Wazua

»

Investor

»

Stocks

»

KCB and NBK material announcement

Rank: Elder Joined: 9/15/2006 Posts: 3,907

|

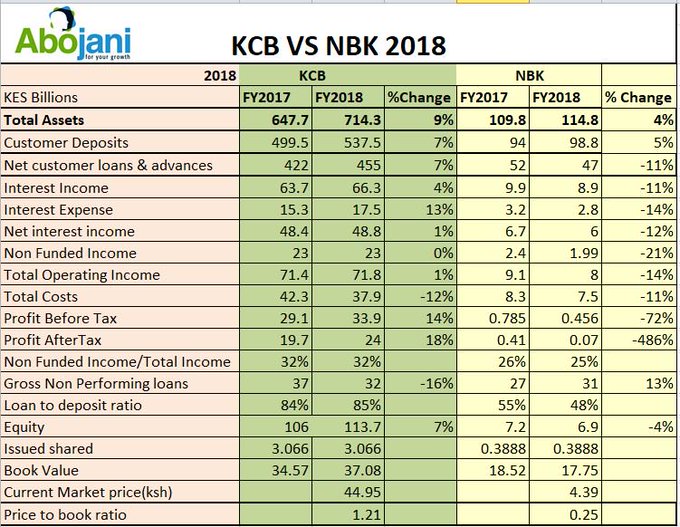

Nairobi Securities Exchange has today morning stopped trading in KCB Group and National Bank shares over a material announcement affecting the two counters. Is KCB planning to buy National Bank? https://www.the-star.co....g-to-buy-national-bank/ In the period ending December 31, 2018 National Bank reported a 98.3 per cent drop in profit

|

|

|

Rank: Veteran Joined: 8/11/2010 Posts: 1,011 Location: nairobi

|

muganda wrote:Nairobi Securities Exchange has today morning stopped trading in KCB Group and National Bank shares over a material announcement affecting the two counters. Is KCB planning to buy National Bank? https://www.the-star.co....g-to-buy-national-bank/ In the period ending December 31, 2018 National Bank reported a 98.3 per cent drop in profit How will this affect value of kcb, i have a material holding

|

|

|

Rank: Elder Joined: 7/26/2007 Posts: 6,514

|

NBK is junk, it will negatively affect KCB performance in the short-term. Business opportunities are like buses,there's always another one coming

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 927 Location: sky

|

what was the announcement? kcb now trading There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Elder Joined: 9/15/2006 Posts: 3,907

|

KulaRaha wrote:NBK is junk, it will negatively affect KCB performance in the short-term.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

KCB intends to acquire 100% of the ordinary shares with a par value of Ksh.5 of National Bank of Kenya. The offer shall be a way of a share swap of 10 ordinary shares of NBK shares for every 1 ordinary share of KCB. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

bartum wrote:muganda wrote:Nairobi Securities Exchange has today morning stopped trading in KCB Group and National Bank shares over a material announcement affecting the two counters. Is KCB planning to buy National Bank? https://www.the-star.co....g-to-buy-national-bank/ In the period ending December 31, 2018 National Bank reported a 98.3 per cent drop in profit How will this affect value of kcb, i have a material holding Please note NBK and KCB will resume trading at 12.30pm Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Top 10 NBK Shareholders as at 31 December 2017National Social Security Fund 162,802,746 48.10% 2.The Permanent Secretary To The Treasury 76,230000 22.50% 3.Kenya Reinsurance Corporation Limited 4,840,000 1.40% 4.Best Investment Decisions Limited 2,350,271 0.70% 5.Co-op Bank Custody A/C 4003a 1,864,863 0.60% 6.Craysell Investments Limited 1,431,069 0.40% 7.NIC Custodial Services A/C 077 1,405,245 0.40% 8.Equity Nominee Ltd A/C00084 1,256,343 0.40% 9.NBK Client A/c 1 1,143,450 0.30% 10.Eng. Ephraim Mwangi Maina 105,003 0.30% 11.Others 84,371,010 24.90% TOTAL 338,800,000Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Member Joined: 8/6/2018 Posts: 299

|

Ericsson wrote:KCB intends to acquire 100% of the ordinary shares with a par value of Ksh.5 of National Bank of Kenya.

