Wazua

»

Investor

»

Stocks

»

KQ FY 2016 operating loss down to 4bn; net loss record (26.2bn)

Rank: User Joined: 8/15/2013 Posts: 13,237 Location: Vacuum

|

Quote:Users browsing this topic

777, ArrestedDev, DBLyon, Felipe, Guest (38), Intelligentsia, joga bonito, maka, Swenani why is @Horton missing? If Obiero did it, Who Am I?

|

|

|

Rank: Member Joined: 5/29/2016 Posts: 898 Location: Nairobi

|

maka wrote:ArrestedDev wrote:Spikes wrote:Impunity wrote:Is this 26B Net loss or Gross loss?

I feel the press is misquoting ndugu @obiero. Suppose assets were not sold imagine how wider the loss would have been! I am now forced to revise my target entry price of 2/- bob downwards to 50 cents coz the loss territory still remains in the next couple of years. I suspect that part of the other income was not booked under FY 15/16 and will be shown under FY 16/17 since not all the deals/transactions were closed before March 16. It will have an impact on the half FY 16/17 results. Many people will think it is an improved performance. @maka, This is 14/15. The impairment costs have an impact in the overall picture of the airline. Look at the price that the two B777-200ERs were sold - way below the net book value resulting to a further loss on disposal.

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

sparkly wrote:KQ investors misled by these two common psychological traps (Hello @Obiero) Source: Investopedia Quote:

DEFINITION of 'Superiority Trap'

A psychological or behavioral trap that leads people to believe that they have superior skill in some areas. The superiority trap can be a dangerous delusion in the stock market, since investors who believe their investment prowess is superior to that of others may end up losing a lot of money. One way of avoiding this trap is through retaining a sense of humility, rather than hubris. An oft-cited example of the superiority trap is the fact that the overwhelming majority of people think they are above-average drivers, which is a contradiction in itself.

DEFINITION of 'Sunk Cost Trap'

The tendency of people to irrationally follow through on an activity that is not meeting their expectations because of the time and/or money they have already spent on it. The sunk cost trap explains why people finish movies they aren’t enjoying, finish meals that taste bad, hold on to investments that are underperforming and keep clothes in their closet that they’ve never worn. The sunk cost trap is also called the Concorde fallacy after the failed supersonic Concorde jet program that funding governments insisted on completing despite the jet’s poor outlook.

Individuals, businesses and governments fall into the sunk cost trap when they base their decisions on past behavior and a desire to not waste the time or money they have already spent, instead of cutting their losses and making the decision that would give them the best outcome going forward. People are reluctant to admit, even to themselves, that they have wasted resources on a past decision. Changing directions is viewed, perhaps only subconsciously, as admitting failure. As a result, people tend to stay the course or even invest additional resources in a bad decision in a futile attempt to make their initial decision seem worthwhile.

A good read. I recommend the above analysis to everybody. John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Member Joined: 5/30/2016 Posts: 217 Location: Talai

|

Impunity wrote:New KQ.  Woi Woi Jesus Christ of Nazareth. at this rate imagewise.   let me watch and listen... Watch and Listen and Live

