Wazua

»

Investor

»

Bonds

»

Treasury Bills and Bonds

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Impunity wrote:maka wrote:Liv wrote:Impunity wrote:Liv wrote:@Bond buyers and traders in this forum,

what is your forecast on the rates on 5 and 20 year bonds next week? And why? I think the 20 yr paper is fixed at 14%, the 5 year paper will fetch 15%, give or take. My 1 bob forecast!

My forecast:

5 year bond coupon rate will average between 13.5 and 13.8%

20 year bond Yield rate will average between 14.3 and 14.7%

@Liv doubt anyone would want to bid aggressively on this papers...the probability of missing them is quite high. ...guys will undercut each other...lets see how next week goes then we will know how rates will be. Its sad I am liquid at the time the rates are looking south with a dark cloud of uncertainity!!!    You can get some many papers at the secondary market at good rates look at Today or Tomorrow price list... possunt quia posse videntur

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,331 Location: Masada

|

maka wrote:Impunity wrote:maka wrote:Liv wrote:Impunity wrote:Liv wrote:@Bond buyers and traders in this forum,

what is your forecast on the rates on 5 and 20 year bonds next week? And why? I think the 20 yr paper is fixed at 14%, the 5 year paper will fetch 15%, give or take. My 1 bob forecast!

My forecast:

5 year bond coupon rate will average between 13.5 and 13.8%

20 year bond Yield rate will average between 14.3 and 14.7%

@Liv doubt anyone would want to bid aggressively on this papers...the probability of missing them is quite high. ...guys will undercut each other...lets see how next week goes then we will know how rates will be. Its sad I am liquid at the time the rates are looking south with a dark cloud of uncertainity!!!    You can get some many papers at the secondary market at good rates look at Today or Tomorrow price list... If the market reads say 12% , is possible to get anything like 14% in the secondary market? Check my inbox for some queries~! Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: User Joined: 8/15/2013 Posts: 13,237 Location: Vacuum

|

Impunity wrote:maka wrote:Impunity wrote:maka wrote:Liv wrote:Impunity wrote:Liv wrote:@Bond buyers and traders in this forum,

what is your forecast on the rates on 5 and 20 year bonds next week? And why? I think the 20 yr paper is fixed at 14%, the 5 year paper will fetch 15%, give or take. My 1 bob forecast!

My forecast:

5 year bond coupon rate will average between 13.5 and 13.8%

20 year bond Yield rate will average between 14.3 and 14.7%

@Liv doubt anyone would want to bid aggressively on this papers...the probability of missing them is quite high. ...guys will undercut each other...lets see how next week goes then we will know how rates will be. Its sad I am liquid at the time the rates are looking south with a dark cloud of uncertainity!!!    You can get some many papers at the secondary market at good rates look at Today or Tomorrow price list... If the market reads say 12% , is possible to get anything like 14% in the secondary market? Check my inbox for some queries~! what's the password? If Obiero did it, Who Am I?

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Liv wrote:maka wrote:maka wrote:KulaRaha wrote:5yr at 12.5%

20yr at 14% undersubscribed From cytonn; In line with the Securities Issuance Calendar, the Government issued 2 bonds: a 5-year bond (FXD 3/2016/5) and a reopened 20-year bond (FXD 1/2016/20) looking to raise Kshs 25.0 bn for the purpose of budgetary support. Given (i) the Government is not under pressure to finance the 2016/2017 budget, having raised Kshs 67.4 bn against a pro-rated target of Kshs 53.0 bn, and (ii) the enactment of the Banking (Amendment) Act, 2015 resulting in lower lending rates by commercial banks and preference to lend to the less risky government, we expect downward pressure on interest rates. Therefore, with the secondary market trading at 13.6% and 14.8% for the 5-year and 20-year bond, respectively, we are of the view that investors should bid between 13.25% and 13.80% for the 5-year and between 14.0% and 14.9% for the 20-year bond with more bids towards the latter.

@Maka,

Thanks for the info.

My forecast is a subset of the Cytonn rates, only that their ranges are wider. The basis is the current market yields. That's why I thought they are not that aggressive as you said

5 year 13 - 13.50 20 year 14.30 -14.50 All in all its going to be a very interesting auction so many variables.... possunt quia posse videntur

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Impunity wrote:maka wrote:Impunity wrote:maka wrote:Liv wrote:Impunity wrote:Liv wrote:@Bond buyers and traders in this forum,

what is your forecast on the rates on 5 and 20 year bonds next week? And why? I think the 20 yr paper is fixed at 14%, the 5 year paper will fetch 15%, give or take. My 1 bob forecast!

