Wazua

»

Investor

»

Economy

»

Kenya Economy Watch

Rank: Elder Joined: 3/2/2009 Posts: 26,331 Location: Masada

|

pops wrote:The president does not get it. His latest directive in vetting KRA officers is like shooting the goose that lays the golden eggs. It will create unnecessary tension and witch hunting within KRA and cause collection to drop even further. He needs to seriously cut back spending, especially pointless entertainment and travel, county level extreme corruption and so called infrastructure white elephants that are gobbling cash without tangible results I.e Konza city, galana, SGR. Reduce counties to 11 if need be to cut costs. If not I agreed we are going to sink so fast in debt and be an African Greece in waiting!! Reducing counties is not a solution now, in fact that will resurrect the now dead Okoa Kenya initiative...plus changing katiba sio kazi rahisi. They should stop the white elephant Galana, Konza city etal but not SGR...all developed countries have a working rail system. Plus its 55% complete now and abandoning it now will be catastrophic. Our poor neighbors in Aitopia are operating their SGR in Jan-2016; we cant afford to lag behind. Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,157 Location: nairobi

|

pops wrote:The president does not get it. His latest directive in vetting KRA officers is like shooting the goose that lays the golden eggs. It will create unnecessary tension and witch hunting within KRA and cause collection to drop even further. He needs to seriously cut back spending, especially pointless entertainment and travel, county level extreme corruption and so called infrastructure white elephants that are gobbling cash without tangible results I.e Konza city, galana, SGR. Reduce counties to 11 if need be to cut costs. If not I agreed we are going to sink so fast in debt and be an African Greece in waiting!! @pops lovely words there, but it is a fact that KRA is rotten to the core. in my view and other experts too, almost 30% of taxes are not collected so as to influence the staffers. the lowest paid staff at KRA earns about 100k but a lifestyle audit shall reveal wealth u never imagined. there are clerks in that place who own a string of flats in Kilimani. ask around and u will be told that the big cars are primarily driven by KRA staffers and are loan free!!! in contrast, try run with a dollar from IRS and see what happens

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 11/5/2010 Posts: 2,459

|

pops wrote:The president does not get it. His latest directive in vetting KRA officers is like shooting the goose that lays the golden eggs. It will create unnecessary tension and witch hunting within KRA and cause collection to drop even further. He needs to seriously cut back spending, especially pointless entertainment and travel, county level extreme corruption and so called infrastructure white elephants that are gobbling cash without tangible results I.e Konza city, galana, SGR. Reduce counties to 11 if need be to cut costs. If not I agreed we are going to sink so fast in debt and be an African Greece in waiting!! I agree with you on the vetting issue. If strictly done, over 90% of custom officers and their bosses would have to leave kra. Could it be the reason why kra is offering former staff a chance to come back ?

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

FRM2011 wrote:pops wrote:The president does not get it. His latest directive in vetting KRA officers is like shooting the goose that lays the golden eggs. It will create unnecessary tension and witch hunting within KRA and cause collection to drop even further. He needs to seriously cut back spending, especially pointless entertainment and travel, county level extreme corruption and so called infrastructure white elephants that are gobbling cash without tangible results I.e Konza city, galana, SGR. Reduce counties to 11 if need be to cut costs. If not I agreed we are going to sink so fast in debt and be an African Greece in waiting!! I agree with you on the vetting issue. If strictly done, over 90% of custom officers and their bosses would have to leave kra. Could it be the reason why kra is offering former staff a chance to come back ? Aaaahaaaa know someone who has been given such an offer...interesting. possunt quia posse videntur

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,157 Location: nairobi

|

maka wrote:FRM2011 wrote:pops wrote:The president does not get it. His latest directive in vetting KRA officers is like shooting the goose that lays the golden eggs. It will create unnecessary tension and witch hunting within KRA and cause collection to drop even further. He needs to seriously cut back spending, especially pointless entertainment and travel, county level extreme corruption and so called infrastructure white elephants that are gobbling cash without tangible results I.e Konza city, galana, SGR. Reduce counties to 11 if need be to cut costs. If not I agreed we are going to sink so fast in debt and be an African Greece in waiting!! I agree with you on the vetting issue. If strictly done, over 90% of custom officers and their bosses would have to leave kra. Could it be the reason why kra is offering former staff a chance to come back ? Aaaahaaaa know someone who has been given such an offer...interesting. How were the former staff exited? The old dogs are the worst in my view.. But maybe there is more to this than meets the eye, just seen a feature on CNN and one was on CCTV yesterday. Now even reuters.. Iko shida http://news.yahoo.com/vi...ms-second-105231525.html

