Wazua

»

Investor

»

Stocks

»

Elliott Wave Analysis Of The NSE 20

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

Sufficiently Philanga....thropic wrote:hisah wrote:Sufficiently Philanga....thropic wrote: And I'll take you back to May 2013.

Quote:Kenya’s Central bank on Tuesday lowered its benchmark lending rate —the Central Bank Rate (CBR)— by 100 basis points citing the country’s low inflation figure and the shilling’s continued stability against major currencies.

Furthermore, the prevailing weather conditions continue to support a low and stable short-term outlook for food inflation in spite of the risk posed by floods on food production and distribution,” said the MPC in a statement.

2yrs later MPC sounds the same... Back then a new gok was setting base. We're now headed to another election, brexit, Trump presidency...

All the best!

Cable is going strong despite this.1.4707 ATM!Wow!!! On Trump presidency, i expect a proper shave on the USD should this nightmare happen. Let Yellen & co continue scaring us with FED rate hike. They will chicken out again in June. Aha....they stayed true to their calling.......never to disappoint.  @SufficientlyP

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

SPT, brexit is a crazy event risk. But expect the Fed to hike otherwise their credibility comes into question... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

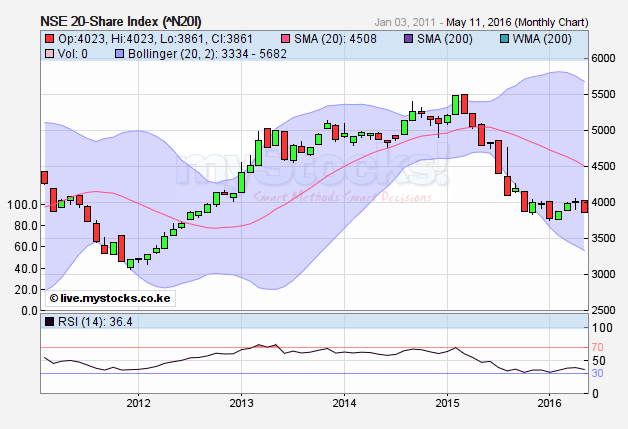

The NSE20 band is getting tighter and tighter in recent weeks. 3770-3830 it has been for about two weeks now. Seems like Mr market is waiting for safcom to top out first before bolting out of its self imposed jail. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

lochaz-index wrote:The NSE20 band is getting tighter and tighter in recent weeks. 3770-3830 it has been for about two weeks now. Seems like Mr market is waiting for safcom to top out first before bolting out of its self imposed jail. Brexit event risk will be a volatility cocktail! Spectacular crash or rally coming up.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 8/17/2007 Posts: 294

|

mnandii wrote:We have ended up with an 'ending diagonal' in the NSE. The drop from current levels will be breathtaking! I will post a chart later. if only we had listened....

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

hisah wrote:lochaz-index wrote:The NSE20 band is getting tighter and tighter in recent weeks. 3770-3830 it has been for about two weeks now. Seems like Mr market is waiting for safcom to top out first before bolting out of its self imposed jail. Brexit event risk will be a volatility cocktail! Spectacular crash or rally coming up. I am counting on a crash. It seems like the easier path while the rest of the issues sort themselves out. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

All the CB's chose to stay their hands. The Fed especially didn't come out smelling like roses...all the dithering and retractions are taking their toll on its credibility. Going forward, they will have a very tough time justifying any decisions they come up with in addition to being ineffective. Decoupling in the making. By holding rates constant, could be they are expecting a bremain after the vote since nothing would change and any after effects may not be far reaching. A brexit on the other hand will pull the proverbial rug from under their feet and they will be chasing the market/behind the curve for a long time. The ECB and BoJ will have it particularly rough if a brexit comes to fruition. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Member Joined: 3/23/2011 Posts: 304

|

lochaz-index wrote:hisah wrote:lochaz-index wrote:The NSE20 band is getting tighter and tighter in recent weeks. 3770-3830 it has been for about two weeks now. Seems like Mr market is waiting for safcom to top out first before bolting out of its self imposed jail. Brexit event risk will be a volatility cocktail! Spectacular crash or rally coming up. I am counting on a crash. It seems like the easier path while the rest of the issues sort themselves out. Also hoping on an exit but the last couple of years have had us kick the can down the road and expect the same (Rally to ATHs). Posted this video over on Investor Lounge that goes into some detail about the pros of an exit. https://www.youtube.com/watch?v=UTMxfAkxfQ0 You dont have to be great to START but you have to start to be GREAT!!!!!!!!

