Wazua

»

Investor

»

Stocks

»

Playing the Market............. 2025

Rank: Elder Joined: 6/23/2009 Posts: 14,180 Location: nairobi

|

VituVingiSana wrote:mufasa wrote:For those of us with good financial analytical knowledge, What keeps driving Diamond Trust upwards? is it undervalued more than the other banks?

I would have thought stockmaster would have picked DT instead of IMH. Needs a new Group CEO, changes at the board level and management! Low ROE. They got a new CEO for Kenya but the GCEO needs to go. Mzee are you sure that answer helps in resolving @mufasa's mystery

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,180 Location: nairobi

|

The following are my picks for 2026 (in order of priority) 1. KQ. NBV KES (31.16). (Current Price: Ksh 3.30; Target Price range Ksh 8.52 by Dec 31st 2026); About 150% Upside Speculative. Primary appreciation factor is the anticipated KES 69B capital injection by a strategic investor. A high risk play, where the share could face a fresh suspension 2. JUB. NBV KES 783 (Current Price: Ksh 345; Target Price range Ksh 420 by Dec 31st 2026); About 21% Upside Dominance in corporate insurance business. Strong sales in run up to the 2027 general election 3. DTB. NBV KES 310 (Current Price: Ksh 117; Target Price range Ksh 200 by Dec 31st 2026); About 70% Upside, excluding dividend gain Grossly undervalued tier 1 banking stock. 4. IMH. NBV 60.4 (Current Price: Ksh 44.90; Target Price range Ksh 54 by Dec 31st 2026); About 20% Upside, excluding dividend gain Emerging giant with steep ROI. Over 20% YoY PBT growth projection in near to mid term 5. TPSEA. NBV KES 60.99 (Current Price: Ksh 15.75; Target Price range Ksh 30 by Dec 31st 2026); About 90% Upside Recovering tourism industry should restore lost glory. Thank me later

KQ ABP 4.26

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,331 Location: Nairobi

|

obiero wrote:The following are my picks for 2026 (in order of priority) 1. KQ. NBV KES (31.16). (Current Price: Ksh 3.30; Target Price range Ksh 8.52 by Dec 31st 2026); About 150% Upside    Speculative. Primary appreciation factor is the anticipated KES 69B capital injection by a strategic investor. A high risk play, where the share could face a fresh suspension 2. JUB. NBV KES 783 (Current Price: Ksh 345; Target Price range Ksh 420 by Dec 31st 2026); About 21% Upside Ongeza cash from Sanlam-Allianz    Dominance in corporate insurance business. Strong sales in run up to the 2027 general election 3. DTB. NBV KES 310 (Current Price: Ksh 117; Target Price range Ksh 200 by Dec 31st 2026); About 70% Upside, excluding dividend gain Grossly undervalued tier 1 banking stock. Needs new top (esp CEO) thinking and management. 4. IMH. NBV 60.4 (Current Price: Ksh 44.90; Target Price range Ksh 54 by Dec 31st 2026); About 20% Upside, excluding dividend gain Emerging giant with steep ROI. Over 20% YoY PBT growth projection in near to mid term 5. TPSEA. NBV KES 60.99 (Current Price: Ksh 15.75; Target Price range Ksh 30 by Dec 31st 2026); About 90% Upside Wow! That's quite ambitious. Don't you fear competition? Tanzania ako na shida Recovering tourism industry should restore lost glory. Thank me later Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,180 Location: nairobi

