Wazua

»

Investor

»

Stocks

»

Elliott Wave Analysis Of The NSE 20

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

hisah wrote:sparkly wrote:hisah wrote:NPL spike and the weird CFC results are indeed reinforcing my lunatic call to short KE banks! What's weird on CFC results? Those CFC results don't feel right. The loss recovery don't make sense compared to the H1 report. Very suspect results vis a vis the business environment in Q4. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 8/16/2009 Posts: 994

|

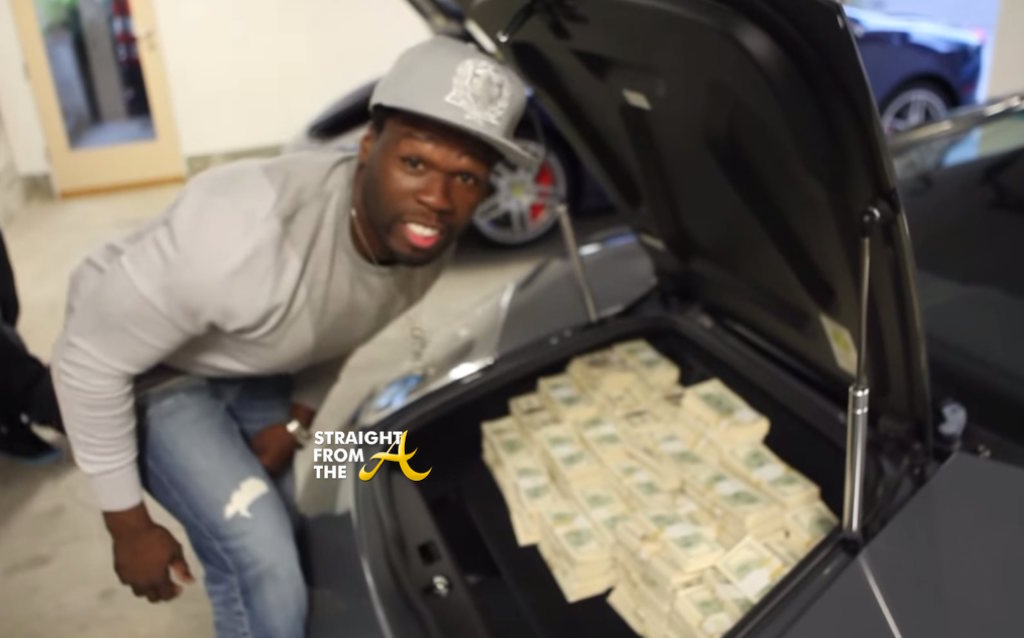

Very interesting read. Explains niggaz insatiable appetite for show off. See how 50 cent is making the judge doubt he is bankrupt. Sonko ako hapo pia. wsj article link. Time is money, so money is time. Money saved is time gained in reverse! Money stores your life’s energy. You expend your energy, get paid money, and store that money for a future purchase made in a currency.

|

|

|

Rank: Elder Joined: 12/25/2014 Posts: 2,301 Location: kenya

|

Gatheuzi wrote:Very interesting read. Explains niggaz insatiable appetite for show off. See how 50 cent is making the judge doubt he is bankrupt. Sonko ako hapo pia.  @murchr I see your point after reading the post and link above .

|

|

|

Rank: Member Joined: 1/3/2014 Posts: 257

|

sparkly wrote:instinct wrote:moving on up....moving on up...4,000 here we come.. Temporary correction or leaving the stage for good? Good question. @mnandii does this count from post 783 still hold? http://www.wazua.co.ke/f...&m=680920#post680920

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

sparkly wrote:instinct wrote:moving on up....moving on up...4,000 here we come.. Temporary correction or leaving the stage for good? Temporary correction in my opinion. Next leg down coming up. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

lochaz-index wrote:sparkly wrote:instinct wrote:moving on up....moving on up...4,000 here we come.. Temporary correction or leaving the stage for good? Temporary correction in my opinion. Next leg down coming up. Since metrics don't lie I believe this is a makeshift price correction . The downward trend will very soon obliterate the gains enjoyed by some stock gurus. John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

CEOs face pay cut as new corporate code comes into forceYet again the law of unintended consequences comes into play. This just like the lending rates control law will unleash opposite effects! NSE bull legs are getting sliced by a thousand cuts... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

