Wazua

»

Investor

»

Stocks

»

Liberty Kenya FY 2014 results after tax up 4%

Rank: Member Joined: 10/7/2010 Posts: 251 Location: nairobi

|

results are out.....it is not readable in twitter....anika hapa

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

madebe wrote:results are out.....it is not readable in twitter....anika hapa

Nothing much to write home about... possunt quia posse videntur

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 923 Location: sky

|

There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 923 Location: sky

|

http://af.reuters.com/article/i...ws/idAFKBN0MZ18N20150408There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Elder Joined: 9/15/2006 Posts: 3,906

|

This group underwhelmed FY 2014, both bank and insurance http://ge.tt/5j0QH4E2/v/0

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

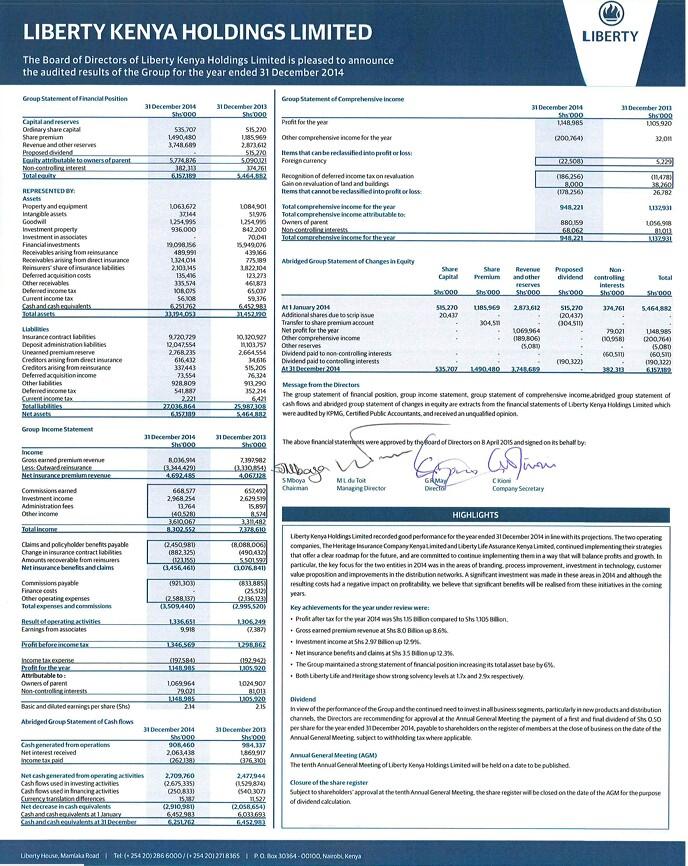

Liberty Kenya, which runs life insurance and general insurance businesses, reported on Wednesday a 3.9 percent jump in its 2014 pretax profit to 1.35 billion shillings ($16 million). The firm, controlled by South Africa's Liberty Holdings and previously known as CFC Insurance Holdings, said its gross premiums rose 8.6 percent during the period to 8.0 billion shillings. Income from its investments went up 12.9 percent to 2.97 billion shillings in the year to end-December. Net benefits and claims from its customers however went up 12.3 percent to 3.5 billion shillings. Liberty recommended a dividend of 0.50 shillings per share, without saying what the prior year dividend was. Insurance is seen as a growth sector in east Africa's biggest economy, where only about 8 percent of the population have any form of cover. possunt quia posse videntur

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Where are the usual suspects @mlennyman et al....just seen this now "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

maka wrote:Liberty Kenya, which runs life insurance and general insurance businesses, reported on Wednesday a 3.9 percent jump in its 2014 pretax profit to 1.35 billion shillings ($16 million).

The firm, controlled by South Africa's Liberty Holdings and previously known as CFC Insurance Holdings, said its gross premiums rose 8.6 percent during the period to 8.0 billion shillings.

Income from its investments went up 12.9 percent to 2.97 billion shillings in the year to end-December.

Net benefits and claims from its customers however went up 12.3 percent to 3.5 billion shillings.

Liberty recommended a dividend of 0.50 shillings per share, without saying what the prior year dividend was. (Scrip dividend of 1/-)

Insurance is seen as a growth sector in east Africa's biggest economy, where only about 8 percent of the population have any form of cover.

"There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 5/25/2012 Posts: 4,105 Location: 08c

|

Key highlights: Key highlights:PAT Kshs. 1.15Bn vs Kshs. 1.105Bn Gross earned premium revenue up 8.6% to Kshs. 8.0Bn Investment income up 12.9% to Kshs. 2.97Bn Net insurance benefits and claims up 12.3% to Kshs. 3.5Bn Total Asset base up 6% EPS marginally down to Kshs. 2.14 from 2.15 Dividend: Kshs. 0.50 Register closure: TBA AGM: TBA Pesa Nane plans to be shilingi when he grows up.

|

|

|

Rank: Veteran Joined: 11/15/2013 Posts: 1,977 Location: Here

|

murchr wrote:Where are the usual suspects @mlennyman et al....just seen this now bado ako easter...either aliwekwo " rice" or amekaliwo shafo...not seen him all day...ametoklezea sasa..@mlenny  Everybody STEALS, a THIEF is one who's CAUGHT stealing something of LITTLE VALUE. !!!

