Wazua

»

Investor

»

Bonds

»

Treasury Bills and Bonds

Rank: Veteran Joined: 11/14/2006 Posts: 1,311

|

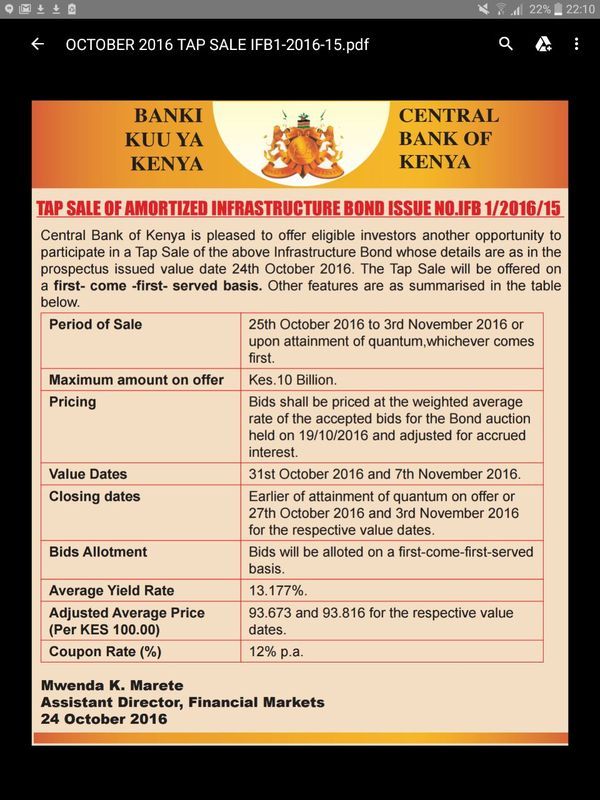

Chaka wrote:Liv wrote:What is the real return of IFB/1/2016/15 bond?

If you bought Shs 100 face value of this bond, you bought it at a discount of Shs 6.471 and therefore you paid Shs 93.529

In the first 6 months which is equivalent to 182 days, you will be paid Shs 5.983 as interest, computed (100x12%x182/365)

If you were to reinvest Shs 5.983 at the same rate 12% for another 6 months, you would earn interest income of Shs 6.341, computed (105.983x12%x182/365) .

Total interest earned in 12 months is 5.983+6.341 = 12.324

Actual funds invested = 93.529

Return = 12.324/93.529 = 13.177%

I thought there is a payment schedule for the interest after every six months?i,e the issue of re-investing the Shs 5.983 is not there because you have to redeem it? You are right,but do you think the cash you receive after the first 6 months should be equivalent in value to the cash you will receive after the 2nd 6 months?

It is assumed you will invest this cash and get some value.

|

|

|

Rank: Elder Joined: 2/16/2007 Posts: 2,114

|

Liv wrote:Chaka wrote:Liv wrote:What is the real return of IFB/1/2016/15 bond?

If you bought Shs 100 face value of this bond, you bought it at a discount of Shs 6.471 and therefore you paid Shs 93.529

In the first 6 months which is equivalent to 182 days, you will be paid Shs 5.983 as interest, computed (100x12%x182/365)

If you were to reinvest Shs 5.983 at thoe same rate 12% for another 6 months, you would earn interest income of Shs 6.341, computed (105.983x12%x182/365) .

Total interest earned in 12 months is 5.983+6.341 = 12.324

Actual funds invested = 93.529

Return = 12.324/93.529 = 13.177%

I thought there is a payment schedule for the interest after every six months?i,e the issue of re-investing the Shs 5.983 is not there because you have to redeem it? You are right,but do you think the cash you receive after the first 6 months should be equivalent in value to the cash you will receive after the 2nd 6 months?

It is assumed you will invest this cash and get some value.

Thanks..now can you also help me out on post # 347?

