CA report;

Active mobile subscriptions - 41.0 million recorded in the first quarter to 42.8 million

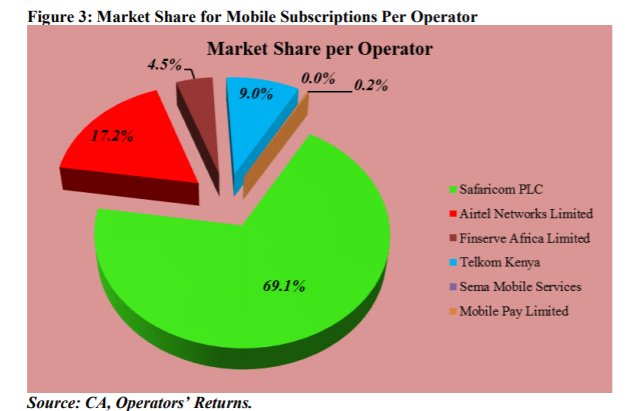

Market share - Safaricom - 69.1% vs 71.9%

Quote:

During the period under review, the number of pre-paid mobile and postpaid mobile

subscriptions stood at 41.4 million and 1.4 million respectively.

Safaricom PLC reported a total of 29.5 million mobile subscriptions with 28.2 million being prepaid and 1.2 million postpaid.

The total number of mobile subscriptions recorded by Airtel Networks Limited rose to 7.3 million subscriptions from 6.1 million. This marked an increase of 20.7 per cent during the quarter.

Telkom Kenya Limited registered 12.4 per cent increase in mobile subscriptions to post 3.8million subscriptions from 3.4 million recorded in the preceding quarter.

Finserve Africa Limited registered a growth of 1.2 per cent during the period under review to record 1.93 million subscriptions up from 1.90 million reported during the previous period.

Mobile Pay limited recorded 89,892 pre-paid mobile subscriptions up from last quarter’s 88,853. On the other hand, Sema Mobile Services lost its mobile subscriptions by 50.2 percent to register 112 subscriptions from 263 recorded in the previous quarter.

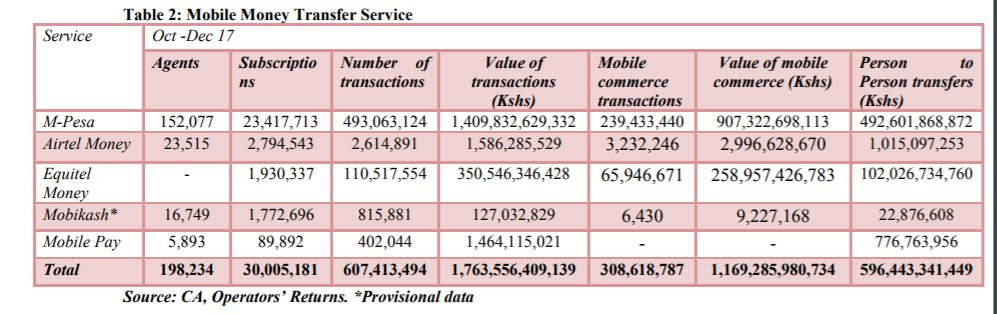

Mobile Money TransferAs at 31st December 2017, the number of active mobile money transfer subscriptions and agents stood at 30.0 million and 198,234 respectively. A total of 607.4 million mobile money transfer transactions valued at Ksh. 1.763 trillion were carried.

In addition there were 308.6 million mobile commerce transactions valued at Ksh.1.1 trillion. The value of person-to-person transfers amounted to Ksh. 596.4 million.

Quote:

Local Mobile Voice Traffic per Operator

Safaricom PLC recorded a total of 8.55 billion minutes of local mobile voice traffic during the quarter under review up from 8.51 billion minutes registered in the previous quarter. On -net and off-net mobile voice minutes stood at 8.2 billion and 350.9 million minutes respectively.

Despite the increase in voice traffic, its voice market share declined by 4.4 percentage points during the period under review to stand at 72.5 per cent.

