Wazua

»

Investor

»

Stocks

»

Exchange Bar: Results forecast

Rank: Elder Joined: 7/22/2009 Posts: 7,787

|

obiero wrote:Q3 PBT projected vs actual

EQTY 61 - 65.6

KCB 59.7 - 62.0

COOP 30.1 - 30.03

ABSA 25.4 - 24.2

NCBA 20.4 - 20.4

IMH 17.1 - 17.8

SCBK 16.3

SBIC 12.7 - 12.8

DTB 10.4 - 11.2

HF 1.1

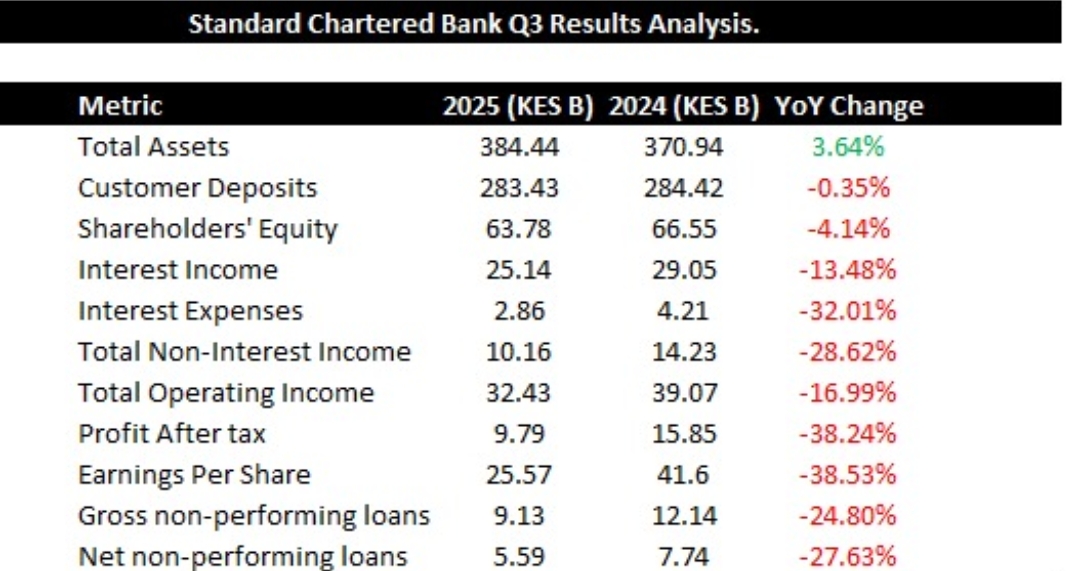

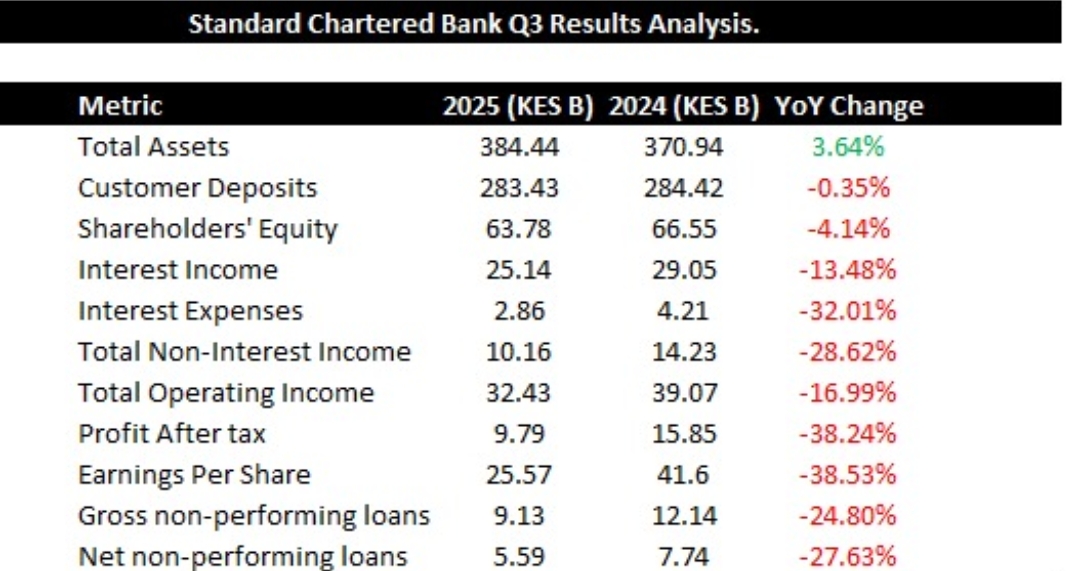

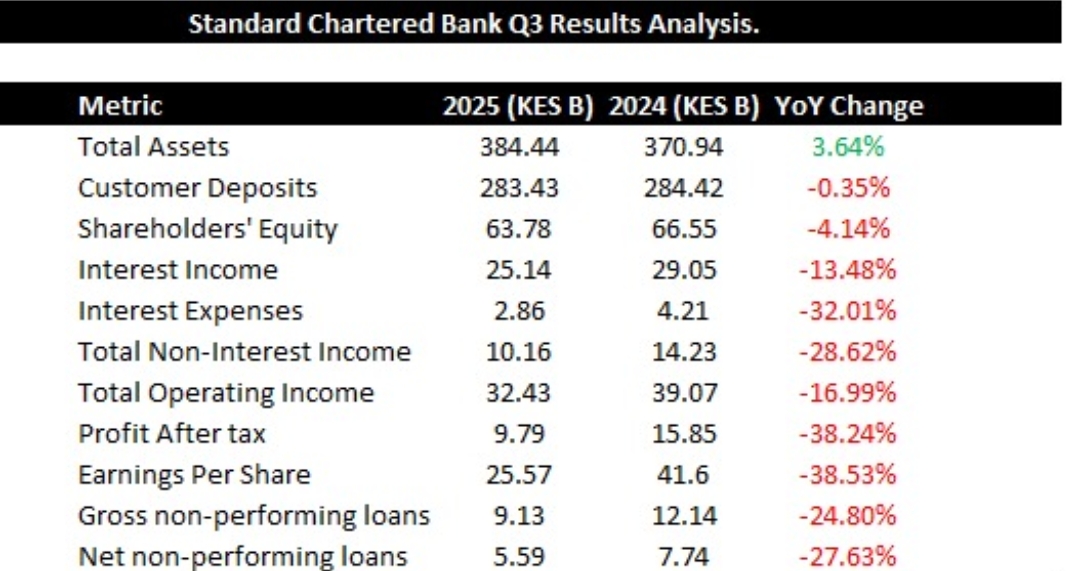

Standard Chartered books have refused to balance, after payout of KES 8 dividend in H1, amidst a 21% drop in PBT. Who does that!

Meantime, Sidian posts 470% YoY growth in PBT

Finally, Family Bank will join the Exchange Bar earnings forecasts with effect from Q4 2025 Who does that? A board where the H1 eps is Kshs. 21.4/=. Makes perfect sense if you ask me. Kshs. 13.4/= per share still retained for H1 2025. More retained earnings than the combined earnings per KQ share for 10 years!!! Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,169 Location: nairobi

|

MaichBlack wrote:obiero wrote:Q3 PBT projected vs actual

EQTY 61 - 65.6

