Wazua

»

Investor

»

Stocks

»

Williamson, Kapchorua Tea HY 2014-2015 gloomy picture

Rank: Elder Joined: 9/15/2006 Posts: 3,906

|

The futility of a new topic, HY 2014-2015 Williamson & Kapchorua, 6 months later - same script WTK earnings down 55% KAPCH earnings down 38% http://ge.tt/9tUFG852This sector is careening, without terrorism, to reflect Tourism sector.

PROSPECTS There are no indications of the global tea market picking up in the near future. As the weather continues to be favourable, we expect that the crop and stock levels will continue to rise depressing the tea prices further. The County Governments have prepared their budgets which appear to impose more taxes on firms operating within their jurisdictions. The labour unions are pressing for higher wages despite the economic conditions currently prevailing in the tea sector. Movement in cash and cash equivalents The Board continues to look into cost effective ways of running the Company operations under the circumstances even as the remaining months to year end are likely to more challenging. Based on the above stated factors ... it is reasonable to anticipate earnings for financial year ending March 2015 will be lower than previous ear's earnings by at least 25%.

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,223 Location: Nairobi

|

Not for the faint-hearted. And worth picking up when the prices fall [due to low tea prices or low production] ... unlike small-scale farmers, WTK/KTC can afford to maintain their bushes, replant/replace old bushes and conduct R+D for future growth. Now hoping it falls towards 200/-... The biggest threat is not low tea prices but land grab by the politicians. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Veteran Joined: 1/10/2015 Posts: 961 Location: Kenya

|

|

|

|

Rank: Veteran Joined: 5/5/2011 Posts: 1,059

|

To Each His Own

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,223 Location: Nairobi

|

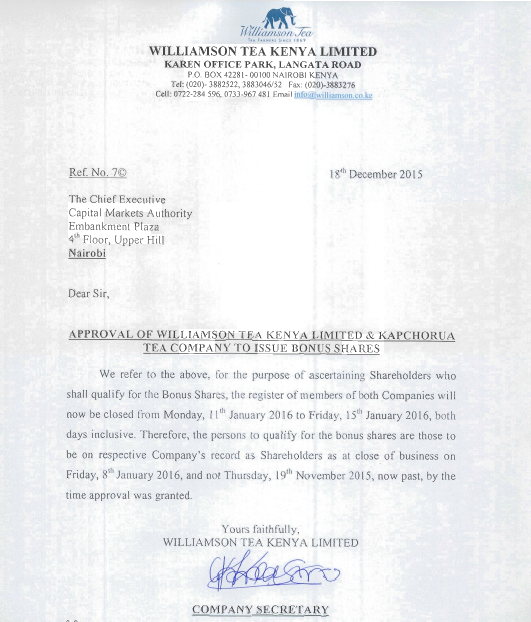

Why did CMA take so long to approve a bonus issue? Why does the CMA need to be involved in the approval? Do you need the permission of the cook to slice your boiled potato into 2 pieces? Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: New-farer Joined: 7/23/2015 Posts: 35

|

VituVingiSana wrote:Why did CMA take so long to approve a bonus issue? Why does the CMA need to be involved in the approval? Do you need the permission of the cook to slice your boiled potato into 2 pieces?  I'm in agreeement @VVS about the achingly long time it takes for what should be a simple process of verification. I almost gave up on this bonus issue until eagle-eyed @pesanane posted the approval on another thread. Why is such approval needed in the first place? If I may dust off my old company law books: since bonus shares are meant to be paid for out of reserves not distributed as dividends, the reason for CMA approval is presumably to ensure that a company does not issue such shares based on inaccurately stated accounts (I have HAFR, Uchumi and EAPC's adventurous accounting in mind) and do not result in unlawful changes in share capital. The consequences can be quite severe in such a scenario since in at least one case a court invalidated the contract to allot bonus shares because the company had insufficient profits to 'pay' for the bonus shares. I doubt the toothless CMA would do much if shares are incorrectly allotted but in theory the rule makes sense so that bonus shares are not wrongly alloted then messily 'retrieved' by court order. It shouldn't take such a long wait though IMHO. Even the birds can testify...but you forget the chief has his son as the judge and his son-in-law as interpreter- Oumar Ba