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,331 Location: Masada

|

@maka, na usicheke hii swali: Suppose one is applying for Kes. 100,000. And he pays CBK Kes.93,673 ex-discount, what will be his/her 6-monthly interest earnable? Will he/she get: 12% of 100,000? or 12% or 93,673? or 13.177% of 100,000? or 13.177% of 93,673? And on maturity, will he/she get back 100,000 or 93,676? #By the way on Sato I forgot to ask you this during the mbuzi-11 due to the thithimaa effect, though we could see you an ontrapruniewol mind.  Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 9/29/2006 Posts: 2,570

|

Impunity wrote:@maka, na usicheke hii swali: Suppose one is applying for Kes. 100,000. And he pays CBK Kes.93,673 ex-discount, what will be his/her 6-monthly interest earnable? Will he/she get: 12% of 100,000? or 12% or 93,673? or 13.177% of 100,000? or 13.177% of 93,673? And on maturity, will he/she get back 100,000 or 93,676? #By the way on Sato I forgot to ask you this during the mbuzi-11 due to the thithimaa effect, though we could see you an ontrapruniewol mind.  You should declare first if you are interested in T/Bill or T/Bond. The opposite of courage is not cowardice, it's conformity.

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,331 Location: Masada

|

jerry wrote:Impunity wrote:@maka, na usicheke hii swali: Suppose one is applying for Kes. 100,000. And he pays CBK Kes.93,673 ex-discount, what will be his/her 6-monthly interest earnable? Will he/she get: 12% of 100,000? or 12% or 93,673? or 13.177% of 100,000? or 13.177% of 93,673? And on maturity, will he/she get back 100,000 or 93,676? #By the way on Sato I forgot to ask you this during the mbuzi-11 due to the thithimaa effect, though we could see you an ontrapruniewol mind.  You should declare first if you are interested in T/Bill or T/Bond. T/Bill ni rahisi sana kama yule mwanamke @kiraitu almost raped. I am talking about T/Bond and especially the current IFB and more so the Tap sale. Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Impunity wrote:jerry wrote:Impunity wrote:@maka, na usicheke hii swali: Suppose one is applying for Kes. 100,000. And he pays CBK Kes.93,673 ex-discount, what will be his/her 6-monthly interest earnable? Will he/she get: 12% of 100,000? or 12% or 93,673? or 13.177% of 100,000? or 13.177% of 93,673? And on maturity, will he/she get back 100,000 or 93,676? #By the way on Sato I forgot to ask you this during the mbuzi-11 due to the thithimaa effect, though we could see you an ontrapruniewol mind.  You should declare first if you are interested in T/Bill or T/Bond. T/Bill ni rahisi sana kama yule mwanamke @kiraitu almost raped. I am talking about T/Bond and especially the current IFB and more so the Tap sale. 12% of 100,000...paid semi annually...(6000 1st 6 months) + (6000 next 6 months) possunt quia posse videntur

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,931

|

Impunity wrote:jerry wrote:Impunity wrote:@maka, na usicheke hii swali: Suppose one is applying for Kes. 100,000. And he pays CBK Kes.93,673 ex-discount, what will be his/her 6-monthly interest earnable? Will he/she get: 12% of 100,000? or 12% or 93,673? or 13.177% of 100,000? or 13.177% of 93,673? And on maturity, will he/she get back 100,000 or 93,676? #By the way on Sato I forgot to ask you this during the mbuzi-11 due to the thithimaa effect, though we could see you an ontrapruniewol mind.  You should declare first if you are interested in T/Bill or T/Bond. T/Bill ni rahisi sana kama yule mwanamke @kiraitu almost raped.I am talking about T/Bond and especially the current IFB and more so the Tap sale. You don't remember the argument on Wazua whether T/Bills in earned upfront or at redemption and there was no conclusion to it.  In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Angelica _ann wrote:Impunity wrote:jerry wrote:Impunity wrote:@maka, na usicheke hii swali: Suppose one is applying for Kes. 100,000. And he pays CBK Kes.93,673 ex-discount, what will be his/her 6-monthly interest earnable? Will he/she get: 12% of 100,000? or 12% or 93,673? or 13.177% of 100,000? or 13.177% of 93,673? And on maturity, will he/she get back 100,000 or 93,676? #By the way on Sato I forgot to ask you this during the mbuzi-11 due to the thithimaa effect, though we could see you an ontrapruniewol mind.  You should declare first if you are interested in T/Bill or T/Bond. T/Bill ni rahisi sana kama yule mwanamke @kiraitu almost raped.I am talking about T/Bond and especially the current IFB and more so the Tap sale. You don't remember the argument on Wazua whether T/Bills in earned upfront or at redemption and there was no conclusion to it.  Really why wasnt there a conclusion? possunt quia posse videntur

