Wazua

»

Investor

»

Stocks

»

Safaricom 2019/2020

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

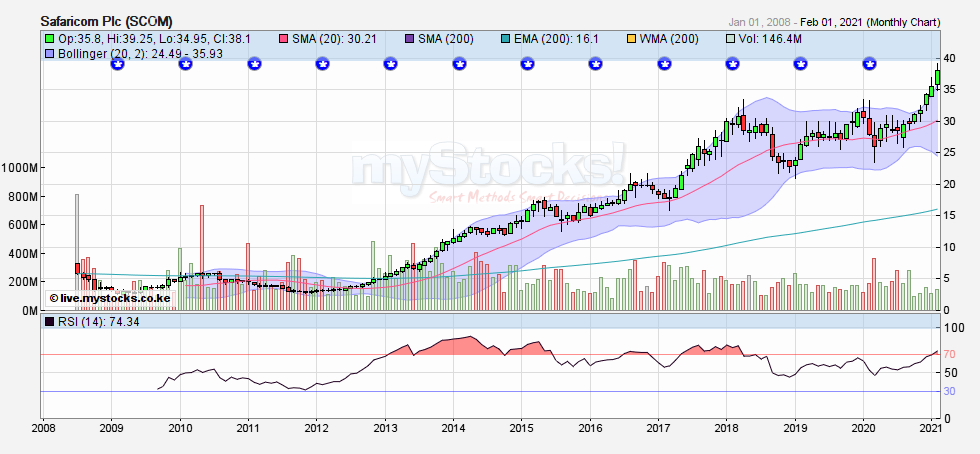

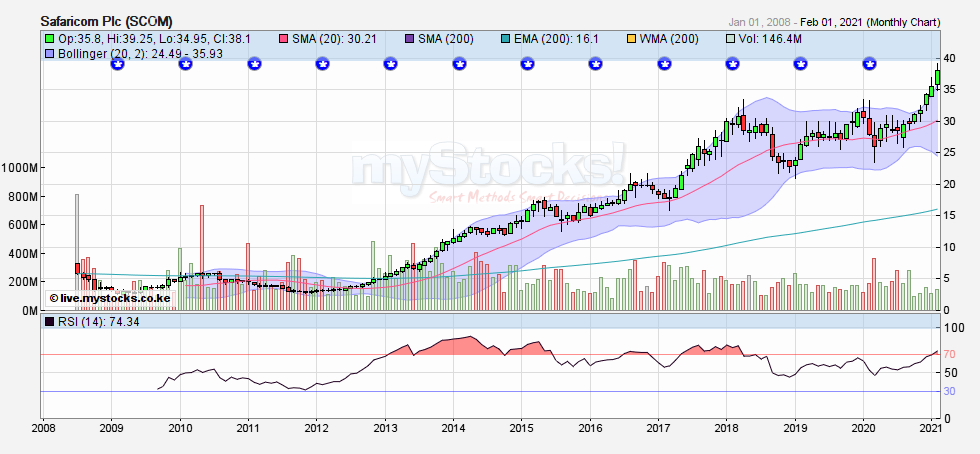

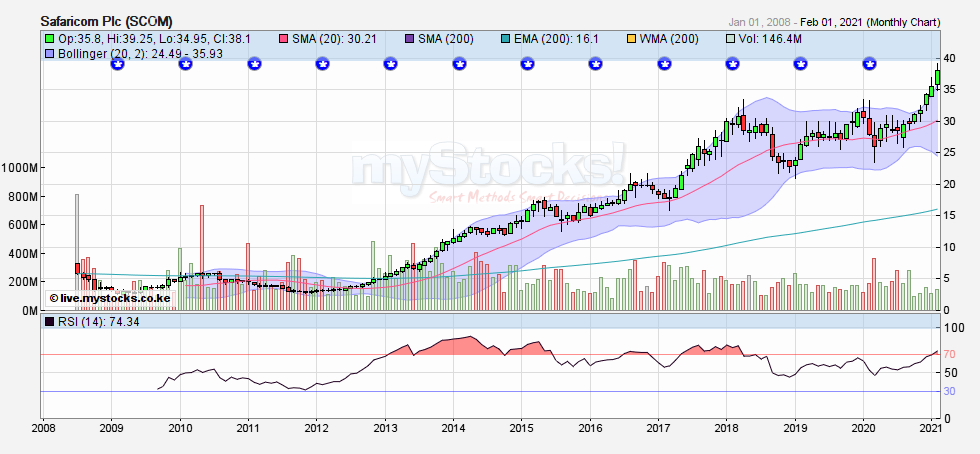

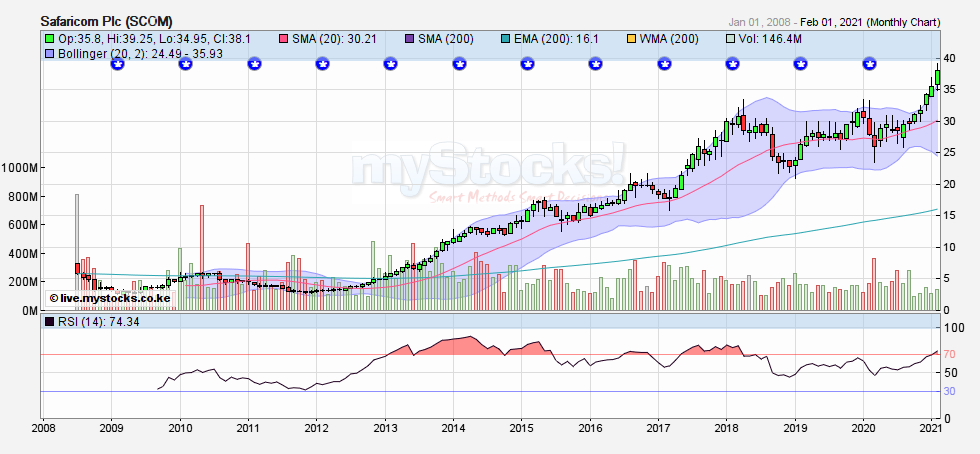

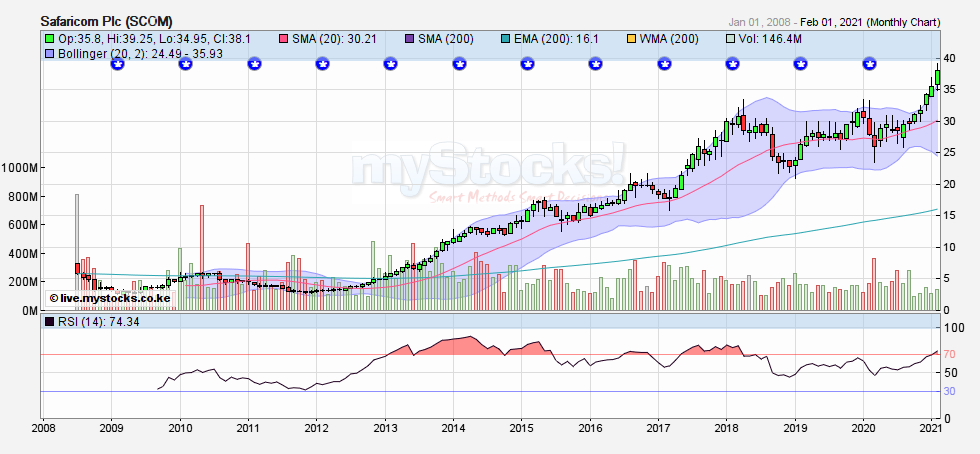

By end of this week share price will be at ksh.35. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,331 Location: Nairobi

|

https://www.businessdail...ile-data-market-3248290 Not that it has a major impact on Safaricom given Saf has multiple revenue streams. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Member Joined: 6/26/2008 Posts: 389

|

Yet another crack at matatus cashless platforms. I feel this is one hard nut to crack

Safaricom, NCBA win cashless matatu fares platform contract

TUESDAY JANUARY 05 2021

matatu (1)

Matatus along Accra Road, Nairobi. FILE PHOTO | NMG

Safaricom is among a group of lenders and IT companies that have been licensed to offer cashless payments in Public Service Vehicles (PSVs), setting the stage for the ban of use of cash in public transport.

In a notice, National Safety and Transport Authority (NTSA) said the licensed 29 companies will offer a platform for cashless fare payment service.

This was in response to a June 16, 2020 tender where NTSA sought tech companies to install mobile software and web applications for the nearly 2 00,000 matatus in the country.

The digital fare collection system will also have the technical capability to contact trace passengers in the fight against the coronavirus disease.

Once the system is in place, all passengers will be required to pay their fares via mobile money platforms, giving the government access to their identities and personal contact information that is needed to combat the Covid-19 pandemic, which has disrupted lives worldwide.

Other top firms permitted to offer the cashless fare system are Craft Silicon (behind taxi-hailing App-Little), JamboPay, Cellullant (a pan-African payments gateway firm), KCB Bank Kenya, and CBA Bank now NCBA.