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Mainat on #851 Posted : Sunday, January 18, 2015 3:17:05 AM wrote:GoK is short of hard cash. By GoK I mean government of kwale in case NIS is on the case What did you know boss!!  "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Veteran Joined: 11/15/2013 Posts: 1,977 Location: Here

|

murchr wrote:Mainat on #851 Posted : Sunday, January 18, 2015 3:17:05 AM wrote:GoK is short of hard cash. By GoK I mean government of kwale in case NIS is on the case What did you know boss!!  Either 1. Mainat = KRA OR2. Mainat = Treasury, or both  nothing else. Everybody STEALS, a THIEF is one who's CAUGHT stealing something of LITTLE VALUE. !!!

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Oct 23 The Central Bank of Kenya said on Friday it was offering 10 billion shillings ($98.09 million) in reverse repos, saying it was acting because liquidity was "skewed". The central bank also offered reverse repos earlier this week, contrary to the bank's recent monetary tightening stance. Traders said the central bank may be seeking to help smaller lenders, who have found it difficult to borrow from larger counterparts after the seizure of a second-tier bank last week. http://www.reuters.com/a...nk-idUSL1N12N07W20151023"There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 9/19/2015 Posts: 2,871 Location: hapo

|

[quote=murchr]Oct 23 The Central Bank of Kenya said on Friday it was offering 10 billion shillings ($98.09 million) in reverse repos, saying it was acting because liquidity was "skewed". The central bank also offered reverse repos earlier this week, contrary to the bank's recent monetary tightening stance. Traders said the central bank may be seeking to help smaller lenders, who have found it difficult to borrow from larger counterparts after the seizure of a second-tier bank last week. http://www.reuters.com/a...k-idUSL1N12N07W20151023[/quote] Try harder. We are waiting to see the next t-bill rates. Not public statements. Thieves are not good people. Tumeelewana?

