Wazua

»

Investor

»

Stocks

»

Equity Bank 2019

Rank: Chief Joined: 1/3/2007 Posts: 18,218 Location: Nairobi

|

Ericsson wrote:VituVingiSana wrote:Equity Bank will need more buys in regional growth plan https://www.businessdail...0864-xk08gmz/index.html

> Will Equity need to raise capital? Or reduce the dividend? Or a scrip dividend? Or Bodo is being overly cautious? After all, Equity is profitable regionally and can expand slowly, sensibly and profitably using the new tools at its disposal. Instead of the "big ticket" deals, it can expand using the SME and MSME route using mobile banking. Bodo article may be a reflection of James Mwangi thinking Does Mwangi have the cash to buy more Equity shares via a Rights Issue? He is better off doing another Helios-like deal at a sensible price that values Equity at a fair value or keep reinvesting the current profits. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Veteran Joined: 8/10/2014 Posts: 989 Location: Kenya

|

VituVingiSana wrote:Equity Bank will need more buys in regional growth plan https://www.businessdail...0864-xk08gmz/index.html

> Will Equity need to raise capital? Or reduce the dividend? Or a scrip dividend? Or Bodo is being overly cautious? After all, Equity is profitable regionally and can expand slowly, sensibly and profitably using the new tools at its disposal. Instead of the "big ticket" deals, it can expand using the SME and MSME route using mobile banking. They still have a bunch of stock left from the 400 million shares they created in 2015 plus I predict a flat dividend growth for FY 2019. I think they have the capital needed considering the Kenyan subsidiary doesn't need that much funding since the rate cap started. Deploying that money to acquire other banks and get a higher return may be a better option.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,778 Location: NAIROBI

|

Tanzania fines five banks for lax anti-money laundering controlsTanzania’s central bank said on Monday it had fined five commercial banks over $800,000 (Sh83 million) for breaching anti-money laundering rules, the latest in a series of moves aimed at tightening regulation in the financial services sector. The Bank of Tanzania (BoT) said in a statement the fines were imposed “for failure to conduct proper customer due diligence and file suspicious transaction reports to the (state-run) Financial Intelligence Unit (FIU).” I&M Bank was slapped with the biggest fine at TSh655 million (Ksh29.62 million), followed by Equity Bank (TSh580 million), UBL Bank (Tsh325 million), Habib African Bank (Tsh175 million) and African Banking Corporation (Tsh145 million). https://www.businessdail...84128-29oynm/index.html

@vvs what is? Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,218 Location: Nairobi

|

Ericsson wrote:Tanzania fines five banks for lax anti-money laundering controlsTanzania’s central bank said on Monday it had fined five commercial banks over $800,000 (Sh83 million) for breaching anti-money laundering rules, the latest in a series of moves aimed at tightening regulation in the financial services sector. The Bank of Tanzania (BoT) said in a statement the fines were imposed “for failure to conduct proper customer due diligence and file suspicious transaction reports to the (state-run) Financial Intelligence Unit (FIU).” I&M Bank was slapped with the biggest fine at TSh655 million (Ksh29.62 million), followed by Equity Bank (TSh580 million), UBL Bank (Tsh325 million), Habib African Bank (Tsh175 million) and African Banking Corporation (Tsh145 million). https://www.businessdail...84128-29oynm/index.html

@vvs what is? No idea! Worrying. Of course, never discount that TZ doesn't like KE firms! Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,769 Location: nairobi

|

VituVingiSana wrote:Ericsson wrote:Tanzania fines five banks for lax anti-money laundering controlsTanzania’s central bank said on Monday it had fined five commercial banks over $800,000 (Sh83 million) for breaching anti-money laundering rules, the latest in a series of moves aimed at tightening regulation in the financial services sector. The Bank of Tanzania (BoT) said in a statement the fines were imposed “for failure to conduct proper customer due diligence and file suspicious transaction reports to the (state-run) Financial Intelligence Unit (FIU).” I&M Bank was slapped with the biggest fine at TSh655 million (Ksh29.62 million), followed by Equity Bank (TSh580 million), UBL Bank (Tsh325 million), Habib African Bank (Tsh175 million) and African Banking Corporation (Tsh145 million). https://www.businessdail...84128-29oynm/index.html

@vvs what is? No idea! Worrying. Of course, never discount that TZ doesn't like KE firms! Last time I checked, simba was the first KE bank in TZ

