Wazua

»

Investor

»

Economy

»

Investors Lounge

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

The KE dream by WB - http://www.theeastafrica...24/-/ag71b7/-/index.html$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 11/13/2006 Posts: 551 Location: Nairobi

|

We are witnessing a rise of separatist movements and third parties across Europe and the United States. It is all in response to the sovereign debt crisis. In the UK, the UKIP party, led by perhaps the only statesman in Europe, Nigel Farage, is gaining ground fast. http://www.guardian.co.u...tor-ukip-support-record

http://www.youtube.com/watch?v=zaUYDeVtG0Q

Europe is being held together by Germany and France. The latter is falling by the wayside as the Marxist politics of Hollande have resulted in the lowest opinion poll rating of a modern-day French president. Merkel is the only hope for the European experiment with the Euro. If she's defeated, things could fall apart. September will be a red letter month for Europe as Germany goes to the ballot box. The best laid plans of Merkel may be thrown asunder by the Alternative für Deutschland (Alternative for Germany). http://www.spiegel.de/in...or-merkel-a-899803.html

http://www.spiegel.de/in...ic-voters-a-887744.html

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Tuesdays market green close - http://www.zerohedge.com/news/2013-05-14/18-out-18$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

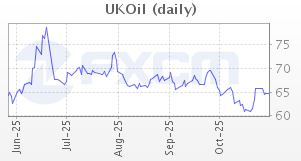

Commodities across board have had it rough since early March including oil  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Gone in 12 months: How fraudsters stole $17m from Kenya’s banks - http://www.theeastafrica...4/-/fe3jd3/-/index.html

Quote:In public, banking executives in Kenya exhibit optimism that white-collar crime rates will soon come down, but in private, they are a worried lot. Latest statistics on banking fraud explain why:

Fraudsters have stolen at least Ksh1.5 billion ($17.64 million) from Kenyan banks in the past one year, in schemes hatched by technology-savvy bank employees.

According to data from the Banking Fraud Investigations Department (BFID), financial institutions reported Ksh1.49 billion ($17.52 million) stolen from customers’ accounts between April 2012 and April 2013. Investigators managed to recover only Ksh530 million ($6.2 million). Several cases are pending in court or are still under investigation.

Most of these crimes keep recurring, raising questions over the ability of financial institutions to seal loopholes in their systems.

Kenya’s top five banks by profitability — Equity, Co-operative, Standard Chartered, KCB and Barclays — were the worst hit by fraudsters.

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Rand rout continues while JSE also continues to rally and posting all time highs to boot. Such stack divergence never ends well. The risk of JSE erasing the entire rally to catch up with the rand reality is very high. Caution if long the JSE since USDZAR looks poised to vault 10.00 handle while gold & platinum get hammered as miners protests seek a fat wage hike. Econ fundies at crosshairs... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

Apple has been accused of being "among America's largest tax avoiders" by a Senate committee. The committee said Apple had used "a complex web of offshore entities" to avoid paying billions of dollars in US income taxes. The committee said there was no indication it had done anything illegal. Apple has a cash stockpile of $145bn (£95bn), but the committee said $102bn of this was held offshore. Apple drew criticism three weeks ago when it sold $ 17bn in bonds to raise cash to fund payouts to shareholders, rather than repatriating some of its cash reserves, which would be taxed in the US. The move saved the company an estimated $9.2bn in taxes. http://m.bbc.co.uk/news/business-22600984

GOD BLESS YOUR LIFE

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Rwanda and the new lions of Africa Dont cry for me Europe"There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

youcan'tstopusnow wrote:Apple has been accused of being "among America's largest tax avoiders" by a Senate committee. The committee said Apple had used "a complex web of offshore entities" to avoid paying billions of dollars in US income taxes. The committee said there was no indication it had done anything illegal. Apple has a cash stockpile of $145bn (£95bn), but the committee said $102bn of this was held offshore. Apple drew criticism three weeks ago when it sold $ 17bn in bonds to raise cash to fund payouts to shareholders, rather than repatriating some of its cash reserves, which would be taxed in the US. The move saved the company an estimated $9.2bn in taxes. http://m.bbc.co.uk/news/business-22600984