An earlier cashless fare payment platform fronted by the government, and which was launched in November 2014, flopped following strong opposition from matatu operators who felt that it was a ploy to monitor their daily earnings for taxation measures.

The digital payment system required passengers to get pre-paid cards or use mobile money for payment of fares in PSVs.

At the time, the stated interest of the government was to eliminate criminal cartels that had infiltrated the PSV industry and to provide the taxman with a platform to track incomes in a sector that grosses more than Sh420 billion annually.

The digital fare collection system was also expected to curb employee fraud by matatu crew because it would have allowed owners to track payments in real time.

The money collected was to be remitted in a bank account, making it easier for vehicle owners to access loans.

Technology firms and banks had come up with products to support the PSV e-ticketing system with their eyes on the one percent processing fee, currently estimated at Sh4 billion annually.

The firms included Safaricom, which declared a “partnership” interest in My 1963 commuter card with Mwakio Ngale, a Nairobi-based techie through his IT firm Fibre Spac.

Now, another pressing need for the cashless payment platform has emerged in the form of contact-tracing amid the Covid-19 pandemic.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

xtina wrote:Yet another crack at matatus cashless platforms. I feel this is one hard nut to crack

Safaricom, NCBA win cashless matatu fares platform contract

TUESDAY JANUARY 05 2021

matatu (1)

Matatus along Accra Road, Nairobi. FILE PHOTO | NMG

Safaricom is among a group of lenders and IT companies that have been licensed to offer cashless payments in Public Service Vehicles (PSVs), setting the stage for the ban of use of cash in public transport.

In a notice, National Safety and Transport Authority (NTSA) said the licensed 29 companies will offer a platform for cashless fare payment service.

This was in response to a June 16, 2020 tender where NTSA sought tech companies to install mobile software and web applications for the nearly 2 00,000 matatus in the country.

The digital fare collection system will also have the technical capability to contact trace passengers in the fight against the coronavirus disease.

Once the system is in place, all passengers will be required to pay their fares via mobile money platforms, giving the government access to their identities and personal contact information that is needed to combat the Covid-19 pandemic, which has disrupted lives worldwide.

Other top firms permitted to offer the cashless fare system are Craft Silicon (behind taxi-hailing App-Little), JamboPay, Cellullant (a pan-African payments gateway firm), KCB Bank Kenya, and CBA Bank now NCBA.

An earlier cashless fare payment platform fronted by the government, and which was launched in November 2014, flopped following strong opposition from matatu operators who felt that it was a ploy to monitor their daily earnings for taxation measures.

The digital payment system required passengers to get pre-paid cards or use mobile money for payment of fares in PSVs.

At the time, the stated interest of the government was to eliminate criminal cartels that had infiltrated the PSV industry and to provide the taxman with a platform to track incomes in a sector that grosses more than Sh420 billion annually.

The digital fare collection system was also expected to curb employee fraud by matatu crew because it would have allowed owners to track payments in real time.

The money collected was to be remitted in a bank account, making it easier for vehicle owners to access loans.

Technology firms and banks had come up with products to support the PSV e-ticketing system with their eyes on the one percent processing fee, currently estimated at Sh4 billion annually.

The firms included Safaricom, which declared a “partnership” interest in My 1963 commuter card with Mwakio Ngale, a Nairobi-based techie through his IT firm Fibre Spac.

Now, another pressing need for the cashless payment platform has emerged in the form of contact-tracing amid the Covid-19 pandemic. It has been overtaken with time. According to treasury and government we are back to normalcy as far as the economy is concerned. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

What is wrong with having the platform existing anyway? If matatus don't use it, it can be repurposed on trains. In technology, you don't have to wait for demand, show the users they need your stuff. Lessons from Steve Jobs, who would have thought we needed smartphones? Even Bill Gates did not envision what we have today. There's nothing like being overtaken by events "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

murchr wrote:What is wrong with having the platform existing anyway? If matatus don't use it, it can be repurposed on trains. In technology, you don't have to wait for demand, show the users they need your stuff. Lessons from Steve Jobs, who would have thought we needed smartphones? Even Bill Gates did not envision what we have today. There's nothing like being overtaken by events This is Kenya, when the time to have one for trains comes, another tender will be issued and bidders invited and of course money 💵 will change hands Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Ericsson wrote:murchr wrote:What is wrong with having the platform existing anyway? If matatus don't use it, it can be repurposed on trains. In technology, you don't have to wait for demand, show the users they need your stuff. Lessons from Steve Jobs, who would have thought we needed smartphones? Even Bill Gates did not envision what we have today. There's nothing like being overtaken by events This is Kenya, when the time to have one for trains comes, another tender will be issued and bidders invited and of course money 💵 will change hands What about Kenya? What Safaricom should be is be ready for any eventuality. "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

