Wazua

»

Investor

»

Stocks

»

Coop Bank - Stocksmaster's 1st Play 2013

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Ericsson wrote:Kusadikika wrote:winmak wrote:obiero wrote:Ericsson wrote:https://www.businessdailyafrica.com/bd/corporate/companies/co-op-bank-lends-sh499m-to-its-brokerage-subsidiary--4595326

Kingdom Securities is going through tough times. In tandem with NSE What's with the price drop? Book closure for 2023 dividends, April 29, 2024. Lacklustre performance in Q1 2024 ABSA will overtake them in FY2025 Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

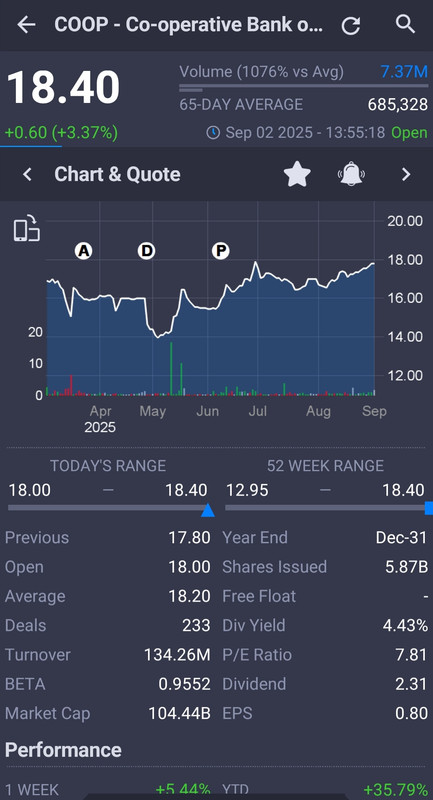

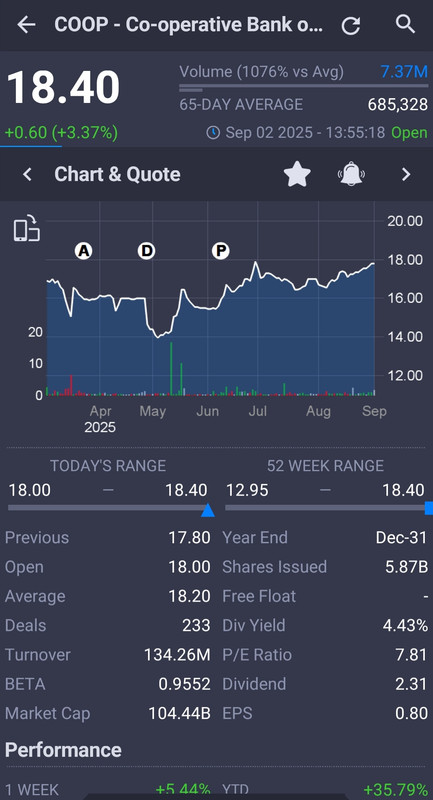

Share price hits 3 year high Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,140 Location: nairobi

|

obiero wrote:VituVingiSana wrote:obiero wrote:Ericsson wrote:obiero wrote:obier wrote:obiero wrote:obiero wrote:VituVingiSana wrote:obiero wrote:Ericsson wrote:obiero wrote:enyands wrote:obiero wrote:obiero wrote:the deal wrote:[quote=obiero]

Coop will emerge second after Equity in next three years Do you have evidence to back it up or is it a hunch? The writing is on the wall Fact: Coop Bank will never overtake KCB in terms of profitability in the next 3yrs...@obiero take that to the bank or your nearest hospital...cos it aint happening...if you think it will...then buy some antiacids... Coop already at number 3. Musical chairs, watch this space. Well maybe 3 yrs is on the shorter side as @deal said, but who else has analysed the NII, asset book, customer numbers.. The writing is on the wall.. www.businessdailyafrica....52/-/qne942/-/index.html @@Obiero I realize you are good at the banking area. You know how and when to get info. Beside the point coop is slowly crawling up top banks in kenya.though it's a solid company their shares have only doubled since they floated the shares in 2008. Hope it will rally one day COOP now with more market share as well as higher capital than KCB Kenya Gideon like most wise leaders is ahead of the rate cap curve in banking.. http://www.businessdaily...56262-q4fyjp/index.html