|

VituVingiSana wrote:obiero wrote:The following are my picks for 2026 (in order of priority) 1. KQ. NBV KES (31.16). (Current Price: Ksh 3.30; Target Price range Ksh 8.52 by Dec 31st 2026); About 150% Upside    Speculative. Primary appreciation factor is the anticipated KES 69B capital injection by a strategic investor. A high risk play, where the share could face a fresh suspension 2. JUB. NBV KES 783 (Current Price: Ksh 345; Target Price range Ksh 420 by Dec 31st 2026); About 21% Upside Ongeza cash from Sanlam-Allianz    Dominance in corporate insurance business. Strong sales in run up to the 2027 general election 3. DTB. NBV KES 310 (Current Price: Ksh 117; Target Price range Ksh 200 by Dec 31st 2026); About 70% Upside, excluding dividend gain Grossly undervalued tier 1 banking stock. Needs new top (esp CEO) thinking and management. 4. IMH. NBV 60.4 (Current Price: Ksh 44.90; Target Price range Ksh 54 by Dec 31st 2026); About 20% Upside, excluding dividend gain Emerging giant with steep ROI. Over 20% YoY PBT growth projection in near to mid term 5. TPSEA. NBV KES 60.99 (Current Price: Ksh 15.75; Target Price range Ksh 30 by Dec 31st 2026); About 90% Upside Wow! That's quite ambitious. Don't you fear competition? Tanzania ako na shida Recovering tourism industry should restore lost glory. Thank me later Happy new year mzee. Watch and learn 😂

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,793

|

obiero wrote:The following are my picks for 2026 (in order of priority)

1. KQ. NBV KES (31.16). (Current Price: Ksh 3.30; Target Price range Ksh 8.52 by Dec 31st 2026); About 150% Upside

Speculative. Primary appreciation factor is the anticipated KES 69B capital injection by a strategic investor. A high risk play, where the share could face a fresh suspension

2. JUB. NBV KES 783 (Current Price: Ksh 345; Target Price range Ksh 420 by Dec 31st 2026); About 21% Upside

Dominance in corporate insurance business. Strong sales in run up to the 2027 general election

3. DTB. NBV KES 310 (Current Price: Ksh 117; Target Price range Ksh 200 by Dec 31st 2026); About 70% Upside, excluding dividend gain

Grossly undervalued tier 1 banking stock.

4. IMH. NBV 60.4 (Current Price: Ksh 44.90; Target Price range Ksh 54 by Dec 31st 2026); About 20% Upside, excluding dividend gain

Emerging giant with steep ROI. Over 20% YoY PBT growth projection in near to mid term

5. TPSEA. NBV KES 60.99 (Current Price: Ksh 15.75; Target Price range Ksh 30 by Dec 31st 2026); About 90% Upside

Recovering tourism industry should restore lost glory.

Thank me later How are they your picks and you haven't bought them??? Your signature shows your usual KQ only! Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,180 Location: nairobi

|

MaichBlack wrote:obiero wrote:The following are my picks for 2026 (in order of priority)

1. KQ. NBV KES (31.16). (Current Price: Ksh 3.30; Target Price range Ksh 8.52 by Dec 31st 2026); About 150% Upside

Speculative. Primary appreciation factor is the anticipated KES 69B capital injection by a strategic investor. A high risk play, where the share could face a fresh suspension

2. JUB. NBV KES 783 (Current Price: Ksh 345; Target Price range Ksh 420 by Dec 31st 2026); About 21% Upside

Dominance in corporate insurance business. Strong sales in run up to the 2027 general election

3. DTB. NBV KES 310 (Current Price: Ksh 117; Target Price range Ksh 200 by Dec 31st 2026); About 70% Upside, excluding dividend gain

Grossly undervalued tier 1 banking stock.

4. IMH. NBV 60.4 (Current Price: Ksh 44.90; Target Price range Ksh 54 by Dec 31st 2026); About 20% Upside, excluding dividend gain

Emerging giant with steep ROI. Over 20% YoY PBT growth projection in near to mid term

5. TPSEA. NBV KES 60.99 (Current Price: Ksh 15.75; Target Price range Ksh 30 by Dec 31st 2026); About 90% Upside

Recovering tourism industry should restore lost glory.

Thank me later How are they your picks and you haven't bought them??? Your signature shows your usual KQ only! Picks/recommendations.. Synonyms I guess. Do I have to buy the shares for the same to be suggested by myself?

