Wazua

»

Investor

»

Stocks

»

Portfolio Balancing: Avoid Over Exposure To Financial Sector

Rank: Elder Joined: 12/4/2009 Posts: 10,800 Location: NAIROBI

|

wukan wrote:Lisemwalo lipo na kama halipo laja

Lazy kenyan bankers the disruption cometh...

Nedbank have come and clarified they are not interested in coming to East Africa and will instead focus in Southern Africa. Standard Bank,what is their plan with Stanbic Kenya;the bank has lost momentum. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,118 Location: nairobi

|

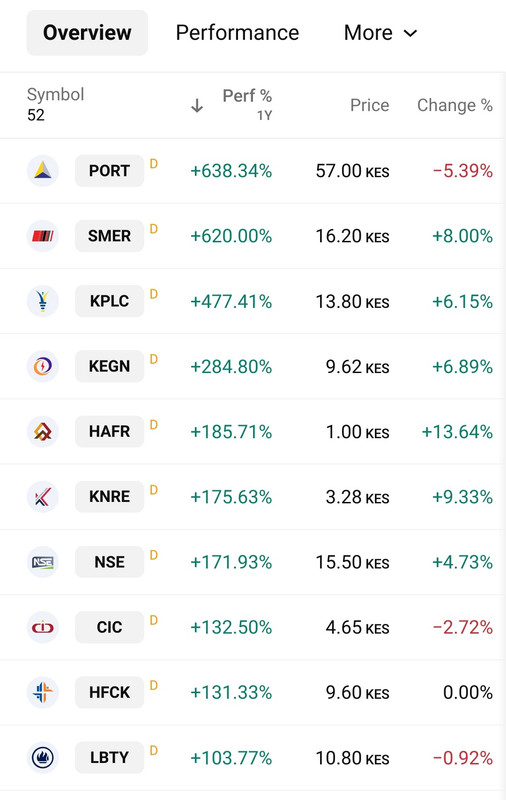

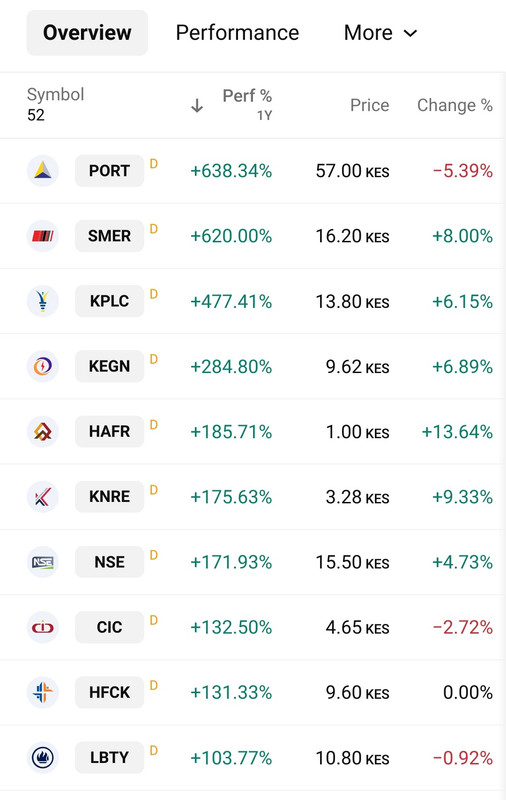

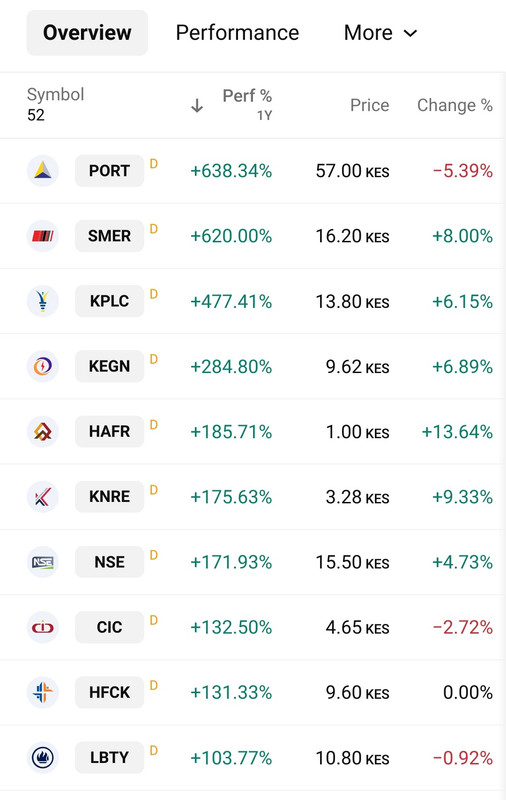

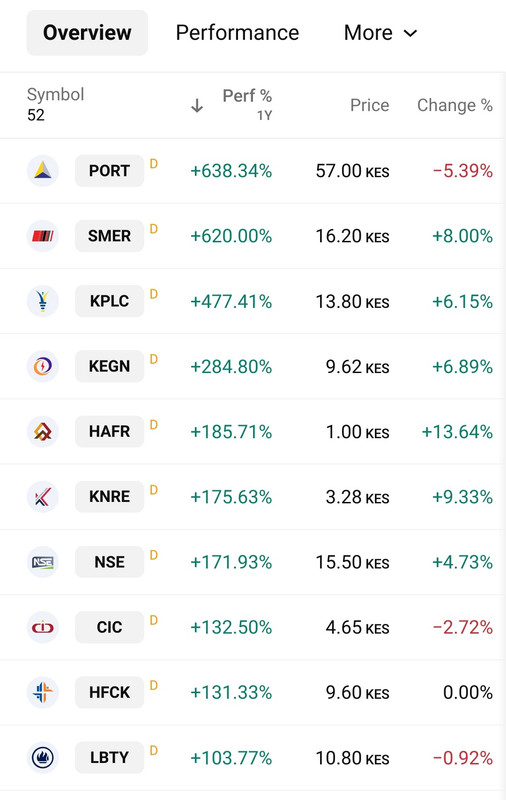

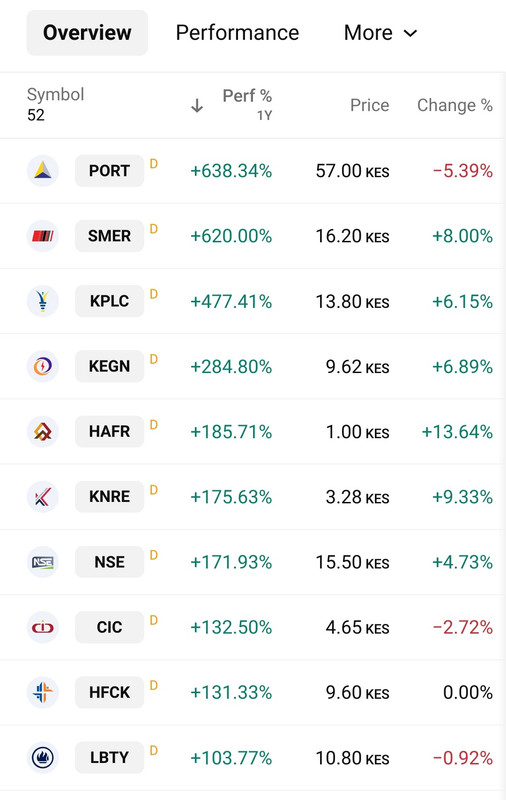

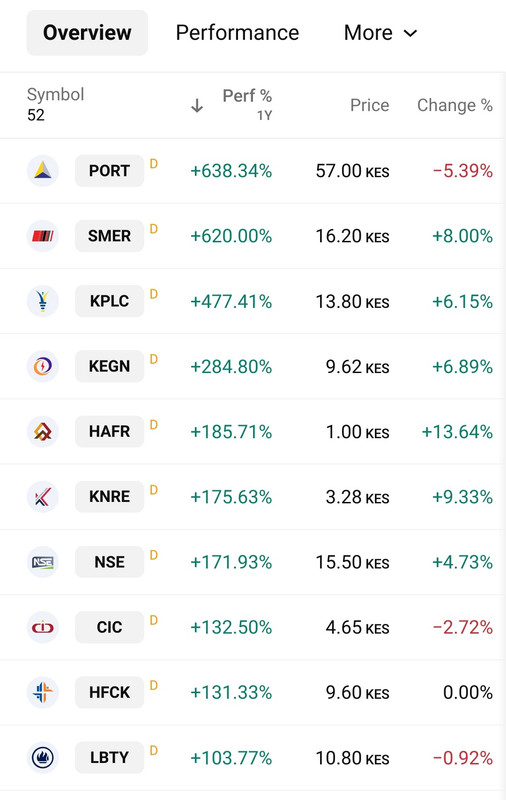

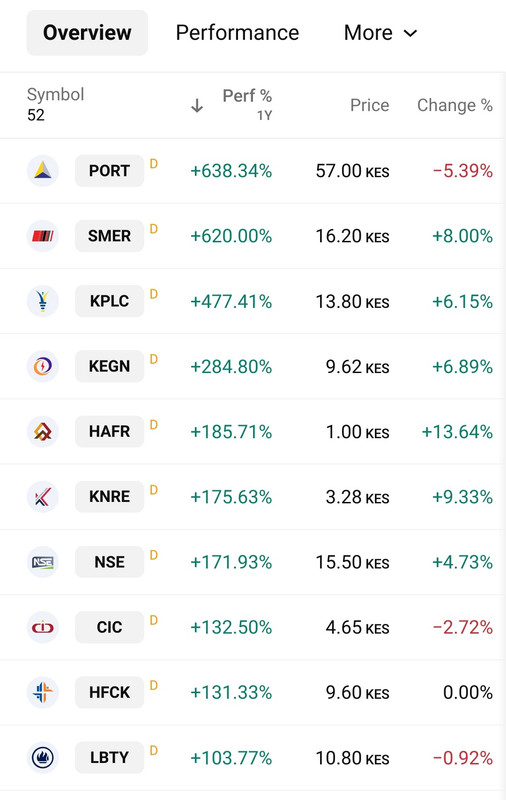

Only one bank makes the YTD top gainers list

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,118 Location: nairobi

|

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,310 Location: Nairobi

|

