Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

Cde Monomotapa wrote:guru267 wrote:Cde Monomotapa wrote:youcan'tstopusnow wrote:Let's see what Prof. Ndung'u has to say on Monday...

Calling a Bullish 'laugh now, cry later' 150-200bps cut. As much as it is fun playing momentum, not wise being out the mkt too long. 50-100bps bruv!! We need excitement my dear  but let us see. 100bps it is... When the guru speaks......  Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

guru267 wrote:Cde Monomotapa wrote:guru267 wrote:Cde Monomotapa wrote:youcan'tstopusnow wrote:Let's see what Prof. Ndung'u has to say on Monday...

Calling a Bullish 'laugh now, cry later' 150-200bps cut. As much as it is fun playing momentum, not wise being out the mkt too long. 50-100bps bruv!! We need excitement my dear  but let us see. 100bps it is... When the guru speaks......  Sure  . Let's see keshoz then.

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

Cde Monomotapa wrote:guru267 wrote:Cde Monomotapa wrote:guru267 wrote:Cde Monomotapa wrote:youcan'tstopusnow wrote:Let's see what Prof. Ndung'u has to say on Monday...

Calling a Bullish 'laugh now, cry later' 150-200bps cut. As much as it is fun playing momentum, not wise being out the mkt too long. 50-100bps bruv!! We need excitement my dear  but let us see. 100bps it is... When the guru speaks......  Sure  . Let's see keshoz then. No white smoke yet. @guru is just speculating. Oops,'spoke' too soon. just saw the rate cut @zerohedge.com @SufficientlyP

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

Feels like a good day.Lets see.

|

|

|

Rank: Veteran Joined: 3/26/2012 Posts: 985 Location: Dar es salaam,Tanzania

|

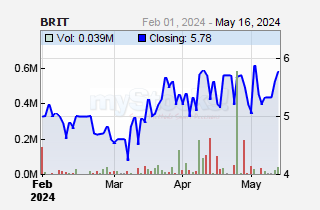

hisah wrote:Britank's recovery is similar to that of Coop bank post listing hard selloff & rally. The listing price (9) is still a barrier until 9.50 is broken with volume spike. That 2nd upleg will be furious. For now insurance counters will consolidate till H1 results are availed. That upleg will sustain till year end. This is still the insurance counters year. Banks had their's last year. Now I wait for mpesa bank results. Let's see if the good news will sustain the buy pressure since Nov 2012. I never expected this elephant to clock above 5.80 in 2013 and I can only watch mr market crazy move. Now that NSE20 is in a reversal mood that is expected to spread into May, any heavy selling (10 - 15%) on mpesa bank post results (if EPS < 0.40) will make the index to sag more. For those still expecting 5400 to print this year, mpesa bank, eabl, member, bbk, coop, scbk, arm & bamburi need to rally at least 20% and sustain those levels. A big boost could also come from kk's recovery above 13. All these will need volume to spike on the bid side.  Interesting volume moves on Britank on an RSI less than 35. Mid morning 2.5 M shares traded by locals.At about 1.00 PM ,foreigners did like 3M shares.Same pattern of behavior like Uchumi,last week when it was trading at 17.8-18 and at an RSI of 31.

“The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.”

|

|

|

Rank: Veteran Joined: 4/30/2010 Posts: 1,635

|

Turnover declined to Kes.633M from the previous session’s Kes.775M, the number of shares

traded stood at 46M against 53M posted yesterday.

The NSE 20 Share Index was up 11.78 points to stand at 4917.46.

All share Index (NASI) edged up 0.45 points to stand at 123.35.

|

|

|

Rank: Elder Joined: 11/7/2007 Posts: 2,182

|

5000 again? LOVE WHAT YOU DO, DO WHAT YOU LOVE.

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

* Net foreign investor inflows to the Nairobi Securities Exchange (NSE) rose to Sh3 billion in April, compared to Sh1.68 billion in March. * Analysts say the positive sentiment following the peaceful election is what has rekindled foreign investor interest. *In a report dated May 5, London-based research firm Business Monitor International said the General election had shown “positive signs for Kenya’s political development.” “Financial markets have responded positively to the result and we have resumed our bullish position on the Nairobi Stock Exchange 20 Index,” said the research firm in the monthly report on political risk and macroeconomic prospects. http://www.businessdailyafrica....4/-/71nph3z/-/index.html

|

|

|

Rank: Veteran Joined: 4/30/2010 Posts: 1,635

|

The Bourse opened the week with a total of 16M shares valued at Kes.362M, down from Kes.1.92bn on a volume of 48M shares posted last Friday.

