Wazua

»

Investor

»

Stocks

»

Mumias Sugar huge demand

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

mlennyma wrote:Mumias is still selling drinking water and some companies have made it with water only,my take is that we should not behave as if mumias is an empty debe,money will be made but my main interest now is to know their debt level before i enter,who can know? Half Year water sales revenue was Kes. 14M, annualized its Kes. 28M. After deducting its cost centre, what will be left? Divide that by the 1.53B Mumias shares and tell us the EPS of the Water business On the debt, it stood at Kes. 6.04B as at 30th June 2013.

|

|

|

Rank: Member Joined: 5/6/2014 Posts: 268 Location: Nairobi, Kenya

|

What could be the 2013 results projections?

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

Sufficiently Philanga....thropic wrote:mawinder wrote:The article is pure crap.Mumias listing price was Kshs 6.25 before they diluted the stock by a factor of 3.By then there were 510m shares against the current 1.53b shares.I remember it even traded at Kshs. 3.05 before the split!!!!! What they had was not a stock split but a bonus of 2:1 Ditto @$p¥. The 2008 plunge was to factor the bonus in the share price. What caused the 2009-10 surge?

|

|

|

Rank: Member Joined: 2/18/2011 Posts: 448

|

I thought some wazuans declared their love for the stock and that they shall buy at any price 2.50 and below.Well your wish is granted,massive supply at ksh 2.5 and so far no takers..

I believe people should stop investing with emotions or sentimental value.The day you realise its all a game of money is when you shall start making decent returns in bear runs.All the best to those on board, ksh 2.40 has printed.

|

|

|

Rank: Hello Joined: 1/10/2014 Posts: 6

|

With only 1 year comesa extension,board room politics, banks attaching, low sugar cane from farmers, cheap illigal sugar imports...etc etc .will go for it when it touches 1.60.

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

@mwekezaji thanks..iam out and not ready to speculate dangerously "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Member Joined: 3/9/2010 Posts: 320 Location: kenya

|

Akenyan2014 wrote:What could be the 2013 results projections? Total disaster. Work hard at your job and you can make a living. Work hard on yourself and you can make a fortune.

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,317 Location: Nairobi

|

It is likely that Mumias will declare a loss for 2013-14. And when there is no 'head' the mice/rats are probably stealing all they can... Good luck to MSC shareholders. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Member Joined: 3/9/2010 Posts: 320 Location: kenya

|

cyruskulei wrote:Akenyan2014 wrote:What could be the 2013 results projections? Total disaster. Demand drying up. Sub 2 coming soon Work hard at your job and you can make a living. Work hard on yourself and you can make a fortune.

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

A bank somewhere is watching "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Member Joined: 3/9/2010 Posts: 320 Location: kenya

|

mlennyma wrote:A bank somewhere is watching I dont understand. Please elaborate. Thanks Work hard at your job and you can make a living. Work hard on yourself and you can make a fortune.

|

|

|

Rank: Veteran Joined: 4/27/2010 Posts: 951 Location: Nyumbani

|

This will be a study case.

I hope all those who are selling are the (other share holders) and not the other 8 top shareholders (Am excluding the Govt. I also hope those who are buying are some of the top 8 shareholders.Only time will tell those who had (do not know what to call it ) guts,luck,acumen and bought /sold.

