Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Rank: Elder Joined: 6/23/2009 Posts: 14,103 Location: nairobi

|

VituVingiSana wrote:Folks - Unless there is fundamentally something wrong with KQ, why worry about averaging down [or buying 'new' shares]?

Do not worry about averaging down [not a good idea] but look at the shares [& price] TODAY... Would you buy the shares today if you had NO shares?

In KQ's case... yes, I would! Tumekushika!

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,103 Location: nairobi

|

mwekez@ji wrote:obiero wrote:mwekez@ji wrote:obiero wrote:Gadaffi wrote:mwekez@ji wrote:hisah wrote:obiero wrote:FYR to be released on 14.06.2013 should settle/unsettle all nerves Should rattle all nerves is more like it unless creative accounting is hired at the finance department. Was the laid off staff issue sorted? The laid off workers were reinstated and wage bill hurdle remains as was ... @Obiero, whats your FYR expectations? the last comm i saw frm KQ was that the case was still in court pending determination. r u saying KQ settled n reinstated workers? Either way, if this issue is nt addressed, th share performance will remain depressed altho significantly improved financial results may overshadow this @hisah. the latest update i saw was www.nation.co.ke/Feature...12/-/egyf4p/-/index.html@mwekeza@ji. yet to visit my connected executives at the Exchange Bar for close-to-exact figures, but my own projections point to a 'respectable' net loss not exceeding KES 450M.. @hisah, @Gadaffi, on the court case, we may go by that link given by @obiero. @Obiero, H1 results was a net loss of KES 4.778 Billion. How could KQ have made a massive net profit of KES 4.338 Billion in H2 results so that FYR can be the said 'respectable' net loss not exceeding KES 450 Million @mwekez@ji. leaking revenue streams have been plugged by pull backs/abandonment to destinations such as London, Rome, Musact and Zanzibar. Africa which contributes upwards of 60% to KQ's bottom line shows growth of 10.2% in their Q3 as seen in this http://www.ventures-africa.com/...perating-results-for-q3/finally, gain from fuel derivates were not disclosed/realised in their half year and could be their silverbullet The horse itself painted a neutral picture on its 3Q operating statistics. http://www.kenya-airways.com/Ho...3_OCT_to_DEC_2012/?dis=yThe total passenger tally, which closed at 991,149, indicatef a growth of 3.6% compared to similar period last year. The resultant cabin factor (the number of seats sold)at 69.7% was lower than prior year’s 71.7%. Within Africa but excluding Kenya (which contibutes c50% of revenue), passengers uplifted totalled 516,894 indicating a growth of 2.9% on the back of 10.1% capacity growth. The resultant passenger cabin factor of 63.6% was 4.5 percentage points lower than similar period last year. Passenger uplift to Europe (which contributes c26% to revenue) at 95,036 was a reduction from last year’s level of 117,527 following capacity reduction of 26.6% compared to the same quarter of prior year due to capacity rationalization occasioned by the Euro zone crisis and the suspension of the Rome flights. The two regions mentioned above, which are the main KQ routes, hadn't done well as at end of Q3. I honestly dont expect the H2 profit you allude. On fuel derivatives, they have been a double edged sword in the past and i dont think anybody should buy KQ based on this coz its not KQ business. That said, KQ remains a very high beta stock for both FAs and TAs 12 years ago

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,103 Location: nairobi

|

In other news, the water canon salute for RAO001 was an emotional marketing masterstroke

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,103 Location: nairobi

|

Refresh on duty free. Black November. Save the date

KQ ABP 4.26

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,310 Location: Nairobi

|

obiero wrote:VituVingiSana wrote:Folks - Unless there is fundamentally something wrong with KQ, why worry about averaging down [or buying 'new' shares]?

Do not worry about averaging down [not a good idea] but look at the shares [& price] TODAY... Would you buy the shares today if you had NO shares?

In KQ's case... yes, I would! Tumekushika! Advice on averaging down (or not) remains solid.  And there is a lot that became and remains fundamentally wrong with KQ    Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,103 Location: nairobi

|

VituVingiSana wrote:obiero wrote:VituVingiSana wrote:Folks - Unless there is fundamentally something wrong with KQ, why worry about averaging down [or buying 'new' shares]?

