Wazua

»

Investor

»

Offshore

»

Realities of Forex Investment

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Back in Oct 2007 when DJIA was smashing records by surpassing 14000pts, EURUSD was @1.41 - 1.45 range, GBPUSD was @2.00, S&P was @1527pts and so forth. However, this time it feels totally different. Traders as well as media houses are not trumpeting the incredible recovery by the US indices, which have reclaimed 5yr highs despite the squeaky global econ being supported by a tsunami slosh of USD, euros and yens. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/23/2009 Posts: 1,626

|

hisah wrote:Back in Oct 2007 when DJIA was smashing records by surpassing 14000pts, EURUSD was @1.41 - 1.45 range, GBPUSD was @2.00, S&P was @1527pts and so forth. However, this time it feels totally different. Traders as well as media houses are not trumpeting the incredible recovery by the US indices, which have reclaimed 5yr highs despite the squeaky global econ being supported by a tsunami slosh of USD, euros and yens.

I like your thinking. You're listening to what they are not saying. Uncertainty is certain.Let go

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

The direct correlation between the DOW/S&P and the EUR/USD is seriously mindblowing!  Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Elder Joined: 2/23/2009 Posts: 1,626

|

guru267 wrote:The direct correlation between the DOW/S&P and the EUR/USD is seriously mindblowing!  What are your theories on causation? Uncertainty is certain.Let go

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

guru267 wrote:The direct correlation between the DOW/S&P and the EUR/USD is seriously mindblowing!  That correlation had partially died between 2011 & 2012. Now its back as it was pre GFC days... Borrow $ then buy euro stocks. Carry trade, borrow yens buy high yield ccys like kiwi & aussie. And all over sudden life is good except this time subprime is missing in action...

My only fear is oil might scale back to $150/bb and that will blow up inflation globally. I dont need to say what next after that!

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 5/7/2009 Posts: 1,032 Location: Sea of Transquility

|

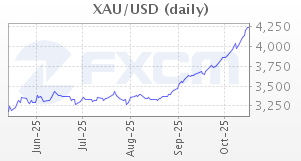

Buy gold 1663, sl 1657, tp 1694. “small step for man”

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

@ceinz - buy gold signal confirmed http://in.reuters.com/ar...r-idINDEE91306G20130204 Target 2011 all time highs! $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 5/7/2009 Posts: 1,032 Location: Sea of Transquility

|

Yes, technically we seems poised for a big move, but the best strategy is to go smaller targets whilst buying pull backs. “small step for man”

|

|

|

Rank: Elder Joined: 2/23/2009 Posts: 1,626

|

W.B. on GoldUncertainty is certain.Let go

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

|

|

|

Rank: Veteran Joined: 5/7/2009 Posts: 1,032 Location: Sea of Transquility

|

Good thinking as expected of a billionaire who wants to create a positive impact in the society and who can afford the luxury of the long term outlook. But for penny worth speculators like us, anything goes as long as it brings some shillings home. “small step for man”

|

|

|

Rank: Elder Joined: 2/23/2009 Posts: 1,626

|

Ceinz wrote:Good thinking as expected of a billionaire who wants to create a positive impact in the society and who can afford the luxury of the long term outlook. But for penny worth speculators like us, anything goes as long as it brings some shillings home. True. Uncertainty is certain.Let go

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Ceinz wrote:Yes, technically we seems poised for a big move, but the best strategy is to go smaller targets whilst buying pull backs. http://www.youtube.com/watch?v=HvbPSB9lwIk $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

At least this time CBK is not asleep like back in 2011. Unless KE elections go really awry, KES weakness will be orderly. My target is around 90/- But anything above 95/$ will be bad news for the econ.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/23/2009 Posts: 1,626

|

When I saw this,this is what I thought. If the shilling weakens the purchasing power of foreigners increases. If something were to happen after the elections both the shilling and stocks might weaken.Thus foreigners will have more money to buy more shares at even cheaper prices.Now I'm left wondering about which option is best if something happens or we have peaceful elections. Uncertainty is certain.Let go

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

ChessMaster wrote:Ceinz wrote:Good thinking as expected of a billionaire who wants to create a positive impact in the society and who can afford the luxury of the long term outlook. But for penny worth speculators like us, anything goes as long as it brings some shillings home. True. @chess - you made me sweat digging up archives to counter WB's negative gold views.

Read this - http://azizonomics.com/2...buffett-priced-in-gold/

What people are forgetting is global CBs have devalued their currencies like crazy post GFC as currency wars escalate. If you price $, €, £ or ¥ assets to mention, but a few in gold term, the devaluation is very stark! Purchasing power has taken a sizable haircut lowering the standard of living for the common man globally!

e.g. Look for the Dow chart priced in gold since 1900 and see the hidden currency devaluation.

WB is right saying gold is a non productive asset unlike a farmland or company xyz, but as a hedge to store value, one needs some gold in their portfolio.

Extra reading - http://azizonomics.com/2...7/gold-tells-the-truth/

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/23/2009 Posts: 1,626

|

hisah wrote:ChessMaster wrote:Ceinz wrote:Good thinking as expected of a billionaire who wants to create a positive impact in the society and who can afford the luxury of the long term outlook. But for penny worth speculators like us, anything goes as long as it brings some shillings home. True. @chess - you made me sweat digging up archives to counter WB's negative gold views.

Read this - http://azizonomics.com/2...buffett-priced-in-gold/

What people are forgetting is global CBs have devalued their currencies like crazy post GFC as currency wars escalate. If you price $, €, £ or ¥ assets to mention, but a few in gold term, the devaluation is very stark! Purchasing power has taken a sizable haircut lowering the standard of living for the common man globally!

e.g. Look for the Dow chart priced in gold since 1900 and see the hidden currency devaluation.

WB is right saying gold is a non productive asset unlike a farmland or company xyz, but as a hedge to store value, one needs some gold in their portfolio.

Extra reading - http://azizonomics.com/2...7/gold-tells-the-truth/

@hisah - I was just sharing links. Ceinz put it well,unless we are billionares,we've got to make money. http://www.bloomberg.com/news/2012-10-10/slim-s-frisco-buys-aurico-mexico-mining-assets-for-750-million.htmlUncertainty is certain.Let go

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Ceinz wrote:Yes, technically we seems poised for a big move, but the best strategy is to go smaller targets whilst buying pull backs. But this chart is making things look cloudy. The $ is quietly rallying after € topped out @1.37 levels and this is making PM prices to sag.

Russia has been on a buying spree as per world gold council as well as other CBs. With all the tsunami money printing, PMs should vault here in due course.

Stumbled upo this written back in 2006 - http://bigpicture.typepa...04/dow_jonesgold_r.html

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Another interesting site called priced in gold - http://pricedingold.com/ $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Anyone still holding yen shorts? Been long GBPJPY (the beast) since Dec @132.46 and we're up 1 big figure. There's scope it may nail the next round level @150 and at the next big figure @152 i'll take profits. By then USDJPY may vault to 100 and nikkei around 12800 - 13000pts and very stretched technically. So a selloff will be in order as yen shorts get a proper squeezing. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Wazua

»

Investor

»

Offshore

»

Realities of Forex Investment

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|