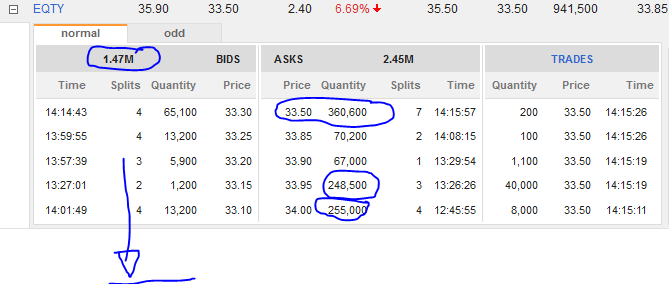

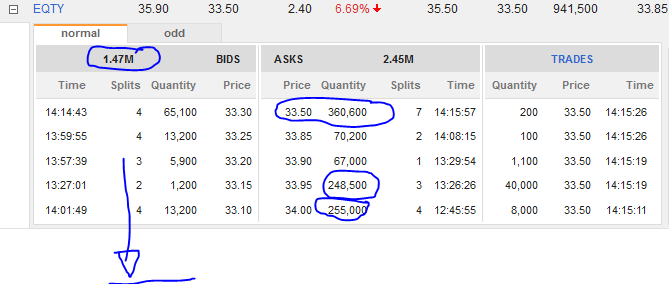

COOP 255,000 ABP 15.85; IMH 5,000 ABP 35.55; KQ 604,200 ABP 6.96; MTN 23,800 ABP 5.20

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,778 Location: NAIROBI

|

obiero wrote:VituVingiSana wrote:Ericsson wrote:Tanzania fines five banks for lax anti-money laundering controlsTanzania’s central bank said on Monday it had fined five commercial banks over $800,000 (Sh83 million) for breaching anti-money laundering rules, the latest in a series of moves aimed at tightening regulation in the financial services sector. The Bank of Tanzania (BoT) said in a statement the fines were imposed “for failure to conduct proper customer due diligence and file suspicious transaction reports to the (state-run) Financial Intelligence Unit (FIU).” I&M Bank was slapped with the biggest fine at TSh655 million (Ksh29.62 million), followed by Equity Bank (TSh580 million), UBL Bank (Tsh325 million), Habib African Bank (Tsh175 million) and African Banking Corporation (Tsh145 million). https://www.businessdail...84128-29oynm/index.html

@vvs what is? No idea! Worrying. Of course, never discount that TZ doesn't like KE firms! Last time I checked, simba was the first KE bank in TZ Yes Simba was the first KE bank in Tz.It launched there in 1996. Simba adhered to the rules Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,778 Location: NAIROBI

|

https://twitter.com/OleI...atus/1177075788438523904Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Veteran Joined: 2/2/2012 Posts: 1,134 Location: Nairobi

|

Ericsson wrote:https://twitter.com/OleItumbi/status/1177075788438523904 Itumbi has not told the story to the end. I'd be interested to hear how the bank resolved the issue. Nevertheless; I have seen too many complaints on Twitter about money disappearing from Equity bank accounts. That's worrying.

|

|

|

Rank: Veteran Joined: 7/3/2007 Posts: 1,635

|

Ericsson wrote:https://twitter.com/OleItumbi/status/1177075788438523904 I read somewhere that Equity was planning to reduce Finserve back to a Division of the bank, chiefly in order to control this thievery. I am not sure I agree with this 'wielding a hammer to kill a fly approach.'The potential to grow Finserve as a subsidiary serving the wider market is the kind of game changer thinking that will finally take the fight to Safaricom. But then the reputational harm to Equity from this conmanship is likely to be significant if nothing is done. But bringing the thieving techies back to HQ will not solve the problem either, otherwise the likes of KCB, even Safaricom with their centralized controls, would not be facing the same problem. "The opposite of a correct statement is a false statement. But the opposite of a profound truth may well be another profound truth." (Niels Bohr)

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,778 Location: NAIROBI

|

https://www.businessdail...10018-x1sfku/index.html

Equity Bank is taking over a total of Sh2 billion worth of loans that had been advanced to East African Cables by various lenders, including Standard Chartered Bank (Kenya) and Ecobank Kenya Limited. Equity Bank, for instance, has been revealed as the lender that provided Sh1.6 billion that was used to settle StanChart claims. StanChart wrote off Sh1.5 billion and opted to walk away from the debt-ridden firm with the Sh1.6 billion. “Subsequent to year end, the group and company signed a facility agreement amounting to Sh1.6 billion with Equity Bank Kenya Limited to restructure the loans previously held by Standard Chartered Bank Kenya and Standard Chartered Bank Tanzania,” EA Cables says in the report. Buyout of the Stanchart loans was completed in May. The cables manufacturer added that it has approached Equity to also take over a Sh161 million loan owed to Ecobank kenya and Sh285 million owed to SBM Bank Kenya. “The new lender has offered the group a tenor of ten (10) years with a moratorium of two (2) years on principal repayments and a six (6) months moratorium on interest payments,” the cables manufacturer said of the negotiations with Equity. Prior to taking over the loans from its rivals, Equity had already lent more than Sh2 billion to EA Cables. Most of the cable manufacturer’s assets are pledged to Equity. EA Cables approached the bank to take over the loans which it is unable to repay on its own. “The loans due to Ecobank Kenya and SBM Bank Kenya … are due and payable on demand and in the event that the lenders recall the loans due, the group and company do not have the ability to settle these loans in the normal course of business,” the company said. This is a toxic deal/move by Equity bank;with the state of economy and kenya power,defaults are likely to reoccur by EA Cables Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Member Joined: 11/17/2018 Posts: 173 Location: Mars