@Obiero In absolute terms it will take years and time before Co-op catches up with KCB. If you compare the PBT in 2015 and 2016 for both firms you will see that the gap between the two is widening. KCB FY 2015 PBT was ksh.26.5bn vs. Co-op ksh.15.4bn. Gap is ksh.11.1bn KCB FY 2016 PBT is ksh.29.1bn vs. Co-op Ksh.17.7bn Gap is ksh.11.4bn It takes just a couple of big ticket items to move a bank from tier 2 to tier 1.. In the same vein, simple strong corporate lending moves can make the difference for COOP, starting with Two Rivers.. Meanwhile, watch the upward price move prior to 27th May http://www.businessdaily...1654-vnmjkrz/index.html

Where have I read this sort of comment before? "Meanwhile, watch the upward price move prior to 27th May " Industry status now shows COOP at number 2 both in terms of assets and liabilities as per Q1 2018 data COOP still the bank to watch. Now second top in market share 9.9%. Slightly behind KCB at 14.4%.. https://www.standardmedi...ns-top-in-pecking-order[/quote] Equity declining www.winda.co.ke has the Q1 forecast For 2022  Mzee 😄 38.5B PBT FY 2024.. A solid firm

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

obiero wrote:obiero wrote:VituVingiSana wrote:obiero wrote:Ericsson wrote:obiero wrote:obier wrote:obiero wrote:obiero wrote:VituVingiSana wrote:obiero wrote:Ericsson wrote:obiero wrote:enyands wrote:obiero wrote:obiero wrote:the deal wrote:[quote=obiero]

Coop will emerge second after Equity in next three years Do you have evidence to back it up or is it a hunch? The writing is on the wall Fact: Coop Bank will never overtake KCB in terms of profitability in the next 3yrs...@obiero take that to the bank or your nearest hospital...cos it aint happening...if you think it will...then buy some antiacids... Coop already at number 3. Musical chairs, watch this space. Well maybe 3 yrs is on the shorter side as @deal said, but who else has analysed the NII, asset book, customer numbers.. The writing is on the wall.. www.businessdailyafrica....52/-/qne942/-/index.html @@Obiero I realize you are good at the banking area. You know how and when to get info. Beside the point coop is slowly crawling up top banks in kenya.though it's a solid company their shares have only doubled since they floated the shares in 2008. Hope it will rally one day COOP now with more market share as well as higher capital than KCB Kenya Gideon like most wise leaders is ahead of the rate cap curve in banking.. http://www.businessdaily...56262-q4fyjp/index.html

@Obiero In absolute terms it will take years and time before Co-op catches up with KCB. If you compare the PBT in 2015 and 2016 for both firms you will see that the gap between the two is widening. KCB FY 2015 PBT was ksh.26.5bn vs. Co-op ksh.15.4bn. Gap is ksh.11.1bn KCB FY 2016 PBT is ksh.29.1bn vs. Co-op Ksh.17.7bn Gap is ksh.11.4bn It takes just a couple of big ticket items to move a bank from tier 2 to tier 1.. In the same vein, simple strong corporate lending moves can make the difference for COOP, starting with Two Rivers.. Meanwhile, watch the upward price move prior to 27th May http://www.businessdaily...1654-vnmjkrz/index.html

