Wazua

»

Investor

»

Economy

»

Kenya Economy Watch

Rank: Veteran Joined: 7/1/2014 Posts: 927 Location: sky

|

https://www.businessdailyafrica.com/bd/economy/mps-sh9trn-debt-cap-for-extra-borrowing-3304514   Parliament will enlarge the debt ceiling currently set at Sh9 trillion to accommodate Treasury’s borrowing for development spending, Majority Leader Amos Kimunya has said. Mr Kimunya said the National Assembly will look at the reasons behind the Treasury’s proposal to increase the statutory debt ceiling and act accordingly once the request is tabled in the House. “We don’t want debt to rise but Kenyans want development. We will look at the Treasury proposals and if it is for raising money for development, we have no problem even if they want the ceiling set at Sh20 trillion,” Mr Kimunya said. THESE GUYS WILL TOTALLY MESS THE COUNTRY BEFORE 2022 There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

.. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

https://www.businessdail...urrent-expenses-3323040

Debt servicing costs have for the first time surpassed recurrent expenditures such as salaries, allowances and government administrative expenses, underlining the pressing burden on taxpayers. Treasury secretary Ukur Yatani says in the latest disclosures total debt repayments, which are largely being driven by fast-maturing commercial and semi-concessional loans, amounted to Sh638.29 billion in the eight-month period through February 2021, Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

https://www.businessdail...ault-helb-loans-3323148

About 106, 443 former university students have defaulted on their Higher Education Loans Board (Helb) in the wake of Covid-19 pandemic that triggered layoffs, business closure and freeze in hiring. Helb data tabled shows loan accounts in default increased by 35, 561 in the six months to December with the defaulted loans increasing 55 per cent or Sh3.7 billion to Sh10.4 billion in the period when the virus ravaged corporate Kenya. Loan defaulters have weakened the Helb’s ability to support university and technical college students, prompting allocation cuts and requests for Sh8.6 billion additional funding from the Treasury. “As at December 2020 Sh10.4 billion was held by 106,443 loanees, a sharp rise from the Sh6.7 billion held by 68,882 loanees as of June 30, 2020, mainly attributed to retrenchment as a result of Covid-19,” said Helb chief executive Charles Ringera. Helb matured loans stood at Sh45 billion, giving the agency a non performing ratio of 23 per cent—which is higher than the banking average of 14.1 per cent. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Veteran Joined: 1/3/2014 Posts: 1,063

|

https://www.businessdailyafrica....offs-salary-cuts-3462562The Kenya Revenue Authority (KRA) has reported a 9.3 percent drop in Pay As You Earn (PAYE) tax receipts in the review period compared to a year earlier when the taxes amounted to Sh399.20 billion. The taxman has blamed the drop from Sh399.20 billion to an estimated Sh362.08 billion on the impact of the pandemic on private sector jobs. “The decline was driven by the reduction in employment emanating from measures taken by mainly private firms to reduce operating costs as a result of Covid-19 pandemic,” KRA Commissioner-General Githii Mburu said in a statement on full-year revenue performance. Consistency is better than intensity

|

|

|

Rank: Member Joined: 3/16/2019 Posts: 313

|

Quote:Treasury sampled 18 of the largest parastatals and established that only 4 were profitable.They include Kenya Ports Authority, Kenya Pipeline Company, Kenya Airports Authority and Kenya Electricity Generating Company.

Kenya Power and Kenya Railways were observed to be highly indebted with loans, large liabilities and experiencing liquidity challenges.

The 18 parastatals have an estimated cumulative financial shortfall of about Sh70 billion annually.

Some of the measures the government has suggested to fill the Sh382 billion shortfall is conducting reforms, new concessional borrowing, deferred payments on loans, debt to equity swap and funding from the exchequer.

LINK

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

kmucheke wrote:Quote:Treasury sampled 18 of the largest parastatals and established that only 4 were profitable.They include Kenya Ports Authority, Kenya Pipeline Company, Kenya Airports Authority and Kenya Electricity Generating Company.

Kenya Power and Kenya Railways were observed to be highly indebted with loans, large liabilities and experiencing liquidity challenges.

The 18 parastatals have an estimated cumulative financial shortfall of about Sh70 billion annually.

Some of the measures the government has suggested to fill the Sh382 billion shortfall is conducting reforms, new concessional borrowing, deferred payments on loans, debt to equity swap and funding from the exchequer.