What happens when suddenly one euro or one pound falls dramatically vs KES? It happened last year to the euro and the net effect was a sagging NSE, which lingers to date. If one pound sinks below KES 100 handle what happens to the portfolio in pounds in a sagging market? These wild currency moves will shatter EM markets as the same foreign currencies bleed vs the local currency while the USD strangles everyone as it sharply inflates in value. This is an outlier liquidity vacuum event! Mattress banks will return with a bang! $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

muandiwambeu wrote:Spikes wrote:moneydust wrote:muandiwambeu wrote:Aguytrying wrote:hisah wrote:murchr wrote:hisah wrote:Spikes wrote:hisah wrote:Watch out for mpesa bank... The swift drops are coming! @hisah are you holding anything or as for you now cash is king? Still in cash. I wanted to board bamburi but decided not to as the market was hinting to give fatter discounts this year. NIC is also on my strike list. I was thinking about Bamburi too because of SGR but the trailing PE 17.6 is not pleasing at all, are you able to gauge what the forward PE would be? My forecast for BAMB is

Turnover 40B vs 36B

EPS - 13 vs 9.80 boosted by forex gains on USD cash holdings thus forward PER = 13.3

Total DPS - 12 (6+6) - Dividend yield at current stock price (173) is 6.9%

I expect this stock stay afloat in the current bearish storm.

That's encouraging coming from you. But we have to agree if the market gets to 3000 points, bamburi will have to shed some weight though not 50% like some have shed Construction boom has leveled up in Kenya. There is cut throat competition in built environment and thinking that Bamburi is Mr king is not here or there. For a whole year in construction have used every brand from Savanah to bamburi with equal access. Unlike before.  My sentiments exactly.I wouldnt buy into a cement company right now,there is too much dust in the air.Only the most efficient and strategic cement company will survive the bruising fight ahead. One thing I know and I would wish shared with Wazuans is that some stocks will remain resilient throughout the bear market. Especially the stocks that are expecting good news after being in the dark for more than three years. Archive/bookmark this thread you will come remembering me! If you know why arm or eapc are where they are, know they grazing field is overpopulated. You might be lucky to have a hump to survive, but you will have a tale to tell how your hump used to be big. After every construction boom cement firms feel the heat since time to change systems are long being highly specialised. Some go into disuse or regionalisation of markets into segments/ turf protection. Eapc and bamburi enjoyed close to monopoly but now it's all a bear knuckles fight for market. Prices of cement are suppressed across the country unlike other years. I guess you now know. Numbers never lie "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

Kenya’s parliament to discuss a bill seeking to grant its citizens cheaper loans http://cctv-africa.com/2...citizens-cheaper-loans/

CBK boss accused of introducing Opus Dei rules in banking  http://www.capitalfm.co....us-dei-rules-in-banking/ http://www.capitalfm.co....us-dei-rules-in-banking/

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

[quote=Cde Monomotapa] Kenya’s parliament to discuss a bill seeking to grant its citizens cheaper loans http://cctv-africa.com/2...citizens-cheaper-loans/

CBK boss accused of introducing Opus Dei rules in banking  http://www.capitalfm.co....s-dei-rules-in-banking/[ http://www.capitalfm.co....s-dei-rules-in-banking/[/quote] Duale must stop demeaning Christianity. How can he refer Opus Dei a sect without conscience? We must go to twirra and fb to take him to thorough task. This is serious brethren . John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,316 Location: Nairobi

|

[quote=Cde Monomotapa] Kenya’s parliament to discuss a bill seeking to grant its citizens cheaper loans http://cctv-africa.com/2...citizens-cheaper-loans/

CBK boss accused of introducing Opus Dei rules in banking  http://www.capitalfm.co....s-dei-rules-in-banking/[ http://www.capitalfm.co....s-dei-rules-in-banking/[/quote] Duale is just trying to protect his cronies who deal in smuggling sugar, electronics and operate hawala stores. I am with Njoroge. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,144 Location: nairobi

|

This bill will be passed and signed into law, without doubt.. The parliamentarians shall seek to win public opinion noting that this matter is critical to almost all Kenyan segments of society, from the kahoonas to the hoi poloi and even the hoi hae