Do not worry about averaging down [not a good idea] but look at the shares [& price] TODAY... Would you buy the shares today if you had NO shares?

In KQ's case... yes, I would! Tumekushika! Advice on averaging down (or not) remains solid.  And there is a lot that became and remains fundamentally wrong with KQ    Hehe. I had just missed you. Needed your input

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,103 Location: nairobi

|

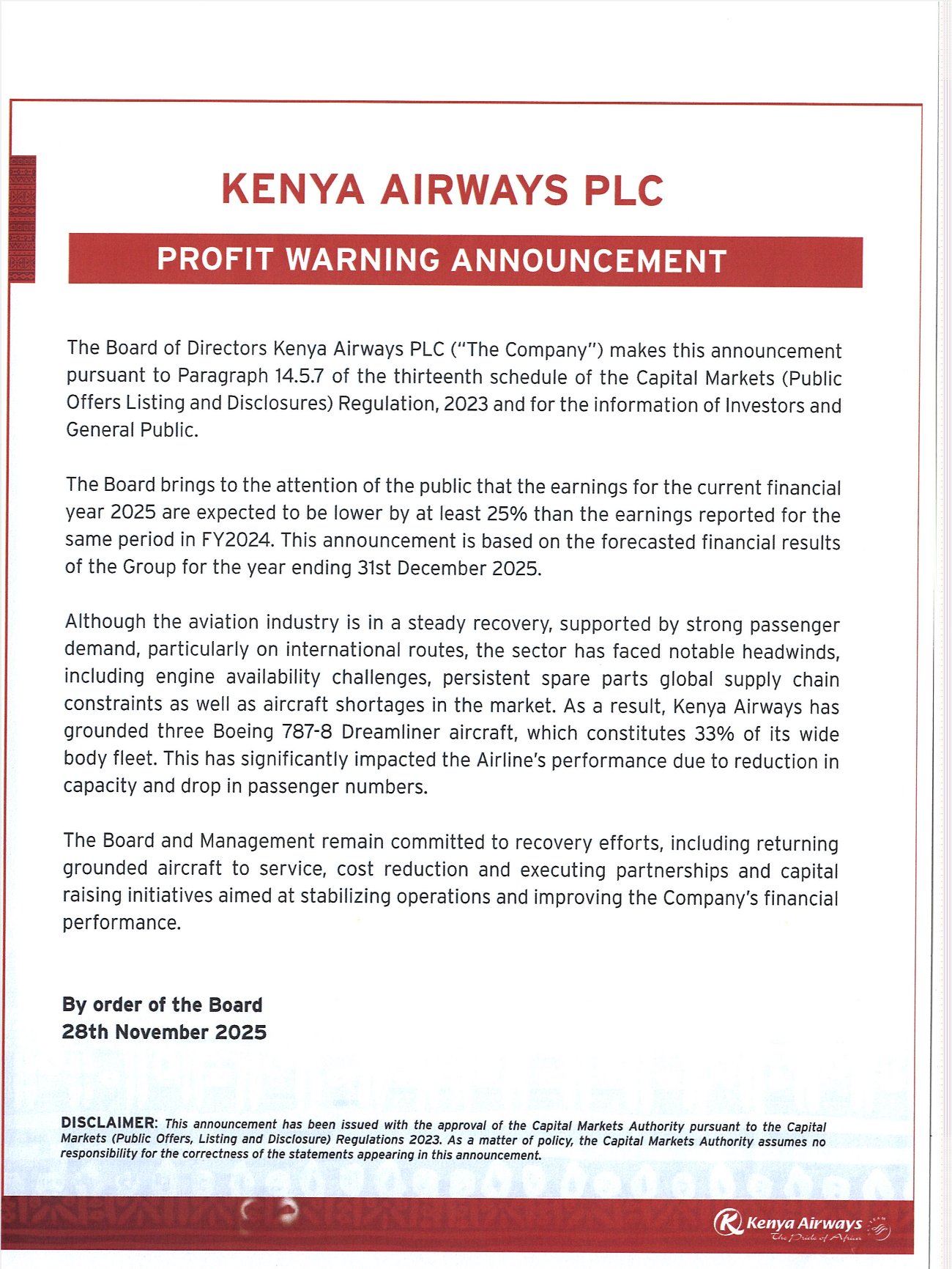

MaichBlack wrote:obiero wrote:Some quick truths

1. The KQ results at operating loss level especially, were not pleasant

2. It is unlikely, near-impossible for KQ to turn a full year profit in 2025

3. With confirmed stoppage of the Open Offer for minority shareholders, the USD 500,000,000 capital injection is the only critical play left on the KQ share. If it fails, it is game over

4. If you are unable to hold mid-term, say two to three years, it is best that you sell today or nearest date to today

5. In case you are liquid and able to go long haul, proceed to add new stock/average down, the KQ share may give you more returns than you ever dreamed about Sell today??? Wait for the market to open and see the blood on the streets! Definitely not a sellers a market. Unless of course one wants to take in losses before they get worse. FY 2025 net loss forecasted at KES 14B, ceteris paribus. In Q1 2026, the KES 69B capital injection should unlock fair value which remains KES 8.52. This share is not for those with weak hearts or illiquid pockets, please avoid it if you need your cash in the near term, anything can go wrong at any time anywhere and anyhow

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,103 Location: nairobi

|

Straight from the Exchange Qatar. Qatar and Fly ET have both put up tentative proposals to purchase GoK stake in KQ. Things are not looking too bad

KQ ABP 4.26

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,310 Location: Nairobi

|

obiero wrote:Straight from the Exchange Qatar. Qatar and Fly ET have both put up tentative proposals to purchase GoK stake in KQ. Things are not looking too bad What about your shares?    Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,103 Location: nairobi