LINK Suggestions of which none will be implemented. Ukur Yattani has less than 12 months as treasury secretary Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,314 Location: Nairobi

|

Ericsson wrote:kmucheke wrote:Quote:Treasury sampled 18 of the largest parastatals and established that only 4 were profitable.They include Kenya Ports Authority, Kenya Pipeline Company, Kenya Airports Authority and Kenya Electricity Generating Company.

Kenya Power and Kenya Railways were observed to be highly indebted with loans, large liabilities and experiencing liquidity challenges.

The 18 parastatals have an estimated cumulative financial shortfall of about Sh70 billion annually.

Some of the measures the government has suggested to fill the Sh382 billion shortfall is conducting reforms, new concessional borrowing, deferred payments on loans, debt to equity swap and funding from the exchequer.

LINK Suggestions of which none will be implemented. Ukur Yattani has less than 12 months as treasury secretary Politically undesirable for the current regime to send underemployed folks home. Plus it is the season for eating and parastatals are prime dining spots. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Member Joined: 7/1/2009 Posts: 270

|

Finally fully exited BOC (after 8 years!). I hope to do the same with my other Manufacturing counters (CARB,EABL), when the prices improve. I see no future for this sector with the prevailing high cost of doing business in Kenya, relative to our competitors. With our level of debt, I do not foresee any tax reductions any time soon, to make this sector competitive.

|

|

|

Rank: Member Joined: 3/9/2010 Posts: 320 Location: kenya

|

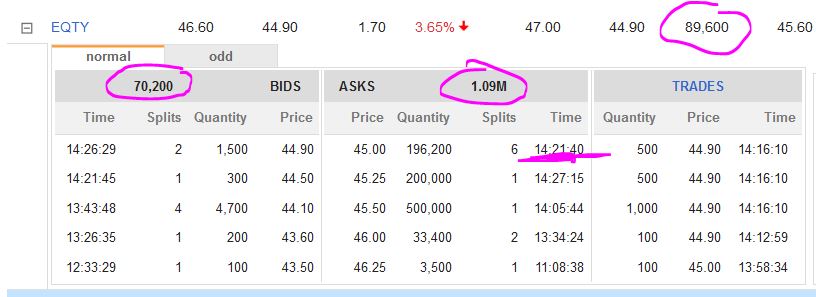

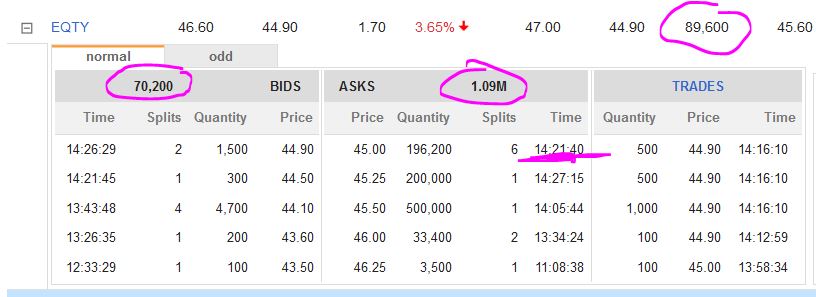

It appears the market is entering recession. Equity might touch 40.0  Work hard at your job and you can make a living. Work hard on yourself and you can make a fortune.

|

|

|

Rank: Veteran Joined: 6/2/2010 Posts: 1,081

|

cyruskulei wrote:It appears the market is entering recession. Equity might touch 40.0  We have been in recession for many years now.

