Wazua

»

Investor

»

Offshore

»

Realities of Forex Investment

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

The "Trump" short promises to be a very volatile show when that event risk triggers. Caution to USD bears and the MXN bulls! $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 3/23/2011 Posts: 304

|

alutacontinua wrote:alutacontinua wrote:http://www.bbc.com/news/uk-politics-37532364

Theresa May to formally trigger Article 50 of the Lisbon Treaty by end of March 2017.

GBP trades should be in focus this coming week. Looking at the indicative Monday morning open prices: GBPUSD is 1.2902 (close 1.2972) while on GBP/JPY at 130.718 (close 131.590)  Took a small short on GBPJPY today at the Frankfurt Open following the gap down fade during Asia. A quick 61pip gain despite some key markets being on Holiday. Used a modified VSA strategy to determine buying and selling pressure. Entry 131.19 SL :131.35 (16pips) Exit: 130.58 (61 pips) You dont have to be great to START but you have to start to be GREAT!!!!!!!!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

SAR!? If this $ peg breaks, that break will travel in the system very fast. Caution. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

hisah wrote:alutacontinua wrote:FED leaves rates unchanged interesting to note that there was a 7-3 decision to hold rates steady only for the time being. Doubt they would raise rates in November (2 days before the US general election) thus December should be a go. A quick glance through the minutes and there is not a substantial reason why they dint hike....As for BOJ i really don't have much to say apart from CURVE IT LIKE KURODA     Market really not buying it. BoJ and FOMC event risks finally out of the way.

Scoping the markets still shows gold rally trapping bulls, GBP trapping bulls and CAD trapping bulls. Shorting opportunities coming soon.

US stock will trap bears in the expected selloff.

The outlier is euro banks. They are a curve ball that will rattle the markets badly. Watch out! 7 trading days later GBP and Gold bulls take it hard in the chin...

Caution Yen bulls. Nose bleed session coming!$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

$Yen tests 104 handle. Yen bulls sweating. Asian session wakes up to GBP fat finger madness as the £ crashes to 1.18 vs USD from 1.26 level?! Thats around 800 pips! 8 big figures! Margin call ulcers central! Currently it has recouped 500 pips to trade at 1.23 level. I wonder how many trading accounts have been blown up as well as how many brokers will be in distress on matters margin. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

NFP just 25 minutes away. Focus on USD, GBP, CAD and Gold. The plot thickens... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: User Joined: 8/15/2013 Posts: 13,237 Location: Vacuum

|

Depressing depressing depressing! If Obiero did it, Who Am I?

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,931

|

Swenani wrote:Depressing depressing depressing! Kwani your stories with GBP never ended, pole   In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: User Joined: 8/15/2013 Posts: 13,237 Location: Vacuum

|

Angelica _ann wrote:Swenani wrote:Depressing depressing depressing! Kwani your stories with GBP never ended, pole   It can only end when my life ends! If Obiero did it, Who Am I?

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Swenani wrote:Depressing depressing depressing! If you are paid in pounds more squeeze is coming up since the USD is bound to get expensive whether HC or DT takes the top seat.

@FX fans take a look at the $DXY monthly chart and spot the looming break out! USD bulls are charging hard. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: User Joined: 8/15/2013 Posts: 13,237 Location: Vacuum

|

The GBP has been on viagra today...I hope the BOE will now raise the interest rates. If Obiero did it, Who Am I?

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Swenani wrote:The GBP has been on viagra today...I hope the BOE will now raise the interest rates. By the time the dust settles 1 GBP = 1 USD. Every currency will lose vs USD when the sovereign debt drama launches.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: User Joined: 8/15/2013 Posts: 13,237 Location: Vacuum

|

hisah wrote:Swenani wrote:The GBP has been on viagra today...I hope the BOE will now raise the interest rates. By the time the dust settles 1 GBP = 1 USD. Every currency will lose vs USD when the sovereign debt drama launches. That will be mid 2017 as of now, we shall ride on the US poll uncertainty and the court ruling on parliament approval for triggering article 50 as well as positive economic outlook of UK for 2016 If Obiero did it, Who Am I?

|

|

|

Rank: User Joined: 8/15/2013 Posts: 13,237 Location: Vacuum

|

Swenani wrote:hisah wrote:Swenani wrote:The GBP has been on viagra today...I hope the BOE will now raise the interest rates. By the time the dust settles 1 GBP = 1 USD. Every currency will lose vs USD when the sovereign debt drama launches. That will be mid 2017 as of now, we shall ride on the US poll uncertainty and the court ruling on parliament approval for triggering article 50 as well as positive economic outlook of UK for 2016 GBP is the winner of Trump's election in the short term! Analyst predict support levels of 1985, but if the pollsters were wrong on US elections why can't the analyst be wrong too!     If Obiero did it, Who Am I?

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Swenani wrote:Swenani wrote:hisah wrote:Swenani wrote:The GBP has been on viagra today...I hope the BOE will now raise the interest rates. By the time the dust settles 1 GBP = 1 USD. Every currency will lose vs USD when the sovereign debt drama launches. That will be mid 2017 as of now, we shall ride on the US poll uncertainty and the court ruling on parliament approval for triggering article 50 as well as positive economic outlook of UK for 2016 GBP is the winner of Trump's election in the short term! Analyst predict support levels of 1985, but if the pollsters were wrong on US elections why can't the analyst be wrong too!       This is not a short term race, it's a marathon. This is not a short term race, it's a marathon.

GBP has fallen through a critical level (1.35 - the GFC panic low) and crashed to a 31 year low. Such a break down is a powerful signal that the long term trend has now flipped in favour of lower lows. But will fair better than the euro.

