Wazua

»

Investor

»

Stocks

»

Bear 2015 Wish List

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

Metasploit wrote:39 just printed..# KCB Yep! this is significant. equity also ready to go below 40.00. They should both be below NIC share price logically. NIC P/E now is 5.5! It has really led the race downwards The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,775 Location: nairobi

|

Aguytrying wrote:Metasploit wrote:39 just printed..# KCB Yep! this is significant. equity also ready to go below 40.00. They should both be below NIC share price logically. NIC P/E now is 5.5! It has really led the race downwards @vvs will still state i shouldnt have sold kcb @60 bob.. :)

COOP 255,000 ABP 15.85; IMH 5,000 ABP 35.55; KQ 604,200 ABP 6.96; MTN 23,800 ABP 5.20

|

|

|

Rank: New-farer Joined: 7/1/2015 Posts: 67

|

Aguytrying wrote:Metasploit wrote:39 just printed..# KCB Yep! this is significant. equity also ready to go below 40.00. They should both be below NIC share price logically. NIC P/E now is 5.5! It has really led the race downwards just wondering...how far south can we go? is this trend likely to go to next year because if that be the case i will be a nomad in NSE  “It’s no good, it’s no good!” says the buyer—

then goes off and boasts about the purchase-Proverbs 20:14

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

Sam_Kibs wrote:Aguytrying wrote:Metasploit wrote:39 just printed..# KCB Yep! this is significant. equity also ready to go below 40.00. They should both be below NIC share price logically. NIC P/E now is 5.5! It has really led the race downwards just wondering...how far south can we go? is this trend likely to go to next year because if that be the case i will be a nomad in NSE  According to our resident chartists, it will go on to next year, this is just the beginning. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Aguytrying wrote:Sam_Kibs wrote:Aguytrying wrote:Metasploit wrote:39 just printed..# KCB Yep! this is significant. equity also ready to go below 40.00. They should both be below NIC share price logically. NIC P/E now is 5.5! It has really led the race downwards just wondering...how far south can we go? is this trend likely to go to next year because if that be the case i will be a nomad in NSE  According to our resident chartists, it will go on to next year, this is just the beginning.   possunt quia posse videntur

