Wazua

»

Investor

»

Stocks

»

Elliott Wave Analysis Of The NSE 20

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Sufficiently Philanga....thropic wrote:Next support, 3070 low of December 2011,below that opens up to 2360, the March 2009 GFC lows.  possunt quia posse videntur

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

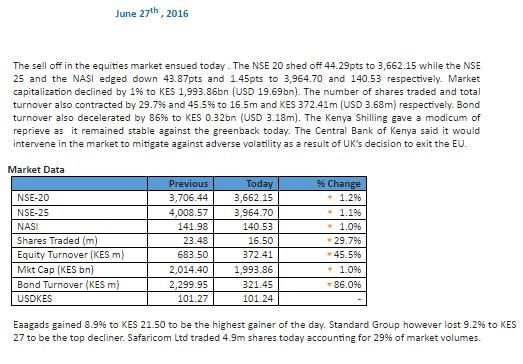

hisah wrote:Sufficiently Philanga....thropic wrote:Finally, 3662,.....4 year low last seen in June 2012 prints.....on the NSE20  Finally the weekly chart bollinger squeeze raptures to the downside. Volatility is back! That setup has taken time to form. Solid distribution that was so the market should fall like a rock! Losing the 3700 - 4000 trading range confirms lower lows trend continuation. 200 day EMA is at 3724 and the index is now below this value confirming bears are firmly in control. Fat tails coming up  The narrow trading range gives way. Eight months on the trot it had been stagnant and it chooses post brexit to snap out of its slumber. Only during the GFC period did it mark time for that long and we all know at what level we ended up in. Bear in mind that these are just the aftershocks of the vote and not the real tremors. This does not portend well for the NSE20. Crash and burn coming up. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Sufficiently Philanga....thropic wrote:Next support, 3070 low of December 2011,below that opens up to 2360, the March 2009 GFC lows. I am still working with the the base case scenario that we will probably not bottom out till we are in sub 2000 territory. Working with that presupposition even the GFC low won't hold. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

lochaz-index wrote:Sufficiently Philanga....thropic wrote:Next support, 3070 low of December 2011,below that opens up to 2360, the March 2009 GFC lows. I am still working with the the base case scenario that we will probably not bottom out till we are in sub 2000 territory. Working with that presupposition even the GFC low won't hold. Recession gallore. The $ is about to become very strong with money moving to safe havens. "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

Chartists remain standing. The rest in disbelief. Waiting for those fat tails. Is there a time frame of how long we could be down in the abbys The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Aguytrying wrote:Chartists remain standing. The rest in disbelief. Waiting for those fat tails. Is there a time frame of how long we could be down in the abbys Trading desks will get busy as summer vacation comes to an end. August/September activity (I expect sizable selling) as books are squared post brexit with a formenting EU madness den, will give an indication of how strong the gravity pull is. For now don't catch a falling knife. The USD rocket is yet to show up and you don't want to stand infront of that force!! $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,317 Location: Nairobi

|

Aguytrying wrote:On Dtb. I think it's the post bonus issue dilution, coupled with bear run and lack of liquidity. But here might be biased coz I have shares. It's getting to the sweet spot DTB - I trust the Management KCB - I am not so sure about the management. Those NPLs... Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Veteran Joined: 6/17/2009 Posts: 1,624

|

lochaz-index wrote:Sufficiently Philanga....thropic wrote:Next support, 3070 low of December 2011,below that opens up to 2360, the March 2009 GFC lows. I am still working with the the base case scenario that we will probably not bottom out till we are in sub 2000 territory. Working with that presupposition even the GFC low won't hold. Do you figure what kind of stock prices would bring NSE 20 to that? EABL@150,SAFCOM @10,Equity @ 21,Centum@24,BAT@450..Much as i look forward to nice discounts that would be insanity and i had enough of it in 09 to last me a lifetime.

