Wazua

»

Investor

»

Stocks

»

CIC Insurance 2019

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

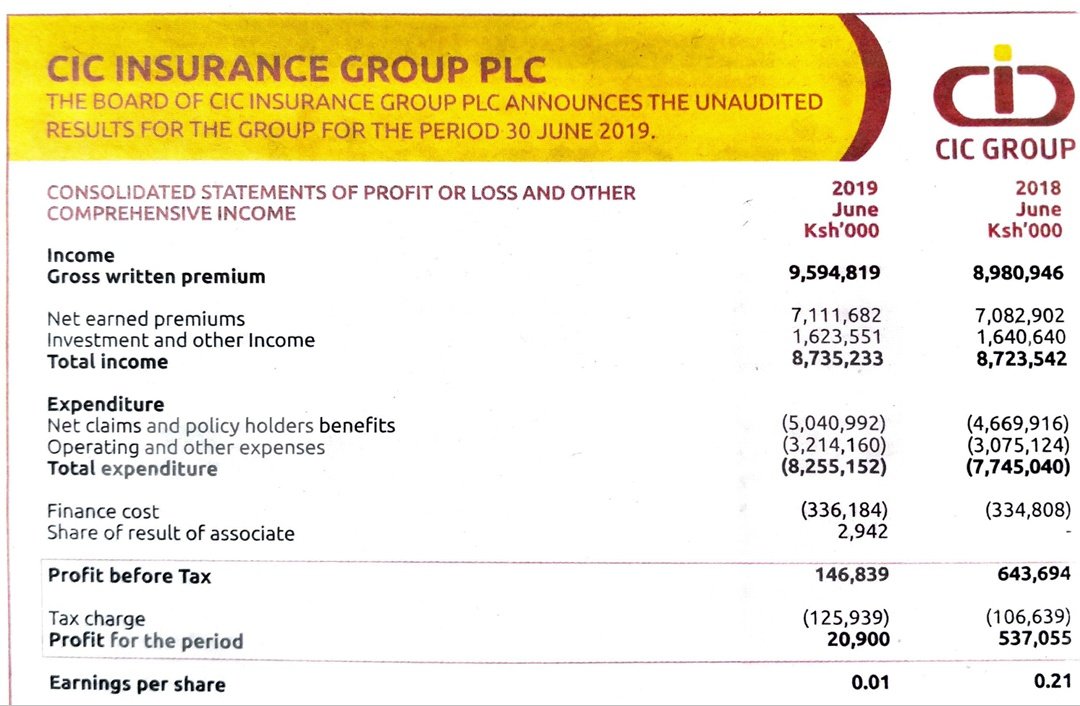

HY 2019 results are out Net earned premiums up 0.04% to ksh.7.1bn from 7.082bn Net claims and policy holders up 7.9% to ksh.5bn for 4.669bn in 2018 Profit before tax @ksh.146.839mn Profit after tax at ksh.20.9mn EPS plunges 95% to ksh.0.01 https://mobile.twitter.c...035182975606784/photo/1

Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Veteran Joined: 8/30/2007 Posts: 1,558 Location: Nairobi

|

Ericsson wrote:HY 2019 results are out

Net earned premiums up 0.04% to ksh.7.1bn from 7.082bn

Net claims and policy holders up 7.9% to ksh.5bn for 4.669bn in 2018

Profit before tax @ksh.146.839mn

Profit after tax at ksh.20.9mn

EPS plunges 95% to ksh.0.01

Yikes.

|

|

|

Rank: Veteran Joined: 1/20/2011 Posts: 1,820 Location: Nakuru

|

This is commendable of CIC for reporting early even before wazungu and/or SA controlled banks e.g., CFC,Barclays and Stanchart. Some firms here at NSE have issued profit warning for FY 2019 and they have not even reported on FY 2018. In the States(USA), bigger firms with revenues > Ksh. 1 trillion and balance sheets of > kshs 10 trillion report 2 days after or even on the last day of the quarter. Other NSE listed firms should emulate CIC. Dumb money becomes dumb only when it listens to smart money