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,793

|

obiero wrote:MaichBlack wrote:obiero wrote:The following are my picks for 2026 (in order of priority)

1. KQ. NBV KES (31.16). (Current Price: Ksh 3.30; Target Price range Ksh 8.52 by Dec 31st 2026); About 150% Upside

Speculative. Primary appreciation factor is the anticipated KES 69B capital injection by a strategic investor. A high risk play, where the share could face a fresh suspension

2. JUB. NBV KES 783 (Current Price: Ksh 345; Target Price range Ksh 420 by Dec 31st 2026); About 21% Upside

Dominance in corporate insurance business. Strong sales in run up to the 2027 general election

3. DTB. NBV KES 310 (Current Price: Ksh 117; Target Price range Ksh 200 by Dec 31st 2026); About 70% Upside, excluding dividend gain

Grossly undervalued tier 1 banking stock.

4. IMH. NBV 60.4 (Current Price: Ksh 44.90; Target Price range Ksh 54 by Dec 31st 2026); About 20% Upside, excluding dividend gain

Emerging giant with steep ROI. Over 20% YoY PBT growth projection in near to mid term

5. TPSEA. NBV KES 60.99 (Current Price: Ksh 15.75; Target Price range Ksh 30 by Dec 31st 2026); About 90% Upside

Recovering tourism industry should restore lost glory.

Thank me later How are they your picks and you haven't bought them??? Your signature shows your usual KQ only! Picks/recommendations.. Synonyms I guess. Do I have to buy the shares for the same to be suggested by myself? Pole. I am here confusing you with @Stocksmaster! Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,180 Location: nairobi

|

MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:The following are my picks for 2026 (in order of priority)

1. KQ. NBV KES (31.16). (Current Price: Ksh 3.30; Target Price range Ksh 8.52 by Dec 31st 2026); About 150% Upside

Speculative. Primary appreciation factor is the anticipated KES 69B capital injection by a strategic investor. A high risk play, where the share could face a fresh suspension

2. JUB. NBV KES 783 (Current Price: Ksh 345; Target Price range Ksh 420 by Dec 31st 2026); About 21% Upside

Dominance in corporate insurance business. Strong sales in run up to the 2027 general election

3. DTB. NBV KES 310 (Current Price: Ksh 117; Target Price range Ksh 200 by Dec 31st 2026); About 70% Upside, excluding dividend gain

Grossly undervalued tier 1 banking stock.

4. IMH. NBV 60.4 (Current Price: Ksh 44.90; Target Price range Ksh 54 by Dec 31st 2026); About 20% Upside, excluding dividend gain

Emerging giant with steep ROI. Over 20% YoY PBT growth projection in near to mid term

5. TPSEA. NBV KES 60.99 (Current Price: Ksh 15.75; Target Price range Ksh 30 by Dec 31st 2026); About 90% Upside

Recovering tourism industry should restore lost glory.

Thank me later How are they your picks and you haven't bought them??? Your signature shows your usual KQ only! Picks/recommendations.. Synonyms I guess. Do I have to buy the shares for the same to be suggested by myself? Pole. I am here confusing you with @Stocksmaster! KQ leading the charge, as anticipated. Always remember, your money is your responsibility and there is no single road to financial success. Watch and learn