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

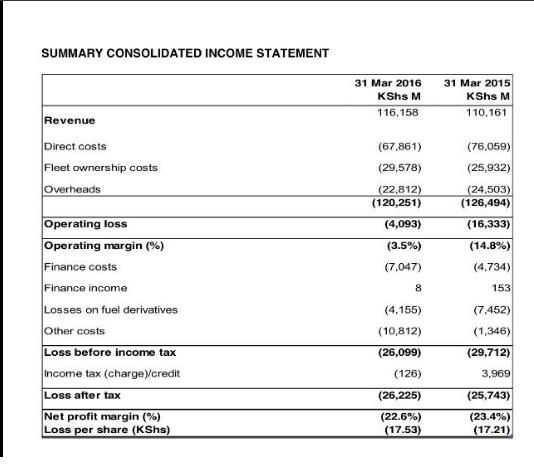

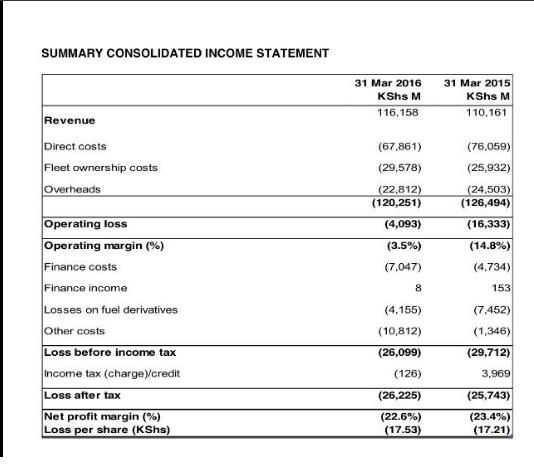

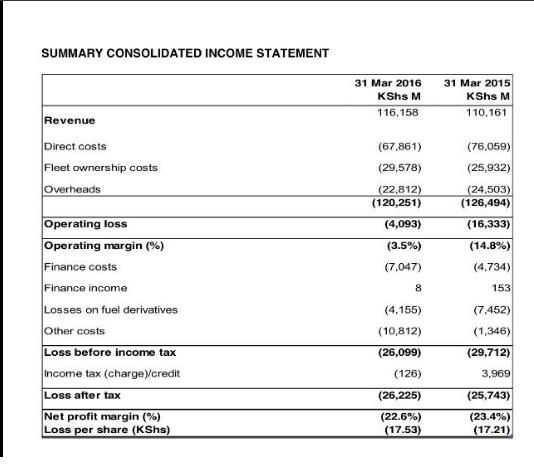

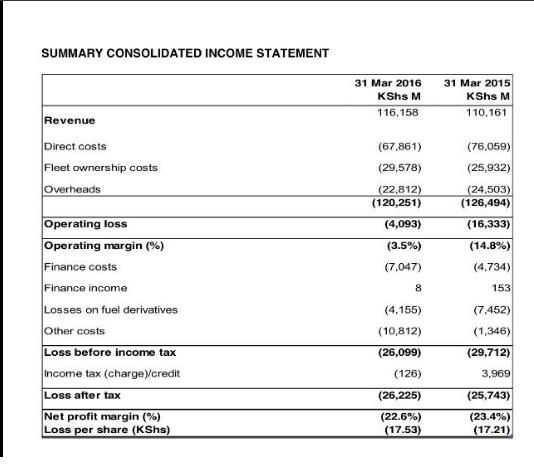

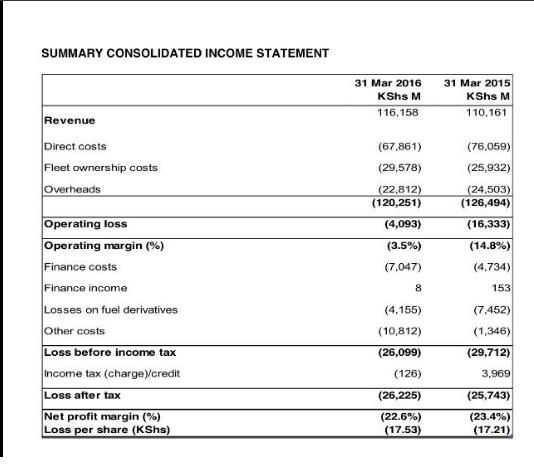

littledove wrote:KQ reduces operating loss from Kshs 16.3 billion to Kshs 4.1 billion

Revenues grew by 5% to sh. 116 billion

possunt quia posse videntur

|

|

|

Rank: Member Joined: 9/14/2011 Posts: 864 Location: nairobi

|

maka wrote:littledove wrote:KQ reduces operating loss from Kshs 16.3 billion to Kshs 4.1 billion

Revenues grew by 5% to sh. 116 billion

what makes up the other costs of 10.8B

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 926 Location: sky

|

maka wrote:littledove wrote:KQ reduces operating loss from Kshs 16.3 billion to Kshs 4.1 billion

Revenues grew by 5% to sh. 116 billion

what is that other cost, that the elephant in the room, a jump from 1.3 billion to 10.8 billion?? There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,330 Location: Masada

|

Spikes wrote:Impunity wrote:Is this 26B Net loss or Gross loss?

