Wazua

»

Investor

»

Economy

»

Investors Lounge

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

As usual Nigel Farage takes jabs at the EU. He says one must be mad to invest in the eurozone - https://www.youtube.com/watch?v=JMf_KwQ2Xlk The ATM queues - http://www.businessinsid...cyprus-atm-panic-2013-3

The protest - http://www.businessinsid...t-protest-photos-2013-3

That gut feeling I have, that one that makes me walk away from the trading desk, that one I dread the most... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

@KK - Have a look at this... Capital flight into bitcoin... Gold is has also rebounded after the hard selloff last month fuelled by Cyprus spanner in the works. http://www.bloomberg.com...euro-for-bitcoins-.html

Quote:Worried your government is going to take your savings? There's an app for that.

Actually, there's an entire currency: Bitcoin, an online-only currency based on a decentralized network. It's unregulated, hard to track and increasingly common. Since Sunday, downloads of three Bitcoin-related apps have surged on Spanish charts, Bloomberg Businessweek reports.

The interest in Bitcoin coincided with news that the Cyprus government planned to tax savings accounts as part of the country's bailout program. The value of the online currency increased more than 20 percent in the past two days to $64, according to the latest price information.

The downside is it's a currency that has experienced price fluctuations, occasional hacking and account thefts, and is a favorite for black-market transactions, including almost 2 million a month in illegal online drug purchases at the Silk Road marketplace. That some Europeans are investing savings in Bitcoin isn't exactly a sign of confidence in European banking.

According to a European Central Bank report published in October, increased demand for Bitcoin "could have a negative impact on the reputation of central banks," especially if the public perceives Bitcoin's rise is due to "a central bank not doing its job properly." $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

EU loses cash control over Cyprus if Russia gives money - https://www.youtube.com/watch?v=_36aJkQJat8 I'm waiting for the default fallout.Cyprus bondholders will get sizable hair cuts... Then we move to contagion - https://www.youtube.com/watch?v=uj4QrAcwVi0$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Market talk - Laiki bank likely to be wound up by next week if by next tuesday no deal is passed. For those interested in watching live the discussions - http://www.cybc.com.cy/en/index.php/tv?id=91

Tough horse trading... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 11/16/2011 Posts: 196 Location: united states of africa

|

Money, money, money, money. For those who are witty, do some due dilligence quickly. GEVO. Energy.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

jonna wrote:Money, money, money, money.

For those who are witty, do some due dilligence quickly.

GEVO. Indeed - http://www.theflyonthewa...-suit-in-Delaware-Court

The excess selling since Sept 2012 presents a good short squeeze ground. So far its up 50% YTD, but still far from it's true value. Yep, I like this one. Thanks.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Btw goldman & MS stocks have been sold this week. The cyprus connection... @cde - can you see the arabs? SWF funds are coming. Cyprus will accelerate the process... \o/  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Back in Jan 2013 the eurocrat Barroso said - The euro crisis is over - http://www.guardian.co.u...ver-jose-manuel-barroso Quote:The euro has been saved and the euro crisis is a

thing of the past, European commission

president José Manuel Barroso has declared. But his optimistic comments and the prospect of

looser rules for banks failed to lift markets,

which ended a strong run of recent gains. "I think we can say that the existential threat

against the euro has essentially been overcome,"

Barroso said in Lisbon. "In 2013 the question

won't be if the euro will, or will not, implode," he

said. Barroso has maintained an optimistic stance

throughout the crisis, but his comments were in

sharp contrast to the new year's message from

German chancellor Angela Merkel, who told TV

viewers last week that the currency zone faced

another rocky 12 months. City analysts are also deeply concerned that

austerity measures demanded by Brussels as the

price of bailout funds would lead to prolonged

recessions in periphery countries and the need

for steeper spending cuts. Cuts to essential public services in Spain, Italy,

Greece and Portugal are expected to increase

unemployment and lead to further social unrest. Protests on the streets of Madrid on Monday

highlighted the tensions inside the euro area

after banner-waving protesters blamed Brussels,

Berlin and the right of centre PP government of

Mariano Rajoy for privatisations and cuts in

healthcare spending. Elga Bartsch, an analyst at Morgan Stanley, said

she was anxious that Barroso and his colleagues

in Brussels would fail to resolve long-running

disputes over the EU's new institutions. "The euro crisis seems contained for now. But

we think it is not resolved for good. In

addressing the fundamental flaws in the euro's

institutional set-up, progress on banking union

will be key. Assuming no crisis escalation, the

euro area should re-emerge from recession and return to sub-par growth. Politics is the main

risk," she said.

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

A rightwing group has submitted more than 106,000 signatures to the federal authorities, seeking a vote on stopping the sale of gold reserves held by the Swiss National Bank (SNB). It also wants gold bars stored in the US to be returned. http://www.swissinfo.ch/...rves_.html?cid=35278920