The USD shock hasn't checked in yet! Have you seen the global bond index post Trump shock? $1 trillion was wiped out this week! This is happening even before the euro crashes!

When the sovereign bond debt default drama starts to unfold, the USD will gain sharply vs all currencies.

Convert some of your GBPs to USD for a rainy day. Take advantage of the GBP strength to do so.

What is the USD shock I keep yapping about? It's the USD shortage that will ensue when bonds vapourize. Those eurobonds that emerging nations have piled in will hurt really bad. Crazy currency devaluations will be the order of the day! Many nations will experience civil unrest  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 8/15/2015 Posts: 817

|

something isnot right on weekly chart euro$ doing down cable going up. damn that divergence has gotta correct asap.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Cornelius Vanderbilt wrote:something isnot right on weekly chart euro$ doing down cable going up. damn that divergence has gotta correct asap. The pound will survive, but the euro is toast! The fall of the euro is what will make the USD smoke out everyone. Capital running from euro to USD. Everyone will get squeezed by that run as the USD becomes a scarce resource. Crazy capital controls will be erected to stem that stampede. Many places globally do not permit withdrawing 10K USD without an essay of explanations!$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

hisah wrote:The "Trump" short promises to be a very volatile show when that event risk triggers. Caution to USD bears and the MXN bulls! 5 weeks later the Trump shorts have been taken to the cleaners. Extreme one sided trades always end up in misery. The aftermath has left:

* Yen bulls broken.

* Euro bulls clobbered. When it breaks below parity vs $, the shock won't be funny!

* Gold bulls still stunned that the price is heading sub 1200 instead of 1400 and higher!

* CAD has lost value, but holding up better. But for how long?

* GBP has also held up quite well post Trump, but the Brexit selloff has already pointed where it will land in months to come. Much lower.

* MXN peso has broken down as expected. Most emerging nation currencies had lost vs $ pre Trump. That trend will now accelerate leading to stupid capital controls

The Trump administration will be blamed for the global bond market turmoil.

Get ready for even more crazy monetary experiments by the G20 CBs as they fight this USD dragon!

The end game is getting clearer now. A new reserve currency system is coming.

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 8/15/2015 Posts: 817

|

so what exactly happened last week (14th - 18th nov 2016) on the euro/usd?well the currency has the longest loosing streak in its history.10 full days damn,some serious bear power. how does that make you bears feel? lol . go on throw a party for yourselves.and the dollar index hitting multi year highs....well i hope trumponomics works for the US

|

|

|

Rank: Member Joined: 8/15/2015 Posts: 817

|

hisah wrote:hisah wrote:The "Trump" short promises to be a very volatile show when that event risk triggers. Caution to USD bears and the MXN bulls! 5 weeks later the Trump shorts have been taken to the cleaners. Extreme one sided trades always end up in misery. The aftermath has left:

* Yen bulls broken.

* Euro bulls clobbered. When it breaks below parity vs $, the shock won't be funny!

* Gold bulls still stunned that the price is heading sub 1200 instead of 1400 and higher!

* CAD has lost value, but holding up better. But for how long?

* GBP has also held up quite well post Trump, but the Brexit selloff has already pointed where it will land in months to come. Much lower.

* MXN peso has broken down as expected. Most emerging nation currencies had lost vs $ pre Trump. That trend will now accelerate leading to stupid capital controls

The Trump administration will be blamed for the global bond market turmoil.

Get ready for even more crazy monetary experiments by the G20 CBs as they fight this USD dragon!

The end game is getting clearer now. A new reserve currency system is coming.

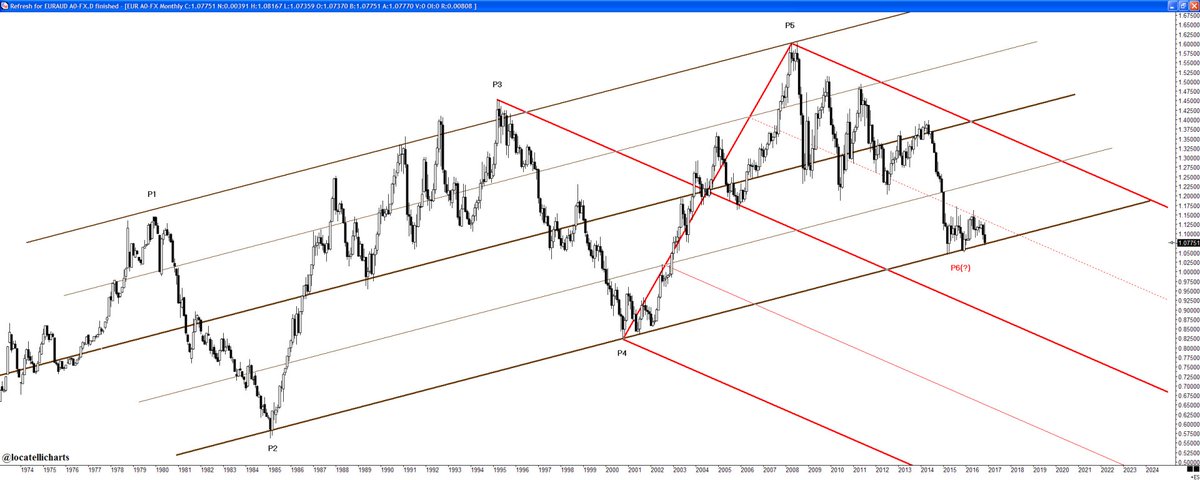

well eurousd bulls have a chance to really rally up the price for years to come.below is along term eurousd chart price approaching the long term rising trendline

|

|

|

Wazua

»

Investor

»

Offshore

»

Realities of Forex Investment

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|