KQ ABP 4.26

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,331 Location: Nairobi

|

obiero wrote:VituVingiSana wrote:obiero wrote:The following are my picks for 2026 (in order of priority) 1. KQ. NBV KES (31.16). (Current Price: Ksh 3.30; Target Price range Ksh 8.52 by Dec 31st 2026); About 150% Upside    Speculative. Primary appreciation factor is the anticipated KES 69B capital injection by a strategic investor. A high risk play, where the share could face a fresh suspension 2. JUB. NBV KES 783 (Current Price: Ksh 345; Target Price range Ksh 420 by Dec 31st 2026); About 21% Upside Ongeza cash from Sanlam-Allianz    Dominance in corporate insurance business. Strong sales in run up to the 2027 general election 3. DTB. NBV KES 310 (Current Price: Ksh 117; Target Price range Ksh 200 by Dec 31st 2026); About 70% Upside, excluding dividend gain Grossly undervalued tier 1 banking stock. Needs new top (esp CEO) thinking and management. 4. IMH. NBV 60.4 (Current Price: Ksh 44.90; Target Price range Ksh 54 by Dec 31st 2026); About 20% Upside, excluding dividend gain Emerging giant with steep ROI. Over 20% YoY PBT growth projection in near to mid term 5. TPSEA. NBV KES 60.99 (Current Price: Ksh 15.75; Target Price range Ksh 30 by Dec 31st 2026); About 90% Upside Wow! That's quite ambitious. Don't you fear competition? Tanzania ako na shida Recovering tourism industry should restore lost glory. Thank me later Happy new year mzee. Watch and learn 😂 I have learnt not to buy KQ    Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,331 Location: Nairobi

|

MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:The following are my picks for 2026 (in order of priority)

1. KQ. NBV KES (31.16). (Current Price: Ksh 3.30; Target Price range Ksh 8.52 by Dec 31st 2026); About 150% Upside

Speculative. Primary appreciation factor is the anticipated KES 69B capital injection by a strategic investor. A high risk play, where the share could face a fresh suspension

2. JUB. NBV KES 783 (Current Price: Ksh 345; Target Price range Ksh 420 by Dec 31st 2026); About 21% Upside

Dominance in corporate insurance business. Strong sales in run up to the 2027 general election

3. DTB. NBV KES 310 (Current Price: Ksh 117; Target Price range Ksh 200 by Dec 31st 2026); About 70% Upside, excluding dividend gain

Grossly undervalued tier 1 banking stock.

4. IMH. NBV 60.4 (Current Price: Ksh 44.90; Target Price range Ksh 54 by Dec 31st 2026); About 20% Upside, excluding dividend gain

Emerging giant with steep ROI. Over 20% YoY PBT growth projection in near to mid term

5. TPSEA. NBV KES 60.99 (Current Price: Ksh 15.75; Target Price range Ksh 30 by Dec 31st 2026); About 90% Upside

Recovering tourism industry should restore lost glory.

Thank me later How are they your picks and you haven't bought them??? Your signature shows your usual KQ only! Picks/recommendations.. Synonyms I guess. Do I have to buy the shares for the same to be suggested by myself? Pole. I am here confusing you with @Stocksmaster! You need to offer @StocksMaster an apology!  Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,793

|

VituVingiSana wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:The following are my picks for 2026 (in order of priority)

1. KQ. NBV KES (31.16). (Current Price: Ksh 3.30; Target Price range Ksh 8.52 by Dec 31st 2026); About 150% Upside

Speculative. Primary appreciation factor is the anticipated KES 69B capital injection by a strategic investor. A high risk play, where the share could face a fresh suspension

2. JUB. NBV KES 783 (Current Price: Ksh 345; Target Price range Ksh 420 by Dec 31st 2026); About 21% Upside

Dominance in corporate insurance business. Strong sales in run up to the 2027 general election

3. DTB. NBV KES 310 (Current Price: Ksh 117; Target Price range Ksh 200 by Dec 31st 2026); About 70% Upside, excluding dividend gain

Grossly undervalued tier 1 banking stock.

4. IMH. NBV 60.4 (Current Price: Ksh 44.90; Target Price range Ksh 54 by Dec 31st 2026); About 20% Upside, excluding dividend gain

Emerging giant with steep ROI. Over 20% YoY PBT growth projection in near to mid term

5. TPSEA. NBV KES 60.99 (Current Price: Ksh 15.75; Target Price range Ksh 30 by Dec 31st 2026); About 90% Upside

Recovering tourism industry should restore lost glory.

