Wazua

»

Investor

»

Stocks

»

Mumias Sugar huge demand

Rank: Veteran Joined: 6/23/2011 Posts: 1,740 Location: Nairobi

|

You keep on talking talking about Mumias, the guy is in charge of the capital city and largest county by allocation.

What do you think is happening as we talk talk.. tell me 5 year later when it comes out

|

|

|

Rank: New-farer Joined: 1/13/2015 Posts: 17 Location: Nairobi, Kenya

|

streetwise wrote:You keep on talking talking about Mumias, the guy is in charge of the capital city and largest county by allocation.

What do you think is happening as we talk talk.. tell me 5 year later when it comes out  Knowledge is knowing that a tomato is a fruit. Wisdom is knowing that it can not be used in a fruit salad.

|

|

|

Rank: Member Joined: 4/26/2011 Posts: 759

|

Kausha wrote:Rollout wrote:PE should buy Mumias for 60% discount, what's the current EBITDA for Mumias, anyone knows? Buy Mumias at 60% discount, institute new management, file bankruptcy, turn it around and then exit in approx 5 yrs. GOK will not be able to fix it. Describe what disc you are talking about. Mumias has no EBITDA. Been making huges loses past 3 years. It's math! Even a negative valuation with still have a discount, the EBITDA could be negative but Mumia value is not negative.

|

|

|

Rank: Elder Joined: 9/29/2006 Posts: 2,570

|

Rollout wrote:Kausha wrote:Rollout wrote:PE should buy Mumias for 60% discount, what's the current EBITDA for Mumias, anyone knows? Buy Mumias at 60% discount, institute new management, file bankruptcy, turn it around and then exit in approx 5 yrs. GOK will not be able to fix it. Describe what disc you are talking about. Mumias has no EBITDA. Been making huges loses past 3 years. It's math! Even a negative valuation with still have a discount, the EBITDA could be negative but Mumia value is not negative. Heard of insolvency? MSC is at that stage. The opposite of courage is not cowardice, it's conformity.

|

|

|

Rank: Member Joined: 1/15/2015 Posts: 681 Location: Kenya

|

I think am learning a lesson on eating from us 'wanjikus' here. Jesus.

60% Learning, 30% synthesizing, 10% Debating

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,318 Location: Nairobi

|

Rollout wrote:Kausha wrote:Rollout wrote:PE should buy Mumias for 60% discount, what's the current EBITDA for Mumias, anyone knows? Buy Mumias at 60% discount, institute new management, file bankruptcy, turn it around and then exit in approx 5 yrs. GOK will not be able to fix it. Describe what disc you are talking about. Mumias has no EBITDA. Been making huges loses past 3 years. It's math! Even a negative valuation with still have a discount, the EBITDA could be negative but Mumia value is not negative. Without GoK support, subsidies and bailout, MSC is bankrupt. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

VituVingiSana wrote:Rollout wrote:Kausha wrote:Rollout wrote:PE should buy Mumias for 60% discount, what's the current EBITDA for Mumias, anyone knows? Buy Mumias at 60% discount, institute new management, file bankruptcy, turn it around and then exit in approx 5 yrs. GOK will not be able to fix it. Describe what disc you are talking about. Mumias has no EBITDA. Been making huges loses past 3 years. It's math! Even a negative valuation with still have a discount, the EBITDA could be negative but Mumia value is not negative. Without GoK support, subsidies and bailout, MSC is bankrupt. Negative value is when liabilities>assets, I haven’t crunched the numbers for mumias but based on the reports available if its not at negative value currently then its very close to it. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 11/21/2006 Posts: 1,590

|

If GoK was behaving like an intelligent entity which also happens to be the largest investor here should be looking at the following options forthwith. -combine with Nzoia (distance between both is very close), economics of scale et al -sell Mumias Nzoia to a private company -instead of pumping money into Mumias, put money into TARDA under newly reconstituted Mumias forcing current shareholders to only own a TARDA. There is no need to run the huge project costing 15bn that was initially envisaged. Use the 2bn that MSC needs Just some ideas, otherwise this is heading one way. Sehemu ndio nyumba

|

|

|

Rank: Veteran Joined: 6/23/2011 Posts: 1,740 Location: Nairobi

|

Makes alot of sense relocate MSC to TARDA. I hear MSC has huge crushing capacity that can't be satisfied by the local farmers, plus early maturing can can help.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Mainat wrote:If GoK was behaving like an intelligent entity which also happens to be the largest investor here should be looking at the following options forthwith.

-combine with Nzoia (distance between both is very close), economics of scale et al

-sell Mumias Nzoia to a private company

-instead of pumping money into Mumias, put money into TARDA under newly reconstituted Mumias forcing current shareholders to only own a TARDA. There is no need to run the huge project costing 15bn that was initially envisaged. Use the 2bn that MSC needs

Just some ideas, otherwise this is heading one way. And what would you propose is to be done to the creditors ie bankers,suppliers,outgrowers etc bearing in mind that no private investor would pump in money in a company riddled by debt unless return>risk which I think is not the case with mumias. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: New-farer Joined: 8/15/2010 Posts: 99 Location: nairobi

|

This Mumias will be another KMC. Always begging for money from Govt. It's funny how private companies are able to compete in this sector yet all parastatals are crying to the govt for cash and after getting it the managers hire their kins without any thoughts. This is a classic example why govt shouldn't involve itself in running of businesses...it should only be in critical sectors such as energy

|

|

|

Rank: Veteran Joined: 6/23/2011 Posts: 1,740 Location: Nairobi

|

Let me ask you a partnet question. Every one complaints loacal sugar is expesive and it is true MSC is.