So they've suddenly made this discovery? What a pathetic side show. What about the other firms that are doing the same? $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

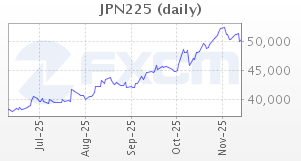

Abenomics and the consequences of the extreme jap leverage caused by the crazy yen debasement/devaluation - $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Rand weakness back to GFC levels! What is Mr Market saying about SA...  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 11/13/2006 Posts: 551 Location: Nairobi

|

@Hisah. The U.S. Dollar concluded a 21 year rally versus the Rand in 2001. It then declined over a 3 year period. The next turning point on a yearly level may be 2013/2014 which is here and now. Technical resistance lies at 10.3 and 11 on a yearly basis. Watch out for the Dollar rally: http://www.scribd.com/do...562355/U-S-Dollar-Index

hisah wrote:Rand weakness back to GFC levels! What is Mr Market saying about SA...

|

|

|

Rank: Veteran Joined: 7/22/2011 Posts: 1,325

|

God bless you Ben Bernanke, the market loves you!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Nikkei today slid by 1000+ points! Last time that happened was during that mega quake in March 2011. It is getting cranky... Japan’s Topix index slides 7%, as financial companies plunge amid rising bond yields - http://www.livemint.com/...-in-afternoon-trade.html$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Quote:I have been very concerned about Europe. The euro is in the process of destroying the European Union. To some extent, this has already happened, in the sense that the EU was meant to be a voluntary association of equal states. - George Soros On Yahoo"There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

murchr wrote:Quote:I have been very concerned about Europe. The euro is in the process of destroying the European Union. To some extent, this has already happened, in the sense that the EU was meant to be a voluntary association of equal states. - George Soros On Yahoo He made a bucket load during the first ERM crisis and almost broke a CB (bank of england)! I wonder what he's up to after riding the current yen debasement by psycho Abe-nomics.

EU NPL spike esp the south regions is big trouble that EU wants to buy that stinking chunk of bad loans to give banks a chance to breath. Spanish banks are looking crimped with Bankia already seeking a bailout- as subprime proves to be a super titanic ship. Next Italian banks. Don't even look at the jobless rate or the recessing econ figures.

But with all these 'rosy' fundies, EU equities are scaling 2007 highs. Perfect storm this one...$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

hisah wrote:murchr wrote:Quote:I have been very concerned about Europe. The euro is in the process of destroying the European Union. To some extent, this has already happened, in the sense that the EU was meant to be a voluntary association of equal states. - George Soros On Yahoo He made a bucket load during the first ERM crisis and almost broke a CB (bank of england)! I wonder what he's up to after riding the current yen debasement by psycho Abe-nomics.

EU NPL spike esp the south regions is big trouble that EU wants to buy that stinking chunk of bad loans to give banks a chance to breath. Spanish banks are looking crimped with Bankia already seeking a bailout- as subprime proves to be a super titanic ship. Next Italian banks. Don't even look at the jobless rate or the recessing econ figures.

But with all these 'rosy' fundies, EU equities are scaling 2007 highs. Perfect storm this one... Now he's blaming the Germans, he told them they must accept Eurobonds or leave the Euro. I wonder what the implications would be if Germany left the Euro. Lord Jacob Rothschild took a £130m bet against the euro...I've been waiting for the chaos. The economist Today"There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

SAC Capital - http://www.foxbusiness.c...na-to-testify-ny-times/ After June 3rd $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Who wouldn't want to have Norway's problems http://www.nytimes.com/2...ns-into-energy.html?_r=0"There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Wazua

»

Investor

»

Economy

»

Investors Lounge

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|