Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Rank: Elder Joined: 6/23/2009 Posts: 14,095 Location: nairobi

|

sold all my MTNU shares at 98% ROI, and invested the proceeds into my KQ play. The time is nigh. If I perish, I perish

KQ ABP 4.26

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,302 Location: Nairobi

|

obiero wrote:sold all my MTNU shares at 98% ROI, and invested the proceeds into my KQ play. The time is nigh. If I perish, I perish Ushabook cremation slot?  Talk to a Ghanaian coffin maker... Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,095 Location: nairobi

|

VituVingiSana wrote:obiero wrote:sold all my MTNU shares at 98% ROI, and invested the proceeds into my KQ play. The time is nigh. If I perish, I perish Ushabook cremation slot?  Talk to a Ghanaian coffin maker... Omadukemeya 😅

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,095 Location: nairobi

|

KES 8.52.. Watch and learn

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,095 Location: nairobi

|

End of the road

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,095 Location: nairobi

|

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,302 Location: Nairobi

|

https://x.com/hon_wamuch...005557496727970202?s=20

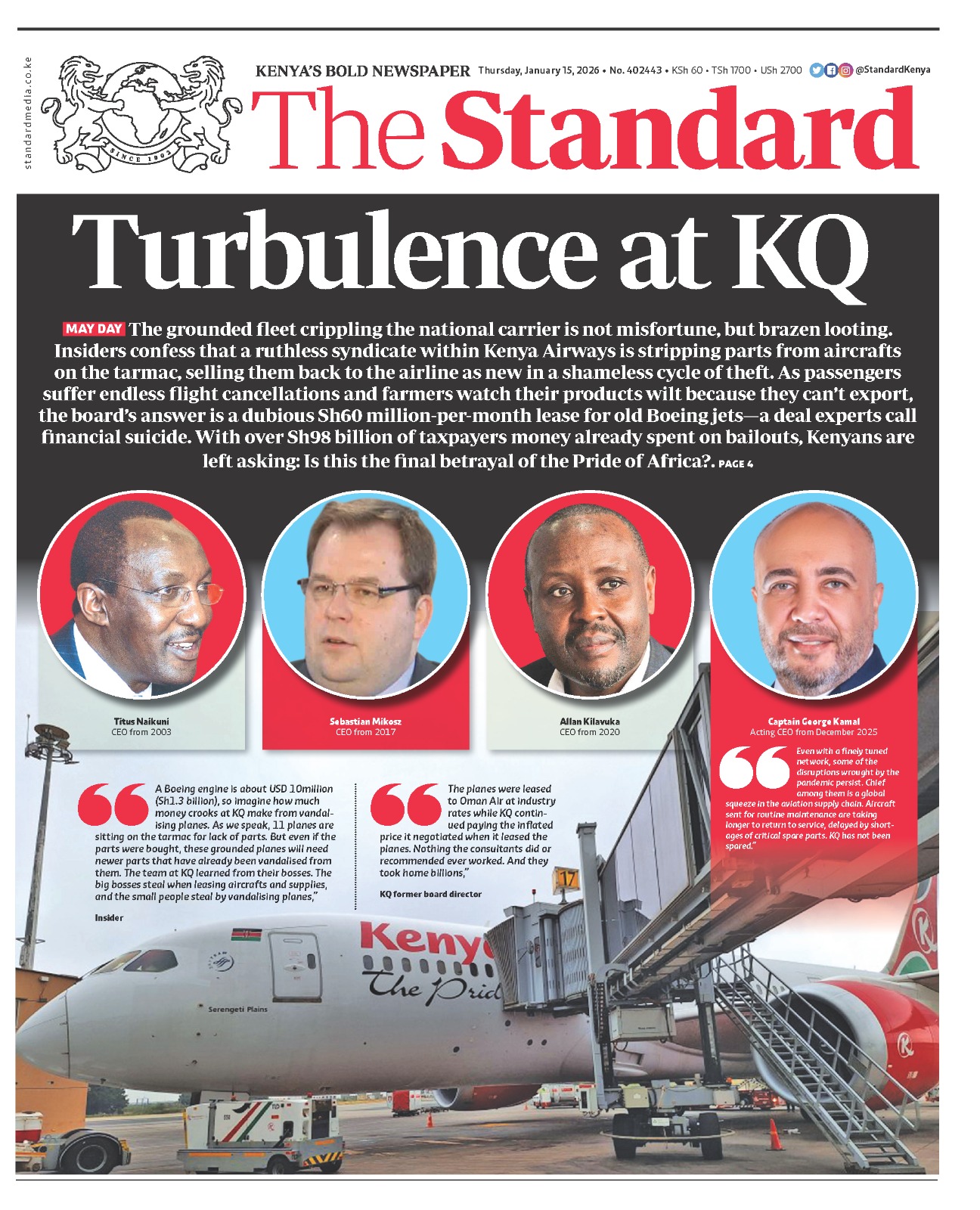

Whats cooking in Kenya Airways ? How many aircrafts are actually parked as non operational by Kenya Airways. KQ spokesperson says 11 KQ managers say 8 Former CEO said 5 Earlier they said only 3 All this numbers are said on their X account and Business daily newspaper and Nation. The employees are being given half pay( pilots, cabin crew and engineers plus ground staff. ) What are the taxpayers and shareholders of KQ supposed to believe? Today ; Kenya Airways has finally admitted that 11 aircrafts are grounded. This is a third of KQ fleet down and the truth is that no other international airlines like Ethiopian, Air Moroc, Middle East Airlines or in the world has had their planes been grounded for 5 years because of lacking spare parts. This would mean Kenyan taxpayers have been paying for leases of 11 planes for 5 years and they aren’t generating income. Why then has KQ management been earning a salary? They need to answer. Ironically Jambojet a subsidiary of KQ had no grounded aircraft since 2020 and borrows money from banks while KQ acting as its guarantor. It’s very evident the management has been and is still lying about this spare parts issue. The acting CEO George Kamal has been in charge of supply chain ( eg spare parts ), flight operations, technical services and operational control center since he was hired in March 14th 2023 