obiero wrote:Only one bank makes the YTD top gainers list  Coz "other" banks (except HF) pay dividends for a better Total Return    and not only in YTD 2025 but in 2024 Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,118 Location: nairobi

|

VituVingiSana wrote:obiero wrote:Only one bank makes the YTD top gainers list  Coz "other" banks (except HF) pay dividends for a better Total Return    and not only in YTD 2025 but in 2024 Mzee! 400% YTD is equivalent to dividend for 40 years, assuming 10% yield per annum consistently. Capital gains return as a stock strategy often out does dividend. But for an aged investor, I understand your view

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,734

|

VituVingiSana wrote:obiero wrote:Only one bank makes the YTD top gainers list  Coz "other" banks (except HF) pay dividends for a better Total Return    and not only in YTD 2025 but in 2024 Wachana na @Obiero @VVS. You know he bought and still owns all these stocks!!! And @Obiero said he doesn't get sarcasm. I'm being sarcastic!!!Easy to post such stuff AFTER it happens. Not helpful at all!!! Everyone knows what happened. Tell us before it happens like @Stockmaster, the guy who predicted KPLC going through the roof when it was was just chillin - at 1.xy or something (I forget his name) among others. Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,118 Location: nairobi

|

MaichBlack wrote:VituVingiSana wrote:obiero wrote:Only one bank makes the YTD top gainers list  Coz "other" banks (except HF) pay dividends for a better Total Return    and not only in YTD 2025 but in 2024 Wachana na @Obiero @VVS. You know he bought and still owns all these stocks!!! And @Obiero said he doesn't get sarcasm. I'm being sarcastic!!!Easy to post such stuff AFTER it happens. Not helpful at all!!! Everyone knows what happened. Tell us before it happens like @Stockmaster, the guy who predicted KPLC going through the roof when it was was just chillin - at 1.xy or something (I forget his name) among others. It's unfair to state my portfolio and recommended picks are unknown. Nyani haoni kundula http://m.wazua.co.ke/for...&m=914370#post914370