Where have I read this sort of comment before? "Meanwhile, watch the upward price move prior to 27th May " Industry status now shows COOP at number 2 both in terms of assets and liabilities as per Q1 2018 data COOP still the bank to watch. Now second top in market share 9.9%. Slightly behind KCB at 14.4%.. https://www.standardmedi...ns-top-in-pecking-order[/quote] Equity declining www.winda.co.ke has the Q1 forecast For 2022  Mzee 😄 38.5B PBT FY 2024.. A solid firm Not possible. Q3 PBT was ksh.26bn. Q4 they have to make a profit of ksh.12bn if they are to report ksh.38.5bn Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,140 Location: nairobi

|

Ericsson wrote:obiero wrote:obiero wrote:VituVingiSana wrote:obiero wrote:Ericsson wrote:obiero wrote:obier wrote:obiero wrote:obiero wrote:VituVingiSana wrote:obiero wrote:Ericsson wrote:obiero wrote:enyands wrote:obiero wrote:obiero wrote:the deal wrote:[quote=obiero]

Coop will emerge second after Equity in next three years Do you have evidence to back it up or is it a hunch? The writing is on the wall Fact: Coop Bank will never overtake KCB in terms of profitability in the next 3yrs...@obiero take that to the bank or your nearest hospital...cos it aint happening...if you think it will...then buy some antiacids... Coop already at number 3. Musical chairs, watch this space. Well maybe 3 yrs is on the shorter side as @deal said, but who else has analysed the NII, asset book, customer numbers.. The writing is on the wall.. www.businessdailyafrica....52/-/qne942/-/index.html @@Obiero I realize you are good at the banking area. You know how and when to get info. Beside the point coop is slowly crawling up top banks in kenya.though it's a solid company their shares have only doubled since they floated the shares in 2008. Hope it will rally one day COOP now with more market share as well as higher capital than KCB Kenya Gideon like most wise leaders is ahead of the rate cap curve in banking.. http://www.businessdaily...56262-q4fyjp/index.html

@Obiero In absolute terms it will take years and time before Co-op catches up with KCB. If you compare the PBT in 2015 and 2016 for both firms you will see that the gap between the two is widening. KCB FY 2015 PBT was ksh.26.5bn vs. Co-op ksh.15.4bn. Gap is ksh.11.1bn KCB FY 2016 PBT is ksh.29.1bn vs. Co-op Ksh.17.7bn Gap is ksh.11.4bn It takes just a couple of big ticket items to move a bank from tier 2 to tier 1.. In the same vein, simple strong corporate lending moves can make the difference for COOP, starting with Two Rivers.. Meanwhile, watch the upward price move prior to 27th May http://www.businessdaily...1654-vnmjkrz/index.html

Where have I read this sort of comment before? "Meanwhile, watch the upward price move prior to 27th May " Industry status now shows COOP at number 2 both in terms of assets and liabilities as per Q1 2018 data COOP still the bank to watch. Now second top in market share 9.9%. Slightly behind KCB at 14.4%.. https://www.standardmedi...ns-top-in-pecking-order[/quote] Equity declining www.winda.co.ke has the Q1 forecast For 2022  Mzee 😄 38.5B PBT FY 2024.. A solid firm Not possible. Q3 PBT was ksh.26bn. Q4 they have to make a profit of ksh.12bn if they are to report ksh.38.5bn Mine is a forecast. You place yours in normal Wazua fashion. Meanwhile, note that their FY 2023 PBT was KES 33.7.. What is impossible in scaling it to KES 38.5.. A mere 14% uptick

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

They need to start paying interim dividend Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

obiero wrote:Ericsson wrote:obiero wrote:obiero wrote:VituVingiSana wrote:obiero wrote:Ericsson wrote:obiero wrote:obier wrote:obiero wrote:obiero wrote:VituVingiSana wrote:obiero wrote:Ericsson wrote:obiero wrote:enyands wrote:obiero wrote:obiero wrote:the deal wrote:[quote=obiero]