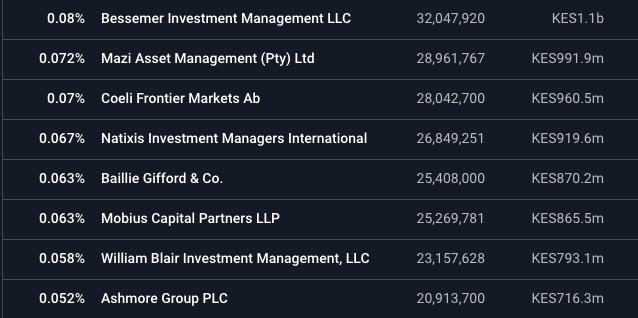

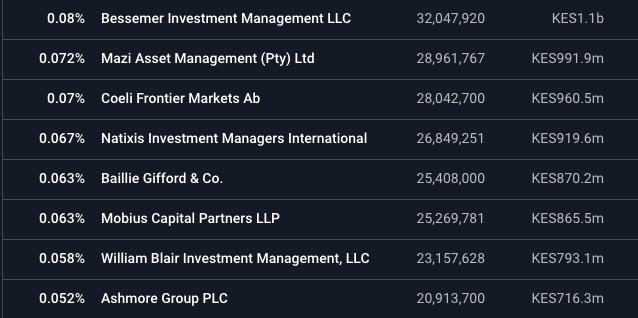

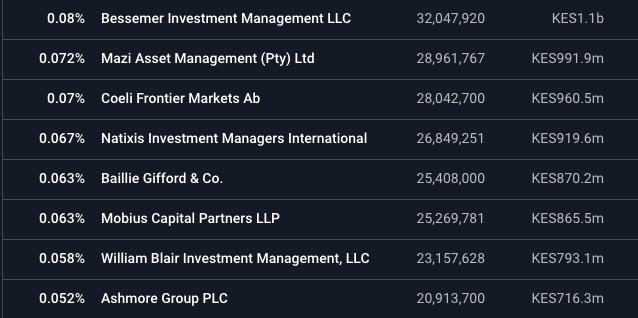

80% of Safaricom is owned by the below. 75% = GOK and Vodafone Source: Tweet by Kenyanwallstreet   "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Member Joined: 5/6/2008 Posts: 199

|

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,931

|

murchr wrote:80% of Safaricom is owned by the below. 75% = GOK and Vodafone Source: Tweet by Kenyanwallstreet   This has been my argument why Safaricom share price doesn't follow social mood charts_ Johnny come lately & Wanjiku were edged out. Majority shareholders here are not erratic sellers. In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Angelica _ann wrote:murchr wrote:80% of Safaricom is owned by the below. 75% = GOK and Vodafone Source: Tweet by Kenyanwallstreet   This has been my argument why Safaricom share price doesn't follow social mood charts_ Johnny come lately & Wanjiku were edged out. Majority shareholders here are not erratic sellers. Are you one of them Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

https://kenyanwallstreet...-regulatory-uncertainty/Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Ericsson wrote:https://kenyanwallstreet.com/citi-downgrades-safaricom-stock-due-to-regulatory-uncertainty/ Safaricom, Kenya’s largest mobile operator, is facing increased regulatory risk which may affect its revenue stream according to analysts at Citi. One of the major threats to the company is the National Payment Strategy by the Central Bank of Kenya (CBK). The telecommunications company is expected to record lower Mpesa revenue due to the updated fee structure which came into effect on 1st January 2021. Safaricom cut the transaction fee for low-value transfers by between 45% and 20%. Citi analysts expect a 9% decline in Mpesa revenue at the end of the financial year 2021 due to the changes in transaction fees. The researchers also revised down fixed data revenue forecast. “Safaricom also intends to bid for new telecom license in Ethiopia; should the bid be successful the cost of roll out, which tends to be front-end loaded, may have a negative impact on earnings in short-to-medium term,” said Citi in a research report. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,931

|

Ericsson wrote:Ericsson wrote:https://kenyanwallstreet.com/citi-downgrades-safaricom-stock-due-to-regulatory-uncertainty/ Safaricom, Kenya’s largest mobile operator, is facing increased regulatory risk which may affect its revenue stream according to analysts at Citi. One of the major threats to the company is the National Payment Strategy by the Central Bank of Kenya (CBK). The telecommunications company is expected to record lower Mpesa revenue due to the updated fee structure which came into effect on 1st January 2021. Safaricom cut the transaction fee for low-value transfers by between 45% and 20%. Citi analysts expect a 9% decline in Mpesa revenue at the end of the financial year 2021 due to the changes in transaction fees. The researchers also revised down fixed data revenue forecast. “Safaricom also intends to bid for new telecom license in Ethiopia; should the bid be successful the cost of roll out, which tends to be front-end loaded, may have a negative impact on earnings in short-to-medium term,” said Citi in a research report. Wachana na hawa elitist research bodies, there is nothing they have got right on Safaricom. Do your own research & go with your gut  feeling. In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