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,734

|

obiero wrote:MaichBlack wrote:VituVingiSana wrote:obiero wrote:Only one bank makes the YTD top gainers list  Coz "other" banks (except HF) pay dividends for a better Total Return    and not only in YTD 2025 but in 2024 Wachana na @Obiero @VVS. You know he bought and still owns all these stocks!!! And @Obiero said he doesn't get sarcasm. I'm being sarcastic!!!Easy to post such stuff AFTER it happens. Not helpful at all!!! Everyone knows what happened. Tell us before it happens like @Stockmaster, the guy who predicted KPLC going through the roof when it was was just chillin - at 1.xy or something (I forget his name) among others. It's unfair to state my portfolio and recommended picks are unknown. Nyani haoni kundula http://m.wazua.co.ke/for...amp;m=914370#post914370 ^ Only HFCK is there and that was a topic for all us anyway. Remember @VVS advising me to get the rights issues when I was 50 - 50? Any other stock in this list here in your recommended picks?? If anything, you warned people against buying HAFR. Ama we look at the list selectively?? Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,118 Location: nairobi

|

MaichBlack wrote:obiero wrote:MaichBlack wrote:VituVingiSana wrote:obiero wrote:Only one bank makes the YTD top gainers list  Coz "other" banks (except HF) pay dividends for a better Total Return    and not only in YTD 2025 but in 2024 Wachana na @Obiero @VVS. You know he bought and still owns all these stocks!!! And @Obiero said he doesn't get sarcasm. I'm being sarcastic!!!Easy to post such stuff AFTER it happens. Not helpful at all!!! Everyone knows what happened. Tell us before it happens like @Stockmaster, the guy who predicted KPLC going through the roof when it was was just chillin - at 1.xy or something (I forget his name) among others. It's unfair to state my portfolio and recommended picks are unknown. Nyani haoni kundula http://m.wazua.co.ke/for...amp;m=914370#post914370 ^ Only HFCK is there and that was a topic for all us anyway. Remember @VVS advising me to get the rights issues when I was 50 - 50? Any other stock in this list here in your recommended picks?? If anything, you warned people against buying HAFR. Ama we look at the list selectively?? HAFR, KURW and Olympia etc are very illiquid stocks. Meanwhile, it will be helpful if you also share your picks. I'm not a deity. I'm just a trader sharing my own views. Take it or leave it!

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,931

|

Standard Chartered Bank Kenya Staff Pension DisputeThe Supreme Court struck out Standard Chartered Bank Kenya’s final appeal on Sept 5, 2025, citing lack of jurisdiction. The ruling upholds a 2022 RBAT order requiring refund of KSh 1.1B to the pension fund with interest dating back to 2000, plus recalculated pensions and arrears for 629 retirees. The payout is now final and enforceable. https://x.com/kenyanwals...tus/1963917075216240705

In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,118 Location: nairobi

|

Angelica _ann wrote:Standard Chartered Bank Kenya Staff Pension DisputeThe Supreme Court struck out Standard Chartered Bank Kenya’s final appeal on Sept 5, 2025, citing lack of jurisdiction. The ruling upholds a 2022 RBAT order requiring refund of KSh 1.1B to the pension fund with interest dating back to 2000, plus recalculated pensions and arrears for 629 retirees. The payout is now final and enforceable. https://x.com/kenyanwals...tus/1963917075216240705

Big news. Thanks for the update swthrt

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,118 Location: nairobi

|

obiero wrote:Angelica _ann wrote:Standard Chartered Bank Kenya Staff Pension DisputeThe Supreme Court struck out Standard Chartered Bank Kenya’s final appeal on Sept 5, 2025, citing lack of jurisdiction. The ruling upholds a 2022 RBAT order requiring refund of KSh 1.1B to the pension fund with interest dating back to 2000, plus recalculated pensions and arrears for 629 retirees. The payout is now final and enforceable. https://x.com/kenyanwals...tus/1963917075216240705

Big news. Thanks for the update swthrt SCBK goes ex dividend this Friday. We live in interesting times

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,118 Location: nairobi

|

12 Kenyan banks face possibility of closure by Dec 31, 2025 https://www.standardmedi...ver-sh20b-capital-crunch

KQ ABP 4.26

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,310 Location: Nairobi

|

The KQs of banking    It's like KQ in a WhatsApp group with Emirates, Singapore and ET discussing profits and capitalization! Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,310 Location: Nairobi

|

obiero wrote:obiero wrote:Angelica _ann wrote:Standard Chartered Bank Kenya Staff Pension DisputeThe Supreme Court struck out Standard Chartered Bank Kenya’s final appeal on Sept 5, 2025, citing lack of jurisdiction. The ruling upholds a 2022 RBAT order requiring refund of KSh 1.1B to the pension fund with interest dating back to 2000, plus recalculated pensions and arrears for 629 retirees. The payout is now final and enforceable. https://x.com/kenyanwals...tus/1963917075216240705