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

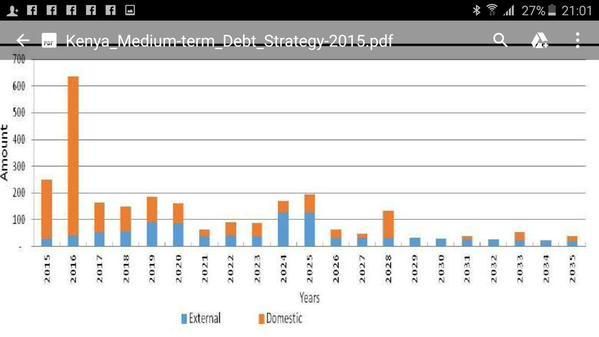

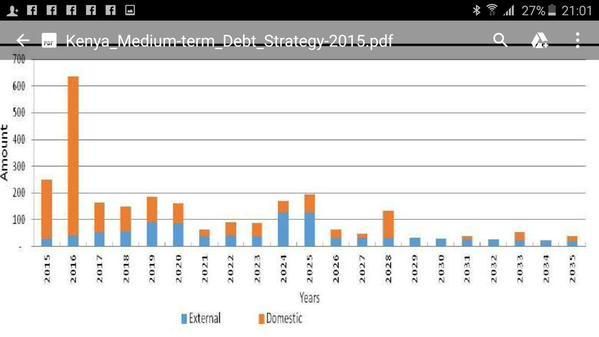

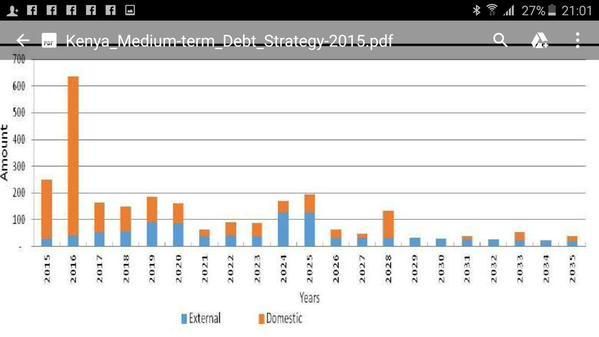

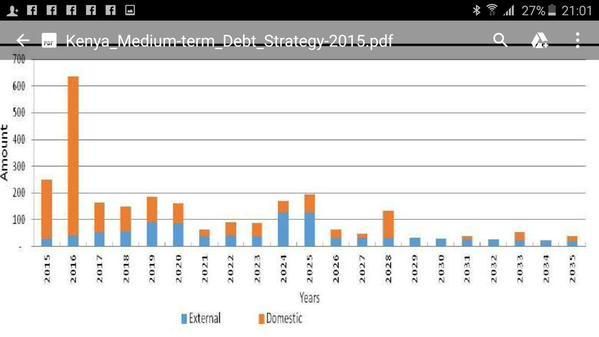

maka wrote:Aguytrying wrote:Sam_Kibs wrote:Aguytrying wrote:Metasploit wrote:39 just printed..# KCB Yep! this is significant. equity also ready to go below 40.00. They should both be below NIC share price logically. NIC P/E now is 5.5! It has really led the race downwards just wondering...how far south can we go? is this trend likely to go to next year because if that be the case i will be a nomad in NSE  According to our resident chartists, it will go on to next year, this is just the beginning.   @maka I've read that strategy plan

2016 will be tight, real tight! The plan is completely obsolete with the current events. I'd like to see a revised version with the current madness unraveling in the money market.

Financial stocks will get clobbered badly! The last time I saw equity bank down 7% plus intraday was during the GFC! Those still attending the lesson learnt class will find the going getting tougher. Those who complete the class will be excellent students and will be well equipped on how to survive in the market in a profitable way.

#Golden handcuffs getting very shiny now $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

Museveni wrote:Aguytrying wrote:The bear is upon us! Emotions play a significant role in choosing what to buy and at what price. We all know the temptation to bottom fish to get the lowest prices, but its difficult to achieve. Then there's the pain of being left by a share after a failed bottom fishing manoeuvre. In light of this I've come up with a systematic way of buying this time round. Using a P|E range of between 7-5.5 and EPS of 2014 or 2013 where necessary. Here is MY wishlist. There are many other good shares, ill be sticking with these for now. STOCK EPS TARGET PRICE PE 5.5-7 CURRENT PRICE

EQUITY 4.63 25-33 40.00

KCB 5.63 30-40 40.25

NIC 7.07 38-49 35.75

NSE 2.13 12-15 20.75

DTB 21.92 120-154 194.00

HFCK 2.75 15-20 20.75

JUBILEE 48 264-340 425.00

PAN AFRICA 6.05 33-43 62.50

SAFARICOM 0.8 8-10(10-12 PE) 14.70

NATION 13.1 72-100 (unlikely) 139.00

TPS SERENA 3.45 20-25 (2013 EPS) 29.50

BAMBURI 9.80 98-130 152.00

KENOL KOBIL 0.74 5-7 (6.7-9.5 PE) 9.00

EABL 11.31 113- 170(10-15 PE) 254.00

ARM 3.01 30-45 37.50

BAT 42.55 300-450 780.00

CROWN PAINTS 3.01 17-21 60.00

FLAME TREE 0.99 6-7 7.00

BOC 11.76 65-85 117.00 Things are getting interesting, the bear is really starting to bite. Silently Jubilee has dropped 135 shilling since this list was made on 5th August 2015. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: New-farer Joined: 6/30/2014 Posts: 86 Location: nairobi

|

hisah wrote:maka wrote:Aguytrying wrote:Sam_Kibs wrote:Aguytrying wrote:Metasploit wrote:39 just printed..# KCB Yep! this is significant. equity also ready to go below 40.00. They should both be below NIC share price logically. NIC P/E now is 5.5! It has really led the race downwards just wondering...how far south can we go? is this trend likely to go to next year because if that be the case i will be a nomad in NSE  According to our resident chartists, it will go on to next year, this is just the beginning.   @maka I've read that strategy plan

2016 will be tight, real tight! The plan is completely obsolete with the current events. I'd like to see a revised version with the current madness unraveling in the money market.