My forecast:

5 year bond coupon rate will average between 13.5 and 13.8%

20 year bond Yield rate will average between 14.3 and 14.7%

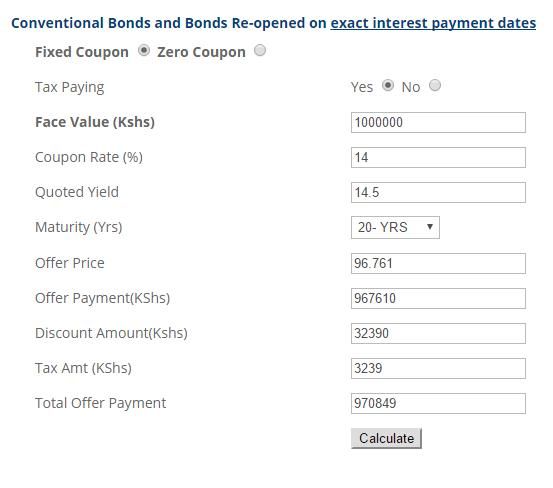

@Liv doubt anyone would want to bid aggressively on this papers...the probability of missing them is quite high. ...guys will undercut each other...lets see how next week goes then we will know how rates will be. Its sad I am liquid at the time the rates are looking south with a dark cloud of uncertainity!!!    You can get some many papers at the secondary market at good rates look at Today or Tomorrow price list... If the market reads say 12% , is possible to get anything like 14% in the secondary market? Check my inbox for some queries~!  Discounts are always available check an extract of todays price list for bonds under 50 mio possunt quia posse videntur

|

|

|

Rank: Veteran Joined: 11/14/2006 Posts: 1,311

|

Any idea on the results of this month's bonds auction results? I expected them to be published today.

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

http://af.reuters.com/ar.../kenyaNews/idAFFWN1BX0AC"Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Liv wrote:Any idea on the results of this month's bonds auction results? I expected them to be published today. Bado they delay the results siku hizi.... possunt quia posse videntur

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

maka wrote:Liv wrote:Any idea on the results of this month's bonds auction results? I expected them to be published today. Bado they delay the results siku hizi.... Interesting results not out yet... possunt quia posse videntur