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,331 Location: Masada

|

maka wrote:Angelica _ann wrote:Impunity wrote:jerry wrote:Impunity wrote:@maka, na usicheke hii swali: Suppose one is applying for Kes. 100,000. And he pays CBK Kes.93,673 ex-discount, what will be his/her 6-monthly interest earnable? Will he/she get: 12% of 100,000? or 12% or 93,673? or 13.177% of 100,000? or 13.177% of 93,673? And on maturity, will he/she get back 100,000 or 93,676? #By the way on Sato I forgot to ask you this during the mbuzi-11 due to the thithimaa effect, though we could see you an ontrapruniewol mind.  You should declare first if you are interested in T/Bill or T/Bond. T/Bill ni rahisi sana kama yule mwanamke @kiraitu almost raped.I am talking about T/Bond and especially the current IFB and more so the Tap sale. You don't remember the argument on Wazua whether T/Bills in earned upfront or at redemption and there was no conclusion to it.  Really why wasnt there a conclusion? @Thitimaaa,T/Bill interest is earned at REDEMPTION, wachana na wale wazee kina @mukiha etal...who will pay you money upfront in any business in this world? If for instance you applied for 182 day papr for amount of 100,000 and the rate was 10% and there was no TAX, then you will pay CBK Kes. 95,251...at maturity you get paid from CBK kes. 100,000 and therefore take with you profits/interest of (100,000-95,251) = Kes 4,749.   Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 9/29/2006 Posts: 2,570

|

Impunity wrote:jerry wrote:Impunity wrote:@maka, na usicheke hii swali: Suppose one is applying for Kes. 100,000. And he pays CBK Kes.93,673 ex-discount, what will be his/her 6-monthly interest earnable? Will he/she get: 12% of 100,000? or 12% or 93,673? or 13.177% of 100,000? or 13.177% of 93,673? And on maturity, will he/she get back 100,000 or 93,676? #By the way on Sato I forgot to ask you this during the mbuzi-11 due to the thithimaa effect, though we could see you an ontrapruniewol mind.  You should declare first if you are interested in T/Bill or T/Bond. T/Bill ni rahisi sana kama yule mwanamke @kiraitu almost raped. I am talking about T/Bond and especially the current IFB and more so the Tap sale. T/Bond is easier than T/Bill. The opposite of courage is not cowardice, it's conformity.

|

|

|

Rank: User Joined: 8/15/2013 Posts: 13,237 Location: Vacuum

|

Impunity wrote:maka wrote:Angelica _ann wrote:Impunity wrote:jerry wrote:Impunity wrote:@maka, na usicheke hii swali: Suppose one is applying for Kes. 100,000. And he pays CBK Kes.93,673 ex-discount, what will be his/her 6-monthly interest earnable? Will he/she get: 12% of 100,000? or 12% or 93,673? or 13.177% of 100,000? or 13.177% of 93,673? And on maturity, will he/she get back 100,000 or 93,676? #By the way on Sato I forgot to ask you this during the mbuzi-11 due to the thithimaa effect, though we could see you an ontrapruniewol mind.  You should declare first if you are interested in T/Bill or T/Bond. T/Bill ni rahisi sana kama yule mwanamke @kiraitu almost raped.I am talking about T/Bond and especially the current IFB and more so the Tap sale. You don't remember the argument on Wazua whether T/Bills in earned upfront or at redemption and there was no conclusion to it.  Really why wasnt there a conclusion? @Thitimaaa,T/Bill interest is earned at REDEMPTION, wachana na wale wazee kina @mukiha etal...who will pay you money upfront in any business in this world? If for instance you applied for 182 day papr for amount of 100,000 and the rate was 10% and there was no TAX, then you will pay CBK Kes. 95,251...at maturity you get paid from CBK kes. 100,000 and therefore take with you profits/interest of (100,000-95,251) = Kes 4,749.   why are you contradicting yourself? The fact that you are paying 95,251 and getting 100,000 later is somebody paying you upfront! If Obiero did it, Who Am I?