|

Ericsson wrote: https://www.businessdail...10018-x1sfku/index.html

Equity Bank is taking over a total of Sh2 billion worth of loans that had been advanced to East African Cables by various lenders, including Standard Chartered Bank (Kenya) and Ecobank Kenya Limited. Equity Bank, for instance, has been revealed as the lender that provided Sh1.6 billion that was used to settle StanChart claims. StanChart wrote off Sh1.5 billion and opted to walk away from the debt-ridden firm with the Sh1.6 billion. “Subsequent to year end, the group and company signed a facility agreement amounting to Sh1.6 billion with Equity Bank Kenya Limited to restructure the loans previously held by Standard Chartered Bank Kenya and Standard Chartered Bank Tanzania,” EA Cables says in the report. Buyout of the Stanchart loans was completed in May. The cables manufacturer added that it has approached Equity to also take over a Sh161 million loan owed to Ecobank kenya and Sh285 million owed to SBM Bank Kenya. “The new lender has offered the group a tenor of ten (10) years with a moratorium of two (2) years on principal repayments and a six (6) months moratorium on interest payments,” the cables manufacturer said of the negotiations with Equity. Prior to taking over the loans from its rivals, Equity had already lent more than Sh2 billion to EA Cables. Most of the cable manufacturer’s assets are pledged to Equity. EA Cables approached the bank to take over the loans which it is unable to repay on its own. “The loans due to Ecobank Kenya and SBM Bank Kenya … are due and payable on demand and in the event that the lenders recall the loans due, the group and company do not have the ability to settle these loans in the normal course of business,” the company said. This is a toxic deal/move by Equity bank;with the state of economy and kenya power,defaults are likely to reoccur by EA Cables When it rains, it pours 😭

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,778 Location: NAIROBI

|

Extraterrestrial wrote:Ericsson wrote: https://www.businessdail...10018-x1sfku/index.html

Equity Bank is taking over a total of Sh2 billion worth of loans that had been advanced to East African Cables by various lenders, including Standard Chartered Bank (Kenya) and Ecobank Kenya Limited. Equity Bank, for instance, has been revealed as the lender that provided Sh1.6 billion that was used to settle StanChart claims. StanChart wrote off Sh1.5 billion and opted to walk away from the debt-ridden firm with the Sh1.6 billion. “Subsequent to year end, the group and company signed a facility agreement amounting to Sh1.6 billion with Equity Bank Kenya Limited to restructure the loans previously held by Standard Chartered Bank Kenya and Standard Chartered Bank Tanzania,” EA Cables says in the report. Buyout of the Stanchart loans was completed in May. The cables manufacturer added that it has approached Equity to also take over a Sh161 million loan owed to Ecobank kenya and Sh285 million owed to SBM Bank Kenya. “The new lender has offered the group a tenor of ten (10) years with a moratorium of two (2) years on principal repayments and a six (6) months moratorium on interest payments,” the cables manufacturer said of the negotiations with Equity. Prior to taking over the loans from its rivals, Equity had already lent more than Sh2 billion to EA Cables. Most of the cable manufacturer’s assets are pledged to Equity. EA Cables approached the bank to take over the loans which it is unable to repay on its own. “The loans due to Ecobank Kenya and SBM Bank Kenya … are due and payable on demand and in the event that the lenders recall the loans due, the group and company do not have the ability to settle these loans in the normal course of business,” the company said. This is a toxic deal/move by Equity bank;with the state of economy and kenya power,defaults are likely to reoccur by EA Cables When it rains, it pours 😭 Equity bank now holds a total of ksh.4bn EA Cables loan Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Veteran Joined: 8/30/2007 Posts: 1,558 Location: Nairobi

|

Ericsson wrote:Extraterrestrial wrote:Ericsson wrote: https://www.businessdail...10018-x1sfku/index.html