according to his hiring Boss then CEO Allan Kilavuka as quoted by Bussiness Daily. Since then more brand new aircrafts have systematically broken down and other donated to schools or bars yet he was expected to improve operations and KQ fortunes. So why was he PROMOTED? To Ground more ? KQ management needs to answer these questions truthfully; for it’s Kenyans taxpayers money they are playing with. It’s not their money. Accountability is a MUST. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,095 Location: nairobi

|

VituVingiSana wrote:https://x.com/hon_wamuchomba/status/2005557496727970202?s=20

Whats cooking in Kenya Airways ? How many aircrafts are actually parked as non operational by Kenya Airways.

KQ spokesperson says 11

KQ managers say 8

Former CEO said 5

Earlier they said only 3

All this numbers are said on their X account and Business daily newspaper and Nation.

The employees are being given half pay( pilots, cabin crew and engineers plus ground staff. )

What are the taxpayers and shareholders of KQ supposed to believe?

Today ;

Kenya Airways has finally admitted that 11 aircrafts are grounded. This is a third of KQ fleet down and the truth is that no other international airlines like Ethiopian, Air Moroc, Middle East Airlines or in the world has had their planes been grounded for 5 years because of lacking spare parts.

This would mean Kenyan taxpayers have been paying for leases of 11 planes for 5 years and they aren’t generating income. Why then has KQ management been earning a salary? They need to answer.

Ironically Jambojet a subsidiary of KQ had no grounded aircraft since 2020 and borrows money from banks while KQ acting as its guarantor.

It’s very evident the management has been and is still lying about this spare parts issue.

The acting CEO George Kamal has been in charge of supply chain ( eg spare parts ), flight operations, technical services and operational control center since he was hired in March 14th 2023 according to his hiring Boss then CEO Allan Kilavuka as quoted by Bussiness Daily.

Since then more brand new aircrafts have systematically broken down and other donated to schools or bars yet he was expected to improve operations and KQ fortunes. So why was he PROMOTED? To Ground more ?

KQ management needs to answer these questions truthfully; for it’s Kenyans taxpayers money they are playing with. It’s not their money.

Accountability is a MUST. Grounded planes are 1 787, and 5 Embraers. KQ have been consistent on their updates. What's all the hullabaloo about

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,095 Location: nairobi

|

things fall apart?