|

|

|

Rank: Elder Joined: 8/16/2011 Posts: 2,368

|

Imagine this is how we fair in Africa    Our GOVT should colonize the first 3 countries and give them ease of investing in Kenya. KQ should have multiple flights to the top 3 that is Black Nigeria, Mixed Egypt and mixed S. Africa Rank Country Nominal GDP (billions US$) Nominal GDP per capita (US$) 1 Nigeria 480.48 2,272.84 2 Egypt 396.33 3,974.75 3 South Africa 329.60 6,102.17 4 Algeria 163.81 3,638.33 5 Morocco 126.04 3,470.80 6 Kenya 109.49 2,198.59 7 Ethiopia 92.76 939.51 8 Ghana 75.49 2,413.10 9 Angola 70.34 2,200.68 10 Tanzania 69.24 1,159.19 11 Ivory Coast 68.84 2,489.10 12 DRC 54.83 593.56 13 Cameroon 44.81 1,645.81 14 Uganda 43.24 1,018.44 15 Tunisia 42.73 3,555.59 16 Sudan 35.92 789.45 17 Senegal 27.58 1,602.90 18 Libya 27.30 4,068.61 19 Zimbabwe 25.79 1,664.76 20 Zambia 21.70 1,115.27 21 Burkina Faso 19.93 926.20 22 Mali 19.56 966.14 23 Gabon 18.29 8,569.22 24 Benin 18.07 1,446.83 25 Botswana 17.61 7,349.88 26 Guinea 16.72 1,168.18 27 Mozambique 15.83 429.27 28 Niger 15.64 622.23 29 Madagascar 14.10 498.68 30 Republic congo 12.74 2,655.72 31 Equatorial G 12.53 8,625.76 32 Chad 12.35 729.84 33 Namibia 12.21 4,693.46 34 Malawi 12.15 565.80 35 Mauritius 11.00 8,681.61 36 Rwanda 10.40 802.26 37 Mauritania 9.16 2,161.28 38 Togo 8.49 1,000.44 39 Somalia 5.42 350.36 40 Eswatini 4.52 3,965.43 41 Sierra Leone 4.41 541.06 42 Djibouti 3.65 3,654.5 43 Liberia 3.38 703.41 44 South Sudan 3.26 230.13 45 Burundi 3.19 261.05 46 C A Republic 2.59 525.91 47 Lesotho 2.48 1,187.51 48 Eritrea 2.25 625.97 49 The Gambia 2.04 746.33 50 Cape Verde 1.89 3,346.55 51 Guinea-Bissau 1.59 858.04 52 Seychelles 1.29 13,140.37 53 Comoros 1.28 1,390.06 54 SãoTomé & P 0.53 2,392.89 -- Total 2,692.59 2,469.66

|

|

|

Rank: Elder Joined: 8/16/2011 Posts: 2,368

|

https://en.wikipedia.org/wiki/List_of_African_countries_by_GDP_(nominal)Realtreaty wrote: Imagine this is how we fair in Africa    Our GOVT should colonize the first 3 countries and give them ease of investing in Kenya. KQ should have multiple flights to the top 3 that is Black Nigeria, Mixed Egypt and mixed S. Africa Rank Country Nominal GDP (billions US$) Nominal GDP per capita (US$) 1 Nigeria 480.48 2,272.84 2 Egypt 396.33 3,974.75 3 South Africa 329.60 6,102.17 4 Algeria 163.81 3,638.33 5 Morocco 126.04 3,470.80 6 Kenya 109.49 2,198.59 7 Ethiopia 92.76 939.51 8 Ghana 75.49 2,413.10 9 Angola 70.34 2,200.68 10 Tanzania 69.24 1,159.19 11 Ivory Coast 68.84 2,489.10 12 DRC 54.83 593.56 13 Cameroon 44.81 1,645.81 14 Uganda 43.24 1,018.44 15 Tunisia 42.73 3,555.59 16 Sudan 35.92 789.45 17 Senegal 27.58 1,602.90 18 Libya 27.30 4,068.61 19 Zimbabwe 25.79 1,664.76 20 Zambia 21.70 1,115.27 21 Burkina Faso 19.93 926.20 22 Mali 19.56 966.14 23 Gabon 18.29 8,569.22 24 Benin 18.07 1,446.83 25 Botswana 17.61 7,349.88 26 Guinea 16.72 1,168.18 27 Mozambique 15.83 429.27 28 Niger 15.64 622.23 29 Madagascar 14.10 498.68 30 Republic congo 12.74 2,655.72 31 Equatorial G 12.53 8,625.76 32 Chad 12.35 729.84 33 Namibia 12.21 4,693.46 34 Malawi 12.15 565.80 35 Mauritius 11.00 8,681.61 36 Rwanda 10.40 802.26 37 Mauritania 9.16 2,161.28 38 Togo 8.49 1,000.44 39 Somalia 5.42 350.36 40 Eswatini 4.52 3,965.43 41 Sierra Leone 4.41 541.06 42 Djibouti 3.65 3,654.5 43 Liberia 3.38 703.41 44 South Sudan 3.26 230.13 45 Burundi 3.19 261.05 46 C A Republic 2.59 525.91 47 Lesotho 2.48 1,187.51 48 Eritrea 2.25 625.97 49 The Gambia 2.04 746.33 50 Cape Verde 1.89 3,346.55 51 Guinea-Bissau 1.59 858.04 52 Seychelles 1.29 13,140.37 53 Comoros 1.28 1,390.06 54 SãoTomé & P 0.53 2,392.89 -- Total 2,692.59 2,469.66

|

|

|

Rank: New-farer Joined: 3/9/2019 Posts: 21 Location: Nakuru

|

Great disclosure. Nigeria got the pop.

|

|

|

Rank: Member Joined: 2/20/2015 Posts: 468 Location: Nairobi

|

With the high fuel prices & inflation why isn't the world economy slowing down and correcting?