Financial stocks will get clobbered badly! The last time I saw equity bank down 7% plus intraday was during the GFC! Those still attending the lesson learnt class will find the going getting tougher. Those who complete the class will be excellent students and will be well equipped on how to survive in the market in a profitable way.

#Golden handcuffs getting very shiny now buying a new notebook as the lessons have been many...  Only option is to wait for the long tails and average down a good one.

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

hisah wrote:maka wrote:Aguytrying wrote:Sam_Kibs wrote:Aguytrying wrote:Metasploit wrote:39 just printed..# KCB Yep! this is significant. equity also ready to go below 40.00. They should both be below NIC share price logically. NIC P/E now is 5.5! It has really led the race downwards just wondering...how far south can we go? is this trend likely to go to next year because if that be the case i will be a nomad in NSE  According to our resident chartists, it will go on to next year, this is just the beginning.   @maka I've read that strategy plan

2016 will be tight, real tight! The plan is completely obsolete with the current events. I'd like to see a revised version with the current madness unraveling in the money market.

Financial stocks will get clobbered badly! The last time I saw equity bank down 7% plus intraday was during the GFC! Those still attending the lesson learnt class will find the going getting tougher. Those who complete the class will be excellent students and will be well equipped on how to survive in the market in a profitable way.

#Golden handcuffs getting very shiny now 2016 will be one hard year... possunt quia posse videntur

|

|

|

Rank: Member Joined: 2/7/2014 Posts: 155

|

Its the last quarter of the year and things seem to be getting worse.In addition the chartist say 2016 will be worse.2017 is an election year and in Kenya Pyramid schemes crop up from everywhere during such times.

Based on above scenarios, seems we have to pack money in Market funds until there is some light at end of tunnel.

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,221 Location: Nairobi

|

obiero wrote:Aguytrying wrote:Metasploit wrote:39 just printed..# KCB Yep! this is significant. equity also ready to go below 40.00. They should both be below NIC share price logically. NIC P/E now is 5.5! It has really led the race downwards @vvs will still state i shouldnt have sold kcb @60 bob.. :) I never faulted your selling. A profit is real profit when cash is pocketed BUT what you bought with that cash is a whole different ball game! [BTW, I quietly sold the few KCB I had at 56. And I lucked out when I sold Equity at 45 though I sold while it was on its way up]. I then bought I&M coz of the decent PER but ouch!  I should have stayed in cash. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Veteran Joined: 8/10/2014 Posts: 989 Location: Kenya

|

Nobody selling NIC stocks

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,330 Location: Masada

|

kasibitta wrote:Its the last quarter of the year and things seem to be getting worse.In addition the chartist say 2016 will be worse.2017 is an election year and in Kenya Pyramid schemes crop up from everywhere during such times.

Based on above scenarios, seems we have to pack money in Market funds until there is some light at end of tunnel. Kabisa, liquid is the way now until huko late 2016 when the market will be at its LOWEST! Then duck in and mint millions in 2017! Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,775 Location: nairobi

|

Impunity wrote:kasibitta wrote:Its the last quarter of the year and things seem to be getting worse.In addition the chartist say 2016 will be worse.2017 is an election year and in Kenya Pyramid schemes crop up from everywhere during such times.