MSC retails at a mergin higher than other brands yet the shoppers prefer the more expesive MSC . What doe this tell you

|

|

|

Rank: Member Joined: 8/4/2012 Posts: 155 Location: Kenya

|

lochaz-index wrote:VituVingiSana wrote:Rollout wrote:Kausha wrote:Rollout wrote:PE should buy Mumias for 60% discount, what's the current EBITDA for Mumias, anyone knows? Buy Mumias at 60% discount, institute new management, file bankruptcy, turn it around and then exit in approx 5 yrs. GOK will not be able to fix it. Describe what disc you are talking about. Mumias has no EBITDA. Been making huges loses past 3 years. It's math! Even a negative valuation with still have a discount, the EBITDA could be negative but Mumia value is not negative. Without GoK support, subsidies and bailout, MSC is bankrupt. Negative value is when liabilities>assets, I haven’t crunched the numbers for mumias but based on the reports available if its not at negative value currently then its very close to it. MSC has a NAV of 6.96/= (2013 - 10.2/=), so it still has value but the losses are reducing it very fast. The major problem with MSC is its ability to generate cash, hence its liquidity,considering it only generated Shs 801m from operations and has a current ratio of 0.41. Its production efficiency also needs to improve a lot since it has a gross profit margin of 6.49% (2013 - 13.06%). But again am talking of a company with no fraud and corruption issues here. Put those into perspective and consider the fact the management still thinks its ERP system is very strong, then only the statement of NAV holds. It could be efficient in production but but margins are reduced by diverted products which account for cost of sales but no actual sales to be booked. If you don't want to go to plan B have a good plan A.

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,318 Location: Nairobi

|

@mucene - If the NAV was 7/- [30 June 2014] then it has been eroded rapidly since. I doubt the 1H 2014-15 results will show a profit. KPLC is demanding a huge payment [Capacity Charge] from Mumias. If KPLC took Mumias to court then that would be another black mark. Add the accumulated interest from the lenders since June 2014 as well. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Member Joined: 8/4/2012 Posts: 155 Location: Kenya

|

@VituVingiSana: MSC will definitely show a loss in the 1H14-15 results, so the NAV will be eroded further, lets wait and see what the current actions we're seeing in the media that the management are undertaking to stem fraud will do to the financials ama its all talk. If you don't want to go to plan B have a good plan A.

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

we even have examples. HFCK and KCB had similar problems, Gov stake reduced (hfck 3.6%). The problem went away. that's the ONLY solution for mumias. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Veteran Joined: 6/23/2011 Posts: 1,740 Location: Nairobi

|

Let the Gova clear the debts then go away. The benefit is the Gv will sells their stake and make some money, the co will be left alive and the fellow who took the risk will become rich. This is the only way to produce all winners.

|

|

|

Rank: Veteran Joined: 4/23/2014 Posts: 929

|

Now this is what should have happened long ago. DPP Keriako Tobiko now weighs in on Mumias Sugar scandal probe http://www.standardmedia...as-sugar-scandal-probe/

“You can get in way more trouble with a good idea than a bad idea, because you forget that the good idea has limits.” - Ben Graham

|

|

|

Rank: Elder Joined: 2/7/2007 Posts: 11,935 Location: Nairobi

|

@Mawinder, Who are the other 12 suspected thieves? Nothing great was ever achieved without enthusiasm.

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

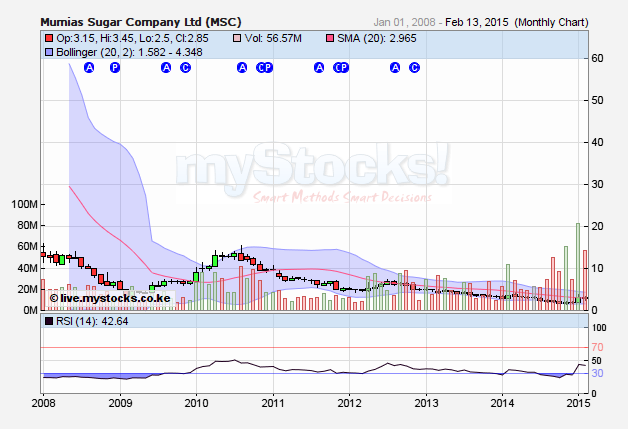

Bullish breakout in January,exit volume of 81.95M shares, at a record high 0f 3.85. Entry volume of 60.09M (smart money) was in November. Currently trading below SMA(20)2.977  @SufficientlyP

|

|

|

Wazua

»

Investor

»

Stocks

»

Mumias Sugar huge demand

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|