Wazua

»

Investor

»

Economy

»

Law Capping interest rates

Rank: Member Joined: 6/26/2008 Posts: 399

|

MaichBlack wrote:winmak wrote:Extraterrestrial wrote:Looks like the bear may be back. If drawdown from recent highs exceeds 20%, we are back into bear territor. For some of us to board True or load up some more!!! Value is more important than price. And buyers love discounts/low prices. You are beginning to sound like VVS, I had to doublecheck your name

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

MaichBlack wrote:winmak wrote:Extraterrestrial wrote:Looks like the bear may be back. If drawdown from recent highs exceeds 20%, we are back into bear territor. For some of us to board True or load up some more!!! Value is more important than price. And buyers love discounts/low prices. Next bull run next year as companies prepare to release full year results Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,820

|

xtina wrote:MaichBlack wrote:winmak wrote:Extraterrestrial wrote:Looks like the bear may be back. If drawdown from recent highs exceeds 20%, we are back into bear territor. For some of us to board True or load up some more!!! Value is more important than price. And buyers love discounts/low prices. You are beginning to sound like VVS, I had to doublecheck your name        @VVS makes a lot of sense in this investment business and we are students of the same teacher. The great Warren Buffet!! That brother (@vvs) made me make a tonne load of money on KK. He was a great driver even when morale was down. We were made fun of here on Wazua like nobody's business. But when the day came, boy, did we laugh all the way to the bank. Then the story changed to allegations of inside information... For more on my love of low prices, see my signature below. Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

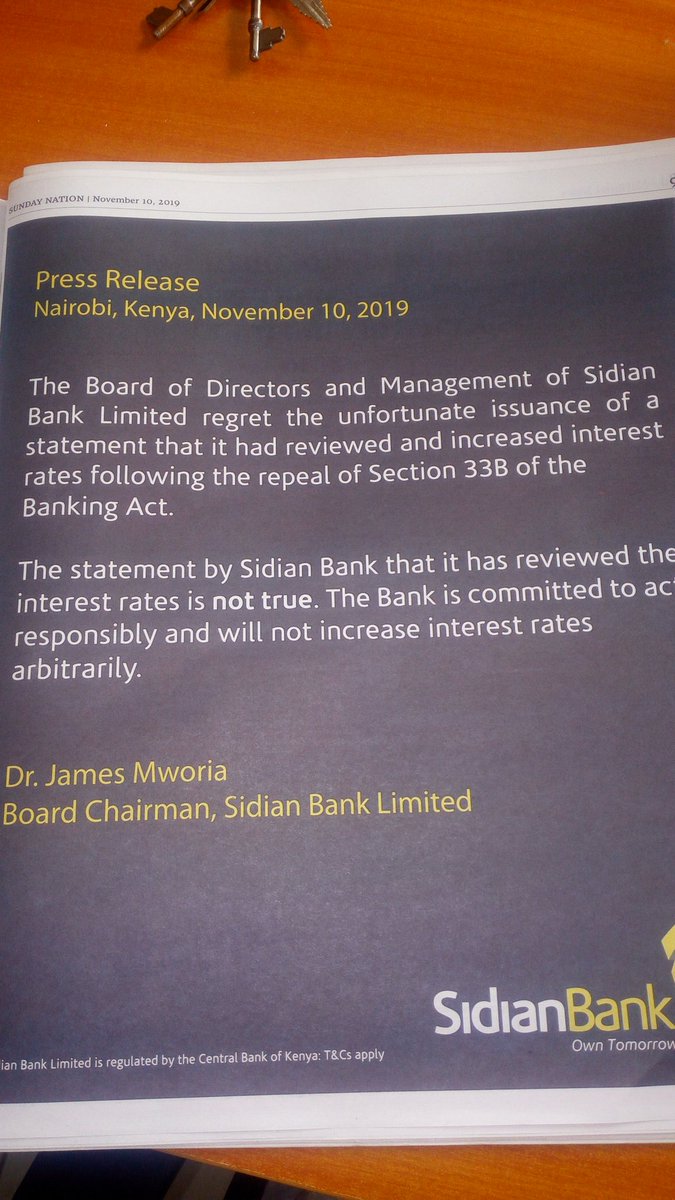

Sidian has started with communication of the revised interest rates Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 3/19/2010 Posts: 3,505 Location: Uganda

|

Ericsson wrote:Sidian has started with communication of the revised interest rates from 13% to what punda amecheka

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 927 Location: sky

|

newfarer wrote:Ericsson wrote:Sidian has started with communication of the revised interest rates from 13% to what ranges from 16 to 19% There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,201 Location: nairobi

|

littledove wrote:newfarer wrote:Ericsson wrote:Sidian has started with communication of the revised interest rates from 13% to what ranges from 16 to 19%

KQ ABP 4.26

|

|

|

Rank: Member Joined: 11/21/2018 Posts: 564 Location: Britain

|

obiero wrote:littledove wrote:newfarer wrote:Ericsson wrote:Sidian has started with communication of the revised interest rates from 13% to what ranges from 16 to 19%  Terrible rates, yet this is the beginning. Kweli benki sio za mama zetu.

|

|

|

Rank: Elder Joined: 12/9/2009 Posts: 6,592 Location: Nairobi

|

obiero wrote:littledove wrote:newfarer wrote:Ericsson wrote:Sidian has started with communication of the revised interest rates from 13% to what ranges from 16 to 19%  I congratulate Sidian for this. Why crucify Chege Thumbi the MD yet he is acting perfectly within the law. After all, this was the intention all along.

