Wazua

»

Investor

»

Stocks

»

Stock traders Corner.

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

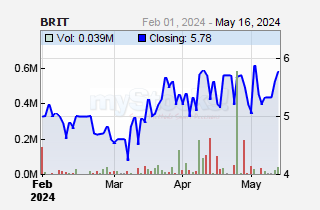

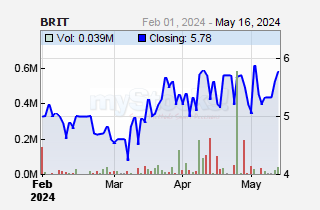

Will take a small trade tomorrow on britank - target 5 - 5.50. Yap a shocking moment   $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

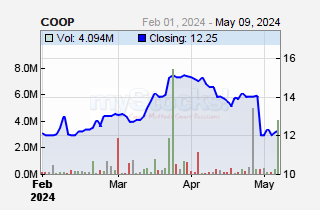

@deal - feel like taking this plane up to reset the oversell. Taking a small trade here too. Target 22.  These are risky trades i.e. coop, britank and KQ. This will require steel balls and ulcers resistance stomach walls. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

All the best. I admire the courage, most people wouldn't take the moves. But then again, most people don't know jack about t.a (cartoons). Co-op is already responding. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: User Joined: 1/24/2012 Posts: 1,675 Location: In Da Hood

|

wow ! the index is really movin ...but its still weak ( techically)

am still sittin on my hands . it should be interesting to see what happens at 3500 resistance level !

|

|

|

Rank: Member Joined: 6/25/2010 Posts: 176

|

QW25091985 wrote:wow ! the index is really movin ...but its still weak ( techically)

am still sittin on my hands . it should be interesting to see what happens at 3500 resistance level ! me too.and those hands are starting to itch.still think people are buying on announcements and profit will be taken 2nd half of the year Rule No.1 is never lose money. Rule No.2 is never forget rule number one

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Mpesa bank - Interesting chart pattern. 3.90 will be a tough barrier to break. This thing has spent to long a time above 3 bob which means heading up is likely than lower. Above 3.35 means 3.90 - 4.00 is the next stop. On what fundamentals - I wonder! Unless they have been able to reverse the H1 horrible results due to fx losses, such lofty price levels are unsustainable. If they report in May that the H1 47% profit dip has been cut back to 20% or less, this thing will fly past 4 and that should drag the index further up.  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

hisah wrote:This cartoon (chart), I like coz of volume spread below 12/- Grabbed some today for a traders play. Target 15/-  Coop FY results have disappointed, as expected. Are you still bullish? Ama TA doesn't mix with FA

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

mwekez@ji wrote:hisah wrote:This cartoon (chart), I like coz of volume spread below 12/- Grabbed some today for a traders play. Target 15/-  Coop FY results have disappointed, as expected. Are you still bullish? Ama TA doesn't mix with FA They were expected to be disappointing. But the volume spike @11.70 says otherwise and this is just a trade call for the ride up. 25 - 30% price gain is good for me. Btw I'm not bullish on banks since Feb 2011 and esp now with high lending rates. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

hisah wrote:mwekez@ji wrote:hisah wrote:This cartoon (chart), I like coz of volume spread below 12/- Grabbed some today for a traders play. Target 15/-  Coop FY results have disappointed, as expected. Are you still bullish? Ama TA doesn't mix with FA They were expected to be disappointing. But the volume spike @11.70 says otherwise and this is just a trade call for the ride up. 25 - 30% price gain is good for me. Btw I'm not bullish on banks since Feb 2011 and esp now with high lending rates. K. You have the 1:5 bonus support. Market is not yet sure how to respond to this unexpected bonus. Otherwise the share would have tanked big time today. I've also seen most banks took advantage of the high lending rates in Q4 to boost their interest income (KCB, CFC, ...). However, the high rates could hurt them if they are sustained in 2012

|

|

|

Rank: Elder Joined: 9/25/2009 Posts: 4,534 Location: Windhoek/Nairobbery

|

hisah wrote:@deal - feel like taking this plane up to reset the oversell. Taking a small trade here too. Target 22.  These are risky trades i.e. coop, britank and KQ. This will require steel balls and ulcers resistance stomach walls.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

the deal wrote:hisah wrote:@deal - feel like taking this plane up to reset the oversell. Taking a small trade here too. Target 22.  These are risky trades i.e. coop, britank and KQ. This will require steel balls and ulcers resistance stomach walls.     make it diamond balls for KQ... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Anaemic volume at NSE still persists... The bull is still a calf. http://www.nation.co.ke/...2/-/3wtk61z/-/index.html$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: User Joined: 1/24/2012 Posts: 1,675 Location: In Da Hood

|

i though people were buying .lol .a rally without volume is just damn too dangerous . Keep off ! Kcb at 14 ? sure

am still calling for 2700's levels nothing has changed . we have heard a nice retrace now for the down trend to resume . that 3500 level is so repelant .. lol

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

hisah wrote:Will take a small trade tomorrow on britank - target 5 - 5.50. Yap a shocking moment   Sold. I expect this thing to tank to 2 bob...$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 9/25/2009 Posts: 4,534 Location: Windhoek/Nairobbery

|

LOL @hisah are u still in Coop? That thing will be mess ex bonus, I'm interested in Britak, I will be watching folks like u capitulate over the coming weeks, voila I will go in at the bottom and ride the re rating to 9 bob!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

the deal wrote:LOL @hisah are u still in Coop? That thing will be mess ex bonus, I'm interested in Britak, I will be watching folks like u capitulate over the coming weeks, voila I will go in at the bottom and ride the re rating to 9 bob! I'll be getting out of the 2 counters this week. KQ's rights from hell caught me squarely offguard. So I'll capitulate from this counter - the other 2 are no capitulations considering how risky the trades are.

Britank back to 9/- this year is fairy tale stuff - I can only wish you goodluck.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: User Joined: 1/24/2012 Posts: 1,675 Location: In Da Hood

|

QW25081985 wrote:the deal wrote:That disconnection between the Shilling rally and the NSE rings alarm bells considering the stock market moves ahead of events. DIVERGANCE !!!!!!!!!!!!!!!!!!!!!!! something of the two has to catch up ..i have also noted the disconnect. am thinking stocks should be rallying but yet again we have too much risk ahead . but i hope the shilling at 85 will lend the stock market some support well. i think i saw the bottom a LONNNNNNG while ago . just look at how powerful that divergence has been. the shilling was at 80's yet the stock market was trading at 3000s .that cannot be allowed sad i never put my money where my mouth was.

|

|

|

Rank: User Joined: 1/24/2012 Posts: 1,675 Location: In Da Hood

|

Some stocks are so beaten down they dnt even know how a rally looks like. Lolest

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

hisah wrote:Anaemic volume at NSE still persists... The bull is still a calf @hisah we are on the brink of 3,600 on the 20 index.. Turnover was a trillion last week and is likely to be a trillion this week.. When will you throw away your charts and join us in this sweet rally... Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

guru267 wrote:hisah wrote:Anaemic volume at NSE still persists... The bull is still a calf @hisah we are on the brink of 3,600 on the 20 index.. Turnover was a trillion last week and is likely to be a trillion this week.. When will you throw away your charts and join us in this sweet rally...    @SufficientlyP

|

|

|

Wazua

»

Investor

»

Stocks

»

Stock traders Corner.

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|