Airtel Networks Limited recorded mobile voice traffic of 2.5 billion minutes up from 1.9 billion minutes recorded in the previous quarter. Consequently, its voice market share went up by 4.6 percentage points to stand at 22.0 per cent.

Telkom Kenya Limited on the other hand recorded a total of 608.6 million minutes in local mobile voice traffic up from 589.8 million minutes reported during the previous period.

However, its voice market share declined marginally by 0.1 percentage points to stand at 5.2 per cent.

Finserve Africa Limited recorded local mobile voice traffic of 37.5 million minutes during the quarter marking a decline of 7.2 per cent when compared to 40.4 million minutes registered in the preceding quarter. Its voice market share stood at 0.3 percent.

Sema Mobile Services reported growth in local mobile voice traffic during the period under review to record 39,711 minutes from 39,255 minutes recorded during the previous period. On the other hand, Mobile Pay Limited registered a decline of 8.7 per cent in voice traffic to post 27,448 minutes whereas the market share remained unchanged at 0.0 percent.

Now Safaricom can kill the monopoly narrative.

Quote:Data/Internet SubscriptionsTotal data/Internet subscriptions stood at 33.3 million up from 30.8 million subscriptions reported in the previous quarter marking an 8.0 per cent growth.

Mobile data/Internet has witnessed strong growth over the past quarters as observed during the period under review. The number of mobile data/Internet subscriptions rose to register 33.0 million from 30.6 million posted during the preceding quarter marking growth of 8.0 per cent.

Safaricom PLC mobile data/Internet subscriptions recorded a market share of 72.8 per cent down from 76.0 per cent recorded in the previous quarter. On the other hand, the market share for Airtel Networks Limited rose by 2.8 percentage points to reach 18.5 per cent.

Telkom Kenya Limited posted a market share of 7.8 per cent up from 7.3 per cent reported in the preceding quarter.

The market share for Finserve Africa Limited stood at 0.6 per cent down from 0.7 per cent posted in the preceding quarter. Mobile Pay Limited and Sema Mobile Services market share for mobile data remained unchanged at 0.3 per cent and 0.0 per cent respectively.

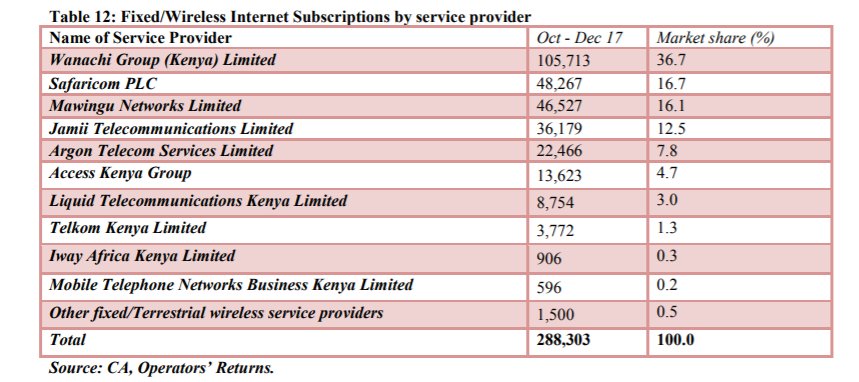

During the period under review there were substantial changes in fixed/wireless data subscriptions and the respective market shares per service provider. Wananchi Group Limited recorded the largest market share at 36.7 per cent, which was a drop compared to 41.0 per cent registered in the previous quarter.

Safaricom PLC gained 1.5 per centage points to register a market share of 16.7 per cent. Similarly, Mawingu Networks Limited recorded an increase of 4.7 per centage points to stand at 16.1 per cent during the period under review. Jamii Telecommunications Limited was fourth with a market share of 12.5 percent.

Other operators offering fixed/wireless data/Internet recorded a market share of 0.5 per cent representing 1,500 subscriptions, which was a decline of 0.1 per centage points.

"There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.