Wazua

»

Investor

»

Stocks

»

EABL HY 2016 earnings up 74% on sale of CGI

Rank: Veteran Joined: 7/1/2014 Posts: 922 Location: sky

|

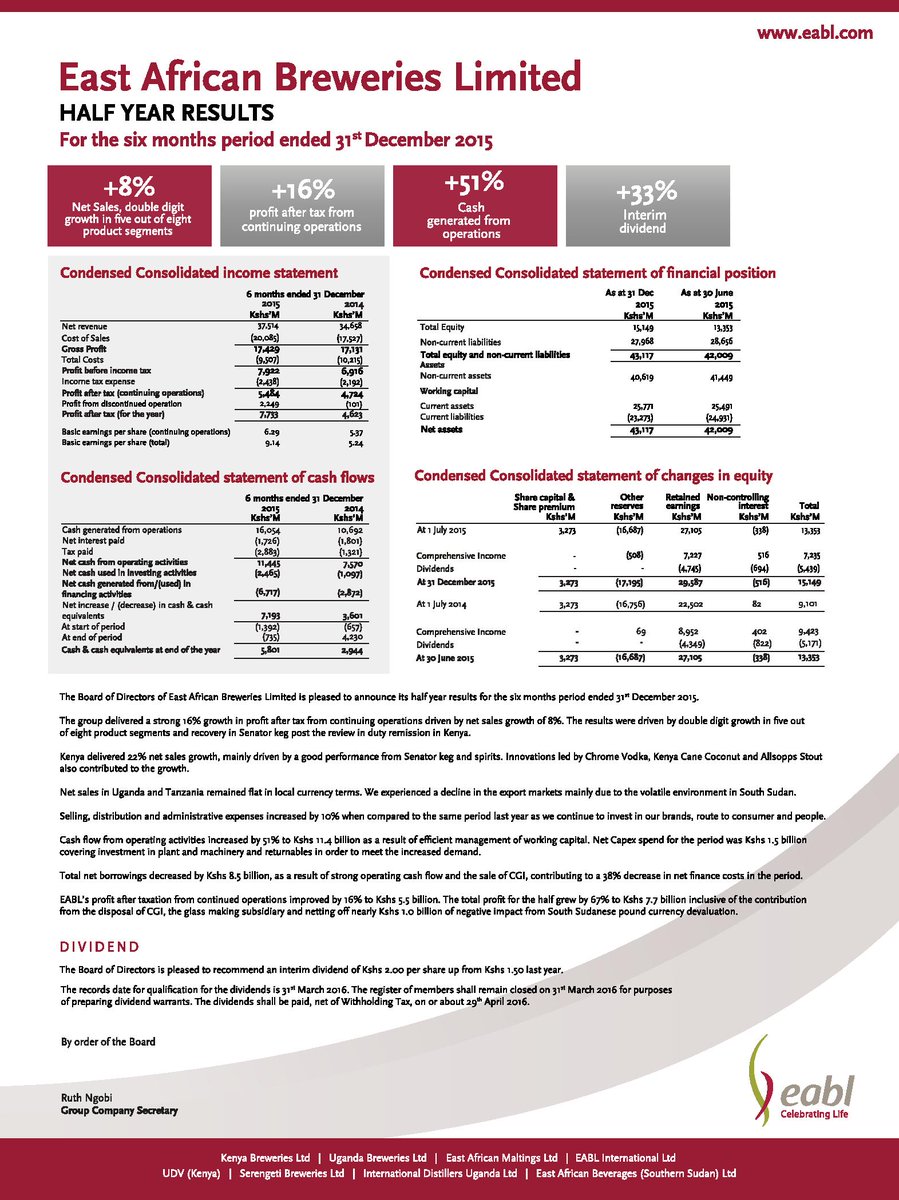

EABL Half Year Pretax Profit up by 14.55% to KES 7.92 Billion compared to the same period in 2014 recommend an interim dividend of KES 2.00 per share There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 922 Location: sky

|

There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,778 Location: NAIROBI

|

Link to the PDF results; https://www.eabl.com/dow...yearresults-feb2016.pdf

Profit boosted by; Sale of CGI--Profit after tax from sale of ksh.2.2bn Sale of land for ksh.707mn Sale of CGI helped to reduce net borrowings from ksh.29bn to ksh.22.485bn South Sudan suffered a huge decline due to devaluation of the currency.Forex loss of ksh.537mn. Net sales growth in South Sudan declined by 74% In Uganda net sales declined by 7% and Tanzania 12% In Kenya sales improved by 22% Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Ericsson wrote:Link to the PDF results; https://www.eabl.com/dow...yearresults-feb2016.pdf