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,331 Location: Masada

|

jerry wrote:Impunity wrote:jerry wrote:Impunity wrote:@maka, na usicheke hii swali: Suppose one is applying for Kes. 100,000. And he pays CBK Kes.93,673 ex-discount, what will be his/her 6-monthly interest earnable? Will he/she get: 12% of 100,000? or 12% or 93,673? or 13.177% of 100,000? or 13.177% of 93,673? And on maturity, will he/she get back 100,000 or 93,676? #By the way on Sato I forgot to ask you this during the mbuzi-11 due to the thithimaa effect, though we could see you an ontrapruniewol mind.  You should declare first if you are interested in T/Bill or T/Bond. T/Bill ni rahisi sana kama yule mwanamke @kiraitu almost raped. I am talking about T/Bond and especially the current IFB and more so the Tap sale. T/Bond is easier than T/Bill. How? I dont think so. T/Bills are short term instruments, while Bonds are bonding for a long time. Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,331 Location: Masada

|

Swenani wrote:Impunity wrote:maka wrote:Angelica _ann wrote:Impunity wrote:jerry wrote:Impunity wrote:@maka, na usicheke hii swali: Suppose one is applying for Kes. 100,000. And he pays CBK Kes.93,673 ex-discount, what will be his/her 6-monthly interest earnable? Will he/she get: 12% of 100,000? or 12% or 93,673? or 13.177% of 100,000? or 13.177% of 93,673? And on maturity, will he/she get back 100,000 or 93,676? #By the way on Sato I forgot to ask you this during the mbuzi-11 due to the thithimaa effect, though we could see you an ontrapruniewol mind.  You should declare first if you are interested in T/Bill or T/Bond. T/Bill ni rahisi sana kama yule mwanamke @kiraitu almost raped.I am talking about T/Bond and especially the current IFB and more so the Tap sale. You don't remember the argument on Wazua whether T/Bills in earned upfront or at redemption and there was no conclusion to it.  Really why wasnt there a conclusion? @Thitimaaa,T/Bill interest is earned at REDEMPTION, wachana na wale wazee kina @mukiha etal...who will pay you money upfront in any business in this world? If for instance you applied for 182 day papr for amount of 100,000 and the rate was 10% and there was no TAX, then you will pay CBK Kes. 95,251...at maturity you get paid from CBK kes. 100,000 and therefore take with you profits/interest of (100,000-95,251) = Kes 4,749.   why are you contradicting yourself? The fact that you are paying 95,251 and getting 100,000 later is somebody paying you upfront! If I place Kes. 95,251 in a fixed account at Equity and get my principal plus interest amounting to Kes.100,000, does that amount to Equity paying me upfront? Please stick to Vaseline and Bar-Soap. Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: User Joined: 8/15/2013 Posts: 13,237 Location: Vacuum

|

Impunity wrote:Swenani wrote:Impunity wrote:maka wrote:Angelica _ann wrote:Impunity wrote:jerry wrote:Impunity wrote:@maka, na usicheke hii swali: Suppose one is applying for Kes. 100,000. And he pays CBK Kes.93,673 ex-discount, what will be his/her 6-monthly interest earnable? Will he/she get: 12% of 100,000? or 12% or 93,673? or 13.177% of 100,000? or 13.177% of 93,673? And on maturity, will he/she get back 100,000 or 93,676? #By the way on Sato I forgot to ask you this during the mbuzi-11 due to the thithimaa effect, though we could see you an ontrapruniewol mind.  You should declare first if you are interested in T/Bill or T/Bond. T/Bill ni rahisi sana kama yule mwanamke @kiraitu almost raped.I am talking about T/Bond and especially the current IFB and more so the Tap sale. You don't remember the argument on Wazua whether T/Bills in earned upfront or at redemption and there was no conclusion to it.  Really why wasnt there a conclusion? @Thitimaaa,T/Bill interest is earned at REDEMPTION, wachana na wale wazee kina @mukiha etal...who will pay you money upfront in any business in this world? If for instance you applied for 182 day papr for amount of 100,000 and the rate was 10% and there was no TAX, then you will pay CBK Kes. 95,251...at maturity you get paid from CBK kes. 100,000 and therefore take with you profits/interest of (100,000-95,251) = Kes 4,749.   why are you contradicting yourself? The fact that you are paying 95,251 and getting 100,000 later is somebody paying you upfront! If I place Kes. 95,251 in a fixed account at Equity and get my principal plus interest amounting to Kes.100,000, does that amount to Equity paying me upfront? Please stick to Vaseline and Bar-Soap. Young man, when you buy TB at Kshs 95,251 with a par value of 100K and you get interest of kshs 12K per year, you have been paid upfront kshs 4,749 aka the discount. Sema ujinga! If Obiero did it, Who Am I?