I feel the press is misquoting ndugu @obiero. Suppose assets were not sold imagine how wider the loss would have been! I am now forced to revise my target entry price of 2/- bob downwards to 50 cents coz the loss territory still remains in the next couple of years. 35cents would be a fair value, pound for pound! Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

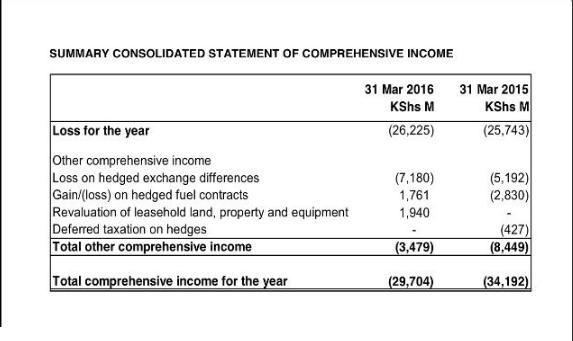

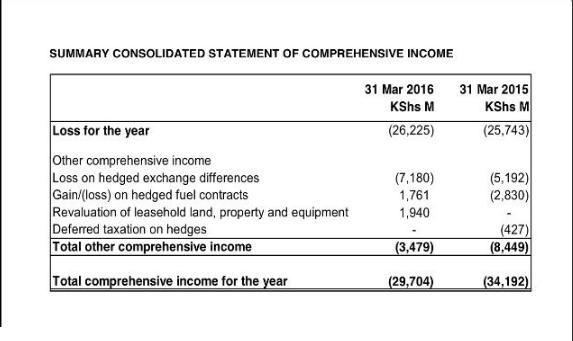

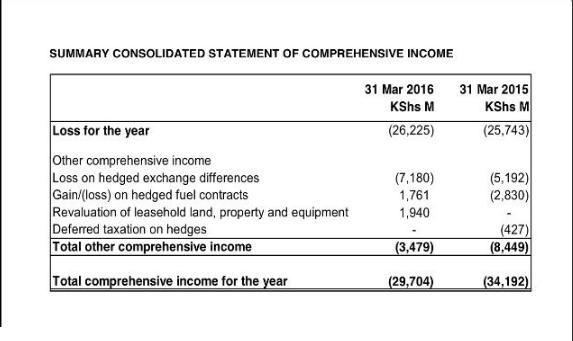

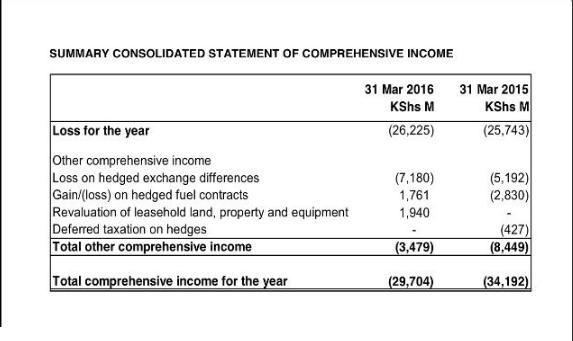

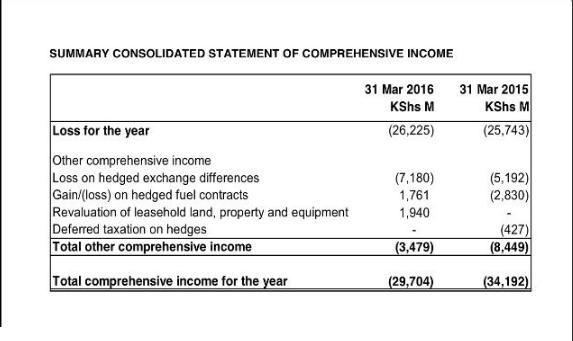

Hedged fuel contracts turned positive  Hedged exchange losses increase 38% How can the hedged fuel contracts be positive? Anyone with the breakdown of this other costs? That's a huge spike! Meanwhile the level to watch is 3.70. Price is slipping towards the 4.00 handle. Somehow the sellers are not spooked by this results based on the traded volume. Has the counter run out of sellers? $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