Big news. Thanks for the update swthrt SCBK goes ex dividend this Friday. We live in interesting times 320 at the moment as I type this. That's almost 2x from its lows 2 years ago. And wanahisa wamekula dividends. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,118 Location: nairobi

|

VituVingiSana wrote:obiero wrote:obiero wrote:Angelica _ann wrote:Standard Chartered Bank Kenya Staff Pension DisputeThe Supreme Court struck out Standard Chartered Bank Kenya’s final appeal on Sept 5, 2025, citing lack of jurisdiction. The ruling upholds a 2022 RBAT order requiring refund of KSh 1.1B to the pension fund with interest dating back to 2000, plus recalculated pensions and arrears for 629 retirees. The payout is now final and enforceable. https://x.com/kenyanwals...tus/1963917075216240705

Big news. Thanks for the update swthrt SCBK goes ex dividend this Friday. We live in interesting times 320 at the moment as I type this. That's almost 2x from its lows 2 years ago. And wanahisa wamekula dividends. Mzee. That bravado is unnecessary. We both know there is an impact via the pension case. But having sufficient PPT experience, I expect this of you 😁

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,118 Location: nairobi

|

VituVingiSana wrote:The KQs of banking    It's like KQ in a WhatsApp group with Emirates, Singapore and ET discussing profits and capitalization! KQ service offering is better than ET, and there are numerous awards to show it. Hate what the share did to your investment journey, but give credit where it's due

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 12/6/2008 Posts: 3,572

|

Biggest bank in Kenya KCB put on the spot "kabisa kabisa" for colluding with Judiciary, and Shah community in fraud cartel, and now possibly murder by Kenya council of elders and Uhuru very powerful uncle!!! Guy has named names. Nowadays judges don't take corruption money in parking lots and petrol stations after a few were caught and they don't do bank or wire transfers after the deputy supreme court judge kalpana rawal was caught distributing bribes (probably including this case on behalf of the shah community), they go to eastleigh!! Easyreee is the headquarter of collecting dollars bribes today, it is perhaps the biggest forex hub in Africa, and the diaspora remittances you hear about are not kisiis or wasapare ni walalalos in USA sending here. Chebukati was very clever and collected his birrions in Eastleigh. You could see how Eastleigh was active in defending the IEBC equipment, refusing to open the server and directing raila (the best engineer) to an input out monitor which could have been done at bomas, and i bet the same garment bank was involved. Dont you remember that carmago who was caught with IEBC materials had a meeting with Abdulahi Abdi Mohamed, who is reportedly not an employee of the electoral commission in easltleigh??? https://www.theafricarep...rial-causes-confusion/. These guys, foreign analyst like cambridge analytica, AI and cartels rule Kenya not the President, sijui parliament and erections etc.  Ras Kienyeji Man

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,734

|

VituVingiSana wrote:The KQs of banking    It's like KQ in a WhatsApp group with Emirates, Singapore and ET discussing profits and capitalization! You took the words from my mouth. It is like using Airtel's financial to discourage someone from buying Safaricom at whatever price. Which of the banks people invest in here is likely to be in the list!!?? Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,118 Location: nairobi

|

MaichBlack wrote:VituVingiSana wrote:The KQs of banking    It's like KQ in a WhatsApp group with Emirates, Singapore and ET discussing profits and capitalization! You took the words from my mouth. It is like using Airtel's financial to discourage someone from buying Safaricom at whatever price. Which of the banks people invest in here is likely to be in the list!!?? Think bigger. There are 75,106 KQ minority shareholders. Singling out 1 vocal shareholder to try create an illusion won't stick. Meanwhile, this thread relates to financial sector, is this good or bad news https://www.businessdail...tel-over-default-5189134

KQ ABP 4.26

|

|

|

Wazua

»

Investor

»

Stocks

»

Portfolio Balancing: Avoid Over Exposure To Financial Sector

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|