Based on above scenarios, seems we have to pack money in Market funds until there is some light at end of tunnel. Kabisa, liquid is the way now until huko late 2016 when the market will be at its LOWEST! Then duck in and mint millions in 2017! @impunity was usered :)

COOP 255,000 ABP 15.85; IMH 5,000 ABP 35.55; KQ 604,200 ABP 6.96; MTN 23,800 ABP 5.20

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

Museveni wrote:Aguytrying wrote:The bear is upon us! Emotions play a significant role in choosing what to buy and at what price. We all know the temptation to bottom fish to get the lowest prices, but its difficult to achieve. Then there's the pain of being left by a share after a failed bottom fishing manoeuvre. In light of this I've come up with a systematic way of buying this time round. Using a P|E range of between 7-5.5 and EPS of 2014 or 2013 where necessary. Here is MY wishlist. There are many other good shares, ill be sticking with these for now. STOCK EPS TARGET PRICE PE 5.5-7 CURRENT PRICE

EQUITY 4.63 25-33 39.25

KCB 5.63 30-40 46.00

NIC 7.07 38-49 49.00

NSE 2.13 12-15 20.00

DTB 21.92 120-154 204.00

HFCK 2.75 15-20 21.50

JUBILEE 48 264-340 560.00

PAN AFRICA 6.05 33-43 67.00

SAFARICOM 0.8 8-10(10-12 PE) 14.00

NATION 13.1 72-100 (unlikely) 184.00

TPS SERENA 3.45 20-25 (2013 EPS) 33.00

BAMBURI 9.80 98-130 154.00

KENOL KOBIL 0.74 5-7 (6.7-9.5 PE) 8.50

EABL 11.31 113- 170(10-15 PE) 295.00

ARM 3.01 30-45 61.00

BAT 42.55 300-450 741.00

CROWN PAINTS 3.01 17-21 62.00

FLAME TREE 0.99 6-7 7.50

BOC 11.76 65-85 133.00 stocks within range, The list grows everyday ARM 36.00

NIC 39.00

KCB 38.75

FTGH 6.00

The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Member Joined: 9/11/2015 Posts: 245 Location: Thika

|

Cash is king at this time. Hoping to get back fully in stocks mid-next year with a substantial warchest and mint serious dough by 2019. Now is the time to accumulate.........cash. I believe prices of some counters will hit rock bottom is coming months. Currently, only safaricom is showing some resistance but when the nosedive starts, it will be a sudden one. Since men have learned to shoot without missing, I have learned to fly without perching

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

Jon Jones wrote:Cash is king at this time. Hoping to get back fully in stocks mid-next year with a substantial warchest and mint serious dough by 2019. Now is the time to accumulate.........cash. I believe prices of some counters will hit rock bottom is coming months. Currently, only safaricom is showing some resistance but when the nosedive starts, it will be a sudden one. equity, BAT and EABL are also showing resistance The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: New-farer Joined: 7/1/2015 Posts: 67

|

Museveni wrote:Aguytrying wrote:The bear is upon us! Emotions play a significant role in choosing what to buy and at what price. We all know the temptation to bottom fish to get the lowest prices, but its difficult to achieve. Then there's the pain of being left by a share after a failed bottom fishing manoeuvre. In light of this I've come up with a systematic way of buying this time round. Using a P|E range of between 7-5.5 and EPS of 2014 or 2013 where necessary. Here is MY wishlist. There are many other good shares, ill be sticking with these for now. STOCK EPS TARGET PRICE PE 5.5-7 CURRENT PRICE

EQUITY 4.63 25-33 39.25

KCB 5.63 30-40 46.00

NIC 7.07 38-49 49.00

NSE 2.13 12-15 20.00

DTB 21.92 120-154 204.00

HFCK 2.75 15-20 21.50

JUBILEE 48 264-340 560.00

PAN AFRICA 6.05 33-43 67.00

SAFARICOM 0.8 8-10(10-12 PE) 14.00

NATION 13.1 72-100 (unlikely) 184.00

TPS SERENA 3.45 20-25 (2013 EPS) 33.00

BAMBURI 9.80 98-130 154.00

KENOL KOBIL 0.74 5-7 (6.7-9.5 PE) 8.50

EABL 11.31 113- 170(10-15 PE) 295.00

ARM 3.01 30-45 61.00

BAT 42.55 300-450 741.00

CROWN PAINTS 3.01 17-21 62.00

FLAME TREE 0.99 6-7 7.50

BOC 11.76 65-85 133.00 are we still in the bear? any revised entry points? “It’s no good, it’s no good!” says the buyer—

