Wazua

»

Investor

»

Stocks

»

KQ H1 2014 results 12.5 B Loss

Rank: Elder Joined: 9/15/2006 Posts: 3,907

|

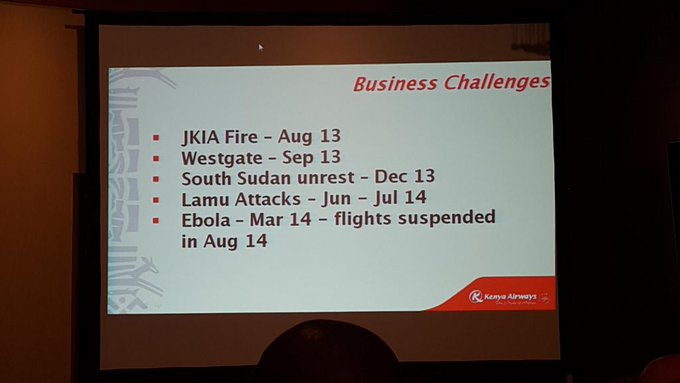

The strong gusts when a plane tumbles from the sky (take that in the chin sage @obiero  ) What is there to say, just bad numbers: • H1 2014 Turnover 56.788b Half Year Loss after Tax 10.451b versus +384m • Gross profit comes to 6.8B compared to last year's 11.1B • Borrowings and Financial lease obligations 95.024b versus 50.120b • Cash and cash equivalent at the end of this half year stands at 4.5M (versus 11bn a year ago) Some excuses  Bad picture in full https://www.nse.co.ke/listed-com...-ended-30-september-2014 Bad picture in full https://www.nse.co.ke/listed-com...-ended-30-september-2014And a profit warning announcement to boot https://www.nse.co.ke/listed-com...fit-warning-announcement

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,192 Location: nairobi

|

Kenya Airways posts a pretax loss of 12.5 bln shillings in H1Thu Nov 13, 2014 5:37am GMT Print | Single Page [-] Text [+] NAIROBI Nov 13 (Reuters) - Kenya Airways reported a pretax loss of 12.5 billion shillings ($138.97 million) in the first half of the year, ending in September, from a profit of 548 million shillings a year ago, its finance director said on Thursday. The carrier, which is part-owned by Air-France KLM , blamed lower passenger yields during the period and higher fleet costs for the loss. http://www.reuters.com/article/...ys-idUSL6N0T30AB20141113"Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,192 Location: nairobi

|

And this guys were refusing wetangulas air fare. "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 11/27/2007 Posts: 3,604

|

mlennyma wrote:Kenya Airways posts a pretax loss of 12.5 bln shillings in H1Thu Nov 13, 2014 5:37am GMT Print | Single Page [-] Text [+] NAIROBI Nov 13 (Reuters) - Kenya Airways reported a pretax loss of 12.5 billion shillings ($138.97 million) in the first half of the year, ending in September, from a profit of 548 million shillings a year ago, its finance director said on Thursday. The carrier, which is part-owned by Air-France KLM , blamed lower passenger yields during the period and higher fleet costs for the loss. http://www.reuters.com/article/...ys-idUSL6N0T30AB20141113 waiting for the counter to pull a MMS African parents don't know how to say sorry.. the closest you will get to a sorry is a 'have you eaten'

|

|

|

Rank: Elder Joined: 10/13/2009 Posts: 1,950 Location: in kenya

|

This must be some kind of a Record.....The Heading tomorrow might cause this stock to crash. KQ results'......to the acknowledgment of the mystery of God, and of the Father, and of Christ; 3 In whom are hid all the treasures of wisdom and knowledge.' Colossians 2:2-3

|

|

|

Rank: Elder Joined: 3/19/2010 Posts: 3,504 Location: Uganda

|

sema financial haemorrhage!! they only have 4.5 millions in cash and cash equivalentsvs 11billion last year. hiyo si nI petty cash ya mdosi mmoja. how will they pay their debts. what a nasty legacy by naikuni. punda amecheka

|

|

|

Rank: Veteran Joined: 3/12/2010 Posts: 1,199 Location: Eastlander

|

Westgate attack... Fire at JKIA... Increased terrorist threats... General Insecurity in KE.. Travel Advisories.. Hon Moses Wetangula's failure to produce photo proof of himself... Prophet Dr Kanyari etc. Reasons for KSH 12.5Billion in losses. However all these did not hinder 33% increase of Top Executives salary packs. It is really hard work to make losses in billions in this country. O.o ..Let your light so shine before men, that they may see your good works, and glorify your Father which is in heaven...Matt5:16

- 1769 Oxford King James Bible 'Authorized Version

|

|

|

Rank: Veteran Joined: 8/16/2009 Posts: 994

|

ProverB wrote:Westgate attack... Fire at JKIA... Increased terrorist threats... General Insecurity in KE.. Travel Advisories.. Hon Moses Wetangula's failure to produce photo proof of himself... Prophet Dr Kanyari etc. Reasons for KSH 12.5Billion in losses.

However all these did not hinder 33% increase of Top Executives salary packs.

It is really hard work to make losses in billions in this country. O.o well said. Time is money, so money is time. Money saved is time gained in reverse! Money stores your life’s energy. You expend your energy, get paid money, and store that money for a future purchase made in a currency.

