Wazua

»

Investor

»

Stocks

»

Elliott Wave Analysis Of The NSE 20

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

kasibitta wrote:mnandii wrote:Schools are burning now. Most people( even theories) can't connect the burning of schools to the Stock Market. Yet, they are of the same causality. I did anticipate the decline in our stock market more than a year ago (see the very first post of this wazua.co.ke thread). Now the the NSE 20 share index is declining massively. I've also posted notes here on the Socionomic aspects of the declining social mood (as measured by the declining stock index). I also indicated that the fact of Universities being opened in almost every corner of Kenya, the winning by the Teachers Union of a tremendous increase in salary for teachers and the selling of a private school at an extremely high price marked the topping process in education matters. The bear market in education was the next logical expectation. Even now there is alot of interest in higher education but when the bear catches proper, then, expect education to be shunned. So, how do we connect the burning of schools to our stock market and then to society as a whole? Simple. The NSE 20 share Index is falling, meaning that negative social mood (the Index is sensitive to mood) is taking over at large degree. The youth respond quicker to changes in social mood (remember they set the trend in fashion for example) and that is why one of the negative consequence of a decline in social mood , i.e. the tendency to destroy (by burning) has manifested itself first in schools (where most youths can be found). This means that in Kenya, going forward, negative mood will entrench itself and the rest of society will also show the destructive impulses that the youth are exhibiting. I have argued here before that come 2017, and IF the the stock market will be shuttling to below 2000 levels (which I expect to happen) then the next General Elections will be bloody i.e far worse than the 2007 -2008 one. The beauty of socionomics is that you get to anticipate events before they happen and you can therefore prepare yourself adequately. Do read: -THE WAVE PRINCIPLE OF HUMAN SOCIAL BEHAVIOUR by ROBERT PRECHTER. -CONQUER THE CRASH by ROBERT PRECHTER. www.socionomics.net Thankyou.An interesting perspective to the current happenings.Always look forward to reading your posts.Keep them coming Very few market participants bother with socio-economics as a leading indicator. Mr market is made up of people who have emotions (greed and fear) and will always have mood swings depending on which emotion is dominant at that particular period (bull or bear). These sentiments (emotions) are always the best gauge in determining larger trend shifts before they happen. I prefer saying markets are readable than predictable since one can read this leading indicator and determine the next likely outcome. The longer the financial markets remain in the pits the more chaotic the society gets. This is why authorities try to manipulate the markets upwards to avoid the storm that comes with negative social mood fed by unbearable financial losses. If we break below 3000 handle I expect the market to experience trading hiccups - the infamous ATS glitches aka late market open. If the negative feedback is too strong as the participants lose hope and sell at throw away prices, then the market shutdown card will be enforced!

29 Instances Of A Major World Stock Market Shutdown

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

MPs endorse Bill to cap the cost of your loanQuote:Kenyan legislators have passed a Bill that seeks to cap bank interest rates at not more than four per cent above the Central Bank Rate (CBR) in their latest attempt to arrest the runaway cost of borrowing.

Chief executives of commercial banks and other lending institutions will face a Sh1 million fine or imprisonment for a term of not less than one year or both if convicted of flouting the law.

The Bill, sponsored by Kiambu MP Jude Njomo, also pegs the minimum interest granted on a deposit held in interest earning accounts to at least 70 per cent of the base rate set and published by CBK.

The MPs also urged President Uhuru Kenyatta Wednesday to quickly assent to the Bill in order to protect Kenyans from high interest rates. Whoa!!! Berserk! NSE support is no where in sight! $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

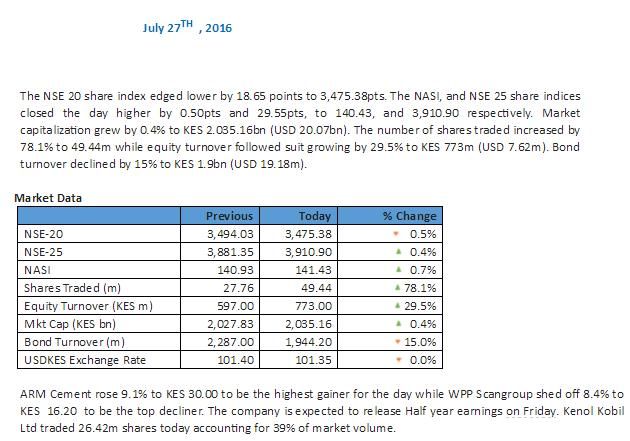

The NSE 20 share index edged lower by 18.65 points to 3,475.38pts. The NASI, and NSE 25 share indices closed the day higher by 0.50pts and 29.55pts, to 140.43, and 3,910.90 respectively. Market capitalization grew by 0.4% to KES 2.035.16bn (USD 20.07bn). The number of shares traded increased by 78.1% to 49.44m while equity turnover followed suit growing by 29.5% to KES 773m (USD 7.62m). Bond turnover declined by 15% to KES 1.9bn (USD 19.18m). possunt quia posse videntur