The offer shall be a way of a share swap of 10 ordinary shares of NBK shares for every 1 ordinary share of KCB. Is a good deal for both KCB and NBK....Though its the NBK shareholders to laugh all the way to the bank...KCB will have to recapitalize by way off injecting new Capital into NBK...Its a winner takes all. With new capital, and increased deposits through GOVERNMENT SINGLE TREASURY ACCOUNT, NBK will lend and lend and lend ....

|

|

|

Rank: Member Joined: 3/15/2009 Posts: 362

|

bartum wrote:muganda wrote:Nairobi Securities Exchange has today morning stopped trading in KCB Group and National Bank shares over a material announcement affecting the two counters. Is KCB planning to buy National Bank? https://www.the-star.co....g-to-buy-national-bank/ In the period ending December 31, 2018 National Bank reported a 98.3 per cent drop in profit How will this affect value of kcb, i have a material holding Figures to watch out for is the non performing loans and the costs. Assuming a large part of the non performing loans are written off, KCB will only get about 90billion in extra assets vs customer deposits of 98 biliion. Income side they are getting nothing. How fast will they cut costs on the N.B.K side and at what cost is the question. Share dilution isn't much, about 1% if you consider ordinary shares. How will prefence shares be handled?

|

|

|

Rank: Member Joined: 8/6/2018 Posts: 299

|

shocks wrote:bartum wrote:muganda wrote:Nairobi Securities Exchange has today morning stopped trading in KCB Group and National Bank shares over a material announcement affecting the two counters. Is KCB planning to buy National Bank? https://www.the-star.co....g-to-buy-national-bank/ In the period ending December 31, 2018 National Bank reported a 98.3 per cent drop in profit How will this affect value of kcb, i have a material holding Figures to watch out for is the non performing loans and the costs. Assuming a large part of the non performing loans are written off, KCB will only get about 90billion in extra assets vs customer deposits of 98 biliion. Income side they are getting nothing. How fast will they cut costs on the N.B.K side and at what cost is the question. Share dilution isn't much, about 1% if you consider ordinary shares. How will prefence shares be handled? Conversion of the NBK outstanding stock of preference shares 1,135,000,000 is proposed to be 1 for 1 ordinary shares as per the offer..

|

|

|

Rank: Member Joined: 8/6/2018 Posts: 299

|

shocks wrote:bartum wrote:muganda wrote:Nairobi Securities Exchange has today morning stopped trading in KCB Group and National Bank shares over a material announcement affecting the two counters. Is KCB planning to buy National Bank? https://www.the-star.co....g-to-buy-national-bank/ In the period ending December 31, 2018 National Bank reported a 98.3 per cent drop in profit How will this affect value of kcb, i have a material holding Figures to watch out for is the non performing loans and the costs. Assuming a large part of the non performing loans are written off, KCB will only get about 90billion in extra assets vs customer deposits of 98 biliion. Income side they are getting nothing. How fast will they cut costs on the N.B.K side and at what cost is the question. Share dilution isn't much, about 1% if you consider ordinary shares. How will prefence shares be handled? Conversion of the NBK outstanding stock of preference shares 1,135,000,000 is proposed to be 1 for 1 ordinary shares as per the offer..

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

KaunganaDoDo wrote:shocks wrote:bartum wrote:muganda wrote:Nairobi Securities Exchange has today morning stopped trading in KCB Group and National Bank shares over a material announcement affecting the two counters. Is KCB planning to buy National Bank? https://www.the-star.co....g-to-buy-national-bank/ In the period ending December 31, 2018 National Bank reported a 98.3 per cent drop in profit How will this affect value of kcb, i have a material holding Figures to watch out for is the non performing loans and the costs. Assuming a large part of the non performing loans are written off, KCB will only get about 90billion in extra assets vs customer deposits of 98 biliion. Income side they are getting nothing. How fast will they cut costs on the N.B.K side and at what cost is the question. Share dilution isn't much, about 1% if you consider ordinary shares. How will prefence shares be handled? Conversion of the NBK outstanding stock of preference shares 1,135,000,000 is proposed to be 1 for 1 ordinary shares as per the offer.. Paste here the offer document. NBK said the offer was conditional on it delisting its shares from the Nairobi Securities Exchange and converting its preference shares into ordinary shares. If the conversion of preference shares is as above,then it means prior to the acquisition GoK will be the majority shareholder in NBK and not NSSF. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 11/5/2010 Posts: 2,459

|

Hope KCB will undertake a massive restructuring at NBK. The board and management of the latter are rotten to the core.

Can you imagine NBK management leasing premises for a new branch, renovate, brand, install everything including computers, network and ATMs, then pays rent for a whole 3 years withoutbecause opening because they realised its not viable. Case in point - Nanyuki.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Throw back Thursday https://citizentv.co.ke/...al-bank-of-kenya-168058/Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Ericsson wrote:KaunganaDoDo wrote:shocks wrote:bartum wrote:muganda wrote:Nairobi Securities Exchange has today morning stopped trading in KCB Group and National Bank shares over a material announcement affecting the two counters. Is KCB planning to buy National Bank? https://www.the-star.co....g-to-buy-national-bank/ In the period ending December 31, 2018 National Bank reported a 98.3 per cent drop in profit How will this affect value of kcb, i have a material holding Figures to watch out for is the non performing loans and the costs. Assuming a large part of the non performing loans are written off, KCB will only get about 90billion in extra assets vs customer deposits of 98 biliion. Income side they are getting nothing. How fast will they cut costs on the N.B.K side and at what cost is the question. Share dilution isn't much, about 1% if you consider ordinary shares. How will prefence shares be handled? Conversion of the NBK outstanding stock of preference shares 1,135,000,000 is proposed to be 1 for 1 ordinary shares as per the offer.. Paste here the offer document. NBK said the offer was conditional on it delisting its shares from the Nairobi Securities Exchange and converting its preference shares into ordinary shares. If the conversion of preference shares is as above,then it means prior to the acquisition GoK will be the majority shareholder in NBK and not NSSF. The par value of Treasury’s portion of the preference shares is Sh4.5 billion with NSSF’s claim at about Sh1.2 billion, adding up to a total of Sh5.7 billion. Gok Owns 79% of the Preference shares and NSSF 21% Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Member Joined: 8/6/2018 Posts: 299