hisah wrote:Hedged fuel contracts turned positive  Hedged exchange losses increase 38% How can the hedged fuel contracts be positive? Anyone with the breakdown of this other costs? That's a huge spike! Meanwhile the level to watch is 3.70. Price is slipping towards the 4.00 handle. Somehow the sellers are not spooked by this results based on the traded volume. Has the counter run out of sellers? Very puzzling on the hedged fuel contracts. They still booked a loss on the derivatives albeit a decreasing one. Unless they took out new contracts(for example a collar)on additional fuel needs to cancel the losses on the old fixed hedges it doesn't make sense since outright canceling the old contracts and seeking new ones comes with heavy penalties which would have shown up here. Looking at the consolidated income statement line by line reveals a very sad affair at KQ. There is still a lot of work to be done if this stock is to get back to investment grade. Save for the approximately 9b saving in direct costs(Mckinsey's trick)the rest of the deductible line items are either flat/flattish or increasing. Finance costs also spiked by some considerable margin(this one if not well managed will sink this company beyond redemption). They have probably exhausted their tax credits at this point too. On the other costs item, the only thing that comes to mind is the consultancy costs that is; Mckinsey,Seabury,PJT and crew... In my opinion, this company will not be making a PAT for the next two financial years at the very minimum. More taxpayers money will be sunk into it year on year without a clear strategy of a turn-around. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

sparkly wrote:KQ investors misled by these two common psychological traps (Hello @Obiero) Source: Investopedia Quote:

DEFINITION of 'Superiority Trap'

A psychological or behavioral trap that leads people to believe that they have superior skill in some areas. The superiority trap can be a dangerous delusion in the stock market, since investors who believe their investment prowess is superior to that of others may end up losing a lot of money. One way of avoiding this trap is through retaining a sense of humility, rather than hubris. An oft-cited example of the superiority trap is the fact that the overwhelming majority of people think they are above-average drivers, which is a contradiction in itself.

DEFINITION of 'Sunk Cost Trap'

The tendency of people to irrationally follow through on an activity that is not meeting their expectations because of the time and/or money they have already spent on it. The sunk cost trap explains why people finish movies they aren’t enjoying, finish meals that taste bad, hold on to investments that are underperforming and keep clothes in their closet that they’ve never worn. The sunk cost trap is also called the Concorde fallacy after the failed supersonic Concorde jet program that funding governments insisted on completing despite the jet’s poor outlook.

Individuals, businesses and governments fall into the sunk cost trap when they base their decisions on past behavior and a desire to not waste the time or money they have already spent, instead of cutting their losses and making the decision that would give them the best outcome going forward. People are reluctant to admit, even to themselves, that they have wasted resources on a past decision. Changing directions is viewed, perhaps only subconsciously, as admitting failure. As a result, people tend to stay the course or even invest additional resources in a bad decision in a futile attempt to make their initial decision seem worthwhile.

If you look on the bright side, there are definitely numerous teachable lessons from KQ and @obiero; -never fall in love with a stock. -hope is not an investing/trading strategy. -never catch a falling knife. -fool me once(earlier losses)shame on you,fool me twice(last year's loss)shame on me, fool me thrice(this year's loss)..... The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

lochaz-index wrote:sparkly wrote:KQ investors misled by these two common psychological traps (Hello @Obiero) Source: Investopedia Quote:

DEFINITION of 'Superiority Trap'

A psychological or behavioral trap that leads people to believe that they have superior skill in some areas. The superiority trap can be a dangerous delusion in the stock market, since investors who believe their investment prowess is superior to that of others may end up losing a lot of money. One way of avoiding this trap is through retaining a sense of humility, rather than hubris. An oft-cited example of the superiority trap is the fact that the overwhelming majority of people think they are above-average drivers, which is a contradiction in itself.

DEFINITION of 'Sunk Cost Trap'

The tendency of people to irrationally follow through on an activity that is not meeting their expectations because of the time and/or money they have already spent on it. The sunk cost trap explains why people finish movies they aren’t enjoying, finish meals that taste bad, hold on to investments that are underperforming and keep clothes in their closet that they’ve never worn. The sunk cost trap is also called the Concorde fallacy after the failed supersonic Concorde jet program that funding governments insisted on completing despite the jet’s poor outlook.

Individuals, businesses and governments fall into the sunk cost trap when they base their decisions on past behavior and a desire to not waste the time or money they have already spent, instead of cutting their losses and making the decision that would give them the best outcome going forward. People are reluctant to admit, even to themselves, that they have wasted resources on a past decision. Changing directions is viewed, perhaps only subconsciously, as admitting failure. As a result, people tend to stay the course or even invest additional resources in a bad decision in a futile attempt to make their initial decision seem worthwhile.