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

cnn wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:Next support, 3070 low of December 2011,below that opens up to 2360, the March 2009 GFC lows. I am still working with the the base case scenario that we will probably not bottom out till we are in sub 2000 territory. Working with that presupposition even the GFC low won't hold. Do you figure what kind of stock prices would bring NSE 20 to that? EABL@150,SAFCOM @10,Equity @ 21,Centum@24,BAT@450..Much as i look forward to nice discounts that would be insanity and i had enough of it in 09 to last me a lifetime. @cnn that's called value investing, not insanity. buying a stock with a forward pe of 20 with the prevailing economic madness and market prices is what is insanity. simply stated it will take 20 years or so for your investment to break even if all earnings were to be dished out as dividends. why put a cent of my coin into such Molotov cocktail of misery. Afadhali kuuza mutumba gikomba ama sukuma na kujenga kibanda kando ya barabara. fantasy chasers just woke up to a harsh reality. ,Behold, a sower went forth to sow;....

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

NSE 20 share index at 3000 is not far fetched. At that level safaricom will be about khs.12,Equity 21-25,Centum 23,EABL 170 Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

I see now we are heading to extreme pessimism zone. which means bottom aint far. 2000? that would be spectacular fallout The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

Ericsson wrote:NSE 20 share index at 3000 is not far fetched.

At that level safaricom will be about khs.12,Equity 21-25,Centum 23,EABL 170 It is very possible though a lot of water must snarl up below the bridge. In a couple of months we shall be there and even deeper. John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

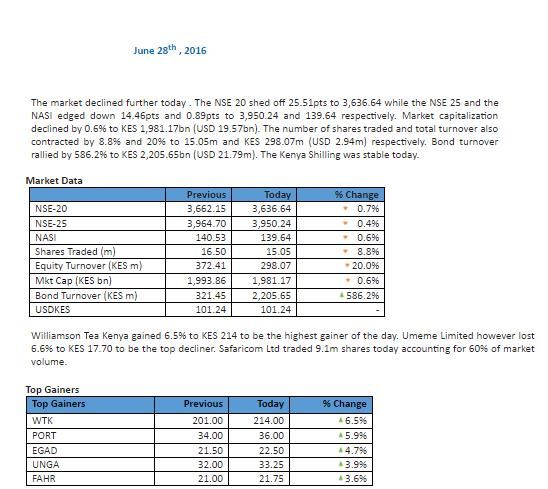

NSE20 closes at 3636 as the market tries to catch a bid. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

hisah wrote:NSE20 closes at 3636 as the market tries to catch a bid. approaching a whole 2,000 points down. "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

mlennyma wrote:hisah wrote:NSE20 closes at 3636 as the market tries to catch a bid. approaching a whole 2,000 points down.   possunt quia posse videntur

|

|

|

Rank: Veteran Joined: 8/16/2009 Posts: 994

|

mlennyma wrote:hisah wrote:NSE20 closes at 3636 as the market tries to catch a bid. approaching a whole 2,000 points down. Loving it all the way.   Time is money, so money is time. Money saved is time gained in reverse! Money stores your life’s energy. You expend your energy, get paid money, and store that money for a future purchase made in a currency.

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

Gatheuzi wrote:mlennyma wrote:hisah wrote:NSE20 closes at 3636 as the market tries to catch a bid. approaching a whole 2,000 points down. Loving it all the way.   Me too equity, stanchart, soon joining the 'party' The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

Aguytrying wrote:Gatheuzi wrote:mlennyma wrote:hisah wrote:NSE20 closes at 3636 as the market tries to catch a bid. approaching a whole 2,000 points down. Loving it all the way.   Me too equity, stanchart, soon joining the 'party' but remember in bear markets the danger of being left out looms large, when all hope drys Mr market rallies up "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

mlennyma wrote:Aguytrying wrote:Gatheuzi wrote:mlennyma wrote:hisah wrote:NSE20 closes at 3636 as the market tries to catch a bid. approaching a whole 2,000 points down. Loving it all the way.   Me too equity, stanchart, soon joining the 'party' but remember in bear markets the danger of being left out looms large, when all hope drys Mr market rallies up True this is most painful The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Wazua

»

Investor

»

Stocks

»

Elliott Wave Analysis Of The NSE 20

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|