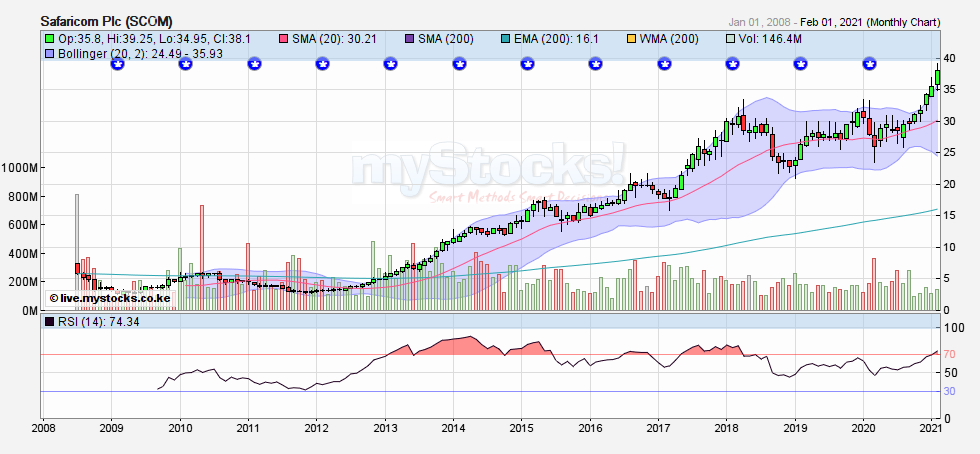

37 rejected twice on Jan 14th and Jan 26th and as such remains an ALL TIME HIGH and is expected to hold until the month of May when they announce results. This however can be taken out should Safaricom announce some positive news eg entry into Ethiopia.  @SufficientlyP

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Sufficiently Philanga....thropic wrote:37 rejected twice on Jan 14th and Jan 26th and as such remains an ALL TIME HIGH and is expected to hold until the month of May when they announce results. This however can be taken out should Safaricom announce some positive news eg entry into Ethiopia.  Deadline for new telecom license bids extended by one month. https://www.sowetanlive....icence-bids-by-a-month/

Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,931

|

Ericsson wrote:Sufficiently Philanga....thropic wrote:37 rejected twice on Jan 14th and Jan 26th and as such remains an ALL TIME HIGH and is expected to hold until the month of May when they announce results. This however can be taken out should Safaricom announce some positive news eg entry into Ethiopia.  Deadline for new telecom license bids extended by one month. https://www.sowetanlive....icence-bids-by-a-month/

This move has too many obstacles, including the government grip on everything. But the population is massive. In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

Sufficiently Philanga....thropic wrote:37 rejected twice on Jan 14th and Jan 26th and as such remains an ALL TIME HIGH and is expected to hold until the month of May when they announce results. This however can be taken out should Safaricom announce some positive news eg entry into Ethiopia.  3rd attempt at 37. This time with more ammunition. Interesting times these. @SufficientlyP

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Sufficiently Philanga....thropic wrote:Sufficiently Philanga....thropic wrote:37 rejected twice on Jan 14th and Jan 26th and as such remains an ALL TIME HIGH and is expected to hold until the month of May when they announce results. This however can be taken out should Safaricom announce some positive news eg entry into Ethiopia.  3rd attempt at 37. This time with more ammunition. Interesting times these. Barrier broken 💔 Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

Ericsson wrote:Sufficiently Philanga....thropic wrote:Sufficiently Philanga....thropic wrote:37 rejected twice on Jan 14th and Jan 26th and as such remains an ALL TIME HIGH and is expected to hold until the month of May when they announce results. This however can be taken out should Safaricom announce some positive news eg entry into Ethiopia.  3rd attempt at 37. This time with more ammunition. Interesting times these. Barrier broken 💔 True. Trading neck to neck with memba. Simba lagging behind both. #Techstocks @SufficientlyP

|

|

|

Wazua

»

Investor

»

Stocks

»

Safaricom 2019/2020

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|