|

Ericsson wrote:KaunganaDoDo wrote:shocks wrote:bartum wrote:muganda wrote:Nairobi Securities Exchange has today morning stopped trading in KCB Group and National Bank shares over a material announcement affecting the two counters. Is KCB planning to buy National Bank? https://www.the-star.co....g-to-buy-national-bank/ In the period ending December 31, 2018 National Bank reported a 98.3 per cent drop in profit How will this affect value of kcb, i have a material holding Figures to watch out for is the non performing loans and the costs. Assuming a large part of the non performing loans are written off, KCB will only get about 90billion in extra assets vs customer deposits of 98 biliion. Income side they are getting nothing. How fast will they cut costs on the N.B.K side and at what cost is the question. Share dilution isn't much, about 1% if you consider ordinary shares. How will prefence shares be handled? Conversion of the NBK outstanding stock of preference shares 1,135,000,000 is proposed to be 1 for 1 ordinary shares as per the offer.. Paste here the offer document. NBK said the offer was conditional on it delisting its shares from the Nairobi Securities Exchange and converting its preference shares into ordinary shares. If the conversion of preference shares is as above,then it means prior to the acquisition GoK will be the majority shareholder in NBK and not NSSF. KCB TAKEOVER

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,314 Location: Nairobi

|

KulaRaha wrote:NBK is junk, it will negatively affect KCB performance in the short-term. If KCB buys NBK for a song then KCB may benefit. KCB may have the resources, heft and experience to follow up on the NPLs. Didn't KCB also want a guarantee to keep the business that GoK gives NBK? Yes, I agree about the short-term hit but the long-term benefits may outweigh the negatives. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,314 Location: Nairobi

|

KaunganaDoDo wrote:Ericsson wrote:KCB intends to acquire 100% of the ordinary shares with a par value of Ksh.5 of National Bank of Kenya.

The offer shall be a way of a share swap of 10 ordinary shares of NBK shares for every 1 ordinary share of KCB. Is a good deal for both KCB and NBK....Though its the NBK shareholders to laugh all the way to the bank...KCB will have to recapitalize by way off injecting new Capital into NBK...Its a winner takes all. With new capital, and increased deposits through GOVERNMENT SINGLE TREASURY ACCOUNT, NBK will lend and lend and lend .... Not really. It is likely that NBK's business will be absorbed into KCB rather than NBK being run as a separate bank with fresh capital. NBK will probably become a subsidiary but will remain "open" (as a firm not an operating bank) as it pursues defaulters. I&M still has Giro as a "subsidiary" but I think that's to keep the continuity for legal reasons e.g. for an ongoing lawsuit. Defaulters would go to court to fight a change in the name of the plaintiff from NBK to KCB. Many of our courts/judges are weird or ignorant in commercial matters. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Member Joined: 6/9/2009 Posts: 85

|

KaunganaDoDo wrote:shocks wrote:bartum wrote:muganda wrote:Nairobi Securities Exchange has today morning stopped trading in KCB Group and National Bank shares over a material announcement affecting the two counters. Is KCB planning to buy National Bank? https://www.the-star.co....g-to-buy-national-bank/ In the period ending December 31, 2018 National Bank reported a 98.3 per cent drop in profit How will this affect value of kcb, i have a material holding Figures to watch out for is the non performing loans and the costs. Assuming a large part of the non performing loans are written off, KCB will only get about 90billion in extra assets vs customer deposits of 98 biliion. Income side they are getting nothing. How fast will they cut costs on the N.B.K side and at what cost is the question. Share dilution isn't much, about 1% if you consider ordinary shares. How will prefence shares be handled? Conversion of the NBK outstanding stock of preference shares 1,135,000,000 is proposed to be 1 for 1 ordinary shares as per the offer.. So total NBK issued shares will be 1,443,000,000 (1,135,000,000 + 308,000,000) after preference shares conversion. This means KCB will issue 144,3000,000 shares to acquire the whole NBK. Given that KCB total issued shares is about 3 billion, this represents a dilution of about 4.8 percent.

|

|

|

Wazua

»

Investor

»

Stocks

»

KCB and NBK material announcement

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|