|

|

|

Rank: Elder Joined: 9/15/2006 Posts: 3,907

|

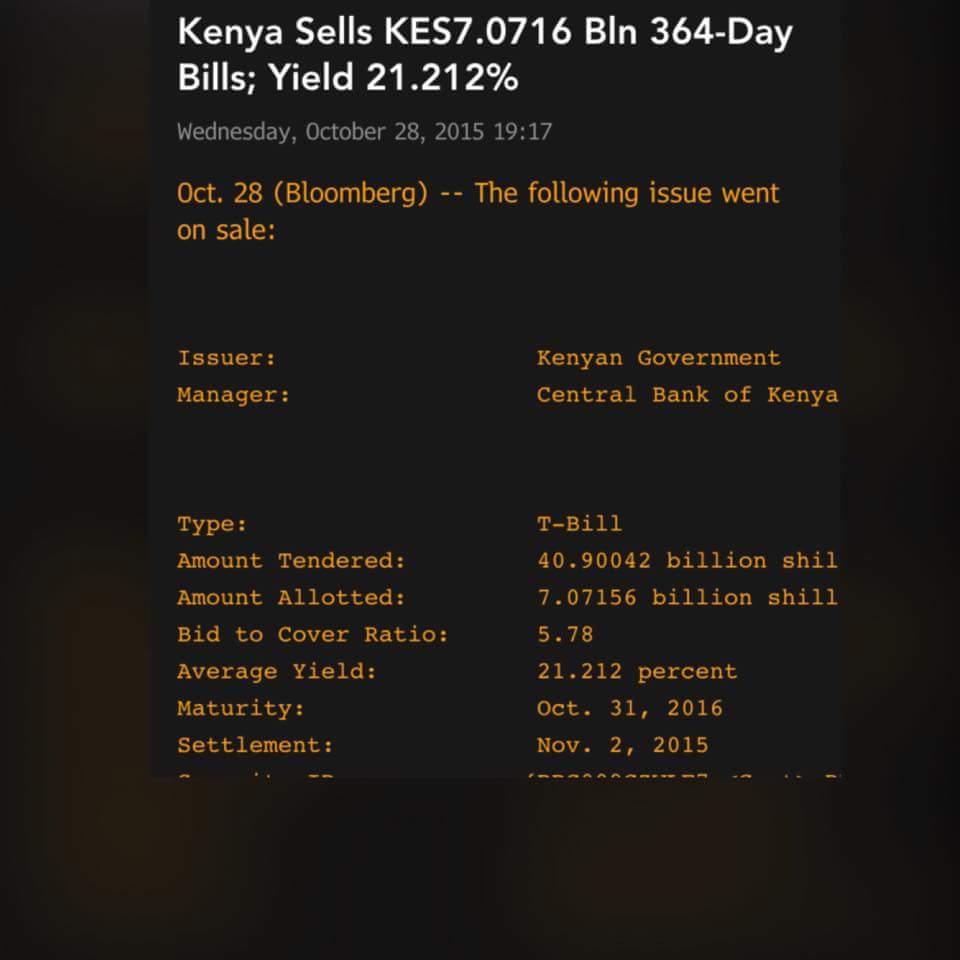

The tide has turned I see, and CBK governor is at the helm. Yesterday saw an outrageous 41bn chasing only 7bn of Treasuries. The inevitable decline of 115bps, the first since June. https://www.centralbank....0dated%2002.11.2015.pdf

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,331 Location: Masada

|

I hope this is natural decline and not someone heeding to a call from the house on the hill. Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

THE BIG STORYKRA misses first quarter target by whopping Sh28 billion The Kenya Revenue Authority missed its first quarter target by a whopping Sh28 billion, precipitating the biting cash crunch that has hit the government in the past two months. http://www.businessdaily...4/-/1595jc9/-/index.html"There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 9/15/2006 Posts: 3,907

|

The bigger story... More money for Kenya syndicated from 3 international banks at 5.7% pa http://www.reuters.com/a...s-idUSL8N12T35720151029

As CS Rotich continues to struggle finding exact use of first Eurobond https://pbs.twimg.com/media/CSjZBkVWwAATuIm.jpg

|

|

|

Rank: User Joined: 1/20/2014 Posts: 3,528

|

The syndicated loan is only KES 75b which will be KRA deficit by half year, excluding the going on. Anyway let us wait for SGR in Naivasha  Formal education will make you a living. Self-education will make you a fortune - Jim Rohn.

|

|

|

Rank: Veteran Joined: 6/23/2014 Posts: 1,652

|

Impunity wrote:I hope this is natural decline and not someone heeding to a call from the house on the hill. The law of demand and supply. Hutia Mundu!!

|

|

|

Rank: Elder Joined: 9/15/2006 Posts: 3,907

|

The words of Aly-Khan Satchu. Hmmmmn... Quote:This Loan is a near-term Silver Bullet for the Treasury.

Kenyan Economy

The loan has a two year tenor.

The Government was looking to drawdown 221b from the domestic bond

markets in this financial Year. In what became a Stand-Off at the OK

Corral the GOK actually redeemed about 61b until the recent

Capitulation which saw 1 Year T-Bills cross 23%.

It was that 'Swing'' which amplified the recent credit crunch.

Therefore 60b Shillings should go a long way towards compensating for

that Swing and ease interest rates in the domestic markets in the near

term.

I would immediately convert the Dollars into Shillings [which would

have the effect of bring the Shilling back into double digits] and

essentially put that Liquidity to work in the domestic market.

This Loan is a near-term Silver Bullet for the Treasury.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

muganda wrote:The words of Aly-Khan Satchu. Hmmmmn... Quote:This Loan is a near-term Silver Bullet for the Treasury.

Kenyan Economy

The loan has a two year tenor.

The Government was looking to drawdown 221b from the domestic bond

markets in this financial Year. In what became a Stand-Off at the OK

Corral the GOK actually redeemed about 61b until the recent

Capitulation which saw 1 Year T-Bills cross 23%.

It was that 'Swing'' which amplified the recent credit crunch.

Therefore 60b Shillings should go a long way towards compensating for

that Swing and ease interest rates in the domestic markets in the near

term.