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

maka wrote:The NSE 20 share index edged lower by 18.65 points to 3,475.38pts. The NASI, and NSE 25 share indices closed the day higher by 0.50pts and 29.55pts, to 140.43, and 3,910.90 respectively. Market capitalization grew by 0.4% to KES 2.035.16bn (USD 20.07bn). The number of shares traded increased by 78.1% to 49.44m while equity turnover followed suit growing by 29.5% to KES 773m (USD 7.62m). Bond turnover declined by 15% to KES 1.9bn (USD 19.18m).    possunt quia posse videntur

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

hisah wrote:MPs endorse Bill to cap the cost of your loanQuote:Kenyan legislators have passed a Bill that seeks to cap bank interest rates at not more than four per cent above the Central Bank Rate (CBR) in their latest attempt to arrest the runaway cost of borrowing.

Chief executives of commercial banks and other lending institutions will face a Sh1 million fine or imprisonment for a term of not less than one year or both if convicted of flouting the law.

The Bill, sponsored by Kiambu MP Jude Njomo, also pegs the minimum interest granted on a deposit held in interest earning accounts to at least 70 per cent of the base rate set and published by CBK.

The MPs also urged President Uhuru Kenyatta Wednesday to quickly assent to the Bill in order to protect Kenyans from high interest rates. Whoa!!! Berserk! NSE support is no where in sight! Never underestimate a cornered politician. Such a counter-productive move. Serious credit contraction in the pipeline. Banks will be pulverised by this one. In a general trend where the NIM was shrinking through normal market mechanics and the NPL's saga yet to be properly resolved...this pops up! The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

maka wrote:The NSE 20 share index edged lower by 18.65 points to 3,475.38pts. The NASI, and NSE 25 share indices closed the day higher by 0.50pts and 29.55pts, to 140.43, and 3,910.90 respectively. Market capitalization grew by 0.4% to KES 2.035.16bn (USD 20.07bn). The number of shares traded increased by 78.1% to 49.44m while equity turnover followed suit growing by 29.5% to KES 773m (USD 7.62m). Bond turnover declined by 15% to KES 1.9bn (USD 19.18m). Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

lochaz-index wrote:hisah wrote:MPs endorse Bill to cap the cost of your loanQuote:Kenyan legislators have passed a Bill that seeks to cap bank interest rates at not more than four per cent above the Central Bank Rate (CBR) in their latest attempt to arrest the runaway cost of borrowing.

Chief executives of commercial banks and other lending institutions will face a Sh1 million fine or imprisonment for a term of not less than one year or both if convicted of flouting the law.

The Bill, sponsored by Kiambu MP Jude Njomo, also pegs the minimum interest granted on a deposit held in interest earning accounts to at least 70 per cent of the base rate set and published by CBK.

The MPs also urged President Uhuru Kenyatta Wednesday to quickly assent to the Bill in order to protect Kenyans from high interest rates. Whoa!!! Berserk! NSE support is no where in sight! Never underestimate a cornered politician. Such a counter-productive move. Serious credit contraction in the pipeline. Banks will be pulverised by this one. In a general trend where the NIM was shrinking through normal market mechanics and the NPL's saga yet to be properly resolved...this pops up! This one will not be signed "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,146 Location: nairobi

|

murchr wrote:lochaz-index wrote:hisah wrote:MPs endorse Bill to cap the cost of your loanQuote:Kenyan legislators have passed a Bill that seeks to cap bank interest rates at not more than four per cent above the Central Bank Rate (CBR) in their latest attempt to arrest the runaway cost of borrowing.

Chief executives of commercial banks and other lending institutions will face a Sh1 million fine or imprisonment for a term of not less than one year or both if convicted of flouting the law.

The Bill, sponsored by Kiambu MP Jude Njomo, also pegs the minimum interest granted on a deposit held in interest earning accounts to at least 70 per cent of the base rate set and published by CBK.