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,223 Location: Nairobi

|

Arconnrk wrote:VituVingiSana wrote:Why did CMA take so long to approve a bonus issue? Why does the CMA need to be involved in the approval? Do you need the permission of the cook to slice your boiled potato into 2 pieces?  I'm in agreeement @VVS about the achingly long time it takes for what should be a simple process of verification. I almost gave up on this bonus issue until eagle-eyed @pesanane posted the approval on another thread. Why is such approval needed in the first place? If I may dust off my old company law books: since bonus shares are meant to be paid for out of reserves not distributed as dividends, the reason for CMA approval is presumably to ensure that a company does not issue such shares based on inaccurately stated accounts (I have HAFR, Uchumi and EAPC's adventurous accounting in mind) and do not result in unlawful changes in share capital. The consequences can be quite severe in such a scenario since in at least one case a court invalidated the contract to allot bonus shares because the company had insufficient profits to 'pay' for the bonus shares. I doubt the toothless CMA would do much if shares are incorrectly allotted but in theory the rule makes sense so that bonus shares are not wrongly alloted then messily 'retrieved' by court order. It shouldn't take such a long wait though IMHO. Bonus shares are not used to raise funds/capital. If the books are cooked, the bonus shares make no difference. Look at Bonus/Split shares as smaller pieces of the same pie. If you owned 10% of Williamson before the bonus/split, you will still own 10% of Williamson after the bonus/split. No difference in your 'ownership' of the profits of Williamson. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: New-farer Joined: 7/23/2015 Posts: 35

|

VituVingiSana wrote:Arconnrk wrote:VituVingiSana wrote:Why did CMA take so long to approve a bonus issue? Why does the CMA need to be involved in the approval? Do you need the permission of the cook to slice your boiled potato into 2 pieces?  I'm in agreeement @VVS about the achingly long time it takes for what should be a simple process of verification. I almost gave up on this bonus issue until eagle-eyed @pesanane posted the approval on another thread. Why is such approval needed in the first place? If I may dust off my old company law books: since bonus shares are meant to be paid for out of reserves not distributed as dividends, the reason for CMA approval is presumably to ensure that a company does not issue such shares based on inaccurately stated accounts (I have HAFR, Uchumi and EAPC's adventurous accounting in mind) and do not result in unlawful changes in share capital. The consequences can be quite severe in such a scenario since in at least one case a court invalidated the contract to allot bonus shares because the company had insufficient profits to 'pay' for the bonus shares. I doubt the toothless CMA would do much if shares are incorrectly allotted but in theory the rule makes sense so that bonus shares are not wrongly alloted then messily 'retrieved' by court order. It shouldn't take such a long wait though IMHO. Bonus shares are not used to raise funds/capital. If the books are cooked, the bonus shares make no difference. Look at Bonus/Split shares as smaller pieces of the same pie. If you owned 10% of Williamson before the bonus/split, you will still own 10% of Williamson after the bonus/split. No difference in your 'ownership' of the profits of Williamson. Indeed a bonus issue is probably just a share split with a better set of clothes. But even if as a shareholder I'm not one cent better off, in this bear run the psychological 'gain' of seeing my shares multiply is all I have to cling to! Williamson was the best performer in my portfolio last year- the rest (Unga, DTB, KPLC and KK) were either flat or gave me heartburn. Even the birds can testify...but you forget the chief has his son as the judge and his son-in-law as interpreter- Oumar Ba

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,223 Location: Nairobi

|

Arconnrk wrote:VituVingiSana wrote:Arconnrk wrote:VituVingiSana wrote:Why did CMA take so long to approve a bonus issue? Why does the CMA need to be involved in the approval? Do you need the permission of the cook to slice your boiled potato into 2 pieces?  I'm in agreeement @VVS about the achingly long time it takes for what should be a simple process of verification. I almost gave up on this bonus issue until eagle-eyed @pesanane posted the approval on another thread. Why is such approval needed in the first place? If I may dust off my old company law books: since bonus shares are meant to be paid for out of reserves not distributed as dividends, the reason for CMA approval is presumably to ensure that a company does not issue such shares based on inaccurately stated accounts (I have HAFR, Uchumi and EAPC's adventurous accounting in mind) and do not result in unlawful changes in share capital. The consequences can be quite severe in such a scenario since in at least one case a court invalidated the contract to allot bonus shares because the company had insufficient profits to 'pay' for the bonus shares. I doubt the toothless CMA would do much if shares are incorrectly allotted but in theory the rule makes sense so that bonus shares are not wrongly alloted then messily 'retrieved' by court order. It shouldn't take such a long wait though IMHO. Bonus shares are not used to raise funds/capital. If the books are cooked, the bonus shares make no difference. Look at Bonus/Split shares as smaller pieces of the same pie. If you owned 10% of Williamson before the bonus/split, you will still own 10% of Williamson after the bonus/split. No difference in your 'ownership' of the profits of Williamson. Indeed a bonus issue is probably just a share split with a better set of clothes.    But even if as a shareholder I'm not one cent better off, in this bear run the psychological 'gain' of seeing my shares multiply is all I have to cling to! Williamson was the best performer in my portfolio last year- the rest (Unga, DTB, KPLC and KK) were either flat or gave me heartburn. I like your picks except for the long term except for KPLC with my aversion for most GoK controlled firms. I lost a bundle on KPLC after I bought into the Rights Issue. We were conned by KPLC/GoK/MoE/ERC about the upcoming triennial rate review that was indicated in the IM as coming due. WTK will face challenges in 2017 with the ushago political climate. In 2008, they lost some equipment & buildings some idiots burnt. It's better they steal the equipment and use it than burning it! Idiots. Profitability: With current (2H) tea prices, high interest rates & weak (100+) KES... plus the recent rains the 2H is looking very good for WTK. Perhaps we will see another 40/- dividend? Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,223 Location: Nairobi

