Wazua

»

Investor

»

Stocks

»

Safaricom HY 2014/2015 EPS up 32%

Rank: Elder Joined: 7/22/2009 Posts: 7,743

|

What is the P.E. For CFC Stanbic. I am getting different figures from different sources. The wazua one for example looks totally off. Madam admin, if you can't maintain upto date and accurate information, you had better scrap or disable certain sections. Wrong information is worse and more dangerous than no information. I hope you know that!!! Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Member Joined: 6/14/2010 Posts: 521 Location: Nairobi

|

mlennyma wrote:And all this is happening during the months considered to be stock markets low seasons as we close the year. Very interesting indeed. And at a time when the much hyped capital gains tax is drawing closer.

|

|

|

Rank: Member Joined: 6/14/2010 Posts: 521 Location: Nairobi

|

MaichBlack wrote:What is the P.E. For CFC Stanbic. I am getting different figures from different sources. The wazua one for example looks totally off.

Madam admin, if you can't maintain upto date and accurate information, you had better scrap or disable certain sections. Wrong information is worse and more dangerous than no information. I hope you know that!!! The EPS was 12.97. At 126/-, the PE is 9.715 Hope this helps you. I would recommend that you use the company results to calculate the PE instead of relying on Sites that could be misleading.

|

|

|

Rank: Member Joined: 8/19/2014 Posts: 125

|

Safaricom equals Kenya Powers price despite Safcom's EPS being 5 times bigger LMAO....the problem with small dividends and government ownership

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,743

|

jwatesh wrote:Safaricom equals Kenya Powers price despite Safcom's EPS being 5 times bigger LMAO....the problem with small dividends and government ownership Totally misleading! Kenya Power has 1.9 Billion issued shares while Safaricom has 40 Billion. Do the math. You even can't start comparing their share price of the two! Not directly like that!!! Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

MaichBlack wrote:jwatesh wrote:Safaricom equals Kenya Powers price despite Safcom's EPS being 5 times bigger LMAO....the problem with small dividends and government ownership Totally misleading! Kenya Power has 1.9 Billion issued shares while Safaricom has 40 Billion. Do the math. You even can't start comparing their share price of the two! Not directly like that!!! Noticed we wazuans have an issue understanding price and value. "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

jwatesh wrote:Safaricom equals Kenya Powers price despite Safcom's EPS being 5 times bigger LMAO....the problem with small dividends and government ownership Please recheck your facts. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 2/26/2008 Posts: 4,449

|

murchr wrote:MaichBlack wrote:jwatesh wrote:Safaricom equals Kenya Powers price despite Safcom's EPS being 5 times bigger LMAO....the problem with small dividends and government ownership Totally misleading! Kenya Power has 1.9 Billion issued shares while Safaricom has 40 Billion. Do the math. You even can't start comparing their share price of the two! Not directly like that!!! Noticed we wazuans have an issue understanding price and value. Maichblack is also here with loud misinformation  (we having 'our' own amicable thing in SK Club section) What do you use to value a share? Boss, Earnings Per Share <> Number of Issued Shares. In fact, doesn't your statement confirm jwatesh's point? With SCOM being a growth company regardless, what is the Price to Earnings Ratio for the two?..

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,743

|

ecstacy wrote:murchr wrote:MaichBlack wrote:jwatesh wrote:Safaricom equals Kenya Powers price despite Safcom's EPS being 5 times bigger LMAO....the problem with small dividends and government ownership Totally misleading! Kenya Power has 1.9 Billion issued shares while Safaricom has 40 Billion. Do the math. You even can't start comparing their share price of the two! Not directly like that!!! Noticed we wazuans have an issue understanding price and value. Maichblack is also here with loud misinformation  (we having 'our' own amicable thing in SK Club section) What do you use to value a share? Boss, Earnings Per Share <> Number of Issued Shares. In fact, doesn't your statement confirm jwatesh's point? With SCOM being a growth company regardless, what is the Price to Earnings Ratio for the two?.. Safaricom shares costing 15.x and Kenya Power shares costing 15.y is NOTHING TO COMPARE because they don't have the same number of issued shares. If safaricom had the same number of shares as Kenya Power, each would be going for 315 (mathematically). Na shida zako za SK Club ukiwache huko!!! Just because I pointed out your misinformation you take personally and start 'hunting' for me? He he he. Relax!!! Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 2/26/2008 Posts: 4,449

|

MaichBlack wrote:ecstacy wrote:murchr wrote:MaichBlack wrote:jwatesh wrote:Safaricom equals Kenya Powers price despite Safcom's EPS being 5 times bigger LMAO....the problem with small dividends and government ownership Totally misleading! Kenya Power has 1.9 Billion issued shares while Safaricom has 40 Billion. Do the math. You even can't start comparing their share price of the two! Not directly like that!!! Noticed we wazuans have an issue understanding price and value. Maichblack is also here with loud misinformation  (we having 'our' own amicable thing in SK Club section) What do you use to value a share? Boss, Earnings Per Share <> Number of Issued Shares. In fact, doesn't your statement confirm jwatesh's point? With SCOM being a growth company regardless, what is the Price to Earnings Ratio for the two?.. Safaricom shares costing 15.x and Kenya Power shares costing 15.y is NOTHING TO COMPARE because they don't have the same number of issued shares. If safaricom had the same number of shares as Kenya Power, each would be going for 315 (mathematically). ..and that is why for VALUE, NOT PRICE, ratios are used not this random comparison you are on..PEACE

