Wazua

»

Investor

»

Stocks

»

KCB buy buy buy

Rank: Veteran Joined: 4/4/2016 Posts: 2,008 Location: Kitale

|

MaichBlack wrote:@Ebenyo - Benjo's land was worth more than double the loan amount (150m vs 70m).

And in any case, Benjo's land should have been sold first whatever the value. And KCB refused to furnish Muigai with a statement of accounts! It is like they were interested in more than their loan being cleared!!! Benjo land was 150 m at the time the case came to appeal court.Meaning that at the time the case was in High court,thats some years back as land appreciates in value,the said land was below the 70 m kcb wanted.The first valuation was done when the case first came to high court.The initial loan was 23 m.Meaning some years lapsed to accrue the additional amount of interest.We are talking of 24 years here. KCB cant furnish Ngengi with statements as he was only a guarantor.Its Benjo who should ask for the same and since they are defaulters,they are guilty as charged. Kcb cant accept liabilty on benjoh part.They couldnt sale benjo land at a price deemed below the loan value.Selling Ngengi land made value to them.So Ngengi bears the liability for benjo as the guarantor. If the land is 3 billion now as its said,Benjo should pay Ngengi the full amount.Bidii are innocent.They should posess their land. Towards the goal of financial freedom

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,764

|

@Ebenyo Quote:Benjoh had provided as security two pieces of land in Kiambu County, which at the time the matter came up for hearing before the Court of Appeal was estimated to be worth Sh150 million.

The Court of Appeal itself had ruled that the bank was free to realise the security that Benjoh had provided for the loan in order to settle the loan which was at the time estimated to be worth Sh70 million.

KCB, however, went ahead and sold Mr Muigai’s land to a private company, Bidii Kenya Limited, in 2007 for Sh70 million, setting up the former politician for what has become one of Kenya’s longest court battles. Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,764

|

@Ebenyo - A guarantor has the right to ask for and be given an statement of accounts if there is a default! You cannot just put his property under the hammer because he might actually be willing/planning to clear the balance to save his property. I have actually seen some financial institutions sending a statement of accounts to the guarantors without being asked for them as they explain the actions they are about to take to recover the money from the guarantors. Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Veteran Joined: 4/4/2016 Posts: 2,008 Location: Kitale

|

MaichBlack wrote:@Ebenyo - A guarantor has the right to ask for and be given an statement of accounts if there is a default! You cannot just put his property under the hammer because he might actually be willing/planning to clear the balance to save his property.

I have actually seen some financial institutions sending a statement of accounts to the guarantors without being asked for them as they explain the actions they are about to take to recover the money from the guarantors. @maichblack,im building on kcb dividends to pay for my daughter, who is now 3 years old,school fees and all her needs.So im partisan in this case as im an interested party.So we will never agree as you too have sided with ngengi. Lets wait for the next angle in high court. Towards the goal of financial freedom

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,764

|

Ebenyo wrote:MaichBlack wrote:@Ebenyo - A guarantor has the right to ask for and be given an statement of accounts if there is a default! You cannot just put his property under the hammer because he might actually be willing/planning to clear the balance to save his property.

I have actually seen some financial institutions sending a statement of accounts to the guarantors without being asked for them as they explain the actions they are about to take to recover the money from the guarantors. @maichblack,im building on kcb dividends to pay for my daughter, who is now 3 years old,school fees and all her needs.So im partisan in this case as im an interested party.So we will never agree as you too have sided with ngengi. Lets wait for the next angle in high court.      Okay my brother. I feel you. Especially on the daughter part. If you read some of my posts, you will realize that a good number of my investments and financial decisions have "the daughter" angle. I totally know the feeling my fellow dad! Let's hope our daughters are not disenfranchised by the actions of a few. Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,321 Location: Nairobi

|

MaichBlack wrote:Ebenyo wrote:MaichBlack wrote:@Ebenyo - A guarantor has the right to ask for and be given an statement of accounts if there is a default! You cannot just put his property under the hammer because he might actually be willing/planning to clear the balance to save his property.