The NSE 20 Share Index shed 22.91 points to stand at 4866.05.

All Share Index (NASI) was up 0.05 points to stand at 122.57

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

KCB exdiv today - market open and bids testing a low of 39/- Waiting to see if 35 - 38 range offers support in coming weeks. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 4/30/2010 Posts: 1,635

|

Buoyed by robust trading, turnover soared to Kes.954M on a volume of 40M shares, up from Kes.362M on 16M shares posted yesterday.

The NSE 20 Share Index shed 21.24 points to stand at 4844.81.

All Share Index (NASI) edged up 0.29 points to stand at 122.86.

|

|

|

Rank: Veteran Joined: 4/30/2010 Posts: 1,635

|

Turnover declined to Kes.679M from the previous session’s Kes.1.37bn, the number of

shares traded stood at 31M against a hefty tally of 83M posted yesterday.

The NSE 20 Share Index closed 37.34 points higher to stand at 4955.61.

All Share Index (NASI) was up 1.36 points to stand at 126.52

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

hisah wrote:KCB exdiv today - market open and bids testing a low of 39/- Waiting to see if 35 - 38 range offers support in coming weeks. So far coping well exdiv.

Bluechip counters need to see more huge bid pressure to dismiss 5100 with aplomb. Though I'm not comfy with that gap @4600 - 4700 level.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

hisah wrote:hisah wrote:KCB exdiv today - market open and bids testing a low of 39/- Waiting to see if 35 - 38 range offers support in coming weeks. So far coping well exdiv.

Bluechip counters need to see more huge bid pressure to dismiss 5100 with aplomb. Though I'm not comfy with that gap @4600 - 4700 level. @hisah when did you become sooo obsessed with this gap theory?? I'm planning a HUGE buy for HFCK at 23.5 ex div on Monday... Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,192 Location: nairobi

|

Hfck goes ex today..you will be lucky to get it sub 23 with an interim div coming in july "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

mlennyma wrote:Hfck goes ex today..you will be lucky to get it sub 23 with an interim div coming in july 26 is a barrier that needs to be broken. With eabl and saf rallying to high heaventhis bodes well for the market in general. And with equity also edging higher its only a matter of time. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

guru267 wrote:hisah wrote:hisah wrote:KCB exdiv today - market open and bids testing a low of 39/- Waiting to see if 35 - 38 range offers support in coming weeks. So far coping well exdiv.

Bluechip counters need to see more huge bid pressure to dismiss 5100 with aplomb. Though I'm not comfy with that gap @4600 - 4700 level. @hisah when did you become sooo obsessed with this gap theory?? I'm planning a HUGE buy for HFCK at 23.5 ex div on Monday... Not obsessed with gaps, just that gaps dont offer support. When a selloff during a bear run gets to a gap zone, ulcers central becomes deadly as no support exists and prices bleed heavily.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

hisah wrote:guru267 wrote:hisah wrote:hisah wrote:KCB exdiv today - market open and bids testing a low of 39/- Waiting to see if 35 - 38 range offers support in coming weeks. So far coping well exdiv.

Bluechip counters need to see more huge bid pressure to dismiss 5100 with aplomb. Though I'm not comfy with that gap @4600 - 4700 level. @hisah when did you become sooo obsessed with this gap theory?? I'm planning a HUGE buy for HFCK at 23.5 ex div on Monday... Not obsessed with gaps, just that gaps dont offer support. When a selloff during a bear run gets to a gap zone, ulcers central becomes deadly as no support exists and prices bleed heavily. @hisah the gap principle guides perfectly liquid and perfectly informed markets... I don't think we should apply it fully to the NSE! Imho Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Veteran Joined: 6/17/2009 Posts: 1,623

|

EABL touches 400 snuffing all the supply at this price today,something more than beer is brewing here!

|

|

|

Rank: Veteran Joined: 12/11/2006 Posts: 918

|

EABL-this is price stuffing. “Invest in yourself. Your career is the engine of your wealth.”

|

|

|

Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|