If you look on the bright side, there are definitely numerous teachable lessons from KQ and @obiero; -never fall in love with a stock. -hope is not an investing/trading strategy. -never catch a falling knife. -fool me once(earlier losses)shame on you,fool me twice(last year's loss)shame on me, fool me thrice(this year's loss)..... reading a view and ignoring the disclaimer  "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,703

|

@Obiero should be placed on suicide watch!!! Anyone who knows where to physically get him??? Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Veteran Joined: 4/4/2016 Posts: 1,999 Location: Kitale

|

Fyatu wrote:In plain(wanjiku) language, can the fundies tell wazuans how KQ makes these phenomenon losses.

1. Is it that people are not flying?

2. Is it that they have excess employees who are paid lots of money?

3. Is it that Jet A-1 is very expensive?

4. Is it they are paying more parking fess at the destinations they land/operate?

5. Is it the interest charged on previous loans?

What is the issue with KQ in leihman language? Their operating costs are higher than revenue. Towards the goal of financial freedom

|

|

|

Rank: Veteran Joined: 4/4/2016 Posts: 1,999 Location: Kitale

|

maka wrote:littledove wrote:KQ reduces operating loss from Kshs 16.3 billion to Kshs 4.1 billion

Revenues grew by 5% to sh. 116 billion

Revenue kshs 116 bilion vs kshs 110 bilion.Increase of only kshs 6 bilion.Kwani with all the assets sale,that was the only amount they got? heathrow slot was more than 3 bilion,fleet sales was more than 6 bilion.Revenue alone should have been 200 bilion Towards the goal of financial freedom

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

Ebenyo wrote:maka wrote:littledove wrote:KQ reduces operating loss from Kshs 16.3 billion to Kshs 4.1 billion

Revenues grew by 5% to sh. 116 billion

Revenue kshs 116 bilion vs kshs 110 bilion.Increase of only kshs 6 bilion.Kwani with all the assets sale,that was the only amount they got? heathrow slot was more than 3 bilion,fleet sales was more than 6 bilion.Revenue alone should have been 200 bilion Which means in the next financial year KQ will break its own record again. Expect an announcement of ksh 40B loss next year ! John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 5/25/2012 Posts: 4,105 Location: 08c

|

Market the Airline, not the financials - Pesa, 21 July 2016  Pesa Nane plans to be shilingi when he grows up.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

lochaz-index wrote:hisah wrote:Hedged fuel contracts turned positive  Hedged exchange losses increase 38% How can the hedged fuel contracts be positive? Anyone with the breakdown of this other costs? That's a huge spike! Meanwhile the level to watch is 3.70. Price is slipping towards the 4.00 handle. Somehow the sellers are not spooked by this results based on the traded volume. Has the counter run out of sellers? Very puzzling on the hedged fuel contracts. They still booked a loss on the derivatives albeit a decreasing one. Unless they took out new contracts(for example a collar)on additional fuel needs to cancel the losses on the old fixed hedges it doesn't make sense since outright canceling the old contracts and seeking new ones comes with heavy penalties which would have shown up here. Looking at the consolidated income statement line by line reveals a very sad affair at KQ. There is still a lot of work to be done if this stock is to get back to investment grade. Save for the approximately 9b saving in direct costs(Mckinsey's trick)the rest of the deductible line items are either flat/flattish or increasing. Finance costs also spiked by some considerable margin(this one if not well managed will sink this company beyond redemption). They have probably exhausted their tax credits at this point too. On the other costs item, the only thing that comes to mind is the consultancy costs that is; Mckinsey,Seabury,PJT and crew... In my opinion, this company will not be making a PAT for the next two financial years at the very minimum. More taxpayers money will be sunk into it year on year without a clear strategy of a turn-around. Finance costs

That's a huge gamble on their huge debt being heavily denominated in USD.

Current affairs in the global market indicates being stuck with USD debt is a dangerous game as it readies to gain more strength due to brexit fallout! Plenty of forex losses next year will likely be reported again.

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,798 Location: NAIROBI

|

Obiero aliuza shares jana when KQ touched a high of 4.80 yesterday and he made his profit Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Getting out of a hole is more of a hard task, but they have to take down those operating costs. "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Wazua

»

Investor

»

Stocks

»

KQ FY 2016 operating loss down to 4bn; net loss record (26.2bn)

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|