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,800 Location: NAIROBI

|

Profit taking begins. Even EABL is suffering the same fate down by ksh.22 today. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Safaricom takes on banks with cross-border cash transfersWhen is the banking license coming to make mpesa bank official... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 7/3/2014 Posts: 245

|

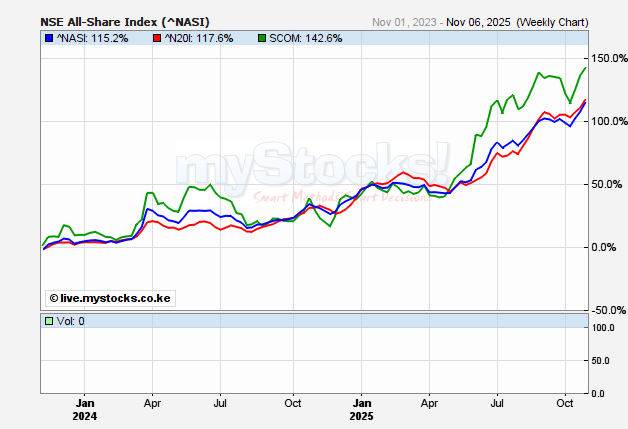

MPESABANK VS NASI VS NSE In the world of securities, courage and patience become the supreme virtues after adequate knowledge and a tested judgment are at hand.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Business Daily wrote:Consumers defied a partial rise in M-Pesa tariffs to push up by one-quarter cash sent through mobile platforms in the first 11 months of last year, surpassing the 2013 total.

Latest Central Bank of Kenya (CBK) data shows mobile payments grew 24.8 per cent to total Sh2.1 trillion as at the end of November, exceeding the Sh1.9 trillion handled in the full year 2013.

This means Kenyans moved an average of Sh6.4 billion everyday through mobile money compared to Sh5.2 billion daily in the first 11 months of 2013.

This is despite Safaricom’s decision to raise M-Pesa (which makes up 60 per cent of total transfers) charges from September last year for those sending more than Sh1,500 through its platform. "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Member Joined: 8/19/2014 Posts: 125

|

Mpesa and Data big areas for growth

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

What if safcom starts a car security and tracking subsidiary...? I think there is market, they are more trusted, have the infrastructure/technology and its all about Internet and communication. just thinking anyway, if they can do a police thing they can excel on this front. "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: New-farer Joined: 1/5/2011 Posts: 93

|

mlennyma wrote:What if safcom starts a car security and tracking subsidiary...? I think there is market, they are more trusted, have the infrastructure/technology and its all about Internet and communication. just thinking anyway, if they can do a police thing they can excel on this front. I think the risk /exposure is more which could possibly lead to bad cv and dent into their goodwill. ... in the event of carjacking or rogue employees of the big transport companies... I think the effort is too much. and again there is no regulator/ a big bro in the industry. If you dont want to use plan B, have a good plan A.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Business Daily wrote:Payments made using plastic cards dipped by a fifth in 11 months to November last year as mobile phone-based payments ate into commercial banks’ business.

Consumers defy rise in tariffs raising mobile cash to Sh2.1trn

Pain and gain as Kenya adopts digital payments

The latest Central Bank of Kenya (CBK) data shows that card payments plunged 18.2 per cent to Sh1.1 trillion as at the end of November, compared to Sh1.4 trillion a year earlier. "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: New-farer Joined: 12/11/2013 Posts: 63

|

MaichBlack wrote:What is the P.E. For CFC Stanbic. I am getting different figures from different sources. The wazua one for example looks totally off.

Madam admin, if you can't maintain upto date and accurate information, you had better scrap or disable certain sections. Wrong information is worse and more dangerous than no information. I hope you know that!!! Rich data accessed freely at www.rich.co.ke is more accurate than wazua's data.

|

|

|

Rank: Member Joined: 5/6/2008 Posts: 9

|

Any one received Dividends from Safaricom in December ? Always received payment in December but so far nothing

|

|

|

Wazua

»

Investor

»

Stocks

»

Safaricom HY 2014/2015 EPS up 32%

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|