KQ ABP 4.26

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 927 Location: sky

|

KQ.... There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,095 Location: nairobi

|

No real trading happening since 2017. Volume is absent. Literally no single day has gone past 1m shares traded, since coming back from the lengthy suspension. Par value is KES 5.00. Fair value remains at post consolidation price for KQLC. No reasonable/sane trader can/should offload below KES 8.68

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,722

|

MaichBlack wrote:VituVingiSana wrote:obiero wrote:Just did the unthinkable. Meanwhile, looking at a one week horizon to possibly dispose COOP holding of KES 4.3m to load up on KQ. @VVS continue to place me in your prayers, especially noting that I owe you KES 10,000 Whaaat? You want to sell dividend-paying Coop, in which its CEO owns a nice stake, to buy loss-making KQ in which the CEO earns millions but has no significant stake?    I am lost for words!!! "Throwing good money after bad" comes to mind. But wacha mimi ni ngangane na hali yangu. @Obiero... Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,095 Location: nairobi

|

MaichBlack wrote:MaichBlack wrote:VituVingiSana wrote:obiero wrote:Just did the unthinkable. Meanwhile, looking at a one week horizon to possibly dispose COOP holding of KES 4.3m to load up on KQ. @VVS continue to place me in your prayers, especially noting that I owe you KES 10,000 Whaaat? You want to sell dividend-paying Coop, in which its CEO owns a nice stake, to buy loss-making KQ in which the CEO earns millions but has no significant stake?    I am lost for words!!! "Throwing good money after bad" comes to mind. But wacha mimi ni ngangane na hali yangu. @Obiero... My sweet name.. Make sure you also remind people here what was the percentage gain from Obiero's COOP shareholdings. I trade openly and inform my stock picks and exits, consistently. Watch and learn

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,722

|

obiero wrote:Just did the unthinkable. Meanwhile, looking at a one week horizon to possibly dispose COOP holding of KES 4.3m to load up on KQ. @VVS continue to place me in your prayers, especially noting that I owe you KES 10,000 @Obiero - You sold in August. Prices were 18/= - 20/=! Stop day dreaming!! Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,095 Location: nairobi

|

MaichBlack wrote:obiero wrote:Just did the unthinkable. Meanwhile, looking at a one week horizon to possibly dispose COOP holding of KES 4.3m to load up on KQ. @VVS continue to place me in your prayers, especially noting that I owe you KES 10,000 @Obiero - You sold in August. Prices were 18/= - 20/=! Stop day dreaming!! You want me to upload my CDS statement? And then again, what was my ABP for COOP since you are heavily invested on my trades? In trading, one only needs to obtain their target exit price, I am not @VVS, Ben Graham, Charlie Munger nor Warren Buffet. Go through wazua and you will note that I have held and flipped multiple counters in KE, UG, RW and Nigeria. SCOM, KNRE, KEGN, KCB, IMH, COOP, BKG, HF, NCBA, BLR.RW, MTN.UG, SBIC.UG, WTK, ZENITH.NGR. None sold below 10% gain, and several above 90% ROI, max being 235%. Finally, since this is the right thread, you will note that I have been averaging down on KQ from previous highs of KES 21 to current ABP of KES 4.26, where my current position represents a dip of only 9% to its last traded price. Dont count my money 😆

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,095 Location: nairobi

|

18% up in 2 days. fair value KES 8.68

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,095 Location: nairobi

|

Obiero's ABP is KES 4.26, tomorrow Jan 21, 2025 at 9:32am KQ will likely reach KES 4.24. Obiero will not sell. 1. The KQ results, especially at operating loss level as at H1 were not pleasant, but heavy lifting has happened in H2 to stop the bleeding. Now only 1 large bird, the 787 remains out of service. In Jun 2026, the 777 returns from Turkish, and is already being prepped and thereafter recoated with KQ livery 2. It is unlikely, near-impossible for KQ to turn a full year profit in 2025. At very best, expect a KES 12B loss for FY 2025 3. With confirmed stoppage of the Open Offer for minority shareholders, the USD 500,000,000 capital injection is the only critical play left on the KQ share. If it fails, it is game over, kamikaze! 4. If you are unable to hold mid-term, say two to three years, you should have sold yesterday or nearest date to yesterday 5. In case you are liquid and able to go long haul, proceed to add new stock/average down at any price below KES 8.68, noting that the KQ share may give you more returns than you ever dreamed about. 6. Watch and learn

KQ ABP 4.26

|

|

|

Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|