Wazua

»

Investor

»

Stocks

»

CENTUM FY2016/2017

Rank: Elder Joined: 12/4/2009 Posts: 10,778 Location: NAIROBI

|

Centum reports a decline of 16 per cent in Net Profit for the year ended 31 March 2017. Net profit declines from sh.9.948bn to 8.31bn Profit before tax declines by 18% from sh.10.873bn to 8.943bn Board recommended a final dividend of sh.1.20 per share Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 922 Location: sky

|

div of ksh1.20 per share There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Elder Joined: 9/15/2006 Posts: 3,906

|

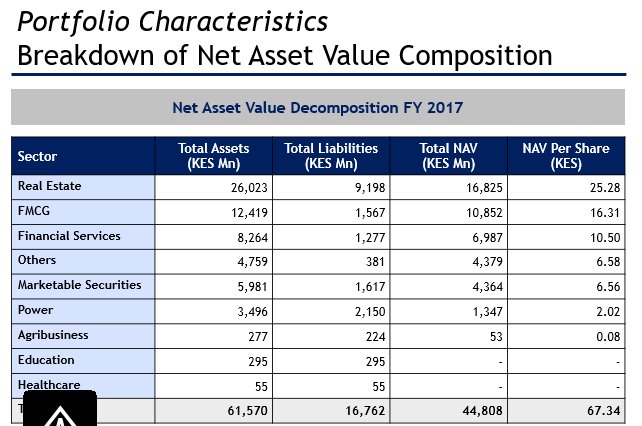

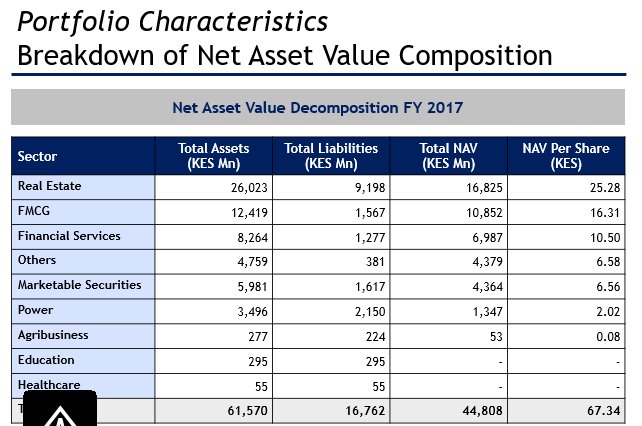

True test on whether we invest on net profit (-18%) or net asset value (+13%)

Full results link https://view.publitas.co...-year-ended-31-mar-2017/

|

|

|

Rank: Veteran Joined: 8/30/2007 Posts: 1,558 Location: Nairobi

|

muganda wrote:True test on whether we invest on net profit (-18%) or net asset value (+13%)  Not a bad performance gearing ratio that had many people nervous can now "rerax"

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,778 Location: NAIROBI

|

http://www.centum.co.ke/images/docs/IB_FY17.pdf

Unrealized gains on real estate at sh.6.452bn Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Veteran Joined: 4/4/2016 Posts: 1,997 Location: Kitale

|

last year dps-1.00 this year dps-1.20 this is now a good attitude towards shareholders.i think i will now view them positively. Towards the goal of financial freedom

|

|

|

Rank: Member Joined: 5/14/2014 Posts: 289 Location: nairobi

|

we need to know the amount of bonnus to employees to compare I find satisfaction in owning great business,not trading them

|

|

|

Rank: Elder Joined: 8/16/2011 Posts: 2,357

|

Spiraling     amp;  amp;   Just wondering whether the 5 year value creation that ends 2018-9 will be successful or horrible   Yes we have many investment vehicles leading to new openings but Centum is still hungry for more funds to do projects.n They do not want to liquefy the stock by issues bonuses but maintaining lower price of a stock that moved from 85 high to now 40!!! Too much regulated!!! Coop Bank has decided to make money by increasing No of shares. So who is making Money?

|

|

|

Rank: Veteran Joined: 4/4/2016 Posts: 1,997 Location: Kitale

|

target1360 wrote:we need to know the amount of bonnus to employees to compare direct and other operating costs is kshs 8,204,607,000- this is the highest expenditure.Then the second highest expenditure is kshs 3,884,669,000 which is called "funding and other costs". Probably bonuses are their in between. Towards the goal of financial freedom