1 Permanent Secretary, Treasury 306,000,000 20.00%

2 Kenya Commercial Bank Limited 26,322,100 1.72%

3 Standard Chartered Nominees Non-Resd. A/C 9894 26,044,467 1.70%

3 The Jubilee Insurance Company Limited 22,335,002 1.46%

4 Standard Chartered Nominee Account KE 14353 14,545,593 0.95%

5 Abdul Karim Charturbhai Popat 14,400,000 0.94%

6 Baloobhai Chhotabhai Patel 14,057,100 0.92%

7 Standard Chartered Nominees A/C 9098 AC 10,109,575 0.66%

8 Pradeep Patani 8,961,002 0.59%

9 Standard Chartered Nominees Non Resd A/C 9573 AC 8,859,000 0.58%

11 Others 1,078,366,161 70.48%

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

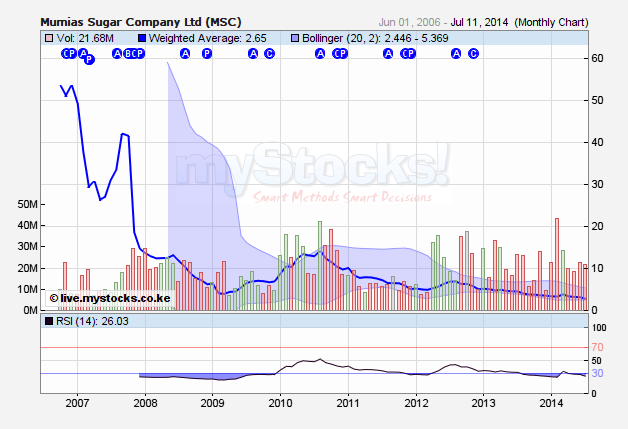

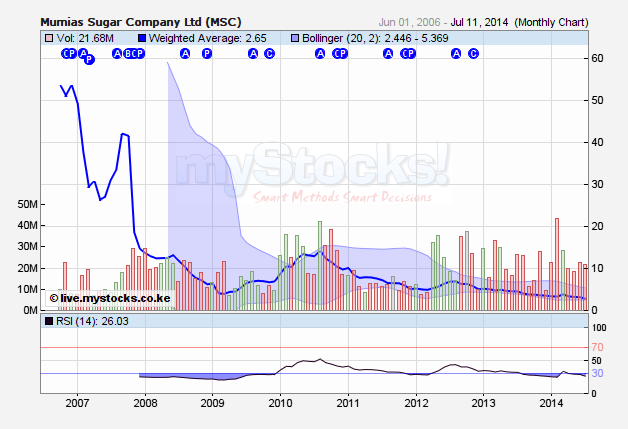

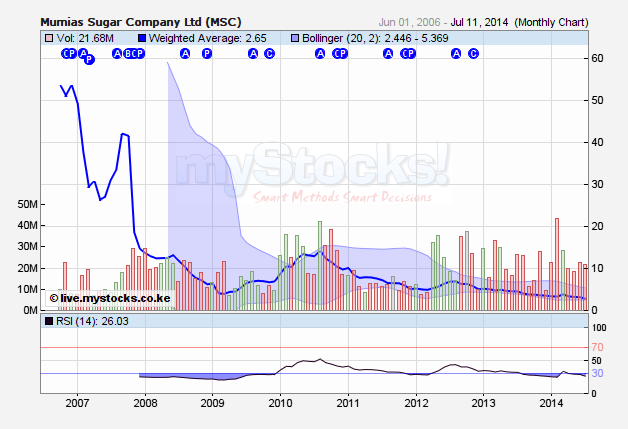

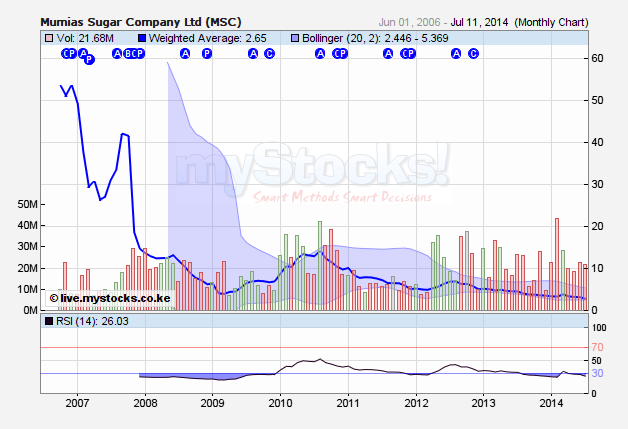

mwekez@ji wrote:Sufficiently Philanga....thropic wrote:mawinder wrote:The article is pure crap.Mumias listing price was Kshs 6.25 before they diluted the stock by a factor of 3.By then there were 510m shares against the current 1.53b shares.I remember it even traded at Kshs. 3.05 before the split!!!!! What they had was not a stock split but a bonus of 2:1 Ditto @$p¥. The 2008 plunge was to factor the bonus in the share price. What caused the 2009-10 surge? Good question. The 2009-2010 surge was due to 'financial engineering' at its best. H1 accounts were released in Feb reflecting a 518% rise in EPS to 0.68. So everyone jumped in pushing the price to highs of 13.80 just before the depressing FY news checked in at -87% EPS growth vs FY2008/2009  And that, for all practical purposes was the end of Mumiasat post 10bob, the end of Mumias, the bluechip! @SufficientlyP

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

@Mweke,that volume spike you see in 2010(between Feb and August)on the cartoon you've pulled up is exit volume. Someone somewhere with the story was slowly bailing out, selling the monkey to unsuspecting buyers  @SufficientlyP

|

|

|

Rank: Member Joined: 5/9/2014 Posts: 130 Location: Nairobi

|

This Mumias Sugar thing is now becoming some soap opera or what?