Equity Bank is taking over a total of Sh2 billion worth of loans that had been advanced to East African Cables by various lenders, including Standard Chartered Bank (Kenya) and Ecobank Kenya Limited. Equity Bank, for instance, has been revealed as the lender that provided Sh1.6 billion that was used to settle StanChart claims. StanChart wrote off Sh1.5 billion and opted to walk away from the debt-ridden firm with the Sh1.6 billion. “Subsequent to year end, the group and company signed a facility agreement amounting to Sh1.6 billion with Equity Bank Kenya Limited to restructure the loans previously held by Standard Chartered Bank Kenya and Standard Chartered Bank Tanzania,” EA Cables says in the report. Buyout of the Stanchart loans was completed in May. The cables manufacturer added that it has approached Equity to also take over a Sh161 million loan owed to Ecobank kenya and Sh285 million owed to SBM Bank Kenya. “The new lender has offered the group a tenor of ten (10) years with a moratorium of two (2) years on principal repayments and a six (6) months moratorium on interest payments,” the cables manufacturer said of the negotiations with Equity. Prior to taking over the loans from its rivals, Equity had already lent more than Sh2 billion to EA Cables. Most of the cable manufacturer’s assets are pledged to Equity. EA Cables approached the bank to take over the loans which it is unable to repay on its own. “The loans due to Ecobank Kenya and SBM Bank Kenya … are due and payable on demand and in the event that the lenders recall the loans due, the group and company do not have the ability to settle these loans in the normal course of business,” the company said. This is a toxic deal/move by Equity bank;with the state of economy and kenya power,defaults are likely to reoccur by EA Cables When it rains, it pours 😭 Equity bank now holds a total of ksh.4bn EA Cables loan Something tells me there may be more than meets the eye here. Perhaps a guarantee from Kuramo 🤷🏽♂️

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,778 Location: NAIROBI

|

Equity bank has had sluggish growth since 2014 after it was firmly a big bank. The expansion into the region may help boost growth. The acquisition of the Atlas Mara banks will be a huge plus but it will take time. 2-3 years. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,218 Location: Nairobi

|

EA Cables cedes assets to Ecobank https://www.businessdail...76092-1o30na/index.html EA Cables took new loans from Equity Bank and used the amounts to pay off StanChart. The company had also disclosed that it was negotiating with Equity Bank to also settle the remaining claims by SBM (Sh285 million) and Ecobank Kenya (Sh161 million). The actions by Ecobank and SBM suggest that the cables manufacturer has been unable to restructure the remaining loans. Prior to taking over the loans from its rivals, Equity Bank had already lent more than Sh2 billion to EA Cables.>>> Is Equity Bank losing its touch? Or does it not have the chops to lend to the corporate sector? Or has it got sufficient collateral that can be liquidated if and when EAC goes into administration? Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,778 Location: NAIROBI

|

VituVingiSana wrote:EA Cables cedes assets to Ecobank https://www.businessdail...76092-1o30na/index.html EA Cables took new loans from Equity Bank and used the amounts to pay off StanChart. The company had also disclosed that it was negotiating with Equity Bank to also settle the remaining claims by SBM (Sh285 million) and Ecobank Kenya (Sh161 million). The actions by Ecobank and SBM suggest that the cables manufacturer has been unable to restructure the remaining loans. Prior to taking over the loans from its rivals, Equity Bank had already lent more than Sh2 billion to EA Cables.>>> Is Equity Bank losing its touch? Yes it isOr does it not have the chops to lend to the corporate sector? Or has it got sufficient collateral that can be liquidated if and when EAC goes into administration? What is it seeing that the likes of stanchart,Ecobank and SBM didn't see.This might turn out to be a bad decision.Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,778 Location: NAIROBI

|

https://www.nse.co.ke/ph...ionary-announcement.pdf

PROPOSED SETTING UP OF A NON-OPERATINGHOLDING COMPANY IN KENYATO HOLDEQUITY GROUP HOLDINGS PLC’S INSURANCE BUSINESS SUBSIDIARIES INCLUDING ASUBSIDIARY IN KENYA FOR CONDUCTING AND UNDERTAKING LONG TERM INSURANCE BUSINESS Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Member Joined: 3/9/2010 Posts: 320 Location: kenya

|

Seems like this counter is deccelarting very fast  Work hard at your job and you can make a living. Work hard on yourself and you can make a fortune.

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,921

|

cyruskulei wrote:Seems like this counter is deccelarting very fast  This was bound to happen once it hit 38-40 bob, we will go below the 32.5 bob that was the previous floor. In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,778 Location: NAIROBI

|

https://www.businessdail...63718-qsnb18/index.html

Equity Group has cancelled its proposed dividend payout of Sh2.50 per share or a total of Sh9.4 billion, citing the need to conserve cash in the wake of the global Covid-19 pandemic. “Accordingly, the board has passed a resolution withdrawing the proposed dividend recommendation and instead will be recommending to the shareholders that no dividend is paid for the financial year ended 31st December, 2019,” Equity said in a statement. “Therefore, the shareholders of the company and other investors are advised to exercise caution when dealing in the company’s ordinary shares on the Nairobi Securities Exchange, the Uganda Securities Exchange and the Rwanda Stock Exchange.” Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Wazua

»

Investor

»

Stocks

»

Equity Bank 2019

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|