|

|

|

Rank: Member Joined: 8/17/2007 Posts: 294

|

alutacontinua wrote:lochaz-index wrote:hisah wrote:lochaz-index wrote:The NSE20 band is getting tighter and tighter in recent weeks. 3770-3830 it has been for about two weeks now. Seems like Mr market is waiting for safcom to top out first before bolting out of its self imposed jail. Brexit event risk will be a volatility cocktail! Spectacular crash or rally coming up. I am counting on a crash. It seems like the easier path while the rest of the issues sort themselves out. Also hoping on an exit but the last couple of years have had us kick the can down the road and expect the same (Rally to ATHs). Posted this video over on Investor Lounge that goes into some detail about the pros of an exit. https://www.youtube.com/watch?v=UTMxfAkxfQ0 http://www.businessdaily...0/-/4j1lht/-/index.html

. "Recent T-bill auctions have attracted heavy bids from investors, indicating a highly liquid market that would see investors compete more fiercely for the few viable investments available."

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

alutacontinua wrote:lochaz-index wrote:hisah wrote:lochaz-index wrote:The NSE20 band is getting tighter and tighter in recent weeks. 3770-3830 it has been for about two weeks now. Seems like Mr market is waiting for safcom to top out first before bolting out of its self imposed jail. Brexit event risk will be a volatility cocktail! Spectacular crash or rally coming up. I am counting on a crash. It seems like the easier path while the rest of the issues sort themselves out. Also hoping on an exit but the last couple of years have had us kick the can down the road and expect the same (Rally to ATHs). Posted this video over on Investor Lounge that goes into some detail about the pros of an exit. https://www.youtube.com/watch?v=UTMxfAkxfQ0 Quite interesting that documentary. I don't expect EU to permit an exit vote. That will kill the EU! The more EU stalls euro states against exiting the bad marriage, the bigger the crash will be when it triggers! After the swiss killed the euro peg last year, that was a major signal that the future of the euro is in limbo. Deflation and unemployment is a deadly cocktail for eurozone, which has only one outcome; the union and its currency has a short time to write the will... If brexit fails, then the pound has a long way to fall! It may fall to its 1985 low vs the $ in future.

Strangely though the FTSE is setting up for a major breakout (new all time highs) - brexit or not! Will the NSE FTSE indices get pulled along when that breakout triggers? I think mpesa bank has already pointed to that setup - flight to quality. Valuations out the window! Capital needs to park somewhere!$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Closed yesterday at 3765 - 20pts away from the year low. Cliff hanging with one finger. The uclers...! Will FTSE save the day?$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

hisah wrote:alutacontinua wrote:lochaz-index wrote:hisah wrote:lochaz-index wrote:The NSE20 band is getting tighter and tighter in recent weeks. 3770-3830 it has been for about two weeks now. Seems like Mr market is waiting for safcom to top out first before bolting out of its self imposed jail. Brexit event risk will be a volatility cocktail! Spectacular crash or rally coming up. I am counting on a crash. It seems like the easier path while the rest of the issues sort themselves out. Also hoping on an exit but the last couple of years have had us kick the can down the road and expect the same (Rally to ATHs). Posted this video over on Investor Lounge that goes into some detail about the pros of an exit. https://www.youtube.com/watch?v=UTMxfAkxfQ0 Quite interesting that documentary. I don't expect EU to permit an exit vote. That will kill the EU! The more EU stalls euro states against exiting the bad marriage, the bigger the crash will be when it triggers! After the swiss killed the euro peg last year, that was a major signal that the future of the euro is in limbo. Deflation and unemployment is a deadly cocktail for eurozone, which has only one outcome; the union and its currency has a short time to write the will... If brexit fails, then the pound has a long way to fall! It may fall to its 1985 low vs the $ in future.