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,271 Location: Nairobi

|

This is very interesting... Delta went for cheaper, older planes than the pricey, newer planes. And Delta is profitable. KQ's partner KLM/AF made huge losses. It is true about they say about the company you keep... KQ needs to change the Board, the Management and the Strategic Investor! Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,798 Location: NAIROBI

|

What is happening to KQ is a reflection of what is happening in kenya. We are becoming an over capacity country. KQ buying newer,bigger expensive planes before looking at whether passengers are there. We are talking about 5000 mw yet industries to consume that power are not there and we don't know whether they will be there. SGR viability was also brought into question. All these are being funded by loans and the question is where will the money to repay the loans while ensuring the firms are profitable when the market is not known Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

leave GK firms to GK. I'm sure it's only a matter of time before the skeletons come out of how cash was siphoned like mms. and I highly doubt that profit of last year now... numbers don't lie. some wazua wise men had serious queries about project mawingu, right now, what they feared is coming true The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Member Joined: 1/13/2014 Posts: 397 Location: Denmark

|

Ericsson wrote:What is happening to KQ is a reflection of what is happening in kenya.

We are becoming an over capacity country.

KQ buying newer,bigger expensive planes before looking at whether passengers are there.

We are talking about 5000 mw yet industries to consume that power are not there and we don't know whether they will be there.

SGR viability was also brought into question.

All these are being funded by loans and the question is where will the money to repay the loans while ensuring the firms are profitable when the market is not known Can I also add the laptop project. BTW, KQ management is acting like kenyan mps- kujiongeza tu mshahara anyhow Seeing is believing

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

@Ericsson. precisely. I also find kengen and kplc exposing (unecessarily) themselves with debt for that high capacity when a lesser gradual growth with less debt would suffice. the motives behind these actions bearing in mind the top shareholder is pretty obvious The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Veteran Joined: 11/15/2013 Posts: 1,977 Location: Here

|

Aguytrying wrote:leave GK firms to GK. I'm sure it's only a matter of time before the skeletons come out of how cash was siphoned like mms. and I highly doubt that profit of last year now... numbers don't lie.

some wazua wise men had serious queries about project mawingu, right now, what they feared is coming true How much does gvt of k have in safaricom ? Everybody STEALS, a THIEF is one who's CAUGHT stealing something of LITTLE VALUE. !!!

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

Boris Boyka wrote:Aguytrying wrote:leave GK firms to GK. I'm sure it's only a matter of time before the skeletons come out of how cash was siphoned like mms. and I highly doubt that profit of last year now... numbers don't lie.

some wazua wise men had serious queries about project mawingu, right now, what they feared is coming true How much does gvt of k have in safaricom ? you tell me. if significant then safaricom could be a special case! The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Member Joined: 3/15/2009 Posts: 362

|

Aguytrying wrote:Boris Boyka wrote:Aguytrying wrote:leave GK firms to GK. I'm sure it's only a matter of time before the skeletons come out of how cash was siphoned like mms. and I highly doubt that profit of last year now... numbers don't lie.

some wazua wise men had serious queries about project mawingu, right now, what they feared is coming true How much does gvt of k have in safaricom ? you tell me. if significant then safaricom could be a special case! Arguement arrested and your trying to worm yourself out

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,798 Location: NAIROBI

|

@Boris Boyka,Aguytrying Safaricom gava has a bigger shareholding than in KQ i.e 35% while in KQ its 29%. Safaricom is a special case in that under the deal they signed with gava;vodafone will be the ones managing and appointing the CEO,CFO and CTO. So gava's work is to sit aside and enjoy the dividends.They are not to interefere with the management. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 10/13/2009 Posts: 1,950 Location: in kenya

|

Ericsson wrote:@Boris Boyka,Aguytrying

Safaricom gava has a bigger shareholding than in KQ i.e 35% while in KQ its 29%.

Safaricom is a special case in that under the deal they signed with gava;vodafone will be the ones managing and appointing the CEO,CFO and CTO.

So gava's work is to sit aside and enjoy the dividends.They are not to interefere with the management. I think Also KQ has the same agreement top management must be sanctioned by KLM. '......to the acknowledgment of the mystery of God, and of the Father, and of Christ; 3 In whom are hid all the treasures of wisdom and knowledge.' Colossians 2:2-3

|

|

|

Rank: Member Joined: 8/19/2014 Posts: 125

|

Ericsson wrote:What is happening to KQ is a reflection of what is happening in kenya.

We are becoming an over capacity country.

KQ buying newer,bigger expensive planes before looking at whether passengers are there.

We are talking about 5000 mw yet industries to consume that power are not there and we don't know whether they will be there.

SGR viability was also brought into question.

All these are being funded by loans and the question is where will the money to repay the loans while ensuring the firms are profitable when the market is not known If you wanted to set up a factory and the power is not enough in the country would u wait years for the country to set up the power or will u go to where there is enough power? Dreamliners we bought since they are cheaper to manage and it gives them a chance to expand their routes and be at par with competitor Ethiopian Airlines, you cant compete without the tools....tools first then compete...just like fibre internet, we still dont use most of the capacity and there were very few smartphones at the time of set up, look at the situation now, 150% growth in consumption year on year....cheap power will be same, more industries, more businesses

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,192 Location: nairobi

|

Sufficient power is as good as mankind especially geothermal which is natures blessing power can also be sold to neighbours if its cheap and natural to produce forever "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Wazua

»

Investor

»

Stocks

»

KQ H1 2014 results 12.5 B Loss

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|