then goes off and boasts about the purchase-Proverbs 20:14

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

Sam_Kibs wrote:Museveni wrote:Aguytrying wrote:The bear is upon us! Emotions play a significant role in choosing what to buy and at what price. We all know the temptation to bottom fish to get the lowest prices, but its difficult to achieve. Then there's the pain of being left by a share after a failed bottom fishing manoeuvre. In light of this I've come up with a systematic way of buying this time round. Using a P|E range of between 7-5.5 and EPS of 2014 or 2013 where necessary. Here is MY wishlist. There are many other good shares, ill be sticking with these for now. STOCK EPS TARGET PRICE PE 5.5-7 CURRENT PRICE

EQUITY 4.63 25-33 39.25

KCB 5.63 30-40 46.00

NIC 7.07 38-49 49.00

NSE 2.13 12-15 20.00

DTB 21.92 120-154 204.00

HFCK 2.75 15-20 21.50

JUBILEE 48 264-340 560.00

PAN AFRICA 6.05 33-43 67.00

SAFARICOM 0.8 8-10(10-12 PE) 14.00

NATION 13.1 72-100 (unlikely) 184.00

TPS SERENA 3.45 20-25 (2013 EPS) 33.00

BAMBURI 9.80 98-130 154.00

KENOL KOBIL 0.74 5-7 (6.7-9.5 PE) 8.50

EABL 11.31 113- 170(10-15 PE) 295.00

ARM 3.01 30-45 61.00

BAT 42.55 300-450 741.00

CROWN PAINTS 3.01 17-21 62.00

FLAME TREE 0.99 6-7 7.50

BOC 11.76 65-85 133.00 are we still in the bear? any revised entry points? We are still in a bear market. The entry points can't be revised. If prices go up I say goodbye to that share because these are the maximum prices I can buy. Beyond that Im no longer interested. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: New-farer Joined: 3/3/2010 Posts: 79

|

sparkly wrote:moneydust wrote:lochaz-index wrote:Afroblk wrote:I'm loving the bear...but it's not gonna last long...and so...one of my bond matured and here's how I'm re-investing the proceeds and take advantage of the bear starting tomorrow until I get all shares as planned, hopefully by 15 Oct. I'll be adding three new counters to my portfolio i.e. Centum, ARM and HFCK. I already have significant KQ and Britam but will be adding some more to average down.

Entry point (9/29/15-10/15/15)

KQ-18,000 @5.5

Britam-8,800 @17

HFCK-6,500 @23

ARM-6000 @42

Centum-5,700 @52

My target exit point is on or around 15 Sep 16 (1 yr from today) and targeting the following returns;

KQ-@9.00

Britam-@36

HFCK-@55

ARM-@92

Centum-@85

As you can see, if all plays and goes well of which I think most companies will do well 1&2 Qtrs then I'm looking at aprx 100% return in profits (Ksh0.9M) calculation based on ex div. I've factored in 100k in est broker fees.

I'll revisit this thread in Aug-Sep 2016 when I'm offloading.

Good Luck! I sincerely hope you have aligned your investment strategy to your risk appetite. Exit prices of Britam,HFCK,ARM and Centum appear grossly optimistic within a one year time frame and given the current market mood. Me thinks so too. We need at least 3 years before the current market mood returns. I finally managed to complete my buys for the year, now waiting for harvesting time! Good luck amigos!  Knowledge is contagious...Infect truth!

|

|

|

Wazua

»

Investor

»

Stocks

»

Bear 2015 Wish List

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|