Strangely though the FTSE is setting up for a major breakout (new all time highs) - brexit or not! Will the NSE FTSE indices get pulled along when that breakout triggers? I think mpesa bank has already pointed to that setup - flight to quality. Valuations out the window! Capital needs to park somewhere! The documentary is a tad too optimistic on the consequences of an exit, however, since both camps are exaggerating and/or glossing over issues it's fair game. That said, an exit is way better for Britain with the big obstacle being that the establishment is hellbent to ensure they stay put. I am not sure whether a flight to quality will greatly impact on the NSE20 to the extent of pulling our market in a supposed lift-off since we don't have a lot of advantages vis a vis competing markets. It might actually end up increasing the rout instead of stemming it. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

lochaz-index wrote:hisah wrote:alutacontinua wrote:lochaz-index wrote:hisah wrote:lochaz-index wrote:The NSE20 band is getting tighter and tighter in recent weeks. 3770-3830 it has been for about two weeks now. Seems like Mr market is waiting for safcom to top out first before bolting out of its self imposed jail. Brexit event risk will be a volatility cocktail! Spectacular crash or rally coming up. I am counting on a crash. It seems like the easier path while the rest of the issues sort themselves out. Also hoping on an exit but the last couple of years have had us kick the can down the road and expect the same (Rally to ATHs). Posted this video over on Investor Lounge that goes into some detail about the pros of an exit. https://www.youtube.com/watch?v=UTMxfAkxfQ0 Quite interesting that documentary. I don't expect EU to permit an exit vote. That will kill the EU! The more EU stalls euro states against exiting the bad marriage, the bigger the crash will be when it triggers! After the swiss killed the euro peg last year, that was a major signal that the future of the euro is in limbo. Deflation and unemployment is a deadly cocktail for eurozone, which has only one outcome; the union and its currency has a short time to write the will... If brexit fails, then the pound has a long way to fall! It may fall to its 1985 low vs the $ in future.

Strangely though the FTSE is setting up for a major breakout (new all time highs) - brexit or not! Will the NSE FTSE indices get pulled along when that breakout triggers? I think mpesa bank has already pointed to that setup - flight to quality. Valuations out the window! Capital needs to park somewhere! The documentary is a tad too optimistic on the consequences of an exit, however, since both camps are exaggerating and/or glossing over issues it's fair game. That said, an exit is way better for Britain with the big obstacle being that the establishment is hellbent to ensure they stay put. I am not sure whether a flight to quality will greatly impact on the NSE20 to the extent of pulling our market in a supposed lift-off since we don't have a lot of advantages vis a vis competing markets. It might actually end up increasing the rout instead of stemming it. Brexit: The 16 areas at risk of VOTE RIGGINGThis article was published last month. Unless either side produces a landslide victory, close results will be subject to rigging as per the required outcome!$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 4/16/2014 Posts: 1,420 Location: Bohemian Grove

|

hisah wrote:lochaz-index wrote:hisah wrote:alutacontinua wrote:lochaz-index wrote:hisah wrote:lochaz-index wrote:The NSE20 band is getting tighter and tighter in recent weeks. 3770-3830 it has been for about two weeks now. Seems like Mr market is waiting for safcom to top out first before bolting out of its self imposed jail. Brexit event risk will be a volatility cocktail! Spectacular crash or rally coming up. I am counting on a crash. It seems like the easier path while the rest of the issues sort themselves out. Also hoping on an exit but the last couple of years have had us kick the can down the road and expect the same (Rally to ATHs). Posted this video over on Investor Lounge that goes into some detail about the pros of an exit. https://www.youtube.com/watch?v=UTMxfAkxfQ0 Quite interesting that documentary. I don't expect EU to permit an exit vote. That will kill the EU! The more EU stalls euro states against exiting the bad marriage, the bigger the crash will be when it triggers! After the swiss killed the euro peg last year, that was a major signal that the future of the euro is in limbo. Deflation and unemployment is a deadly cocktail for eurozone, which has only one outcome; the union and its currency has a short time to write the will... If brexit fails, then the pound has a long way to fall! It may fall to its 1985 low vs the $ in future.