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,314 Location: Nairobi

|

Fyatu wrote:This is commendable of CIC for reporting early even before wazungu and/or SA controlled banks e.g., CFC,Barclays and Stanchart. Some firms here at NSE have issued profit warning for FY 2019 and they have not even reported on FY 2018. In the States(USA), bigger firms with revenues > Ksh. 1 trillion and balance sheets of > kshs 10 trillion report 2 days after or even on the last day of the quarter. Other NSE listed firms should emulate CIC. All that jazz about reporting faster is fine but what went wrong in 1H? Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Member Joined: 3/20/2008 Posts: 503

|

VituVingiSana wrote:Fyatu wrote:This is commendable of CIC for reporting early even before wazungu and/or SA controlled banks e.g., CFC,Barclays and Stanchart. Some firms here at NSE have issued profit warning for FY 2019 and they have not even reported on FY 2018. In the States(USA), bigger firms with revenues > Ksh. 1 trillion and balance sheets of > kshs 10 trillion report 2 days after or even on the last day of the quarter. Other NSE listed firms should emulate CIC. All that jazz about reporting faster is fine but what went wrong in 1H?   good question.....infact why is it that all our insurers underwrite at Losses year in year out?.The answer to these questions may explain why the Jinnah's are putting their stakes in these insurance companies on the chopping block.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

xxxxx wrote:VituVingiSana wrote:Fyatu wrote:This is commendable of CIC for reporting early even before wazungu and/or SA controlled banks e.g., CFC,Barclays and Stanchart. Some firms here at NSE have issued profit warning for FY 2019 and they have not even reported on FY 2018. In the States(USA), bigger firms with revenues > Ksh. 1 trillion and balance sheets of > kshs 10 trillion report 2 days after or even on the last day of the quarter. Other NSE listed firms should emulate CIC. All that jazz about reporting faster is fine but what went wrong in 1H?   good question.....infact why is it that all our insurers underwrite at Losses year in year out?.The answer to these questions may explain why the Jinnah's are putting their stakes in these insurance companies on the chopping block. Consolidation is needed in the insurance industry,too many players Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

Tough.. . those claims are very high,i hope there is no inside job in eating them. "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

mlennyma wrote:Tough.. . those claims are very high,i hope there is no inside job in eating them. The company says losses in the life business caused by adverse group life claims. General insurance unit made a pre-tax profit of ksh.326mn Asset management pretax profit of ksh.104mn Subsidiaries made a combined pretax profit of ksh.50mn https://www.businessdail...15312-gf3u37z/index.htmlWealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

cash generated from operations was a whopping Kshs. 1.96b! The business is roaring, despite one-offs. Regional subsidiaries contributed 10% to GWPs (Gross Written Premiums). Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Member Joined: 9/14/2011 Posts: 864 Location: nairobi

|

Ericsson wrote:cash generated from operations was a whopping Kshs. 1.96b! The business is roaring, despite one-offs.

Regional subsidiaries contributed 10% to GWPs (Gross Written Premiums). But they need alot more to pay the bond

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Share price going up and up as the market bleeds Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 927 Location: sky

|

Ericsson wrote:Share price going up and up as the market bleeds may be someone has an idea of whats going on concerning the land transaction and bond repayment There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

littledove wrote:Ericsson wrote:Share price going up and up as the market bleeds may be someone has an idea of whats going on concerning the land transaction and bond repayment Most likely the bond repayment like they will fully repay the bond without taking any borrowing. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Veteran Joined: 4/4/2016 Posts: 2,002 Location: Kitale

|

Ericsson wrote:Share price going up and up as the market bleeds The day price range was 3.20-3.50 with a volume of 51,500 Towards the goal of financial freedom

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Ebenyo wrote:Ericsson wrote:Share price going up and up as the market bleeds The day price range was 3.20-3.50 with a volume of 51,500 3.44 closing price today Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,931

|

KRA targets doctors' payments from 12 foreign insurance firms https://www.businessdail...262-126o9fez/index.html

Will this affect our listed insurance companies in any way? In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

It's not a foreign firm Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Even this one bull run has caught up with it Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 927 Location: sky

|

Ericsson wrote:Even this one bull run has caught up with it i missed coop but this one im heavily loaded at 3 There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Profit warning pap Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Wazua

»

Investor

»

Stocks

»

CIC Insurance 2019

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|