Wazua

»

Investor

»

Stocks

»

buy and never sell great businesses

Rank: Member Joined: 9/14/2011 Posts: 868 Location: nairobi

|

Thanks Guru

on Unaitas, i saw they advertised for consultants to do capital restructuring

do you think they will start restricting new members to allow old members get more shares

how long do you think they will keep the doors open for new members considering they target to list within the new strategic plan period of 2014-2018

|

|

|

Rank: New-farer Joined: 3/1/2014 Posts: 82

|

I think UNAITAS will restrict new members from buying the shares when they hit the 1.8 billion target. They then, might limit the number of shares existing members can buy “The beauty of success is that it doesn’t matter how many times you have failed, you only have to be right once and then everyone can tell you how lucky you are.” - Mark Cuban

|

|

|

Rank: Member Joined: 5/14/2014 Posts: 289 Location: nairobi

|

target1360 wrote:sparkly wrote:target1360 wrote:After reading many books on investments,especially on munger and my own experience i now dont see the need for selling stocks of a business that has a relatively high ROE and expected continous high growth in EPS.

1. i bought centum at 13 then sold ar 20.bought at 24 sold at 35.then the other day i bought at 37.realy whats the point if paying all the transaction costs?

2.i have traded other stocks and paid unnecessary expenses not to mention market timing challenges.

bottom line is if you are able to identify a stock that compounds at a constitently high roe eg equity,centum,britam then theres no point in trading/watching the nse Change that to "buy undervalued stocks and sell overvalued stocks". Centum's NAV is around 26. It makee sense to buy at 13 and at 24 but buying at 37 exposes you to a loss in real terms. @sparkly thank you for the insight which i nappreciate but i have learnt to assign very little weight to NAV.For instance olympia has a NAV of over 20 but am sure you wouldnt recomend it. Also consinder an instance where at a given time two companies hav an equal NAV but one grows its earnings/NAV at 35% while the other grows at say 5% one might buy an investment company at a premium to the NAV where one has certainty that he wil very soon compensated for the premium by the fast growth of the business. price is what you pay and value is what you get. centum just clocked 48 jumping in anf out of a good mbass can be injurious because one will not always get the timing right I find satisfaction in owning great business,not trading them

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

target1360 wrote:After reading many books on investments,especially on munger and my own experience i now dont see the need for selling stocks of a business that has a relatively high ROE and expected continous high growth in EPS.

1. i bought centum at 13 then sold ar 20.bought at 24 sold at 35.then the other day i bought at 37.realy whats the point if paying all the transaction costs?

2.i have traded other stocks and paid unnecessary expenses not to mention market timing challenges.

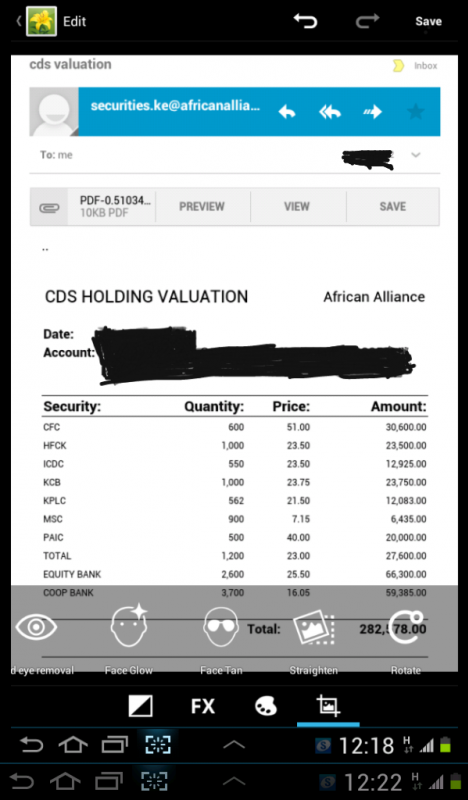

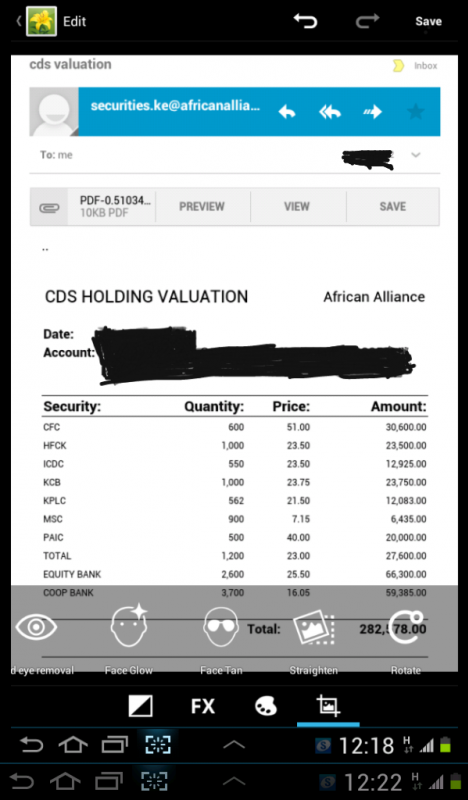

bottom line is if you are able to identify a stock that compounds at a constitently high roe eg equity,centum,britam then theres no point in trading/watching the nse  What of these would you continue buying or sell,note the initial purchase price... possunt quia posse videntur

|

|

|

Rank: Member Joined: 5/14/2014 Posts: 289 Location: nairobi

|

maka wrote:target1360 wrote:After reading many books on investments,especially on munger and my own experience i now dont see the need for selling stocks of a business that has a relatively high ROE and expected continous high growth in EPS.