Strangely though the FTSE is setting up for a major breakout (new all time highs) - brexit or not! Will the NSE FTSE indices get pulled along when that breakout triggers? I think mpesa bank has already pointed to that setup - flight to quality. Valuations out the window! Capital needs to park somewhere! The documentary is a tad too optimistic on the consequences of an exit, however, since both camps are exaggerating and/or glossing over issues it's fair game. That said, an exit is way better for Britain with the big obstacle being that the establishment is hellbent to ensure they stay put. I am not sure whether a flight to quality will greatly impact on the NSE20 to the extent of pulling our market in a supposed lift-off since we don't have a lot of advantages vis a vis competing markets. It might actually end up increasing the rout instead of stemming it. Brexit: The 16 areas at risk of VOTE RIGGINGThis article was published last month. Unless either side produces a landslide victory, close results will be subject to rigging as per the required outcome! Over to MI6. Brexit can't be allowed by the powers that be. You can take that to your favorite bookie!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Dear NSE PPT I hope you are ready today. Maybe a market shutdown will be necessary! Putin shut the market during GFC so that heads could settle down  FTSE has crashed 7.7% in asian session! When europe opens it'll be crazy. As for volatility hunters we're getting into the hopeless end of the curve where fattest discounts are to be found. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

@hisah, do you see another recession? "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Veteran Joined: 8/16/2009 Posts: 994

|

Brexit carries the day!Bloomberg wrote: The BBC, ITV and Sky News project the Leave campaign has won Britain's EU referendum, Bloomberg News reports. Time is money, so money is time. Money saved is time gained in reverse! Money stores your life’s energy. You expend your energy, get paid money, and store that money for a future purchase made in a currency.

|

|

|

Rank: Veteran Joined: 8/16/2009 Posts: 994

|

Gatheuzi wrote:Brexit carries the day!Bloomberg wrote: The BBC, ITV and Sky News project the Leave campaign has won Britain's EU referendum, Bloomberg News reports. BBC forecasts Leave had wonBBC wrote: The UK has voted by 52% to 48% to leave the European Union after 43 years in an historic referendum, a BBC forecast suggests.

London and Scotland voted strongly to stay in the EU but the remain vote has been undermined by poor results in the north of England.

Voters in Wales and the English shires have backed Brexit in large numbers.

The pound fell to its lowest level against the dollar since 1985 as the markets reacted to the results. Time is money, so money is time. Money saved is time gained in reverse! Money stores your life’s energy. You expend your energy, get paid money, and store that money for a future purchase made in a currency.

|

|

|

Rank: Veteran Joined: 8/16/2009 Posts: 994

|

Time is money, so money is time. Money saved is time gained in reverse! Money stores your life’s energy. You expend your energy, get paid money, and store that money for a future purchase made in a currency.

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

Sufficiently Philanga....thropic wrote: As you can see from the above cartoon, we bottomed in Jan at 3745, the bears having taken charge since March 2015 after we hit 5500 on the NSE20. Before that, the previous bottom was the Dec 2011 low of 3070 which gave way to the bull, made more vicious by the discovery of oil news in Q12012. They controlled the show for about 15 months, with a few corrections in between, eg after the swearing in of Uhuru in April 2013. Bank collapses will shift capital to Government stock and Equities from FDRs. A surge in Treasury bids will bring down yields hence my bottom call. Scom and Equity have both announced FY and Q12016 respectively and its now all systems go. We just need a spark akin to the Q12012 discovery of oil news and the bull will develop legs and run till August 2017, when i foresee a major correction after announcement of the major news. IMF and western envoys are beginning to lecture the opposition and its anyone's guess where they lean.....pointer to political stability in the run up to 2017 elections. Notice today's price movements and foreign interest in Mpesa and member and you don't want to be left out lamenting  #StockUp Expect NSE to tankto 3600 levels today. With brexit, New lows will be the norm  And there goes my bottom call  @SufficientlyP

|

|

|

Wazua

»

Investor

»

Stocks

»

Elliott Wave Analysis Of The NSE 20

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|