KQ ABP 4.26

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

obiero wrote:This bill will be passed and signed into law, without doubt.. The parliamentarians shall seek to win public opinion noting that this matter is critical to almost all Kenyan segments of society, from the kahoonas to the hoi poloi and even the hoi hae That lending rate bill will light a fuse of unintended consequences. Until that cloud passes I'm not willing to touch anything in NSE. If we had derivatives, I'd be short KE banks.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

hisah wrote:obiero wrote:This bill will be passed and signed into law, without doubt.. The parliamentarians shall seek to win public opinion noting that this matter is critical to almost all Kenyan segments of society, from the kahoonas to the hoi poloi and even the hoi hae That lending rate bill will light a fuse of unintended consequences. Until that cloud passes I'm not willing to touch anything in NSE. If we had derivatives, I'd be short KE banks. Add the confluence of ICT delivery while unwinding brick & mortar. That should be expensive.

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,316 Location: Nairobi

|

hisah wrote:obiero wrote:This bill will be passed and signed into law, without doubt.. The parliamentarians shall seek to win public opinion noting that this matter is critical to almost all Kenyan segments of society, from the kahoonas to the hoi poloi and even the hoi hae That lending rate bill will light a fuse of unintended consequences. Until that cloud passes I'm not willing to touch anything in NSE. If we had derivatives, I'd be short KE banks. Tha banks will simply stop lending to anyone they deem "less than stellar" ... The beneficiary will be GoK which can mop up (cheaper) cash using T-Bills. The fees eg commitment fees will increase. The banks will start charging fees for everything under the sun. Banks like KCB and Equity will charge 'facilitation' fees similar to M-Shwari. So instead of interest, they will charge a "fee" at 2% [or more] per month. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

VituVingiSana wrote:hisah wrote:obiero wrote:This bill will be passed and signed into law, without doubt.. The parliamentarians shall seek to win public opinion noting that this matter is critical to almost all Kenyan segments of society, from the kahoonas to the hoi poloi and even the hoi hae That lending rate bill will light a fuse of unintended consequences. Until that cloud passes I'm not willing to touch anything in NSE. If we had derivatives, I'd be short KE banks. Tha banks will simply stop lending to anyone they deem "less than stellar" ... The beneficiary will be GoK which can mop up (cheaper) cash using T-Bills. The fees eg commitment fees will increase. The banks will start charging fees for everything under the sun. Banks like KCB and Equity will charge 'facilitation' fees similar to M-Shwari. So instead of interest, they will charge a "fee" at 2% [or more] per month. Mpigs just looking to fatten their wallets in the guise of helping wanjiku. This one, like the thousands before, will definately not see the light of day! @SufficientlyP

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

This is not attractive at all i dont know why ground is not shifting............... The weighted average yield on Kenya's 91-day Treasury bills fell to 8.807 percent at Thursday's auction from 9.060 percent last week, the central bank said. The bank received bids worth a total of 12.4 billion shillings ($122.35 million). It had offered to sell 4 billion shillings' worth, but accepted 9.2 billion shillings' worth of bids. "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Sufficiently Philanga....thropic wrote:VituVingiSana wrote:hisah wrote:obiero wrote:This bill will be passed and signed into law, without doubt.. The parliamentarians shall seek to win public opinion noting that this matter is critical to almost all Kenyan segments of society, from the kahoonas to the hoi poloi and even the hoi hae That lending rate bill will light a fuse of unintended consequences. Until that cloud passes I'm not willing to touch anything in NSE. If we had derivatives, I'd be short KE banks. Tha banks will simply stop lending to anyone they deem "less than stellar" ... The beneficiary will be GoK which can mop up (cheaper) cash using T-Bills. The fees eg commitment fees will increase. The banks will start charging fees for everything under the sun. Banks like KCB and Equity will charge 'facilitation' fees similar to M-Shwari. So instead of interest, they will charge a "fee" at 2% [or more] per month. Mpigs just looking to fatten their wallets in the guise of helping wanjiku. This one, like the thousands before, will definately not see the light of day! I wouldn't underestimate the politicos resolve to see this bill through in light of their performance over the last three years. Cheap populist policy to score easy points in an election. Banks as per usual will 'lobby' hard against it but the deck might be stacked against them this time round. As if the macro factors were not bad enough this pops up. Grim horizon. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

The International Monetary Fund (IMF) has approved two-year standby credit facilities for Kenya worth about $1.5 billion, it said late on Monday. "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Wazua

»

Investor

»

Stocks

»

Elliott Wave Analysis Of The NSE 20

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|