|

VituVingiSana wrote:obiero wrote:Straight from the Exchange Qatar. Qatar and Fly ET have both put up tentative proposals to purchase GoK stake in KQ. Things are not looking too bad What about your shares?    May God's will be done 😁

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,103 Location: nairobi

|

obiero wrote:obiero wrote:VituVingiSana wrote:jawgey wrote:MaichBlack wrote:Kufa dereva, kufa makanga, kufa mechanic, kufa mwenye gari!!! A good thing he referred to 'kamikaze'- kill or be killed! Best bid at 9.58am is 1.80 Some poor suckers bought at 3.90 @Obiero Splash out the 500k! I have placed the low bid that you have sighted. Averaging down. So help me God 😁 Gained +30% ROI on COOP and I have sold it at prevailing rate, with awareness it could trace higher to KES 26. Full sale proceeds applied to KQ. Insanity? Maybe! Watch and learn @Obiero has always known the NBV for COOP. @Obiero is not a stranger in Jerusalem. Watch and learn

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,103 Location: nairobi

|

Project Kifaru gathering steam. One of the two grounded birds back in the air. June 2026, the 777 resumes from Turkish lease duty, to rump up capacity for long haul routes. I see blue clear skies ahead. I speak in code

KQ ABP 4.26

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,310 Location: Nairobi

|

obiero wrote:Project Kifaru gathering steam. One of the two grounded birds back in the air. June 2026, the 777 resumes from Turkish lease duty, to rump up capacity for long haul routes. I see blue clear skies ahead. I speak in code I&M declared an interim while you speak in code.  Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,103 Location: nairobi

|

VituVingiSana wrote:obiero wrote:Project Kifaru gathering steam. One of the two grounded birds back in the air. June 2026, the 777 resumes from Turkish lease duty, to rump up capacity for long haul routes. I see blue clear skies ahead. I speak in code I&M declared an interim while you speak in code.  Hehe. Mzee wangu. The race doesn't belong to the swift. Watch and learn