|

|

|

Rank: Elder Joined: 7/26/2007 Posts: 6,514

|

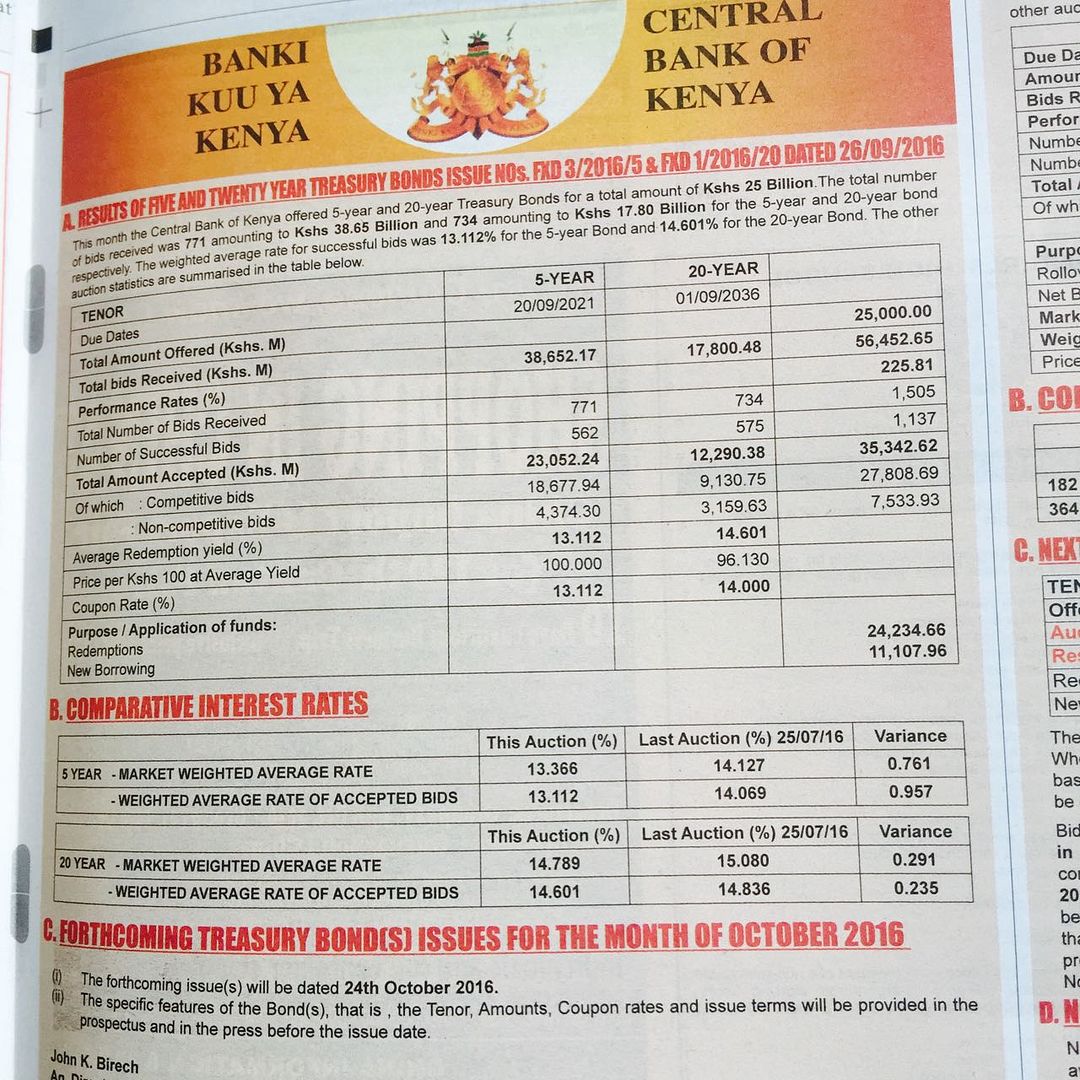

5yr coupon @ 13.112% (-95.7bps). Market Avg. 13.366% (-76.1bps). Subs 310%. Bids 38.7b. Acceptd 23.1b. Total auction bidders where 1505 and 368 or 24% were rejected. 20yr yield @ 14.601% (-23.5bps). Market Avg. 14.789% (-29.1bps). Subs 142%. Bids 17.8b. Acceptd 12.3b. Business opportunities are like buses,there's always another one coming

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

KulaRaha wrote:5yr coupon @ 13.112% (-95.7bps). Market Avg. 13.366% (-76.1bps). Subs 310%. Bids 38.7b. Acceptd 23.1b. Total auction bidders where 1505 and 368 or 24% were rejected.

20yr yield @ 14.601% (-23.5bps). Market Avg. 14.789% (-29.1bps). Subs 142%. Bids 17.8b. Acceptd 12.3b.  possunt quia posse videntur

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Why should a bank loan to a risky individual like you and me at 14% ? Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Ericsson wrote:Why should a bank loan to a risky individual like you and me at 14% ? No reason at all.... possunt quia posse videntur

|

|

|

Rank: Elder Joined: 7/26/2007 Posts: 6,514

|

maka wrote:Ericsson wrote:Why should a bank loan to a risky individual like you and me at 14% ? No reason at all.... No reason whatsoever when GoK is paying 13%. Business opportunities are like buses,there's always another one coming

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,331 Location: Masada

|

KulaRaha wrote:maka wrote:Ericsson wrote:Why should a bank loan to a risky individual like you and me at 14% ? No reason at all.... No reason whatsoever when GoK is paying 13%. Then investing in treasury bills / bonds will no longer look lucrative for middle class @wanjiku.    Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Member Joined: 1/22/2015 Posts: 682

|

Ericsson wrote:Why should a bank loan to a risky individual like you and me at 14% ? Are wazuans risky individuals kweli? It's OK to feel for the ordinary mwananchi, but don't pretend like you're one of them, it's disengenious.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Mike Ock wrote:Ericsson wrote:Why should a bank loan to a risky individual like you and me at 14% ? Are wazuans risky individuals kweli? It's OK to feel for the ordinary mwananchi, but don't pretend like you're one of them, it's disengenious. We have so many loan defaulters here in wazua "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

Ericsson wrote:Why should a bank loan to a risky individual like you and me at 14% ? Because the law prevents them lending to me and you at more than 14%. Do not look for complicated answers where simple answers exist. Creative banks will find a way to make a killing within the law. Non imaginative banks will go bust. Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,166 Location: nairobi

|

Impunity wrote:KulaRaha wrote:maka wrote:Ericsson wrote:Why should a bank loan to a risky individual like you and me at 14% ? No reason at all.... No reason whatsoever when GoK is paying 13%. Then investing in treasury bills / bonds will no longer look lucrative for middle class @wanjiku.    GOK borrowing rates are falling steeply.. Banks had better book long term with GOK, force liquidity crisis to the common man hence rise in CBR

KQ ABP 4.26

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

I repeat this is one crowded corner. Perfect storm...! $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Wazua

»

Investor

»

Bonds

»

Treasury Bills and Bonds

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|