The MPs also urged President Uhuru Kenyatta Wednesday to quickly assent to the Bill in order to protect Kenyans from high interest rates. Whoa!!! Berserk! NSE support is no where in sight! Never underestimate a cornered politician. Such a counter-productive move. Serious credit contraction in the pipeline. Banks will be pulverised by this one. In a general trend where the NIM was shrinking through normal market mechanics and the NPL's saga yet to be properly resolved...this pops up! This one will not be signed It is highly like to be signed for wananchi points

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

In Finance the Law of Supply and Demand is Irrelevant, and EMH is Inappropriate. The socionomic theory of finance (STF) posits that contextual differences between economics and finance produce different behavior so that in finance the law of supply and demand is irrelevant....... Learn More: https://t.co/Pzbk0KRmlJConventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,146 Location: nairobi

|

[quote=mnandii]In Finance the Law of Supply and Demand is Irrelevant, and EMH is Inappropriate. The socionomic theory of finance (STF) posits that contextual differences between economics and finance produce different behavior so that in finance the law of supply and demand is irrelevant....... Learn More: https://t.co/Pzbk0KRmlJ[/quote] @mnadii long time.. good to read from you

KQ ABP 4.26

|

|

|

Rank: Member Joined: 8/17/2007 Posts: 294

|

The NSE 20 Share Index was down 18.65 points to settle at 3475.38. 3200 support in sight. The day SCOM trades exdiv the dogs will be out

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

obiero wrote:mnandii wrote: In Finance the Law of Supply and Demand is Irrelevant, and EMH is Inappropriate. The socionomic theory of finance (STF) posits that contextual differences between economics and finance produce different behavior so that in finance the law of supply and demand is irrelevant....... Learn More: https://t.co/Pzbk0KRmlJ @mnadii long time.. good to read from you  Thanks buddy! The markets are getting exciting. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

kasibitta wrote:mnandii wrote:Schools are burning now. Most people( even theories) can't connect the burning of schools to the Stock Market. Yet, they are of the same causality. I did anticipate the decline in our stock market more than a year ago (see the very first post of this wazua.co.ke thread). Now the the NSE 20 share index is declining massively. I've also posted notes here on the Socionomic aspects of the declining social mood (as measured by the declining stock index). I also indicated that the fact of Universities being opened in almost every corner of Kenya, the winning by the Teachers Union of a tremendous increase in salary for teachers and the selling of a private school at an extremely high price marked the topping process in education matters. The bear market in education was the next logical expectation. Even now there is alot of interest in higher education but when the bear catches proper, then, expect education to be shunned. So, how do we connect the burning of schools to our stock market and then to society as a whole? Simple. The NSE 20 share Index is falling, meaning that negative social mood (the Index is sensitive to mood) is taking over at large degree. The youth respond quicker to changes in social mood (remember they set the trend in fashion for example) and that is why one of the negative consequence of a decline in social mood , i.e. the tendency to destroy (by burning) has manifested itself first in schools (where most youths can be found). This means that in Kenya, going forward, negative mood will entrench itself and the rest of society will also show the destructive impulses that the youth are exhibiting. I have argued here before that come 2017, and IF the the stock market will be shuttling to below 2000 levels (which I expect to happen) then the next General Elections will be bloody i.e far worse than the 2007 -2008 one. The beauty of socionomics is that you get to anticipate events before they happen and you can therefore prepare yourself adequately. Do read: -THE WAVE PRINCIPLE OF HUMAN SOCIAL BEHAVIOUR by ROBERT PRECHTER. -CONQUER THE CRASH by ROBERT PRECHTER. www.socionomics.net Thankyou.An interesting perspective to the current happenings.Always look forward to reading your posts.Keep them coming  Thanks and welcome. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

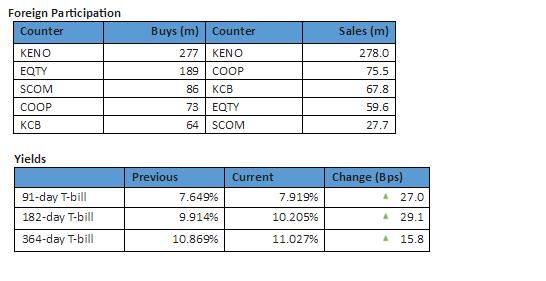

Stocks might bleed some more 182 and 364 day T Bills have significantly gone up... https://www.centralbank....results/182-days-t-billspossunt quia posse videntur

