Wazua

»

Investor

»

Stocks

»

Elliott Wave Analysis Of The NSE 20

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

Mukiri wrote:hisah wrote:Sufficiently Philanga....thropic wrote:hisah wrote:mnandii wrote:USDKES at 88.13. Falling as expected. Inflation up, econ slump yet bulls are trying to push the market at these lofty levels... This won't end nicely for the bulls... USD strength is definitely coming in Sept. @Hisah, what happens on Sept 15th? I see it's a day before Safcom's div book close. Black monday perhaps at the NSE? Hope not! Likely the day when some major news hits the fx market about the USD money policy as per credit market rumour mill. This, from someone who's been bearish on banks as they continue to outdo themselves? The same someone who made a wrong call on KQ not so long ago? This might be big money, making alot of noise, looking for bigger discounts, to get in. Historically, September is to the market, what January is to most salaried folk. But maybe not as dramatic as is being painted. @mukiri. My take is that this year is going to be the worst for the buy and hold people. The banks' share prices are doing good but it may be the best time to take profits. Failure to do so will only mean watching your 'unrealized' profits vanishing.  As I had stated in a previous post within this thread, I expect NSE 20 Share index to top at a max of 5450 points then fall off. And the drop will not be limited to bank stocks only.  Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 7/11/2012 Posts: 5,222

|

mnandii wrote:Mukiri wrote:hisah wrote:Sufficiently Philanga....thropic wrote:hisah wrote:mnandii wrote:USDKES at 88.13. Falling as expected. Inflation up, econ slump yet bulls are trying to push the market at these lofty levels... This won't end nicely for the bulls... USD strength is definitely coming in Sept. @Hisah, what happens on Sept 15th? I see it's a day before Safcom's div book close. Black monday perhaps at the NSE? Hope not! Likely the day when some major news hits the fx market about the USD money policy as per credit market rumour mill. This, from someone who's been bearish on banks as they continue to outdo themselves? The same someone who made a wrong call on KQ not so long ago? This might be big money, making alot of noise, looking for bigger discounts, to get in. Historically, September is to the market, what January is to most salaried folk. But maybe not as dramatic as is being painted. @mukiri. My take is that this year is going to be the worst for the buy and hold people. The banks' share prices are doing good but it may be the best time to take profits. Failure to do so will only mean watching your 'unrealized' profits vanishing.  As I had stated in a previous post within this thread, I expect NSE 20 Share index to top at a max of 5450 points then fall off. And the drop will not be limited to bank stocks only.  Ok. Though the post was to @Hisah, who's prophesied 15 Sept to be black Monday. I'm curious seeing as I wasn't in Wazua then, did anybody here correctly predict the last global meltdown?

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Mukiri wrote:mnandii wrote:Mukiri wrote:hisah wrote:Sufficiently Philanga....thropic wrote:hisah wrote:mnandii wrote:USDKES at 88.13. Falling as expected. Inflation up, econ slump yet bulls are trying to push the market at these lofty levels... This won't end nicely for the bulls... USD strength is definitely coming in Sept. @Hisah, what happens on Sept 15th? I see it's a day before Safcom's div book close. Black monday perhaps at the NSE? Hope not! Likely the day when some major news hits the fx market about the USD money policy as per credit market rumour mill. This, from someone who's been bearish on banks as they continue to outdo themselves? The same someone who made a wrong call on KQ not so long ago? This might be big money, making alot of noise, looking for bigger discounts, to get in. Historically, September is to the market, what January is to most salaried folk. But maybe not as dramatic as is being painted. @mukiri. My take is that this year is going to be the worst for the buy and hold people. The banks' share prices are doing good but it may be the best time to take profits. Failure to do so will only mean watching your 'unrealized' profits vanishing.  As I had stated in a previous post within this thread, I expect NSE 20 Share index to top at a max of 5450 points then fall off. And the drop will not be limited to bank stocks only.  Ok. Though the post was to @Hisah, who's prophesied 15 Sept to be black Monday. I'm curious seeing as I wasn't in Wazua then, did anybody here correctly predict the last global meltdown? @mukiri - I have never come across anyone that has been 100% on the money in any fin market call. If you know one, let me know

As for Sept 15, likely marks the start of the turbulent period i.e. Sept - Nov. Not sure how low markets may dip. But a 10 - 20% dip will trigger me to be a buyer - global stocks first.

As fo KQ I made a small gain and bailed out and explained the reasons in the wazua google group.