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,191 Location: nairobi

|

Boris Boyka wrote:murchr wrote:Where are the usual suspects @mlennyman et al....just seen this now bado ako easter...either aliwekwo " rice" or amekaliwo shafo...not seen him all day...ametoklezea sasa..@mlenny  below the belt results,  iam selling this to buy cic because I can get 2 units of cic with one unit of liberty and keep change "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

mlennyma wrote:Boris Boyka wrote:murchr wrote:Where are the usual suspects @mlennyman et al....just seen this now bado ako easter...either aliwekwo " rice" or amekaliwo shafo...not seen him all day...ametoklezea sasa..@mlenny  below the belt results,  iam selling this to buy cic because I can get 2 units of cic with one unit of liberty and keep change What about valuations? The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,191 Location: nairobi

|

Aguytrying wrote:mlennyma wrote:Boris Boyka wrote:murchr wrote:Where are the usual suspects @mlennyman et al....just seen this now bado ako easter...either aliwekwo " rice" or amekaliwo shafo...not seen him all day...ametoklezea sasa..@mlenny  below the belt results,  iam selling this to buy cic because I can get 2 units of cic with one unit of liberty and keep change What about valuations? I just feel I must spread any risk by sharing both counters "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

mlennyma wrote: Boris Boyka wrote: murchr wrote:Where are the usual suspects @mlennyman et al....just seen this now bado ako easter...either aliwekwo " rice" or amekaliwo shafo...not seen him all day...ametoklezea sasa..@mlenny  below the belt results,  iam selling this to buy cic because I can get 2 units of cic with one unit of liberty and keep change H2 must have been real bad, but i'd rather Liberty than CIC "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Member Joined: 6/14/2010 Posts: 521 Location: Nairobi

|

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,191 Location: nairobi

|

The optimist wrote:Dismal performance. this insurance companies give very good H1 results only to erode the gains in full year to the extend of some reporting declines,I guess claims pile towards year end, its becoming risky....reducing dividend from 1bob to 50cts is a very unfriendly move  "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Veteran Joined: 8/16/2009 Posts: 994

|

mlennyma wrote:The optimist wrote:Dismal performance. this insurance companies give very good H1 results only to erode the gains in full year to the extend of some reporting declines,I guess claims pile towards year end, its becoming risky. Increase in Insurance Contract Liabilities from 490M to 882M an 80% increase is partly to blame for the flat results. Another factor is 40M other loss. Time is money, so money is time. Money saved is time gained in reverse! Money stores your life’s energy. You expend your energy, get paid money, and store that money for a future purchase made in a currency.

|

|

|

Rank: Veteran Joined: 11/15/2013 Posts: 1,977 Location: Here

|

Aguytrying wrote:mlennyma wrote:Boris Boyka wrote:murchr wrote:Where are the usual suspects @mlennyman et al....just seen this now bado ako easter...either aliwekwo " rice" or amekaliwo shafo...not seen him all day...ametoklezea sasa..@mlenny  below the belt results,  iam selling this to buy cic because I can get 2 units of cic with one unit of liberty and keep change What about valuations? Welcome bro @mlenny  @Aguy is a brother in Kenyan Killers and Simiti  Everybody STEALS, a THIEF is one who's CAUGHT stealing something of LITTLE VALUE. !!!

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Business Daily wrote:

Stanlib to list Sh9bn property units on bourse

Listing of property unit is meant to give investors an exit avenue and help in price discovery. (what is this?)

Stanlib said it will package a mix of properties and sell them as Reits (property share units) in June this year.

The investment firm has a property portfolio of Sh15 billion, but the Kenya-focused Reit will list real-estate assets worth just Sh9 billion.

Stanlib Investments plans to list a Sh9 billion Real Estate Investment Trust (Reit) at the bourse in the next two months.

Stanlib, part of South African Liberty Group, said it will package a mix of properties and sell them as Reits (property share units) in June this year.

The investment firm has a property portfolio of Sh15 billion, but the Kenya-focused Reit will list real-estate assets worth just Sh9 billion. Finer details including pricing and the properties involved will come out in May. "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

Boris Boyka wrote:Aguytrying wrote:mlennyma wrote:Boris Boyka wrote:murchr wrote:Where are the usual suspects @mlennyman et al....just seen this now bado ako easter...either aliwekwo " rice" or amekaliwo shafo...not seen him all day...ametoklezea sasa..@mlenny  below the belt results,  iam selling this to buy cic because I can get 2 units of cic with one unit of liberty and keep change What about valuations? Welcome bro @mlenny  @Aguy is a brother in Kenyan Killers and Simiti  KK amekua kenyan killers. ha ha. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Wazua

»

Investor

»

Stocks

»

Liberty Kenya FY 2014 results after tax up 4%

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|