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,331 Location: Masada

|

Swenani wrote:Impunity wrote:Swenani wrote:Impunity wrote:maka wrote:Angelica _ann wrote:Impunity wrote:jerry wrote:Impunity wrote:@maka, na usicheke hii swali: Suppose one is applying for Kes. 100,000. And he pays CBK Kes.93,673 ex-discount, what will be his/her 6-monthly interest earnable? Will he/she get: 12% of 100,000? or 12% or 93,673? or 13.177% of 100,000? or 13.177% of 93,673? And on maturity, will he/she get back 100,000 or 93,676? #By the way on Sato I forgot to ask you this during the mbuzi-11 due to the thithimaa effect, though we could see you an ontrapruniewol mind.  You should declare first if you are interested in T/Bill or T/Bond. T/Bill ni rahisi sana kama yule mwanamke @kiraitu almost raped.I am talking about T/Bond and especially the current IFB and more so the Tap sale. You don't remember the argument on Wazua whether T/Bills in earned upfront or at redemption and there was no conclusion to it.  Really why wasnt there a conclusion? @Thitimaaa,T/Bill interest is earned at REDEMPTION, wachana na wale wazee kina @mukiha etal...who will pay you money upfront in any business in this world? If for instance you applied for 182 day papr for amount of 100,000 and the rate was 10% and there was no TAX, then you will pay CBK Kes. 95,251...at maturity you get paid from CBK kes. 100,000 and therefore take with you profits/interest of (100,000-95,251) = Kes 4,749.   why are you contradicting yourself? The fact that you are paying 95,251 and getting 100,000 later is somebody paying you upfront! If I place Kes. 95,251 in a fixed account at Equity and get my principal plus interest amounting to Kes.100,000, does that amount to Equity paying me upfront? Please stick to Vaseline and Bar-Soap. Young man, when you buy TB at Kshs 95,251 with a par value of 100K and you get interest of kshs 12K per year, you have been paid upfront kshs 4,749 aka the discount. Sema ujinga!     Let me ask you,at the time you remit the money to CBK,do you give them 100,000 or 95,251? NOBODY WILL NEVER PAY YOU FOR GOODS NOT DELIVERED,IN ANY HONEST BIGNESS! Endelea kunyonga nyoka lako,u may use kamirithu herbal bar soaps to enhance whatever! Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: User Joined: 8/15/2013 Posts: 13,237 Location: Vacuum