|

Without counting the Time Value of Money, and a possible 40/- dividend for FY 2015-16, Williamson has been one of my best payback via dividends. 50/- after selling Williamson House. 40/- last year after a bumper harvest + low CAPEX For 2015-16, I expect low CAPEX [no need to spend on the farm to build or buy what idiots might burn down] & a high payout approx 40/- Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: New-farer Joined: 7/23/2015 Posts: 35

|

VituVingiSana wrote:Without counting the Time Value of Money, and a possible 40/- dividend for FY 2015-16, Williamson has been one of my best payback via dividends.

50/- after selling Williamson House.

40/- last year after a bumper harvest + low CAPEX

For 2015-16, I expect low CAPEX [no need to spend on the farm to build or buy what idiots might burn down] & a high payout approx 40/- Amen to the 40/- dividend. I hope they can resolve the issue of the state of their land ownership before the next election. Thanks for the heads-up on KPLC. I'll go slowly in accumulating this one and focus more on the companies that are safely (I hope) in private hands. Even the birds can testify...but you forget the chief has his son as the judge and his son-in-law as interpreter- Oumar Ba

|

|

|

Rank: Member Joined: 10/26/2015 Posts: 151

|

@vvs looking to load up on some wtk or kapc. What'll be the effect of the bonus isssue on share price?

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,223 Location: Nairobi

|

MadDoc wrote:@vvs looking to load up on some wtk or kapc. What'll be the effect of the bonus isssue on share price? I do not know what the effect of a bonus on the share price will be. I focus on my criteria which has more to do with Quality of Management, (future) earnings, business environment, Assets & Liabilities. I feel that the price will eventually reflect the sustainable profitability of a firm. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,223 Location: Nairobi

|

Arconnrk wrote:VituVingiSana wrote:Without counting the Time Value of Money, and a possible 40/- dividend for FY 2015-16, Williamson has been one of my best payback via dividends.

50/- after selling Williamson House.

40/- last year after a bumper harvest + low CAPEX

For 2015-16, I expect low CAPEX [no need to spend on the farm to build or buy what idiots might burn down] & a high payout approx 40/- Amen to the 40/- dividend. I hope they can resolve the issue of the state of their land ownership before the next election. Thanks for the heads-up on KPLC. I'll go slowly in accumulating this one and focus more on the companies that are safely (I hope) in private hands. KPLC generates a lot of cash but I feel there a need for an extensive audit of all the assets on its books. I see it as a 'Bond' rather than an equity play in the long term. Williamson - The issue about their properties will not be sorted out by 2017 the way our slow court system works. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: New-farer Joined: 7/1/2015 Posts: 67

|

somebody shafted today @359 poor wanjiku “It’s no good, it’s no good!” says the buyer—

then goes off and boasts about the purchase-Proverbs 20:14

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,223 Location: Nairobi

|

Damn! I wish I had sold mine. I missed the boat. 13,000+ shares sold x 180 [50% of 360] = a lot of mullah! Though the bulk were sold at 319. Lucky seller. I think the buyers may have been foreign buyers not wanjiku. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,223 Location: Nairobi

|

Mombasa auction set to resume tea exports to Iran as embargo is lifted http://www.businessdaily...8/-/ndadjo/-/index.html

Iran was previously one of the major markets for Kenyan tea and the association is banking on the new development to lift the price of the beverage.    Iran has a huge population with over 100 million people making it a niche market for the Kenyan tea Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: New-farer Joined: 8/26/2015 Posts: 26 Location: Nairobi

|

I would like to pick up some WTK stock ahead of the financials announcement.

This would be my first share purchase so I just wanted to confirm if I acquired some today, I'm I eligible for the dividend payout for this years earnings?

Or rather, upto what date do I have to purchase to be eligible for a dividend payout of this year

|

|

|

Rank: Member Joined: 2/28/2014 Posts: 188 Location: Nairobi

|

You will be paid as long as you don't sell by the book closure date announced by the company...why ahead of the FS announcement? Offering my personal finance knowledge for free

|

|

|

Rank: New-farer Joined: 8/26/2015 Posts: 26 Location: Nairobi

|

nashx wrote:You will be paid as long as you don't sell by the book closure date announced by the company...why ahead of the FS announcement? I expect really positive returns from this company plus maybe a generous dividend issue which will lead to a rally of the share price upwards. I find the 175 to be a nice bargain

|

|

|

Wazua

»

Investor

»

Stocks

»

Williamson, Kapchorua Tea HY 2014-2015 gloomy picture

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|