KCB 59.7 - 62.0

COOP 30.1 - 30.03

ABSA 25.4 - 24.2

NCBA 20.4 - 20.4

IMH 17.1 - 17.8

SCBK 16.3

SBIC 12.7 - 12.8

DTB 10.4 - 11.2

HF 1.1

Standard Chartered books have refused to balance, after payout of KES 8 dividend in H1, amidst a 21% drop in PBT. Who does that!

Meantime, Sidian posts 470% YoY growth in PBT

Finally, Family Bank will join the Exchange Bar earnings forecasts with effect from Q4 2025 Who does that? A board where the H1 eps is Kshs. 21.4/=. Makes perfect sense if you ask me. Kshs. 13.4/= per share still retained for H1 2025. More retained earnings than the combined earnings per KQ share for 10 years!!! Watch and learn

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,787

|

obiero wrote:MaichBlack wrote:obiero wrote:Q3 PBT projected vs actual

EQTY 61 - 65.6

KCB 59.7 - 62.0

COOP 30.1 - 30.03

ABSA 25.4 - 24.2

NCBA 20.4 - 20.4

IMH 17.1 - 17.8

SCBK 16.3

SBIC 12.7 - 12.8

DTB 10.4 - 11.2

HF 1.1

Standard Chartered books have refused to balance, after payout of KES 8 dividend in H1, amidst a 21% drop in PBT. Who does that!