As for KE banks, mr market is irrational and continues to ignore the CBK reports on NPLs and capital adequacy ratios. Mr market always comes round to readjust that irrational tempo. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

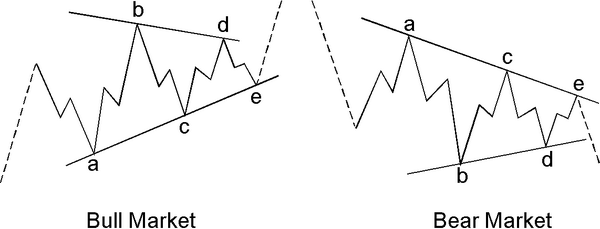

After the triangle comes a thrust.  KES$ at 88.45 presently. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

mnandii wrote: After the triangle comes a thrust.  KES$ at 88.45 presently. NSE20 bullish, KES weakening. Now when did I see this pattern? Q3 2010...

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: New-farer Joined: 4/1/2014 Posts: 47

|

@hisah.pls enlighten us on the chart of cfc.after stagnating at 128 then a sharp drop.i don't think there was bad news to warrant the drop.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Kagame wrote:@hisah.pls enlighten us on the chart of cfc.after stagnating at 128 then a sharp drop.i don't think there was bad news to warrant the drop. The economy slump doesn't offer any cheer for the market to mount a strong rally.

I don't care how far mr market is willing to stretch the bank stocks up, all I can foresee is a correction in order for mr market to be in sync with the econ mood/slump. - @muchiri - bookmark this statement...

KES down, econ slump while NSE up is a trump vote that reads 2/3 or 66% in favour of a slump. NSE vote says 33% bullish. Econ majority says 66% bearish. The NSE bull push is unsustainable in such an econ environment. Waiting for the discounts

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

hisah wrote:Kagame wrote:@hisah.pls enlighten us on the chart of cfc.after stagnating at 128 then a sharp drop.i don't think there was bad news to warrant the drop. The economy slump doesn't offer any cheer for the market to mount a strong rally.

I don't care how far mr market is willing to stretch the bank stocks up, all I can foresee is a correction in order for mr market to be in sync with the econ mood/slump. - @muchiri - bookmark this statement...

KES down, econ slump while NSE up is a trump vote that reads 2/3 or 66% in favour of a slump. NSE vote says 33% bullish. Econ majority says 66% bearish. The NSE bull push is unsustainable in such an econ environment. Waiting for the discounts

Consider it done. "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

If USDKES breaks above 90 it opens up 95 which means NSE will definitely start bending lower (selling pressure increases). Both are never aligned since they are inversely related. Bulls need KES to strength to keep the steam up... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 7/11/2012 Posts: 5,222

|

Kagame wrote:@hisah.pls enlighten us on the chart of cfc.after stagnating at 128 then a sharp drop.i don't think there was bad news to warrant the drop. CFC is temporary under-performing as foreign investors have reached their max allowable. That should tell you something. #neversellagoodthing

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

hisah wrote:If USDKES breaks above 90 it opens up 95 which means NSE will definitely start bending lower (selling pressure increases). Both are never aligned since they are inversely related. Bulls need KES to strength to keep the steam up... Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

Safaricom, thrusting from a triangle. Beware that the upside is limited. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

Sufficiently Philanga....thropic wrote:mnandii wrote:DETAILED ANALYTICS Working Long Term Chart of the NSE 20 Share Index:  Wave B is from March 2009 and subdivides into Waves [a], ..[ .b] and [c]. The target top is calculated as follows: 1. Length of wave A = (6161.46 - 2360.01) = 3801.45 points 0.786 X wave A = wave B Therefore: 0.786 X 3801.45 = 2987.94 points Add 2987.94 points to Wave A bottom to get the end of wave B: 2987.94 + 2360.01 = 5347.952. The Widest Height of the triangle added to wave [ .e] bottom gives a target for final wave. Wave [ .b], in our case, is the widest (tallest) and therefore: (5137.21 - 4561.74) = 575.47 points Wave [e] bottom at 4863.87 + 575.47 = 5439.343.  Wave [a] length = ( 4701.15 - 2360.01 ) = 2341.14 For Wave [a] = Wave [c] ( a common wave relationship) then we add the length of wave [ .a] to bottom of wave [ .b] to get the top of wave [c] (and also wave B). Therefore: (2341.14 + 3070.36) = 5411.5AND THUS THE TARGETED RANGE >> 5340 - 5440 POINTS FOR NSE 20 SHARE INDEX. Great attempt @mnandii at calling the top. I think we are in agreement that we shall get here early to mid September(16th Sept) and then the fall. But it may be earlier if the 90 USDKES psychological level is breached this week. NSE 20 Share Index at 5139 29th August, 2014. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