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,103 Location: nairobi

|

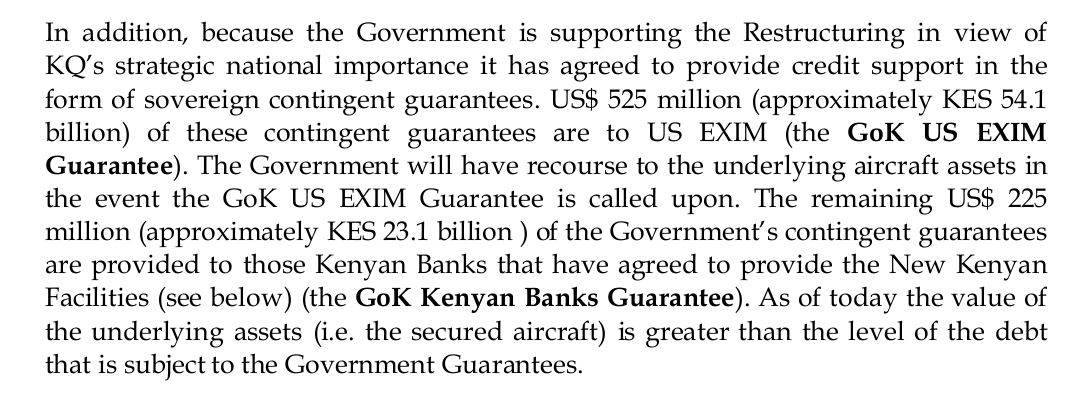

Ericsson wrote:the deal wrote:KQ will be nationalised by 2020....I also believe Gava will bid higher...KES8.52 is just a guideline...could be high as KES15...although KES23 could make @obiero extremely happy...KQ is my signature contrarian play...just minor profit taking and then the stock will rally again... Jubilee government doesn't have the financial capability to nationalise KQ,unless MPIGs take a pay cut Years later, the payout is imminent. Remember KQLC 2017 Limited which includes Equity Bank Group Limited, KCB Bank Kenya Ltd and Co-operative Bank Kenya Limited sit on the board of KQ, with 38.1% shareholding. They got in at KES 8.52 per share in 2017. Watch and learn  Time and tide..

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,103 Location: nairobi

|

An update: 1. The KQ results, especially at operating loss level as at H1 were not pleasant 2. It is unlikely, near-impossible for KQ to turn a full year profit in 2025. At best, expect a KES 12B loss 3. With confirmed stoppage of the Open Offer for minority shareholders, the USD 500,000,000 capital injection is the only critical play left on the KQ share. If it fails, it is game over 4. If you are unable to hold mid-term, say two to three years, you should have sold yesterday or nearest date to yesterday 5. In case you are liquid and able to go long haul, proceed to add new stock/average down at any price below KES 8.52, noting that the KQ share may give you more returns than you ever dreamed about. 6. Watch and learn

KQ ABP 4.26

|

|

|

Rank: Member Joined: 9/26/2006 Posts: 457 Location: CENTRAL PROVINCE

|

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,103 Location: nairobi

|

stocksmaster wrote:https://x.com/AmbokoJH/status/1994055562565144681?t=zyl7CEjX1J6yPleZfjGEaA&s=19

KQ issues a profit warning.

Happy Hunting This was certain

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,103 Location: nairobi

|

obiero wrote:An update:

1. The KQ results, especially at operating loss level as at H1 were not pleasant

2. It is unlikely, near-impossible for KQ to turn a full year profit in 2025. At best, expect a KES 12B loss

3. With confirmed stoppage of the Open Offer for minority shareholders, the USD 500,000,000 capital injection is the only critical play left on the KQ share. If it fails, it is game over

4. If you are unable to hold mid-term, say two to three years, you should have sold yesterday or nearest date to yesterday

5. In case you are liquid and able to go long haul, proceed to add new stock/average down at any price below KES 8.52, noting that the KQ share may give you more returns than you ever dreamed about.

6. Watch and learn 3.8m is the highest single day trading volume done in the last 10 years. This happened in Jan 2020. Minority shareholders aren't trading this stock. Majority of the minority shareholders bought at highs of KES 40 per share and simply won't sell unless it's determined that the final rites are being performed by GoK

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,103 Location: nairobi

|

KQ ABP 4.26

|

|

|

Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|