Meantime, Sidian posts 470% YoY growth in PBT

Finally, Family Bank will join the Exchange Bar earnings forecasts with effect from Q4 2025 Who does that? A board where the H1 eps is Kshs. 21.4/=. Makes perfect sense if you ask me. Kshs. 13.4/= per share still retained for H1 2025. More retained earnings than the combined earnings per KQ share for 10 years!!! Watch and learn Inverse Jim Cramer/@Obiero index pap!!! Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,169 Location: nairobi

|

Q3 PBT projected vs actual EQTY 61 - 65.6 KCB 59.7 - 62.0 COOP 30.1 - 30.03 ABSA 25.4 - 24.2 NCBA 20.4 - 20.4 IMH 17.1 - 17.8 SCBK 16.3 - 13.2 SBIC 12.7 - 12.8 DTB 10.4 - 11.2 HF 1.1

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,169 Location: nairobi

|

MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:Q3 PBT projected vs actual

EQTY 61 - 65.6

KCB 59.7 - 62.0

COOP 30.1 - 30.03

ABSA 25.4 - 24.2

NCBA 20.4 - 20.4

IMH 17.1 - 17.8

SCBK 16.3

SBIC 12.7 - 12.8

DTB 10.4 - 11.2

HF 1.1

Standard Chartered books have refused to balance, after payout of KES 8 dividend in H1, amidst a 21% drop in PBT. Who does that!

Meantime, Sidian posts 470% YoY growth in PBT

Finally, Family Bank will join the Exchange Bar earnings forecasts with effect from Q4 2025 Who does that? A board where the H1 eps is Kshs. 21.4/=. Makes perfect sense if you ask me. Kshs. 13.4/= per share still retained for H1 2025. More retained earnings than the combined earnings per KQ share for 10 years!!! Watch and learn Inverse Jim Cramer/@Obiero index pap!!! SCBK reports 41% drop in PBT. Meantime, second group of pensioners have returned to court seeking KES 30B. With all the case uncertainty you strongly believe that a full year dividend will be shared. All the best boss  https://www.citizen.digi...-pension-dispute-n370128 https://www.citizen.digi...-pension-dispute-n370128

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,169 Location: nairobi

|

obiero wrote:Q3 PBT projected vs actual

EQTY 61 - 65.6

KCB 59.7 - 62.0

COOP 30.1 - 30.03

ABSA 25.4 - 24.2

NCBA 20.4 - 20.4

IMH 17.1 - 17.8

SCBK 16.3 - 13.2

SBIC 12.7 - 12.8

DTB 10.4 - 11.2

HF 1.1 Only HF remains, and they should be saying something before Friday. Expect 230% YoY PBT increase, the final big spike. Going forward, it will revert to industry spread circa 6-20% YoY

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,787

|

obiero wrote:obiero wrote:Q3 PBT projected vs actual

EQTY 61 - 65.6

KCB 59.7 - 62.0

COOP 30.1 - 30.03

ABSA 25.4 - 24.2

NCBA 20.4 - 20.4

IMH 17.1 - 17.8

SCBK 16.3 - 13.2

SBIC 12.7 - 12.8

DTB 10.4 - 11.2

HF 1.1 Only HF remains, and they should be saying something before Friday. Expect 230% YoY PBT increase, the final big spike. Going forward, it will revert to industry spread circa 6-20% YoY Kesho asubuhi na mapema!! By 9:31 am bei ya share itakuwa tofauti. Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,330 Location: Nairobi

|

obiero wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:Q3 PBT projected vs actual

EQTY 61 - 65.6

KCB 59.7 - 62.0

COOP 30.1 - 30.03

ABSA 25.4 - 24.2

NCBA 20.4 - 20.4

IMH 17.1 - 17.8

SCBK 16.3

SBIC 12.7 - 12.8

DTB 10.4 - 11.2

HF 1.1

Standard Chartered books have refused to balance, after payout of KES 8 dividend in H1, amidst a 21% drop in PBT. Who does that!