1. i bought centum at 13 then sold ar 20.bought at 24 sold at 35.then the other day i bought at 37.realy whats the point if paying all the transaction costs?

2.i have traded other stocks and paid unnecessary expenses not to mention market timing challenges.

bottom line is if you are able to identify a stock that compounds at a constitently high roe eg equity,centum,britam then theres no point in trading/watching the nse  What of these would you continue buying or sell,note the initial purchase price... 1.personally i wouldnt sell any. 2.If i must sell then i would sell the two weaklings/weeds in your farm/gava firms i.e kplc and msc. 3.At the moment am not in a position to advise on what to buy 4.i think you have a great portfolio of above average busineness capable of consistently delivering above average returns without need of unnecessary trading. my 2cents I find satisfaction in owning great business,not trading them

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,931

|

You can imagine if you sold CFC in 80's, KCB in 40's, Pan Africa in 90's etc In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Angelica _ann wrote:You can imagine if you sold CFC in 80's, KCB in 40's, Pan Africa in 90's etc  I have really learnt to be patient in this market...want to stock up on Kenol now... possunt quia posse videntur

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

This sums it all up "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 9/15/2006 Posts: 3,907

|

Even the greatest trader who ever lived agrees..  Aguytrying wrote:this is what young was preaching on wazua and I too have been preaching.

@sparkly. Ben Graham taught us the buy undervalued and sell overvalued. Buffet perfected it by buying great relatively undervalued well run with top notch trustworthy management and never selling And right here let me say one thing: After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I’ve known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine that is, they made no real money out of it. Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money. It is literally true that millions come easier to a trader after he knows how to trade than hundreds did in the days of his ignorance. – Jesse Livermore

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

@muganda. so true.  . the challenge for most is that frequently buying and selling feels right when done frequently. it feels clever in the short term. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Member Joined: 5/14/2014 Posts: 289 Location: nairobi

|

target1360 wrote:After reading many books on investments,especially on munger and my own experience i now dont see the need for selling stocks of a business that has a relatively high ROE and expected continous high growth in EPS.

1. i bought centum at 13 then sold ar 20.bought at 24 sold at 35.then the other day i bought at 37.realy whats the point if paying all the transaction costs?

2.i have traded other stocks and paid unnecessary expenses not to mention market timing challenges.

bottom line is if you are able to identify a stock that compounds at a constitently high roe eg equity,centum,britam then theres no point in trading/watching the nse Looking back at the first post on this thread on 1st June year an investor who bought the three noted stocks has made a tidy return in less than half an year. britam was 17.55 now 36.5=107%profit centum was 38.5 now 77& =100% profit equity was 41.75 now 59 =41% profit. simple average return of 82% in less than half a year. Ignoring these short term results i expect the three stocks to compound wealth at an average of over 50% over the fore see able future. Thank you. I find satisfaction in owning great business,not trading them

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,770

|

guru267 wrote:jawgey wrote:In view of this thread I'd love if we shared some of the currently undervalued companies with massive potential for growth. A good example to start with would be KPLC and KQ(I know this is debatable but I still believe there's great potential if project mawingu is something to go by) 1. Unaitas 2. C&G 3. Kenya re @guru267 - Kindly break down the numbers on Unaitas. Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Member Joined: 1/2/2008 Posts: 268 Location: Nairobi

|

target1360 wrote:target1360 wrote:After reading many books on investments,especially on munger and my own experience i now dont see the need for selling stocks of a business that has a relatively high ROE and expected continous high growth in EPS.

1. i bought centum at 13 then sold ar 20.bought at 24 sold at 35.then the other day i bought at 37.realy whats the point if paying all the transaction costs?

2.i have traded other stocks and paid unnecessary expenses not to mention market timing challenges.

bottom line is if you are able to identify a stock that compounds at a constitently high roe eg equity,centum,britam then theres no point in trading/watching the nse Looking back at the first post on this thread on 1st June year an investor who bought the three noted stocks has made a tidy return in less than half an year. britam was 17.55 now 36.5=107%profit centum was 38.5 now 77& =100% profit equity was 41.75 now 59 =41% profit. simple average return of 82% in less than half a year. Ignoring these short term results i expect the three stocks to compound wealth at an average of over 50% over the fore see able future. Thank you. The above % profits are just on paper. You will only make that profit if you sell off the shares, otherwise, these values can easily go back to 0% and -% in no time.

|

|

|

Rank: Member Joined: 5/14/2014 Posts: 289 Location: nairobi

|

icecube wrote:target1360 wrote:target1360 wrote:After reading many books on investments,especially on munger and my own experience i now dont see the need for selling stocks of a business that has a relatively high ROE and expected continous high growth in EPS.