Coop will emerge second after Equity in next three years Do you have evidence to back it up or is it a hunch? The writing is on the wall Fact: Coop Bank will never overtake KCB in terms of profitability in the next 3yrs...@obiero take that to the bank or your nearest hospital...cos it aint happening...if you think it will...then buy some antiacids... Coop already at number 3. Musical chairs, watch this space. Well maybe 3 yrs is on the shorter side as @deal said, but who else has analysed the NII, asset book, customer numbers.. The writing is on the wall.. www.businessdailyafrica....52/-/qne942/-/index.html @@Obiero I realize you are good at the banking area. You know how and when to get info. Beside the point coop is slowly crawling up top banks in kenya.though it's a solid company their shares have only doubled since they floated the shares in 2008. Hope it will rally one day COOP now with more market share as well as higher capital than KCB Kenya Gideon like most wise leaders is ahead of the rate cap curve in banking.. http://www.businessdaily...56262-q4fyjp/index.html

@Obiero In absolute terms it will take years and time before Co-op catches up with KCB. If you compare the PBT in 2015 and 2016 for both firms you will see that the gap between the two is widening. KCB FY 2015 PBT was ksh.26.5bn vs. Co-op ksh.15.4bn. Gap is ksh.11.1bn KCB FY 2016 PBT is ksh.29.1bn vs. Co-op Ksh.17.7bn Gap is ksh.11.4bn It takes just a couple of big ticket items to move a bank from tier 2 to tier 1.. In the same vein, simple strong corporate lending moves can make the difference for COOP, starting with Two Rivers.. Meanwhile, watch the upward price move prior to 27th May http://www.businessdaily...1654-vnmjkrz/index.html

Where have I read this sort of comment before? "Meanwhile, watch the upward price move prior to 27th May " Industry status now shows COOP at number 2 both in terms of assets and liabilities as per Q1 2018 data COOP still the bank to watch. Now second top in market share 9.9%. Slightly behind KCB at 14.4%.. https://www.standardmedi...ns-top-in-pecking-order[/quote] Equity declining www.winda.co.ke has the Q1 forecast For 2022  Mzee 😄 38.5B PBT FY 2024.. A solid firm Not possible. Q3 PBT was ksh.26bn. Q4 they have to make a profit of ksh.12bn if they are to report ksh.38.5bn Mine is a forecast. You place yours in normal Wazua fashion. Meanwhile, note that their FY 2023 PBT was KES 33.7.. What is impossible in scaling it to KES 38.5.. A mere 14% uptick And it came to pass.PBT of ksh.38.5bn probably in FY2025 0r 2026 Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,140 Location: nairobi

|

Q4 2024 PBT projected - actual KCB 75.6 - 81.9B EQTY 66.4 - 60.7 COOP 38.5 - 34.8 SCBK 29.6 - 28.2 ABSA 29.1 - 29.7 NCBA 29.1 - 25.1 STBC 21.2 - 18.9 I&M 18.5 - 20.8 DTB 13.8 - 11.1 HF 0.52 - 0.43 COOP looking rosy by the day, EQTY taking a tumble

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,140 Location: nairobi

|

Firmly in the driver's seat

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

obiero wrote:Firmly in the driver's seat Let it come down to below 15 Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,140 Location: nairobi

|

Ericsson wrote:obiero wrote:Firmly in the driver's seat Let it come down to below 15 There is a 100% chance that COOP will reach KES 18 per share, before it reaches anywhere near KES 15. Atleast you have moved up though, you previously had sworn it will get to KES 13. Watch and learn

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,140 Location: nairobi

|

obiero wrote:Ericsson wrote:obiero wrote:Firmly in the driver's seat Let it come down to below 15 There is a 100% chance that COOP will reach KES 18 per share, before it reaches anywhere near KES 15. Atleast you have moved up though, you previously had sworn it will get to KES 13. Watch and learn KES 18.45 printed. Next stop KES 20