Thank me later How are they your picks and you haven't bought them??? Your signature shows your usual KQ only! Picks/recommendations.. Synonyms I guess. Do I have to buy the shares for the same to be suggested by myself? Pole. I am here confusing you with @Stocksmaster! You need to offer @StocksMaster an apology!      Pole sana @Stockmaster! Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,180 Location: nairobi

|

MaichBlack wrote:VituVingiSana wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:The following are my picks for 2026 (in order of priority)

1. KQ. NBV KES (31.16). (Current Price: Ksh 3.30; Target Price range Ksh 8.52 by Dec 31st 2026); About 150% Upside

Speculative. Primary appreciation factor is the anticipated KES 69B capital injection by a strategic investor. A high risk play, where the share could face a fresh suspension

2. JUB. NBV KES 783 (Current Price: Ksh 345; Target Price range Ksh 420 by Dec 31st 2026); About 21% Upside

Dominance in corporate insurance business. Strong sales in run up to the 2027 general election

3. DTB. NBV KES 310 (Current Price: Ksh 117; Target Price range Ksh 200 by Dec 31st 2026); About 70% Upside, excluding dividend gain

Grossly undervalued tier 1 banking stock.

4. IMH. NBV 60.4 (Current Price: Ksh 44.90; Target Price range Ksh 54 by Dec 31st 2026); About 20% Upside, excluding dividend gain

Emerging giant with steep ROI. Over 20% YoY PBT growth projection in near to mid term

5. TPSEA. NBV KES 60.99 (Current Price: Ksh 15.75; Target Price range Ksh 30 by Dec 31st 2026); About 90% Upside

Recovering tourism industry should restore lost glory.

Thank me later How are they your picks and you haven't bought them??? Your signature shows your usual KQ only! Picks/recommendations.. Synonyms I guess. Do I have to buy the shares for the same to be suggested by myself? Pole. I am here confusing you with @Stocksmaster! You need to offer @StocksMaster an apology!      Pole sana @Stockmaster! To those riding the KQ wave, stay put. The rally still has wheels. There is a reason for the 17 Jan 2025 peak. Fair value KES 8.68

KQ ABP 4.26

|

|

|

Rank: Member Joined: 9/26/2006 Posts: 462 Location: CENTRAL PROVINCE

|

Ericsson wrote:Nedbank have clarified they are not interested in entering East Africa https://x.com/i/status/2013997267339161711

Nedbank seeking to enter Kenya via NCBA. Happy Hunting x handle: @stocksmaster79

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,793

|

Wasn't Stanbic also planning to acquire NCBA? Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Member Joined: 9/26/2006 Posts: 462 Location: CENTRAL PROVINCE

|

MaichBlack wrote:Wasn't Stanbic also planning to acquire NCBA? It seems Stanbic started the courtship for NCBA but Nedbank stole the show mid stream. Stanbic and First Rand must now be looking elsewhere for acquisitions within the banking sector. My concern with the Nedbank deal of 20% cash and 4.02994 Nedbank shares for every 100 NCBA shares is how the local investors will be pushed into the JSE. Will they be linked to a stock broker in SA? Nedbank should ideally cross list in NSE such that local investors receive their Nedbank shares locally. Happy Hunting x handle: @stocksmaster79

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,180 Location: nairobi

|

stocksmaster wrote:MaichBlack wrote:Wasn't Stanbic also planning to acquire NCBA? It seems Stanbic started the courtship for NCBA but Nedbank stole the show mid stream. Stanbic and First Rand must now be looking elsewhere for acquisitions within the banking sector. My concern with the Nedbank deal of 20% cash and 4.02994 Nedbank shares for every 100 NCBA shares is how the local investors will be pushed into the JSE. Will they be linked to a stock broker in SA? Nedbank should ideally cross list in NSE such that local investors receive their Nedbank shares locally. Happy Hunting It is likely that a cross listing will be the way forward, otherwise the movement by minority shareholders to JSE will be tedious

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,180 Location: nairobi

|

obiero wrote:VituVingiSana wrote:mufasa wrote:For those of us with good financial analytical knowledge, What keeps driving Diamond Trust upwards? is it undervalued more than the other banks?