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

mwekez@ji wrote:Sufficiently Philanga....thropic wrote:mawinder wrote:The article is pure crap.Mumias listing price was Kshs 6.25 before they diluted the stock by a factor of 3.By then there were 510m shares against the current 1.53b shares.I remember it even traded at Kshs. 3.05 before the split!!!!! What they had was not a stock split but a bonus of 2:1 Ditto @$p¥. The 2008 plunge was to factor the bonus in the share price. What caused the 2009-10 surge?  @mweke - all markets started their sharp rebound in Mar 2009 when the CBs (ECB, BoE and Fed) stepped in to support the market with QE 1.0 to arrest the GFC armaggedon. But by 2011 when the KES was getting hammered vs USD MSC fundies had already turned sour. That top is still in place to date!

The MSC cartoon is still bearish, but other TA indicators are pointing to a bounce coming soon as overselling bleeds into the monthly timeframes. Any slight good news will send this thing rallying. One highly risky contra play since gok is in the mix and anything goes. You will need to die emotionally to catch this falling knife. Not for the faint hearted...

The query is will gok let MSC fold and mess jobs and lives that depended on this firm? What political gain will gok get if MSC folds? Why do I smell a protectionist policy on sugar coming soon as comesa agreements are ripped apart...

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 6/2/2011 Posts: 4,818 Location: -1.2107, 36.8831

|

So, 2.30/- printed? Hii ndio huwa inaitwa KUCHOMEKA! Jamaneni. Sirkal saidia. Sisi iko mbaya saidi! Receive with simplicity everything that happens to you.” ― Rashi

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

dunkang wrote:So, 2.30/- printed?

Hii ndio huwa inaitwa KUCHOMEKA!

Jamaneni. Sirkal saidia. Sisi iko mbaya saidi! Nikubaya wololo... possunt quia posse videntur

|

|

|

Rank: Member Joined: 3/9/2010 Posts: 320 Location: kenya

|

hisah wrote:mwekez@ji wrote:Sufficiently Philanga....thropic wrote:mawinder wrote:The article is pure crap.Mumias listing price was Kshs 6.25 before they diluted the stock by a factor of 3.By then there were 510m shares against the current 1.53b shares.I remember it even traded at Kshs. 3.05 before the split!!!!! What they had was not a stock split but a bonus of 2:1 Ditto @$p¥. The 2008 plunge was to factor the bonus in the share price. What caused the 2009-10 surge?  @mweke - all markets started their sharp rebound in Mar 2009 when the CBs (ECB, BoE and Fed) stepped in to support the market with QE 1.0 to arrest the GFC armaggedon. But by 2011 when the KES was getting hammered vs USD MSC fundies had already turned sour. That top is still in place to date!

The MSC cartoon is still bearish, but other TA indicators are pointing to a bounce coming soon as overselling bleeds into the monthly timeframes. Any slight good news will send this thing rallying. One highly risky contra play since gok is in the mix and anything goes. You will need to die emotionally to catch this falling knife. Not for the faint hearted...

The query is will gok let MSC fold and mess jobs and lives that depended on this firm? What political gain will gok get if MSC folds? Why do I smell a protectionist policy on sugar coming soon as comesa agreements are ripped apart...

The Gov can let it go if it wishes. Look at Panpaper, its gone, sold to an indian who totally burned it. Mumias is an homegrown thing and if the likes of Kidero had not mismanaged it, we would be talking of a blue chip now. However, the future is good as they have diversified their products. Work hard at your job and you can make a living. Work hard on yourself and you can make a fortune.

|

|

|

Rank: Member Joined: 1/13/2014 Posts: 398 Location: Denmark

|

dunkang wrote:So, 2.30/- printed?

Hii ndio huwa inaitwa KUCHOMEKA!

Jamaneni. Sirkal saidia. Sisi iko mbaya saidi!    unacheka wengine ama umeathiriwa? Seeing is believing

|

|

|

Wazua

»

Investor

»

Stocks

»

Mumias Sugar huge demand

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|