I have actually seen some financial institutions sending a statement of accounts to the guarantors without being asked for them as they explain the actions they are about to take to recover the money from the guarantors. @maichblack,im building on kcb dividends to pay for my daughter, who is now 3 years old,school fees and all her needs.So im partisan in this case as im an interested party.So we will never agree as you too have sided with ngengi. Lets wait for the next angle in high court.      Okay my brother. I feel you. Especially on the daughter part. If you read some of my posts, you will realize that a good number of my investments and financial decisions have "the daughter" angle. I totally know the feeling my fellow dad! Let's hope our daughters are not disenfranchised by the actions of a few. How did Ngengi come by the huge piece of land? Easy come, easy go. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Hello Joined: 7/11/2016 Posts: 2 Location: japan

|

GFL used the net proceeds from the offering to repay its outstanding borrowings under its senior secured revolving credit facility, to pay fees and expenses in connection with the offering and for general corporate purposes that includes the financing of future acquisitions and organic growth initiatives, gfl.

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,321 Location: Nairobi

|

So the money to pay the contractors is finally in. http://www.businessdaily...2/-/iklm8z/-/index.html

How will KCB account for the NPLs that were shown but not provided for in March? And it seems they remained outstanding at the end of June? How SHOULD a bank like KCB account for such NPLs that have crossed both the 90 and 180 day mark? Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,157 Location: nairobi

|

VituVingiSana wrote:So the money to pay the contractors is finally in. http://www.businessdaily...2/-/iklm8z/-/index.html

How will KCB account for the NPLs that were shown but not provided for in March? And it seems they remained outstanding at the end of June? How SHOULD a bank like KCB account for such NPLs that have crossed both the 90 and 180 day mark? KES 33 per share.. Wow

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

obiero wrote:VituVingiSana wrote:So the money to pay the contractors is finally in. http://www.businessdaily...2/-/iklm8z/-/index.html

How will KCB account for the NPLs that were shown but not provided for in March? And it seems they remained outstanding at the end of June? How SHOULD a bank like KCB account for such NPLs that have crossed both the 90 and 180 day mark? KES 33 per share.. Wow still expensive sir,25 is appealing "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Member Joined: 5/30/2016 Posts: 332 Location: Kayole

|

mlennyma wrote:obiero wrote:VituVingiSana wrote:So the money to pay the contractors is finally in. http://www.businessdaily...2/-/iklm8z/-/index.html

How will KCB account for the NPLs that were shown but not provided for in March? And it seems they remained outstanding at the end of June? How SHOULD a bank like KCB account for such NPLs that have crossed both the 90 and 180 day mark? KES 33 per share.. Wow still expensive sir,25 is appealing waiting for this one at 20 and below after rights issue KEGN, KPLC, KQ, SCOM

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

@mkate_nusu After the rights issue below 20 doesn't seem possible but this will be dependent on the number of shares to be offered during the rights. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

Ericsson wrote:@mkate_nusu

After the rights issue below 20 doesn't seem possible but this will be dependent on the number of shares to be offered during the rights. the slaughter now is important because it will dictate the rights price "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,157 Location: nairobi

|

mkate_nusu wrote:mlennyma wrote:obiero wrote:VituVingiSana wrote:So the money to pay the contractors is finally in. http://www.businessdaily...2/-/iklm8z/-/index.html

How will KCB account for the NPLs that were shown but not provided for in March? And it seems they remained outstanding at the end of June? How SHOULD a bank like KCB account for such NPLs that have crossed both the 90 and 180 day mark? KES 33 per share.. Wow still expensive sir,25 is appealing waiting for this one at 20 and below after rights issue To imagine I sold at KES 60

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

obiero wrote:mkate_nusu wrote:mlennyma wrote:obiero wrote:VituVingiSana wrote:So the money to pay the contractors is finally in. http://www.businessdaily...2/-/iklm8z/-/index.html

How will KCB account for the NPLs that were shown but not provided for in March? And it seems they remained outstanding at the end of June? How SHOULD a bank like KCB account for such NPLs that have crossed both the 90 and 180 day mark? KES 33 per share.. Wow still expensive sir,25 is appealing waiting for this one at 20 and below after rights issue To imagine I sold at KES 60 i can remember well,you sold at 60,it climbed and got stuck at 65 for about a month and hell started breaking loose  "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