I would immediately convert the Dollars into Shillings [which would

have the effect of bring the Shilling back into double digits] and

essentially put that Liquidity to work in the domestic market.

This Loan is a near-term Silver Bullet for the Treasury. The debt repayment bill for 2016 cannot be resolved with this patch up fixes as election mood sets in. Until treasury revises the debt plan the tbill market will be back on the up swing next year. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 4/16/2014 Posts: 1,420 Location: Bohemian Grove

|

muganda wrote:The words of Aly-Khan Satchu. Hmmmmn... Quote:This Loan is a near-term Silver Bullet for the Treasury.

Kenyan Economy

The loan has a two year tenor.

The Government was looking to drawdown 221b from the domestic bond

markets in this financial Year. In what became a Stand-Off at the OK

Corral the GOK actually redeemed about 61b until the recent

Capitulation which saw 1 Year T-Bills cross 23%.

It was that 'Swing'' which amplified the recent credit crunch.

Therefore 60b Shillings should go a long way towards compensating for

that Swing and ease interest rates in the domestic markets in the near

term.

I would immediately convert the Dollars into Shillings [which would

have the effect of bring the Shilling back into double digits] and

essentially put that Liquidity to work in the domestic market.

This Loan is a near-term Silver Bullet for the Treasury. I tend to over analyze anything he says before I can digest it.

|

|

|

Rank: New-farer Joined: 10/19/2015 Posts: 21 Location: Everywhere

|

whiteowl wrote:muganda wrote:The words of Aly-Khan Satchu. Hmmmmn... Quote:This Loan is a near-term Silver Bullet for the Treasury.

Kenyan Economy

The loan has a two year tenor.

The Government was looking to drawdown 221b from the domestic bond

markets in this financial Year. In what became a Stand-Off at the OK

Corral the GOK actually redeemed about 61b until the recent

Capitulation which saw 1 Year T-Bills cross 23%.

It was that 'Swing'' which amplified the recent credit crunch.

Therefore 60b Shillings should go a long way towards compensating for

that Swing and ease interest rates in the domestic markets in the near

term.

I would immediately convert the Dollars into Shillings [which would

have the effect of bring the Shilling back into double digits] and

essentially put that Liquidity to work in the domestic market.

This Loan is a near-term Silver Bullet for the Treasury. I tend to over analyze anything he says before I can digest it. This guy is a perma-bull. Indeed this credit will be a short-term boost but remember that our debt servicing costs are rising and our dollar flows seem patchy therefore the currency is far from being out of the woods. Secondly, a decline in interest rates to 10-11 should correspond with a decrease in the opportunity cost of holding dollar so from a macro perspective its just a patchwork.

|

|

|

Rank: Veteran Joined: 11/21/2006 Posts: 1,590

|

Always bear in mind that AA is a fund manager aka broker grahamsdisciple wrote:whiteowl wrote:muganda wrote:The words of Aly-Khan Satchu. Hmmmmn... Quote:This Loan is a near-term Silver Bullet for the Treasury.

Kenyan Economy

The loan has a two year tenor.

The Government was looking to drawdown 221b from the domestic bond

markets in this financial Year. In what became a Stand-Off at the OK

Corral the GOK actually redeemed about 61b until the recent

Capitulation which saw 1 Year T-Bills cross 23%.

It was that 'Swing'' which amplified the recent credit crunch.

Therefore 60b Shillings should go a long way towards compensating for

that Swing and ease interest rates in the domestic markets in the near

term.

I would immediately convert the Dollars into Shillings [which would

have the effect of bring the Shilling back into double digits] and

essentially put that Liquidity to work in the domestic market.

This Loan is a near-term Silver Bullet for the Treasury. I tend to over analyze anything he says before I can digest it. This guy is a perma-bull. Indeed this credit will be a short-term boost but remember that our debt servicing costs are rising and our dollar flows seem patchy therefore the currency is far from being out of the woods. Secondly, a decline in interest rates to 10-11 should correspond with a decrease in the opportunity cost of holding dollar so from a macro perspective its just a patchwork. Sehemu ndio nyumba

|

|

|

Wazua

»

Investor

»

Economy

»

Kenya Economy Watch

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|