GOD BLESS YOUR LIFE

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

http://dealbook.nytimes....trade-halts-operations/

Somehow Intrade.com went off just a few days before the Cyprus 'surprise'. But everyone says Cyprus is just a small piece of the euro pie. If so, why does EU hang on instead of letting it default and kick it out of the euro? Is Cyprus that small? Contagion won't happen. Really? $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 11/13/2006 Posts: 551 Location: Nairobi

|

"When more of the people's sustenance is exacted through the form of taxation than is necessary to meet the just obligations of government and expenses of its economical administration, such exaction becomes ruthless extortion and a violation of the fundamental principles of a free government." - Grover Cleveland, December 1886 "France’s top private sector bosses could see their salaries capped under a bill being tabled by the Socialist government, in the latest high-profile move aimed at punishing the rich. The measure came as President Francois Hollande seeks to woo back left-wing supporters who are angry at his focus on the deficit and debt reduction and failure to stem rising unemployment. Their disapproval has helped turn him into the most unpopular French president ever after 10 months in office..." Read more: http://business.financia...nce-private-sector-pay/

|

|

|

Rank: Member Joined: 11/13/2006 Posts: 551 Location: Nairobi

|

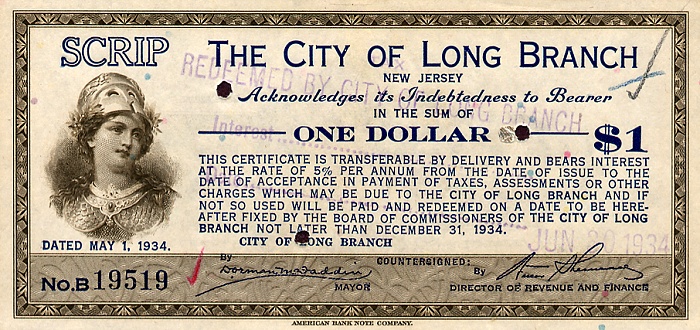

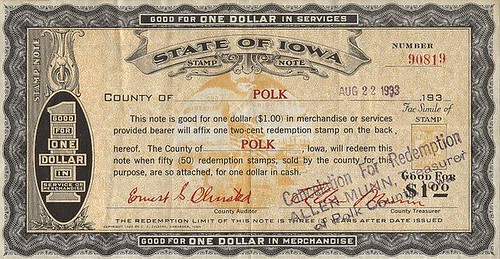

@Hisah. Indeed, gold has rebounded off the lows around $1560 and the U.S. Dollar continues to defy the doomsday scenario by acting as a safe haven as it did in the 1930s. Bitcoin is acting as a scrip or substitute paper money the same way the U.S. had Depression Scrips due to a shortage of paper currency in the 1930s. This was a direct result of the thousands of bank failures and hoarding of money.     Even the American Civil War of 1861 to 1865 caused a drastic shortage of coinage resulting in scrip issuance.  hisah wrote:@KK - Have a look at this... Capital flight into bitcoin... Gold is has also rebounded after the hard selloff last month fuelled by Cyprus spanner in the works. http://www.bloomberg.com...euro-for-bitcoins-.html

Quote:Worried your government is going to take your savings? There's an app for that.

Actually, there's an entire currency: Bitcoin, an online-only currency based on a decentralized network. It's unregulated, hard to track and increasingly common. Since Sunday, downloads of three Bitcoin-related apps have surged on Spanish charts, Bloomberg Businessweek reports.

The interest in Bitcoin coincided with news that the Cyprus government planned to tax savings accounts as part of the country's bailout program. The value of the online currency increased more than 20 percent in the past two days to $64, according to the latest price information.

The downside is it's a currency that has experienced price fluctuations, occasional hacking and account thefts, and is a favorite for black-market transactions, including almost 2 million a month in illegal online drug purchases at the Silk Road marketplace. That some Europeans are investing savings in Bitcoin isn't exactly a sign of confidence in European banking.

According to a European Central Bank report published in October, increased demand for Bitcoin "could have a negative impact on the reputation of central banks," especially if the public perceives Bitcoin's rise is due to "a central bank not doing its job properly."

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

That hurried move by the Brit Government to stuff a plane full of Euros destined to appease its troops based in Cyprus, helped recall how at the height of #Casinonomics GoZ was moved to do the following -> Zimbabwe troops 'eat elephants' http://news.bbc.co.uk/2/hi/africa/7820885.stm

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

BRICs summit - http://www.brics5.co.za/ $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

The dutch subprime deleveraging/unwinding continues - http://www.macrobusiness...ches-economy-for-monday/$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

http://www.marketwatch.c...-23?mod=wsj_share_tweet This week the Cyprus drama will be determined - bailout or default. My trading the news strategy - Bailout failure will see global stocks selloff then recover in a month's time for the next rally cycle. Think Greece crisis and US downgrade past events. - Successful bailout will see global stocks rally only to selloff hard in a few weeks time. From the look of things a successful bailout is the likely setup. Stocks are quite high and a catalyst is needed to present a discount window. Btw April will likely be a sellside in both cases! Market discounts must come... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Bullion as collateral permitted by Bank of Russia - http://www.4-traders.com...red-with-gold-16558214/ Hmmm... The Banker takes bullion in Russia... Something changing here... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Cyprus bailout + positive headlines = Perfect trade setup for the trap - http://www.cnbc.com/id/100574390 When GS puts an overweight rating on something, shitty deals abound... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

Visiting, Tanzania, South Africa and Republic of Congo on his first trip abroad as president following a visit to Russia, Xi is expected to build on expanding economic relations that many Africans see as a healthy counterbalance to the influence of the West. The agreements with Tanzania included plans to co-develop a new port and industrial zone complex, a concessional loan for communications infrastructure and an interest free loan to the Tanzanian government. http://www.reuters.com/a...0CG0KV20130324?irpc=932

GOD BLESS YOUR LIFE

|

|

|

Wazua

»

Investor

»

Economy

»

Investors Lounge

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|