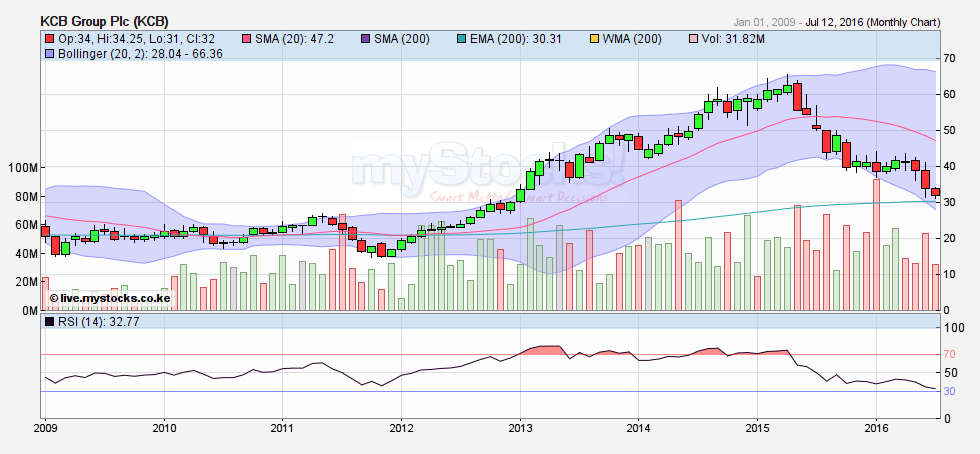

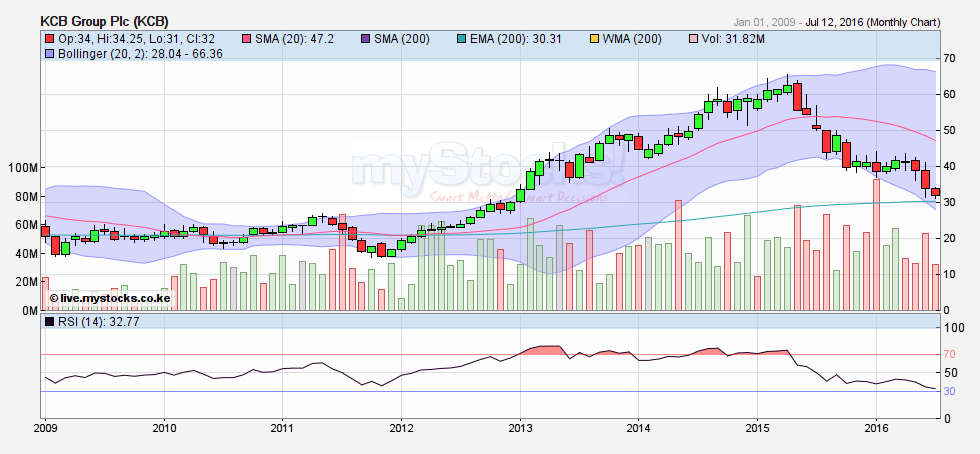

Trending towards the EMA200 level of 30.3  Now at 31.5   @SufficientlyP

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

Any info? supply is scary  @SufficientlyP

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

Sufficiently Philanga....thropic wrote:Trending towards the EMA200 level of 30.3  Now at 31.5   Wow really taking a beating. Surely this is not just coz of rights issue. Is it? we'll know in due time. Maybe those crazy NPLS ( that will soon reduce) or who knows The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

Sufficiently Philanga....thropic wrote:Any info? supply is scary  the whole market is scary,you buy today thinking you got the best price only to wakeup tomorrow and find your "Ninii "bleeding "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,157 Location: nairobi

|

mlennyma wrote:Sufficiently Philanga....thropic wrote:Any info? supply is scary  the whole market is scary,you buy today thinking you got the best price only to wakeup tomorrow and find your "Ninii "bleeding South Sudi

KQ ABP 4.26

|

|

|

Wazua

»

Investor

»

Stocks

»

KCB buy buy buy

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|