Profit boosted by; Sale of CGI--Profit after tax from sale of ksh.2.2bn Sale of land for ksh.707mnSale of CGI helped to reduce net borrowings from ksh.29bn to ksh.22.485bn South Sudan suffered a huge decline due to devaluation of the currency.Forex loss of ksh.537mn.Net sales growth in South Sudan declined by 74% In Uganda net sales declined by 7% and Tanzania 12%In Kenya sales improved by 22% Don't know what to say...they need new energy in TZ and UG "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

http://mobile.reuters.com/article/idUSL8N15C3KRJohn 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

http://mobile.reuters.com/article/idUSL8N15C3KRJohn 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,224 Location: Nairobi

|

EABL lost the plot when they sold off 20% of TBL for a pittance and then paid 3x that for 20% of KBL. They took on debt to finance the acquisition of 20% of KBL. Then more debt to buy Serengeti Breweries. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Multinational brewer Diageo is set to walk away with approximately Sh1.78 billion from the special dividends that its subsidiary East African Breweries Limited (EABL) has declared from the sale of its glass-making business. The regional brewer has announced a special payout of Sh4.50 per share that will see Diageo, which owns 50.03 per cent of the brewer (395.6 million of the firm’s issued shares) get a tidy payout. EABL sold off Central Glass Industries (CGI) to South Africa’s Consol Glass in September for Sh4.5 billion. The beer maker had initially told its shareholders that the money would go towards reducing existing debt and investing in its core business. http://www.businessdaily...48/-/a5bv0i/-/index.html"There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Member Joined: 6/17/2008 Posts: 36

|

What's the cut-off for owning the shares to get the pay out?

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,224 Location: Nairobi

|

[quote=murchr]Multinational brewer Diageo is set to walk away with approximately Sh1.78 billion from the special dividends that its subsidiary East African Breweries Limited (EABL) has declared from the sale of its glass-making business. The regional brewer has announced a special payout of Sh4.50 per share that will see Diageo, which owns 50.03 per cent of the brewer (395.6 million of the firm’s issued shares) get a tidy payout. EABL sold off Central Glass Industries (CGI) to South Africa’s Consol Glass in September for Sh4.5 billion. The beer maker had initially told its shareholders that the money would go towards reducing existing debt and investing in its core business. http://www.businessdaily...8/-/a5bv0i/-/index.html[/quote] I prefer EABL paying down the debt during these uncertain times... Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Business Daily - July 20 wrote:Beer maker East Africa Breweries Limited (EABL) wants the High Court to lift an order barring it from appointing other suppliers to routes operated by supplies firm Bia Tosha, arguing that the directive has put it at risk of being sued by third parties. The

EABL says in an application filed yesterday that the contract it has with Bia Tosha and other distributors are not exclusive, and that it has appointed more than one supplier in some routes who may now sue it if the order is not lifted. the Star June 21 wrote:Kenya’s largest brewer, EABL has lost a bid to appoint another beer distributor on the same routes as its single-largest distributor, Bia Tosha.

The High court yesterday declined to set aside an order stopping EABL from allowing other distributors to supply on the same routes as Bia Tosha.

The beer maker had filed an urgent application at the High Court saying the orders issued in favour of Bia Tosha on June 14 were obtained through misrepresentation of facts.

Through lawyer Kamau Karori, EABL accused the distributor of failing to disclose material facts, which if they had been presented, the court would not have issued the orders. Online news is instant. Nation media needs to move with speed or they will be rendered irrelevant. "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,778 Location: NAIROBI

|

Nation media newspapers ni za kufunga nyama, nyama choma, kachumbari na glass products Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Member Joined: 5/6/2014 Posts: 268 Location: Nairobi, Kenya

|

Ericsson wrote:Nation media newspapers ni za kufunga nyama, nyama choma, kachumbari na glass products Bigger market, you mean? The more nyama you 'funga' the bigger the Nation Media revenue .

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,778 Location: NAIROBI

|

@Akenyan2014 Yes hiyo si ya kusoma news. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,778 Location: NAIROBI

|

Another asset sale to prop up profits in the financial year 2016/2017. http://www.businessdaily...74/-/4n3vkm/-/index.htmlWealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Member Joined: 3/3/2016 Posts: 132

|

[quote=Ericsson]Another asset sale to prop up profits in the financial year 2016/2017. http://www.businessdaily...4/-/4n3vkm/-/index.html[/quote] Brilliant move. Sell the overvalued asset for 675 million and rent it. Real estate prices are so high renting wins over buying easily, especially for corporates.

|

|

|

Rank: Veteran Joined: 6/23/2011 Posts: 1,740 Location: Nairobi

|

Let the shareholder benefit by getting some dividends and capital appreciation.

Keeping the land will not help the shareholder at all

.

|

|

|

Rank: Veteran Joined: 8/30/2007 Posts: 1,558 Location: Nairobi

|

Plimsoul wrote:[quote=Ericsson]Another asset sale to prop up profits in the financial year 2016/2017. http://www.businessdaily...4/-/4n3vkm/-/index.html[/quote] Brilliant move. Sell the overvalued asset for 675 million and rent it. Real estate prices are so high renting wins over buying easily, especially for corporates. Not sure if that was indeed a "brilliant move" for eabl anyway....... With quick fire asset disposals, what I can see with my naked eye is that they are in serious need of cash. Was Selling CGI a brilliant move? I dont know, time will tell. 7-8% yield is actually a good yield for commercial real estate, from a large company, commiting a LT lease and I assume a 5-10% rental acceleration yearly, these tembo sacco guys will be singing show tunes in no time. The notion "real estate is overvalued" has been sung for too long now still waiting on the crash. Prices have corrected slightly, but rentals are still going strong yielding quite nicely

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,778 Location: NAIROBI

|

EABL should have setup a real estate arm and construct commercial buildings for rent on the land they own. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Wazua

»

Investor

»

Stocks

»

EABL HY 2016 earnings up 74% on sale of CGI

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|