|

|

|

Rank: Veteran Joined: 2/26/2015 Posts: 1,147

|

mnandii wrote:kasibitta wrote:mnandii wrote:Schools are burning now. Most people( even theories) can't connect the burning of schools to the Stock Market. Yet, they are of the same causality. I did anticipate the decline in our stock market more than a year ago (see the very first post of this wazua.co.ke thread). Now the the NSE 20 share index is declining massively. I've also posted notes here on the Socionomic aspects of the declining social mood (as measured by the declining stock index). I also indicated that the fact of Universities being opened in almost every corner of Kenya, the winning by the Teachers Union of a tremendous increase in salary for teachers and the selling of a private school at an extremely high price marked the topping process in education matters. The bear market in education was the next logical expectation. Even now there is alot of interest in higher education but when the bear catches proper, then, expect education to be shunned. So, how do we connect the burning of schools to our stock market and then to society as a whole? Simple. The NSE 20 share Index is falling, meaning that negative social mood (the Index is sensitive to mood) is taking over at large degree. The youth respond quicker to changes in social mood (remember they set the trend in fashion for example) and that is why one of the negative consequence of a decline in social mood , i.e. the tendency to destroy (by burning) has manifested itself first in schools (where most youths can be found). This means that in Kenya, going forward, negative mood will entrench itself and the rest of society will also show the destructive impulses that the youth are exhibiting. I have argued here before that come 2017, and IF the the stock market will be shuttling to below 2000 levels (which I expect to happen) then the next General Elections will be bloody i.e far worse than the 2007 -2008 one. The beauty of socionomics is that you get to anticipate events before they happen and you can therefore prepare yourself adequately. Do read: -THE WAVE PRINCIPLE OF HUMAN SOCIAL BEHAVIOUR by ROBERT PRECHTER. -CONQUER THE CRASH by ROBERT PRECHTER. www.socionomics.net Thankyou.An interesting perspective to the current happenings.Always look forward to reading your posts.Keep them coming  Thanks and welcome. hi mnandii. welcome back. your opinion on this. my thoughts on the chart  It's not over until I winskype id: karasinga. email: kkarasinga@gmail.com

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

mnandii wrote:Schools are burning now. Most people( even theories) can't connect the burning of schools to the Stock Market. Yet, they are of the same causality. I did anticipate the decline in our stock market more than a year ago (see the very first post of this wazua.co.ke thread). Now the the NSE 20 share index is declining massively. I've also posted notes here on the Socionomic aspects of the declining social mood (as measured by the declining stock index). I also indicated that the fact of Universities being opened in almost every corner of Kenya, the winning by the Teachers Union of a tremendous increase in salary for teachers and the selling of a private school at an extremely high price marked the topping process in education matters. The bear market in education was the next logical expectation. Even now there is alot of interest in higher education but when the bear catches proper, then, expect education to be shunned. So, how do we connect the burning of schools to our stock market and then to society as a whole? Simple. The NSE 20 share Index is falling, meaning that negative social mood (the Index is sensitive to mood) is taking over at large degree. The youth respond quicker to changes in social mood (remember they set the trend in fashion for example) and that is why one of the negative consequence of a decline in social mood , i.e. the tendency to destroy (by burning) has manifested itself first in schools (where most youths can be found). This means that in Kenya, going forward, negative mood will entrench itself and the rest of society will also show the destructive impulses that the youth are exhibiting. I have argued here before that come 2017, and IF the the stock market will be shuttling to below 2000 levels (which I expect to happen) then the next General Elections will be bloody i.e far worse than the 2007 -2008 one. The beauty of socionomics is that you get to anticipate events before they happen and you can therefore prepare yourself adequately. Do read: -THE WAVE PRINCIPLE OF HUMAN SOCIAL BEHAVIOUR by ROBERT PRECHTER. -CONQUER THE CRASH by ROBERT PRECHTER. www.socionomics.net @mnandii thanks a lot for awakening us with brutal truth. I remember some Wazuans dismissed you when they first read socionomics from you. Bleeding continues... John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

When i see traces of a green market it gives me hope that one day the market will fly "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Member Joined: 5/30/2016 Posts: 332 Location: Kayole

|

mlennyma wrote:When i see traces of a green market it gives me hope that one day the market will fly Layman analysis: even though prices keep falling it means there are people buying. As some fear the market others are taking positions, depends which side you are on KEGN, KPLC, KQ, SCOM

|

|

|

Rank: Member Joined: 5/30/2016 Posts: 332 Location: Kayole

|

mkate_nusu wrote:mlennyma wrote:When i see traces of a green market it gives me hope that one day the market will fly Layman analysis: even though prices keep falling it means there are people buying. As some fear the market others are taking positions, depends which side you are on As the NSE lags global indices and if the recent highs in the Dow 30 and the like are anything to go by we should fasten our seatbelts KEGN, KPLC, KQ, SCOM

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

mkate_nusu wrote:mlennyma wrote:When i see traces of a green market it gives me hope that one day the market will fly Layman analysis: even though prices keep falling it means there are people buying. As some fear the market others are taking positions, depends which side you are on the layman is not always wrong  "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Wazua

»

Investor

»

Stocks

»

Elliott Wave Analysis Of The NSE 20

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|