Meantime, Sidian posts 470% YoY growth in PBT

Finally, Family Bank will join the Exchange Bar earnings forecasts with effect from Q4 2025 Who does that? A board where the H1 eps is Kshs. 21.4/=. Makes perfect sense if you ask me. Kshs. 13.4/= per share still retained for H1 2025. More retained earnings than the combined earnings per KQ share for 10 years!!! Watch and learn Inverse Jim Cramer/@Obiero index pap!!! SCBK reports 41% drop in PBT. Meantime, second group of pensioners have returned to court seeking KES 30B. With all the case uncertainty you strongly believe that a full year dividend will be shared. All the best boss  https://www.citizen.digi...pension-dispute-n370128 https://www.citizen.digi...pension-dispute-n370128 Let's pick this up in March 2026 when I expect SCBK will announce a (smaller) final dividend.  Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,169 Location: nairobi

|

MaichBlack wrote:obiero wrote:obiero wrote:Q3 PBT projected vs actual

EQTY 61 - 65.6

KCB 59.7 - 62.0

COOP 30.1 - 30.03

ABSA 25.4 - 24.2

NCBA 20.4 - 20.4

IMH 17.1 - 17.8

SCBK 16.3 - 13.2

SBIC 12.7 - 12.8

DTB 10.4 - 11.2

HF 1.1 Only HF remains, and they should be saying something before Friday. Expect 230% YoY PBT increase, the final big spike. Going forward, it will revert to industry spread circa 6-20% YoY Kesho asubuhi na mapema!! By 9:31 am bei ya share itakuwa tofauti. This stock is trading above book value and is unable to issue dividend until negative equity is reversed by 2027. Then with the increased float from previous rights issue, numerous shares will only lead to a dividend of KES 0.20 at best, in 2028

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,169 Location: nairobi

|

VituVingiSana wrote:obiero wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:Q3 PBT projected vs actual

EQTY 61 - 65.6

KCB 59.7 - 62.0

COOP 30.1 - 30.03

ABSA 25.4 - 24.2

NCBA 20.4 - 20.4

IMH 17.1 - 17.8

SCBK 16.3

SBIC 12.7 - 12.8

DTB 10.4 - 11.2

HF 1.1

Standard Chartered books have refused to balance, after payout of KES 8 dividend in H1, amidst a 21% drop in PBT. Who does that!

Meantime, Sidian posts 470% YoY growth in PBT

Finally, Family Bank will join the Exchange Bar earnings forecasts with effect from Q4 2025 Who does that? A board where the H1 eps is Kshs. 21.4/=. Makes perfect sense if you ask me. Kshs. 13.4/= per share still retained for H1 2025. More retained earnings than the combined earnings per KQ share for 10 years!!! Watch and learn Inverse Jim Cramer/@Obiero index pap!!! SCBK reports 41% drop in PBT. Meantime, second group of pensioners have returned to court seeking KES 30B. With all the case uncertainty you strongly believe that a full year dividend will be shared. All the best boss  https://www.citizen.digi...pension-dispute-n370128 https://www.citizen.digi...pension-dispute-n370128 Let's pick this up in March 2026 when I expect SCBK will announce a (smaller) final dividend.  insha'Allah my mzee

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,169 Location: nairobi

|

Q3 PBT projected vs actual EQTY 61 - 65.6 KCB 59.7 - 62.0 COOP 30.1 - 30.03 ABSA 25.4 - 24.2 NCBA 20.4 - 20.4 IMH 17.1 - 17.8 SCBK 16.3 - 13.2 SBIC 12.7 - 12.8 DTB 10.4 - 11.2 HF 1.1 - 1.1 SCBK is our sick man in the room. A miracle that it's trading above KES 265

KQ ABP 4.26

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,330 Location: Nairobi

|

obiero wrote:Q3 PBT projected vs actual

EQTY 61 - 65.6

KCB 59.7 - 62.0

COOP 30.1 - 30.03

ABSA 25.4 - 24.2

NCBA 20.4 - 20.4

IMH 17.1 - 17.8

SCBK 16.3 - 13.2

SBIC 12.7 - 12.8

DTB 10.4 - 11.2

HF 1.1 - 1.1

SCBK is our sick man in the room. A miracle that it's trading above KES 265 Makes more money in 1 day while sick than KQ in a decade    One-off manenos. Only 3bn vs what folks were saying sijui 30bn Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,787

|

VituVingiSana wrote:obiero wrote:Q3 PBT projected vs actual

EQTY 61 - 65.6

KCB 59.7 - 62.0

COOP 30.1 - 30.03

ABSA 25.4 - 24.2

NCBA 20.4 - 20.4

IMH 17.1 - 17.8

SCBK 16.3 - 13.2

SBIC 12.7 - 12.8

DTB 10.4 - 11.2

HF 1.1 - 1.1

SCBK is our sick man in the room. A miracle that it's trading above KES 265 Makes more money in 1 day while sick than KQ in a decade    One-off manenos. Only 3bn vs what folks were saying sijui 30bn How did they ever get 30 Billion? How many (single company) pension funds in Kenya are worth 30 Billion let alone owe 30 Billion!!?? Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,169 Location: nairobi