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,140 Location: nairobi

|

kawi254 wrote:With the high fuel prices & inflation why isn't the world economy slowing down and correcting? The world economy is slowing down

KQ ABP 4.26

|

|

|

Rank: Member Joined: 2/20/2015 Posts: 468 Location: Nairobi

|

obiero wrote:kawi254 wrote:With the high fuel prices & inflation why isn't the world economy slowing down and correcting? The world economy is slowing down My small farm fuel water pumping costs are not sustainable. I wonder how much longer farms can sustain the high costs.

|

|

|

Rank: Veteran Joined: 11/13/2015 Posts: 1,637

|

Been a while since I posted here Today I listened to the CS Treasury and the policy wonks give a pep talk. Much of it focused on the past year accomplishments and self-congratulations. They even mentioned somewhere the NSE and market cap as evidence of the economy charged up  and banks are reducing the base rates. There wasn't any meaningful forward policy guidance from the treasury. Well apart from saying they want to pay pending bills to stimulate spending (  essentially going back to the tenderpreneur economy of 2014-2020) Got me thinking and few things to point out to the policy wonks 1. The NSE/$$ move was a limited macro play and not necessarily an endorsement on the economy and the management of companies. 2. Markets have shown they are ready for risk assets, but that appetite has not been matched. 3. There is an epic battle in the markets between the forces of status quo and the disruptors. Pick a side and give forward policy guidance. 4. Forward policy guidance requires you give markets a hint on the overall strategy (if at all there is one). Keep it short to make it interesting and long to cover the essential parts. 5. Time waits for no man. You have a limited window before the markets turn on you. Provide leadership

|

|

|

Rank: Veteran Joined: 11/13/2015 Posts: 1,637

|

You begin to feel the window of opportunity to deliver the structural reforms is now closing. Focus is now shifting to 2027 elections

|

|

|

Rank: Elder Joined: 12/6/2008 Posts: 3,576

|

Reality is Eurobonds and CS Mbadi sentiments are nothing compared to 2027 elections in Kenya and the dollars involved. Even regular black American folk some on welfare are flocking in thousands to kilimani/westlands apartments built by Chinese even eastlando and are all over youtube boasting how they are chewing our “most beautiful in the world” clueless genz with their benefits. Middle class Kenyans wanaskumwa dustbowl and ocha. The wealthier "wazungus" black and white are heavily investing in Kenya which beats all African countries in American to American startup investments including those KES 3k/4K burns charcoal jikos forked from our KES 250/- jikos which jua kali unfortunately did not patent, the American wazungus startups are milking billions while cheating Kenyans and throwing bait ati technology is software na iko kwa sms na apps ati "fintech". Microsoft, google, facebook investing and employing. When American ambassadors and some brits come here they refuse to go home, ceos, akina bill lay, rannberger, micheal joseph and colymore etc and even marry here. They own tatu city and I guarantee you majority residents will be American. If south africa was the largest receiver of US investment, that is definitely changing very fast to Kenya. They are building their first major infrastructure project in Africa the Mombasa Nairobi expressway to flex at the Chinese. This will not change with Trump given the sheer number of American investment and passports in Kenya and the historical partnership, i bet you he will hasten the transfer of 50% operations of UN from New York to Nairobi, i personally don’t feel he thinks they deserve all the NY prime estate, utaskia DOGE akisema wahamie Kenya tatu city very soon and remember doge hates SA governemt, and where America goes everyone follows. We are in a booming economy. Avacadoes, macadamia, coffee etc going direct to New York even in small packages. The central bank and mbadi have very little to do with the stability of the dollar, and economic growth waache uongo ya policy this monetary that, fiscal here and there. Labda these dim twitter tiktok kumbaffs watuharibie, things are looking up, we are officially the choice emerging market for US and China investment in Africa.  Wacha wasiwasi na weka pesa kwa soko bwana with all focus on 2027 elections! That’s how Trump became president against all the expectations of burukenges like usaid. If Russian/Croatia and Israeli/Hamas war ends, KES99 to USD instant and many more Eurobonds and others. Ile pesa itakua hapa 2027!!! Kwa jina la Yesu  Ras Kienyeji Man

|

|

|

Wazua

»

Investor

»

Economy

»

Kenya Economy Watch

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|