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

obiero wrote:obiero wrote:Ericsson wrote:obiero wrote:Firmly in the driver's seat Let it come down to below 15 There is a 100% chance that COOP will reach KES 18 per share, before it reaches anywhere near KES 15. Atleast you have moved up though, you previously had sworn it will get to KES 13. Watch and learn KES 18.45 printed. Next stop KES 20 I can see clearly next stop is 20 Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,140 Location: nairobi

|

Ericsson wrote:obiero wrote:obiero wrote:Ericsson wrote:obiero wrote:Firmly in the driver's seat Let it come down to below 15 There is a 100% chance that COOP will reach KES 18 per share, before it reaches anywhere near KES 15. Atleast you have moved up though, you previously had sworn it will get to KES 13. Watch and learn KES 18.45 printed. Next stop KES 20 I can see clearly next stop is 20 Ebb and flow. Stocks oscillate. Watch and learn

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,140 Location: nairobi

|

obiero wrote:Ericsson wrote:obiero wrote:obiero wrote:Ericsson wrote:obiero wrote:Firmly in the driver's seat Let it come down to below 15 There is a 100% chance that COOP will reach KES 18 per share, before it reaches anywhere near KES 15. Atleast you have moved up though, you previously had sworn it will get to KES 13. Watch and learn KES 18.45 printed. Next stop KES 20 I can see clearly next stop is 20 Ebb and flow. Stocks oscillate. Watch and learn KES 20 is imminent. Thank me later

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,140 Location: nairobi

|

obiero wrote:obiero wrote:Ericsson wrote:obiero wrote:obiero wrote:Ericsson wrote:obiero wrote:Firmly in the driver's seat Let it come down to below 15 There is a 100% chance that COOP will reach KES 18 per share, before it reaches anywhere near KES 15. Atleast you have moved up though, you previously had sworn it will get to KES 13. Watch and learn KES 18.45 printed. Next stop KES 20 I can see clearly next stop is 20 Ebb and flow. Stocks oscillate. Watch and learn KES 20 is imminent. Thank me later

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,140 Location: nairobi

|

obiero wrote:obiero wrote:obiero wrote:Ericsson wrote:obiero wrote:obiero wrote:Ericsson wrote:obiero wrote:Firmly in the driver's seat Let it come down to below 15 There is a 100% chance that COOP will reach KES 18 per share, before it reaches anywhere near KES 15. Atleast you have moved up though, you previously had sworn it will get to KES 13. Watch and learn KES 18.45 printed. Next stop KES 20 I can see clearly next stop is 20 Ebb and flow. Stocks oscillate. Watch and learn KES 20 is imminent. Thank me later  KES 13 they said? Today's volume indicate a breakout, with KES 21 now being unavoidable. Watch and learn

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,140 Location: nairobi

|

obiero wrote:obiero wrote:obiero wrote:obiero wrote:Ericsson wrote:obiero wrote:obiero wrote:Ericsson wrote:obiero wrote:Firmly in the driver's seat Let it come down to below 15 There is a 100% chance that COOP will reach KES 18 per share, before it reaches anywhere near KES 15. Atleast you have moved up though, you previously had sworn it will get to KES 13. Watch and learn KES 18.45 printed. Next stop KES 20 I can see clearly next stop is 20 Ebb and flow. Stocks oscillate. Watch and learn KES 20 is imminent. Thank me later  KES 13 they said? Today's volume indicate a breakout, with KES 21 now being unavoidable. Watch and learn  KES 21 is unavoidable. Watch and learn

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,140 Location: nairobi

|

COOP reached its all-time high of KES 20.00 on May 17, 2018 and its all-time low was KES 3.25 reached on Mar 26, 2009. Fair value based on NBV is KES 26.00. Thank me later

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,140 Location: nairobi

|

obiero wrote:COOP reached its all-time high of KES 20.00 on May 17, 2018 and its all-time low was KES 3.25 reached on Mar 26, 2009. Fair value based on NBV is KES 26.00. Thank me later All time high shattered today. There's someone still waiting for KES 13.00? Remember dividend minimum is KES 1.5 per share going by their honored dividend policy. At circa KES 26, I exit. Watch and learn

KQ ABP 4.26

|

|

|

Wazua

»

Investor

»

Stocks

»

Coop Bank - Stocksmaster's 1st Play 2013

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|