I would have thought stockmaster would have picked DT instead of IMH. Needs a new Group CEO, changes at the board level and management! Low ROE. They got a new CEO for Kenya but the GCEO needs to go. Mzee are you sure that answer helps in resolving @mufasa's mystery Stanchart chases away its Kenya CEO

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,180 Location: nairobi

|

obiero wrote:MaichBlack wrote:VituVingiSana wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:The following are my picks for 2026 (in order of priority)

1. KQ. NBV KES (31.16). (Current Price: Ksh 3.30; Target Price range Ksh 8.52 by Dec 31st 2026); About 150% Upside

Speculative. Primary appreciation factor is the anticipated KES 69B capital injection by a strategic investor. A high risk play, where the share could face a fresh suspension

2. JUB. NBV KES 783 (Current Price: Ksh 345; Target Price range Ksh 420 by Dec 31st 2026); About 21% Upside

Dominance in corporate insurance business. Strong sales in run up to the 2027 general election

3. DTB. NBV KES 310 (Current Price: Ksh 117; Target Price range Ksh 200 by Dec 31st 2026); About 70% Upside, excluding dividend gain

Grossly undervalued tier 1 banking stock.

4. IMH. NBV 60.4 (Current Price: Ksh 44.90; Target Price range Ksh 54 by Dec 31st 2026); About 20% Upside, excluding dividend gain

Emerging giant with steep ROI. Over 20% YoY PBT growth projection in near to mid term

5. TPSEA. NBV KES 60.99 (Current Price: Ksh 15.75; Target Price range Ksh 30 by Dec 31st 2026); About 90% Upside

Recovering tourism industry should restore lost glory.

Thank me later How are they your picks and you haven't bought them??? Your signature shows your usual KQ only! Picks/recommendations.. Synonyms I guess. Do I have to buy the shares for the same to be suggested by myself? Pole. I am here confusing you with @Stocksmaster! You need to offer @StocksMaster an apology!      Pole sana @Stockmaster! To those riding the KQ wave, stay put. The rally still has wheels. There is a reason for the 17 Jan 2025 peak. Fair value KES 8.68  An update on KQ. 40% up YTD. Next week Monday, it crosses the KES 5.24 ceiling, which will the new floor as per Fibonacci guidance Wakenya musilale.. Bado mapambano, mapambano..