|

MaichBlack wrote:VituVingiSana wrote:obiero wrote:Q3 PBT projected vs actual

EQTY 61 - 65.6

KCB 59.7 - 62.0

COOP 30.1 - 30.03

ABSA 25.4 - 24.2

NCBA 20.4 - 20.4

IMH 17.1 - 17.8

SCBK 16.3 - 13.2

SBIC 12.7 - 12.8

DTB 10.4 - 11.2

HF 1.1 - 1.1

SCBK is our sick man in the room. A miracle that it's trading above KES 265 Makes more money in 1 day while sick than KQ in a decade    One-off manenos. Only 3bn vs what folks were saying sijui 30bn How did they ever get 30 Billion? How many (single company) pension funds in Kenya are worth 30 Billion let alone owe 30 Billion!!?? Determined payout for the 629 is KES 7.7B while the fresh case by the non-629 could balloon to 23B as more ex staff enjoin into the matter, total KES 30.7B

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,169 Location: nairobi

|

FY 2025 PBT projected vs actual EQTY 88.9 KCB 82.8 COOP 40.7 ABSA 33 NCBA 27.2 IMH 24.4 SBIC 17.8 SCBK 17.4 DTB 15.4 FBKL 6.4 HF 1.47

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,169 Location: nairobi

|

This is the month, this is the month, that the Lord has made

KQ ABP 4.26

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,330 Location: Nairobi

|

obiero wrote:MaichBlack wrote:VituVingiSana wrote:obiero wrote:Q3 PBT projected vs actual

EQTY 61 - 65.6

KCB 59.7 - 62.0

COOP 30.1 - 30.03

ABSA 25.4 - 24.2

NCBA 20.4 - 20.4

IMH 17.1 - 17.8

SCBK 16.3 - 13.2

SBIC 12.7 - 12.8

DTB 10.4 - 11.2

HF 1.1 - 1.1

SCBK is our sick man in the room. A miracle that it's trading above KES 265 Makes more money in 1 day while sick than KQ in a decade    One-off manenos. Only 3bn vs what folks were saying sijui 30bn How did they ever get 30 Billion? How many (single company) pension funds in Kenya are worth 30 Billion let alone owe 30 Billion!!?? Determined payout for the 629 is KES 7.7B while the fresh case by the non-629 could balloon to 23B as more ex staff enjoin into the matter, total KES 30.7B Is KQ up-to-date on pension remittances? Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,169 Location: nairobi

|

VituVingiSana wrote:obiero wrote:MaichBlack wrote:VituVingiSana wrote:obiero wrote:Q3 PBT projected vs actual

EQTY 61 - 65.6

KCB 59.7 - 62.0

COOP 30.1 - 30.03

ABSA 25.4 - 24.2

NCBA 20.4 - 20.4

IMH 17.1 - 17.8

SCBK 16.3 - 13.2

SBIC 12.7 - 12.8

DTB 10.4 - 11.2

HF 1.1 - 1.1

SCBK is our sick man in the room. A miracle that it's trading above KES 265 Makes more money in 1 day while sick than KQ in a decade    One-off manenos. Only 3bn vs what folks were saying sijui 30bn How did they ever get 30 Billion? How many (single company) pension funds in Kenya are worth 30 Billion let alone owe 30 Billion!!?? Determined payout for the 629 is KES 7.7B while the fresh case by the non-629 could balloon to 23B as more ex staff enjoin into the matter, total KES 30.7B Is KQ up-to-date on pension remittances? Yes. The KES 26.1B KQ pension fund was reinstated in 2023, after a brief pause during COVID

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,169 Location: nairobi

|

Let the games begin 🔹 March 5 – ABSA 🔹 March 11 – SBIC & KCB 🔹 March 13 – COOP 🔹 March 17 – EQTY 🔹 March 18 – SCBK 🔹 March 19 – IMH 🔹 March 20 – DTB 🔹 March 23 – HFC 🔹 March 26 – NCBA

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,169 Location: nairobi

|

obiero wrote:FY 2025 PBT projected vs actual

EQTY 88.9

KCB 82.8

COOP 40.7

ABSA 33

NCBA 27.2

IMH 24.4

SBIC 17.8

SCBK 17.4

DTB 15.4

FBKL 6.4

HF 1.47 Margin of allowable error is +/- 0.5

KQ ABP 4.26

|

|

|

Wazua

»

Investor

»

Stocks

»

Exchange Bar: Results forecast

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|