1. i bought centum at 13 then sold ar 20.bought at 24 sold at 35.then the other day i bought at 37.realy whats the point if paying all the transaction costs?

2.i have traded other stocks and paid unnecessary expenses not to mention market timing challenges.

bottom line is if you are able to identify a stock that compounds at a constitently high roe eg equity,centum,britam then theres no point in trading/watching the nse Looking back at the first post on this thread on 1st June year an investor who bought the three noted stocks has made a tidy return in less than half an year. britam was 17.55 now 36.5=107%profit centum was 38.5 now 77& =100% profit equity was 41.75 now 59 =41% profit. simple average return of 82% in less than half a year. Ignoring these short term results i expect the three stocks to compound wealth at an average of over 50% over the fore see able future. Thank you. The above % profits are just on paper. You will only make that profit if you sell off the shares, otherwise, these values can easily go back to 0% and -% in no time. @icecube. you are right.Am not planning to sell, i hold on and see what the future holds for these businesses. I find satisfaction in owning great business,not trading them

|

|

|

Rank: Member Joined: 1/4/2013 Posts: 255

|

The problem with the "buy and never sell" doctrine is that unless the dividend yield is really really good (or it's average but you invested really big capital to base it on) the paper profit doesn't help you much. You can only advance yourself by realising profit and reinvesting it. Even the great man that the quote is attributed to has bought and sold/traded shares. It's his own company stock that he doesnt sell. I think the better doctrine would be "buy and don't be in a hurry to sell". The 'secret' is the TIMING.

|

|

|

Rank: Member Joined: 5/14/2014 Posts: 289 Location: nairobi

|

its2013 wrote:The problem with the "buy and never sell" doctrine is that unless the dividend yield is really really good (or it's average but you invested really big capital to base it on) the paper profit doesn't help you much. You can only advance yourself by realising profit and reinvesting it. Even the great man that the quote is attributed to has bought and sold/traded shares. It's his own company stock that he doesnt sell. I think the better doctrine would be "buy and don't be in a hurry to sell". The 'secret' is the TIMING. i agree. I find satisfaction in owning great business,not trading them

|

|

|

Rank: Member Joined: 5/14/2014 Posts: 289 Location: nairobi

|

target1360 wrote:its2013 wrote:The problem with the "buy and never sell" doctrine is that unless the dividend yield is really really good (or it's average but you invested really big capital to base it on) the paper profit doesn't help you much. You can only advance yourself by realising profit and reinvesting it. Even the great man that the quote is attributed to has bought and sold/traded shares. It's his own company stock that he doesnt sell. I think the better doctrine would be "buy and don't be in a hurry to sell". The 'secret' is the TIMING. i agree. i have today broken my rules and booked my profits.i expect to be completly exit tommorow . This thread is therefore expired I will be back when mr.market regains sanity. I find satisfaction in owning great business,not trading them

|

|

|

Rank: Member Joined: 1/4/2013 Posts: 255

|

target1360 wrote:target1360 wrote:its2013 wrote:The problem with the "buy and never sell" doctrine is that unless the dividend yield is really really good (or it's average but you invested really big capital to base it on) the paper profit doesn't help you much. You can only advance yourself by realising profit and reinvesting it. Even the great man that the quote is attributed to has bought and sold/traded shares. It's his own company stock that he doesnt sell. I think the better doctrine would be "buy and don't be in a hurry to sell". The 'secret' is the TIMING. i agree. i have today broken my rules and booked my profits.i expect to be completly exit tommorow . This thread is therefore expired I will be back when mr.market regains sanity. Good for you. I'm still in. My counters haven't joined in the rally as such.

|

|

|

Rank: Member Joined: 1/2/2008 Posts: 268 Location: Nairobi

|

its2013 wrote:The problem with the "buy and never sell" doctrine is that unless the dividend yield is really really good (or it's average but you invested really big capital to base it on) the paper profit doesn't help you much. You can only advance yourself by realising profit and reinvesting it. Even the great man that the quote is attributed to has bought and sold/traded shares. It's his own company stock that he doesnt sell. I think the better doctrine would be "buy and don't be in a hurry to sell". The 'secret' is the TIMING. I agree. This "buy and never sell" chorus can be misleading. You only make the profit by buying low and selling high, just like in any other trading. The key thing is TIMING as you have said. Holding just gives the consolation that my shares have increased in value, but until you sell the shares, that increase in value doesn't mean much. For example, an investor who bought CIC insurance shares at 8/= and sold at 11/90 would have made a profit of more than 48% before transaction charges. Very few investments can give you such a return in a few months, apart from shylocking. If he/she did not sell the shares, he makes nothing and remains with the shares. The shares can still go back to 8/= or even less..my opinion.

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

@its2013, icecube. what if the same investor bought cic at equivalent of 1.00 shs before it listed. the company is doing well and will do so for the foreseeable future. is there really any need for him to sell at 11.00? you see his capital has already grown 8 fold, If he sells, do you think he will ever buy cic at 1.00 shs again? The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Wazua

»

Investor

»

Stocks

»

buy and never sell great businesses

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|