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,793

|

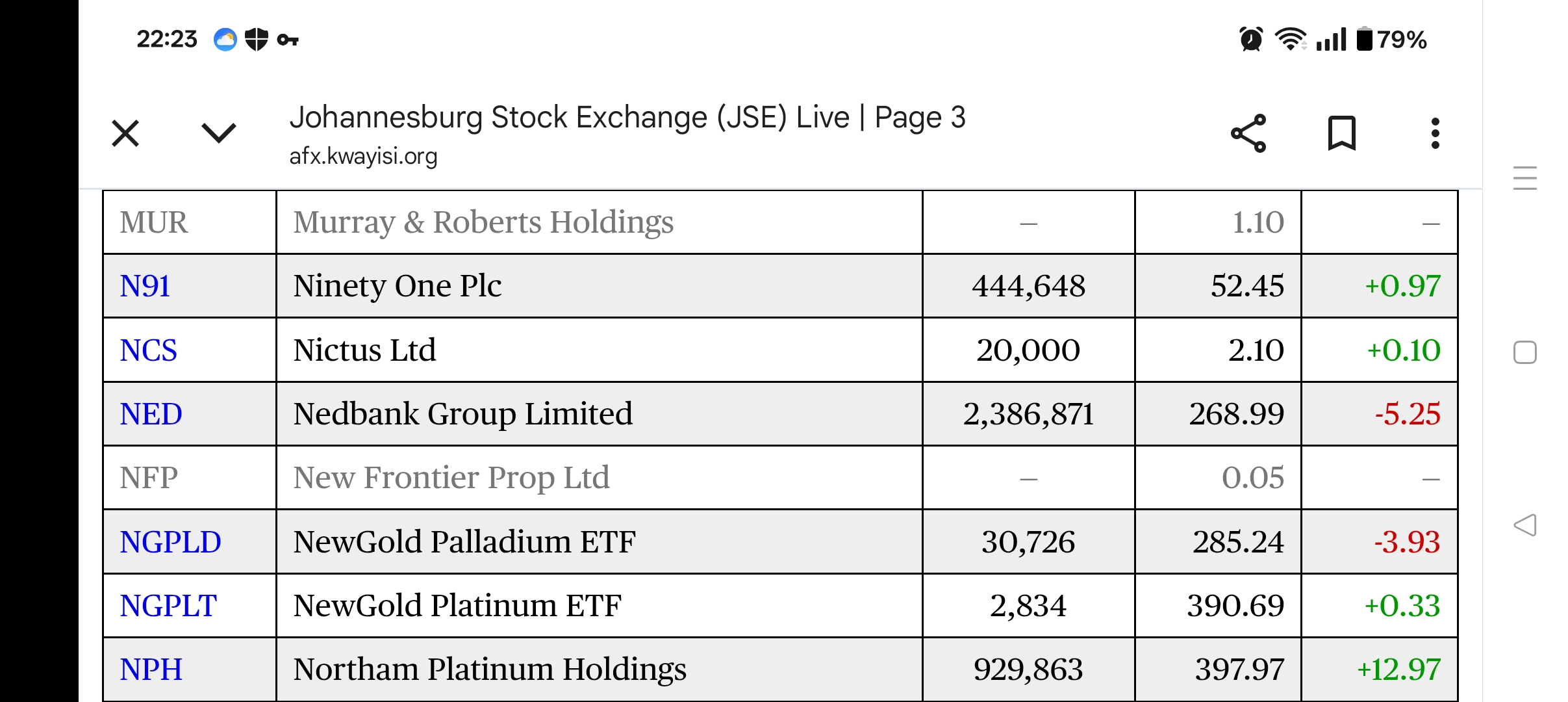

stocksmaster wrote:MaichBlack wrote:Wasn't Stanbic also planning to acquire NCBA? It seems Stanbic started the courtship for NCBA but Nedbank stole the show mid stream. Stanbic and First Rand must now be looking elsewhere for acquisitions within the banking sector. My concern with the Nedbank deal of 20% cash and 4.02994 Nedbank shares for every 100 NCBA shares is how the local investors will be pushed into the JSE. Will they be linked to a stock broker in SA? Nedbank should ideally cross list in NSE such that local investors receive their Nedbank shares locally. Happy Hunting Exactly!!! I was wondering if they were planning to cross list. How much is Nedbank trading at at the moment @Obiero. Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,180 Location: nairobi

|

MaichBlack wrote:stocksmaster wrote:MaichBlack wrote:Wasn't Stanbic also planning to acquire NCBA? It seems Stanbic started the courtship for NCBA but Nedbank stole the show mid stream. Stanbic and First Rand must now be looking elsewhere for acquisitions within the banking sector. My concern with the Nedbank deal of 20% cash and 4.02994 Nedbank shares for every 100 NCBA shares is how the local investors will be pushed into the JSE. Will they be linked to a stock broker in SA? Nedbank should ideally cross list in NSE such that local investors receive their Nedbank shares locally. Happy Hunting Exactly!!! I was wondering if they were planning to cross list. How much is Nedbank trading at at the moment @Obiero. About KES 2138 per share. ZAR to KES rate 7.95. For all African stock exchange markets info rely on kwayisi. AFX: African Stock (Securities) Exchanges Live https://afx.kwayisi.org/jse/

KQ ABP 4.26

|

|

|

Wazua

»

Investor

»

Stocks

»

Playing the Market............. 2025

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|