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

|

|

|

Rank: Member Joined: 5/14/2014 Posts: 289 Location: nairobi

|

correct me if am wrong.centum has less than 700m shares.at kes 1.2 each total divedend is still less than a billion I find satisfaction in owning great business,not trading them

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 922 Location: sky

|

target1360 wrote:correct me if am wrong.centum has less than 700m shares.at kes 1.2 each total divedend is still less than a billion true Shares Issued 665,441,775 There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Veteran Joined: 8/30/2007 Posts: 1,558 Location: Nairobi

|

As someone has already said here, I dont get the economics of Bonus shares making a share price rally....its quite amateurish. If hypothetically, Centum announced a 1:2 or even a 1:10 bonus this share would have shot up (coop comes to mind) so these new shares increase supply but only in Kenya where demand would increase because of a "bonus"

BRK.A has never given a dividend, bonus or a split (with the exception of BRK.B stock but that was for different purposes) I guess it would be a pretty unpopular stock in Kenya.

BRK also measures its performance relative to NAV and pays good bonuses to retain the likes of Ajit Jain.

This company is nimble and agile. Its trading at a NAV and PE discount it should be worth atleast its value in assets.

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,921

|

littledove wrote:target1360 wrote:correct me if am wrong.centum has less than 700m shares.at kes 1.2 each total divedend is still less than a billion true Shares Issued 665,441,775 Dealing with psychology of Wanjuku. She cried, give her something small    In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Member Joined: 5/21/2014 Posts: 184

|

Horton wrote:As someone has already said here, I dont get the economics of Bonus shares making a share price rally....its quite amateurish. If hypothetically, Centum announced a 1:2 or even a 1:10 bonus this share would have shot up (coop comes to mind) so these new shares increase supply but only in Kenya where demand would increase because of a "bonus"

BRK.A has never given a dividend, bonus or a split (with the exception of BRK.B stock but that was for different purposes) I guess it would be a pretty unpopular stock in Kenya.

BRK also measures its performance relative to NAV and pays good bonuses to retain the likes of Ajit Jain.

This company is nimble and agile. Its trading at a NAV and PE discount it should be worth atleast its value in assets.

It is purely psychological. It is hope of the the counter realising a price that is higher than the theoretical post-scrip price. It is the hope of taking advantage of the irrationality of the market and also of one who comes to the market without doing their homework on the counter that has done a bonus issue. There are too many opportunities all around. Open your eyes and maybe you'll spot one

|

|

|

Rank: Member Joined: 5/21/2014 Posts: 184

|

Ebenyo wrote:last year dps-1.00

this year dps-1.20

this is now a good attitude towards shareholders.i think i will now view them positively. Nope. Just a move to support the share price. There are too many opportunities all around. Open your eyes and maybe you'll spot one

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,778 Location: NAIROBI

|

http://www.businessdaily...7684-h6y6c2z/index.html

The bank laid off 108 out of its total 560 staff at a cost of Sh70 million as a strategy to contain costs under the rate caps regime. Despite the job cuts, Sidian’s wage bill increased 10 per cent to 374 million in the half-year period. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,223 Location: Nairobi

|

Ericsson wrote:http://www.businessdailyafrica.com/markets/news/Sidian-slips-loss-lower-interest-income-/3815534-4057684-h6y6c2z/index.html

The bank laid off 108 out of its total 560 staff at a cost of Sh70 million as a strategy to contain costs under the rate caps regime.

Despite the job cuts, Sidian’s wage bill increased 10 per cent to 374 million in the half-year period. Tough times for Tier 3 banks. As a shareholder of Centum, I hope Sidian can find a strategic investor who can bring in new cash [equity] and expertise in micro-banking. Is there a possibility of Sidian acquiring Platinum (micro-lender) as a subsidiary? Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,921

|

Repeat In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,921

|

Ericsson wrote:http://www.businessdailyafrica.com/markets/news/Sidian-slips-loss-lower-interest-income-/3815534-4057684-h6y6c2z/index.html

The bank laid off 108 out of its total 560 staff at a cost of Sh70 million as a strategy to contain costs under the rate caps regime.

Despite the job cuts, Sidian’s wage bill increased 10 per cent to 374 million in the half-year period. Probably because of bonuses to employees like mother  In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Wazua

»

Investor

»

Stocks

»

CENTUM FY2016/2017

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|