:Finally the Jan 2017 low has been smashed and we are at levels never seen in this decade. NSE 20 currently at 2783. We were last here twice last decade, in October 2004, when Kibaki was still new in the Presidency, and April 2009 during the GFC. Yes 9 years of gains wiped out of the NSE. What separates us now from the Sept 2002 lows of 1005 is the 2360 GFC low of March 2009......more popcorns please   The GFC lows were a great buying time for some good dividend paying stocks .I have kept BAT since then . Another 15 to 20 percent fall in the indices and some great long term buys should present themselves . Indeed. Agreed. Awesome buy window coming up. However going through the various sentiments expressed here it would appear the majority have already thrown in the towel or are just about to. As earlier intimated the tricky bit this time round won't be in the buying but in the waiting as prices stagnate or continue to tumble. Suicide watch!!! My portifolio is 25% and if it goes to more than 50% i think i need to be on suicide watch jameni, how much loss can we take though still paper losses And there are lunatics who think they will be a country to talk about if things continue this way with the 2 at the top At times like this the best you can do is buy more to lower ABP. But pesa imekosekana pia. 20% DOWN. Tuko Pamoja You are doing well, if anything you have beaten the market. And the best you can is to beat it even more averaging down not on a single position but averaging down your overall portfolio(diversification) ,Behold, a sower went forth to sow;....

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,293 Location: Nairobi

|

How has all this been financed? MugundaMan wrote:Kenyans just like to

cry cry cry

Wail wail wail

Ngweeh ngweeh ngweeh

About any and everything

Economy red hot at 6.3% last quarter, 5%+ for the previous 16 years

SGR huyooooo mpaka Naivasha by Madaraka day.. clean and spanking new with double stack Sasa.

Stima nywee to every village and public school over the past 6 years

Masomo freeeeee mpaka secondary

Title deeds hizooooo even in ticking time bombs like Embakasi caused by the two chaps who lived in the back room of their bars

Transmission lines hizoooo Lolongyani, Ethiopia, Suswa to Msa and much more

Barabara hizoooooo falling on Kenya like elephant dung

Corruption hiyooo big boys are heading to kamiti like flies

Jameni what more do you fellows want?

Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

MugundaMan wrote:Kenyans just like to

cry cry cry

Wail wail wail

Ngweeh ngweeh ngweeh

About any and everything

Economy red hot at 6.3% last quarter, 5%+ for the previous 16 years

SGR huyooooo mpaka Naivasha by Madaraka day.. clean and spanking new with double stack Sasa.

Stima nywee to every village and public school over the past 6 years

Masomo freeeeee mpaka secondary

Title deeds hizooooo even in ticking time bombs like Embakasi caused by the two chaps who lived in the back room of their bars

Transmission lines hizoooo Lolongyani, Ethiopia, Suswa to Msa and much more

Barabara hizoooooo falling on Kenya like elephant dung

Corruption hiyooo big boys are heading to kamiti like flies

Jameni what more do you fellows want?

Fiddling while Kenya is burning.... possunt quia posse videntur

|

|

|

Rank: Elder Joined: 1/8/2018 Posts: 2,212 Location: DC (Dustbowl County)

|

ombaalbt wrote:I could use your kind of optimism. But a good number of respected economists are pointing to doom and gloom. Or do listen to David Ndii and the likes too much Ndii is a big joker and a puppet of his masters in Kaburuland. I knew he was not a serious fellow when he started prating about SGR not making a "profit" yet it is a public good. Since when did Uhuru highway make a profit? But he knows the average Kenyan does not read..he points this out over and over in his tweets, so they will believe anything he says as gospel. By the way why does he keep those "red kambas" on his glasses? I cannot remember ever seeing any other person with those things since the 1980s jameni.

|

|

|

Rank: Elder Joined: 1/8/2018 Posts: 2,212 Location: DC (Dustbowl County)

|

maka wrote:MugundaMan wrote:Kenyans just like to

cry cry cry

Wail wail wail

Ngweeh ngweeh ngweeh

About any and everything

Economy red hot at 6.3% last quarter, 5%+ for the previous 16 years

SGR huyooooo mpaka Naivasha by Madaraka day.. clean and spanking new with double stack Sasa.

Stima nywee to every village and public school over the past 6 years

Masomo freeeeee mpaka secondary

Title deeds hizooooo even in ticking time bombs like Embakasi caused by the two chaps who lived in the back room of their bars

Transmission lines hizoooo Lolongyani, Ethiopia, Suswa to Msa and much more

Barabara hizoooooo falling on Kenya like elephant dung

Corruption hiyooo big boys are heading to kamiti like flies

Jameni what more do you fellows want?

Fiddling while Kenya is burning.... How now? Kenya is very peaceful and running smooth with minor hiccups hapa na pale. God bless baba for the handshake. Imagine if the chap was still in opposition, Kenya would be having no rest!

|

|

|

Rank: Elder Joined: 1/8/2018 Posts: 2,212 Location: DC (Dustbowl County)

|

VituVingiSana wrote:How has all this been financed?

I think we have done reasonably well on our borrowing prudence. But I am not a fan of the crazy KRA revenue target projections that keep increasing by funny numbers each year yet are never met. It doesn't make sense. Why increase revenue targets by 30% yet the previous 5 years not more than 15% was ever met? This is why I preferred Kibaki's way of handling such matters. Kenyans should seriously think of bringing stylo hiyo hiyo hapaaaana out of retirement to be honorary finance minister (supervising treasury). The guy ran a tight ship and laid the foundation for everything we are currently enjoying in our lovely country.

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,293 Location: Nairobi

|

MugundaMan wrote:VituVingiSana wrote:How has all this been financed?

I think we have done reasonably well on our borrowing prudence. But I am not a fan of the crazy KRA revenue target projections that keep increasing by funny numbers each year yet are never met. It doesn't make sense. Why increase revenue targets by 30% yet the previous 5 years not more than 15% was ever met? This is why I preferred Kibaki's way of handling such matters. Kenyans should seriously think of bringing stylo hiyo hiyo hapaaaana out of retirement to be honorary finance minister (supervising treasury). The guy ran a tight ship and laid the foundation for everything we are currently enjoying in our lovely country. How has all this been financed? Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|