A running triangle. Thrusts from triangles always forewarn of an ending move. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

The stock market as a whole has never accelerated upward at a market top. It often accelerates off bottoms, and it always accelerates in the center of a third wave; but it has always lost momentum in a fifth wave relative to the third wave. Predictions for a blow-off defy history. Commodities are the exception … . [They] often accelerate upward before reversing. … The reason for the difference is that commodities peak on fear, whereas stocks peak on complacency. The Elliott Wave Theorist, December 2013 Read more: http://www.elliottwave.c...Bang.aspx#ixzz3Btbg8RqD Follow us: @elliottwaveintl on Twitter | ElliottWaveInternational on Facebook Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

Stanford finance professor Anat Admati says big U.S. banks are putting the nation's financial system at risk. Even after the rule changes brought on by the financial crisis, banks still lend out 95% of depositors' money. In other words: Big U.S. banks only keep 5% of deposits on hand. Admati says "something is very wrong" with the banking industry's overuse of leverage. She's been on a relentless public crusade to get regulators to raise the reserve requirements of banks. Otherwise, she believes it's just a matter of time before there's another financial crisis. Ms. Admati argues that banks are taking larger risks than other kinds of companies because they use other people's money, and the results are that they keep crashing the economy. …. [She] says large banks should be required to raise at least 30 percent of their funding in the form of equity. New York Times, Aug. 10 As you might imagine, bank executives disagree with Ms. Admati's stance on reserve requirements. Bankers say higher reserve levels will make U.S. banks less competitive. Yet consider that before the 2007-2009 financial crisis, bankers had persuaded regulators to reduce their reserve requirements to almost non-existent levels. Quote:In the early 1990s, the Federal Reserve Board … took a controversial step and removed banks’ reserve requirements almost entirely.

Now banks can lend out virtually all of their deposits. In fact, they can lend out more than all of their deposits, because banks’ parent companies can issue stock, bonds, commercial paper or any financial instrument and lend the proceeds to their subsidiary banks, upon which assets the banks can make new loans. …

… when banks lend money, it gets deposited in other banks, which can lend it out again. Without a reserve requirement, the multiplier effect is no longer restricted to ten times deposits; it is virtually unlimited. Every new dollar deposited can be lent over and over throughout the system: A deposit becomes a loan becomes a deposit becomes a loan, and so on. Conquer the Crash, second edition, pp. 101-102 The July/August 2013 Elliott Wave Theorist described bank accounts as "IOUs backed by IOUs." Read more: http://www.elliottwave.c...ong-.aspx#ixzz3Bte6LlW1 Follow us: @elliottwaveintl on Twitter | ElliottWaveInternational on Facebook Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

@mnandii @sparkly @philanga - have a look at KCB and EQTY weekly and monthly charts (3/5/10yr).  I am very concerned... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

hisah wrote:@mnandii @sparkly @philanga - have a look at KCB and EQTY weekly and monthly charts (3/5/10yr).  I am very concerned... Heavily overbought. Waiting for a strong USD(end of QE) for the perfect haircut  @SufficientlyP

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Sufficiently Philanga....thropic wrote:hisah wrote:@mnandii @sparkly @philanga - have a look at KCB and EQTY weekly and monthly charts (3/5/10yr).  I am very concerned... Heavily overbought. Waiting for a strong USD(end of QE) for the perfect haircut  And there comes the headlines.

www.businessdailyafrica....6/-/7q7u4sz/-/index.html

Holding my breath...$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

hisah wrote:Sufficiently Philanga....thropic wrote:hisah wrote:@mnandii @sparkly @philanga - have a look at KCB and EQTY weekly and monthly charts (3/5/10yr).  I am very concerned... Heavily overbought. Waiting for a strong USD(end of QE) for the perfect haircut  And there comes the headlines.

www.businessdailyafrica....6/-/7q7u4sz/-/index.html

Holding my breath... They must read wazua(S.A English) Slaughter house getting set up as we speak  @SufficientlyP

|

|

|

Wazua

»

Investor

»

Stocks

»

Elliott Wave Analysis Of The NSE 20

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|