|

Impunity wrote:Swenani wrote:Impunity wrote:Swenani wrote:Impunity wrote:maka wrote:Angelica _ann wrote:Impunity wrote:jerry wrote:Impunity wrote:@maka, na usicheke hii swali: Suppose one is applying for Kes. 100,000. And he pays CBK Kes.93,673 ex-discount, what will be his/her 6-monthly interest earnable? Will he/she get: 12% of 100,000? or 12% or 93,673? or 13.177% of 100,000? or 13.177% of 93,673? And on maturity, will he/she get back 100,000 or 93,676? #By the way on Sato I forgot to ask you this during the mbuzi-11 due to the thithimaa effect, though we could see you an ontrapruniewol mind.  You should declare first if you are interested in T/Bill or T/Bond. T/Bill ni rahisi sana kama yule mwanamke @kiraitu almost raped.I am talking about T/Bond and especially the current IFB and more so the Tap sale. You don't remember the argument on Wazua whether T/Bills in earned upfront or at redemption and there was no conclusion to it.  Really why wasnt there a conclusion? @Thitimaaa,T/Bill interest is earned at REDEMPTION, wachana na wale wazee kina @mukiha etal...who will pay you money upfront in any business in this world? If for instance you applied for 182 day papr for amount of 100,000 and the rate was 10% and there was no TAX, then you will pay CBK Kes. 95,251...at maturity you get paid from CBK kes. 100,000 and therefore take with you profits/interest of (100,000-95,251) = Kes 4,749.   why are you contradicting yourself? The fact that you are paying 95,251 and getting 100,000 later is somebody paying you upfront! If I place Kes. 95,251 in a fixed account at Equity and get my principal plus interest amounting to Kes.100,000, does that amount to Equity paying me upfront? Please stick to Vaseline and Bar-Soap. Young man, when you buy TB at Kshs 95,251 with a par value of 100K and you get interest of kshs 12K per year, you have been paid upfront kshs 4,749 aka the discount. Sema ujinga!     Let me ask you,at the time you remit the money to CBK,do you give them 100,000 or 95,251? NOBODY WILL NEVER PAY YOU FOR GOODS NOT DELIVERED,IN ANY HONEST BIGNESS! Endelea kunyonga nyoka lako,u may use kamirithu herbal bar soaps to enhance whatever! Hauwezi saidika, I will revisit this when I'm in the mood of lowering my IQ, today is not one of those days   If Obiero did it, Who Am I?

|

|

|

Rank: Elder Joined: 2/16/2007 Posts: 2,114

|

@Liv, Chaka wrote:My understanding of a bond issue is that either it has a coupon rate or it doesn't(zero coupon) in which case it will then be sold at a lower price than the par value.In this issue is seems both of these are applying?What's the explanation? http://www.investingansw.../bonds/coupon-rate-1323

maka wrote:Impunity wrote:@when do they close shop for accepting bids for this tap issuance?

|

|

|

Rank: User Joined: 8/15/2013 Posts: 13,237 Location: Vacuum

|

Chaka wrote:@Liv, Chaka wrote:My understanding of a bond issue is that either it has a coupon rate or it doesn't(zero coupon) in which case it will then be sold at a lower price than the par value.In this issue is seems both of these are applying?What's the explanation? http://www.investingansw.../bonds/coupon-rate-1323

maka wrote:Impunity wrote:@when do they close shop for accepting bids for this tap issuance?  Both are not applying, In the above, the coupon rate is 12% while the discount is the difference between par value-market value Both the zero coupon and coupon bonds can have a discount and vice versa is also true depending on the yield rate If Obiero did it, Who Am I?

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,331 Location: Masada

|

Swenani wrote:Chaka wrote:@Liv, Chaka wrote:My understanding of a bond issue is that either it has a coupon rate or it doesn't(zero coupon) in which case it will then be sold at a lower price than the par value.In this issue is seems both of these are applying?What's the explanation? http://www.investingansw.../bonds/coupon-rate-1323

maka wrote:Impunity wrote:@when do they close shop for accepting bids for this tap issuance?  Both are not applying, In the above, the coupon rate is 12% while the discount is the difference between par value-market value Both the zero coupon and coupon bonds can have a discount and vice versa is also true depending on the yield rate As you nguys continue yada-yadaing, me I am waiting for my first pay check on 24th-Apr-2017 and to be followed by 29 more checks for 15 years... We should have mbuzi-12 on the last week of April next year!  Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 2/16/2007 Posts: 2,114

|

Swenani wrote:

Both are not applying, In the above, the coupon rate is 12% while the discount is the difference between par value-market value

Both the zero coupon and coupon bonds can have a discount and vice versa is also true depending on the yield rate

If there is a coupon rate and a discount, then both are applying?In which case, this thing should be called a "hybrid" bond?To me it appears that this bond biz has been made mysterious to discourage small timers from investing therein?

|

|

|

Wazua

»

Investor

»

Bonds

»

Treasury Bills and Bonds

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|