BBI will solve it :)

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

obiero wrote:littledove wrote:newfarer wrote:Ericsson wrote:Sidian has started with communication of the revised interest rates from 13% to what ranges from 16 to 19%  those who were half dead are reacting so quickly "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 7/28/2015 Posts: 9,562 Location: Rodi Kopany, Homa Bay

|

|

|

|

Rank: Elder Joined: 7/28/2015 Posts: 9,562 Location: Rodi Kopany, Homa Bay

|

Queen wrote:obiero wrote:littledove wrote:newfarer wrote:Ericsson wrote:Sidian has started with communication of the revised interest rates from 13% to what ranges from 16 to 19%  Terrible rates, yet this is the beginning. Kweli benki sio za mama zetu. But you have all been saying that the capped rates have been strangling the economy, and that we should get back to 20%+ to recharge/supercharge the economy.

|

|

|

Rank: Member Joined: 11/21/2018 Posts: 564 Location: Britain

|

hardwood wrote:Queen wrote:obiero wrote:littledove wrote:newfarer wrote:Ericsson wrote:Sidian has started with communication of the revised interest rates from 13% to what ranges from 16 to 19%  Terrible rates, yet this is the beginning. Kweli benki sio za mama zetu. But you have all been saying that the capped rates have been strangling the economy, and that we should get back to 20%+ to recharge/supercharge the economy. Domestic borrowing by the GK is the cause of the strangling of the economy, not rate caps.

|

|

|

Rank: Member Joined: 11/21/2018 Posts: 564 Location: Britain

|

The board had to sit on a weekend following a call from Opus Dei. https://www.standardmedi...on-interest-rate-charges

|

|

|

Rank: Elder Joined: 7/28/2015 Posts: 9,562 Location: Rodi Kopany, Homa Bay

|

Queen wrote:hardwood wrote:Queen wrote:obiero wrote:littledove wrote:newfarer wrote:Ericsson wrote:Sidian has started with communication of the revised interest rates from 13% to what ranges from 16 to 19% https://i.imgur.com/jfes2SY.jpg Terrible rates, yet this is the beginning. Kweli benki sio za mama zetu. But you have all been saying that the capped rates have been strangling the economy, and that we should get back to 20%+ to recharge/supercharge the economy. Domestic borrowing by the GK is the cause of the strangling of the economy, not rate caps. I gerrit now...

|

|

|

Rank: Elder Joined: 3/19/2010 Posts: 3,505 Location: Uganda

|

Queen wrote:[quote=hardwood]  The board had to sit on a weekend following a call from Opus Dei. https://www.standardmedi...n-interest-rate-charges[/quote] I said we are watching. punda amecheka

|

|

|

Rank: Veteran Joined: 4/23/2014 Posts: 931

|

Bank CEO who jumped the gun on interest rate charges“You can get in way more trouble with a good idea than a bad idea, because you forget that the good idea has limits.” - Ben Graham

|

|

|

Rank: Member Joined: 11/21/2018 Posts: 564 Location: Britain

|

MaichBlack wrote:Queen wrote:MaichBlack wrote:FUNKY wrote:https://www.businessdailyafrica.com/news/Interest-on-risky-loans-forecast-at-16pc/539546-5339802-ks7r6az/index.html ^ "The MPs shielded the people with existing loans from higher rates...". Where did this writer get this from?? Is there something I am missing? I am not aware of such an amendment going through. The Finance committee tabled their report which contained an amendment on existing loans. There was lack of quorum in the house and therefore the report, together with the amendment therein, was never debated. The pertinent question should now be:- is it these committee's report that was passed in lieu of quorum or was it the President's memo to the house that was passed as it were without any amendment. My understanding is that the house was meant to debate and pass the Finance committee's report and not the president's memo directly. Am however not a lawyer. They were to accept or reject the president's memorandum. To reject, they needed 2/3 majority which they did not get. So the "accepted" it (by default). Judging from today's advert in the papers, Joshua Oigara (Chairman, Kenya Bankers' Association) is categorical that the amendment to the presidential memo sailed through by default and therefore existing Contracts for old loans will remain unchanged. It would appear, therefore, that what was passed by default was the Report of the Finance Committee and not the president's memo per se, unless of course Oigara himself is also confused.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Barclays bank Kenya share price back to pre-interest rates repeal level Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Member Joined: 6/26/2008 Posts: 399

|

Ericsson wrote:Barclays bank Kenya share price back to pre-interest rates repeal level Not entirely surprising, I think it was wukan or lochaz index who mentioned that Kenya's economy has a fundamental problem and removing the interest rate caps will not be a magic bullet to solve those fundamental issues.

|

|

|

Wazua

»

Investor

»

Economy

»

Law Capping interest rates

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|