Wazua

»

Investor

»

Stocks

»

Safaricom FY 2014 results +31% profit after tax

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

the deal on Wednesday, January 18, 2012 7:22:47 PM wrote:It's a season of DowngradesApplause Applause Applause All in all unless Safaricom cuts it's operational costs i expect full year EBITDA to drop by 15-30% because i expect ARPU to continue falling as inflation and the recent price hike forces customers to switch to cheaper options, the weak Shilling will also continue to pose a challenge thus i expect full year EPS to come in around Sh0.23. So at the current price of Sh3.30-Sh3.35 I rate Safaricom Expense/Sell/Avoid since I don't expect it to gain by more than 15% from this current price levels. My target price is Sh2.30 by June 2012. Read more on this Link http://www.contrarianinv...ot-with-that-price-hike itz on Thursday, February 16, 2012 1:04:06 AM wrote:I think Safaricom will be last man standing in this harsh telecom game and that is partly why the stock is catching a bid.Safcom is asserting itself as the leader in the industry and with mpesa,data,cloud computing and tech growing as the economy expands it just means brighter days for Safcom.The worst thing Safcom did was float too many shares during the IPO.I would be a buyer if it dips below 3.10 I love history "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: New-farer Joined: 3/13/2012 Posts: 15

|

sparkly wrote:Boris Boyka wrote:Sufficiently Philanga....thropic wrote:Boris Boyka wrote:Dear Customer, your PostPay Bundle subscription will remain available til 25 Mar 2015 after which you can migrate to your preferred PrePay or PostPay service......via sms usiulize Rink Got that as well. By then, i'll be a proud memba sim card holder  @sp thropic I think even if the amount is doubled it's still good than prepay!! Minimum bundle will be 3k (info by customer care). This will be pay as you use, no bundles or anything. It seems it will be equal to loading via Mpesa or scratch cards

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

it was too good to be true The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Elder Joined: 9/29/2006 Posts: 2,570

|

keved wrote:sparkly wrote:Boris Boyka wrote:Sufficiently Philanga....thropic wrote:Boris Boyka wrote:Dear Customer, your PostPay Bundle subscription will remain available til 25 Mar 2015 after which you can migrate to your preferred PrePay or PostPay service......via sms usiulize Rink Got that as well. By then, i'll be a proud memba sim card holder  @sp thropic I think even if the amount is doubled it's still good than prepay!! Minimum bundle will be 3k (info by customer care). This will be pay as you use, no bundles or anything. It seems it will be equal to loading via1 Mpesa or scratch cards How is "Pay as you use" a postpay? The opposite of courage is not cowardice, it's conformity.

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

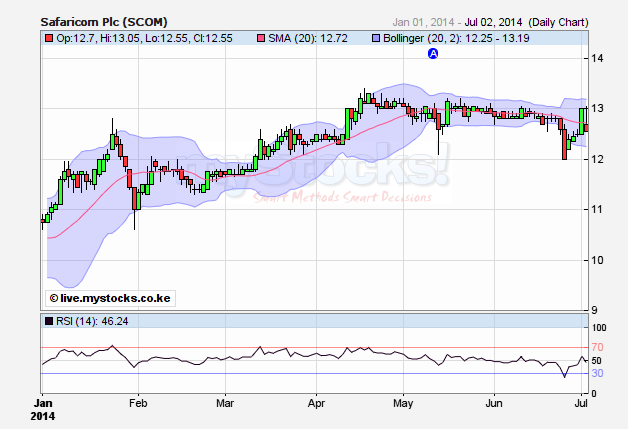

Notice the stock bottomed out when the red long candle stick which floors at 12 stuck out and closed outside the bollinger bands on 25th of June(Wednesday last week touching a low of 12) Notice also the RSI(Currently at 56.73)confirms an uptrend,which essentially happens when RSI moves above 50 level. @SufficientlyP

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

@philanga - seems like the 11.50 test is being defended. Was expecting it to be tested before the next push towards 15 - 16 level. Mpesa bank is now morphing into security and content; mobile banking is huge for all...   Note mpesa bank's cartoon influence on NSE20's cartoon. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,313 Location: Nairobi

|

Wow! Safaricom's M-Pesa under 'threat' [well, there's still a long way to go] by Airtel and Equity. It will not be easy to beat Safaricom but the battle has begun. More options and lower costs are good for consumers. http://www.businessdaily.../-/ivr2jvz/-/index.html

http://www.businessdaily...0/-/pj45q6z/-/index.htmlGreedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

If the price ever dips below 7.50 then it loses the bull power. From vol spread position, 15-16 will be tested once 13.50 gives way. There is nothing stopping that melt up. Quite a steep PER but mr market has never been rational. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,313 Location: Nairobi

|

hisah wrote:If the price ever dips below 7.50 then it loses the bull power. From vol spread position, 15-16 will be tested once 13.50 gives way. There is nothing stopping that melt up. Quite a steep PER but mr market has never been rational. Probably. At sub-10... I would look at it. At sub-8 jump in with both feet. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Volume - 67,818,500 wao! "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Member Joined: 2/18/2011 Posts: 448

|

Safaricom is shaken by Equity, whatever angle you look at it this tech shall revolutionise banking while ensuring loyal safaricom customers do not jump ship. Its a superior value proposition viz preious mobile money attempts. Disruptive technology at its best.A soon to be case study in MBA schools worldwide http://www.standardmedia...ld-affect-mpesa-s-future

|

|

|

Rank: Member Joined: 5/9/2014 Posts: 130 Location: Nairobi

|

I like the upcoming competition which should benefit Wanjiku in the long run, Safcom has made super profits in recent years unchallenged and almost forgot the plight of Wanjiku with increases especially in their money transfer fee the order of business

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

This so called coming competition might just not be. Implementation will be key the line between success and failure is very thin. Infact Safcom says it will not change its transaction fees rather increase services that it will offer. Cant wait to see how this rolls out. Interesting times ahead. "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Veteran Joined: 11/15/2013 Posts: 1,977 Location: Here

|

murchr wrote:This so called coming competition might just not be. Implementation will be key the line between success and failure is very thin. Infact Safcom says it will not change its transaction fees rather increase services that it will offer. Cant wait to see how this rolls out. Interesting times ahead. @murchr I also thought so. will.equity be looking for money or numbers of customers? eventually it will be competition btwn parties that will agree behind the counter and maintain the charges (won't drop significantly). Many banks have come up but loan rates are still high! So many players in energy sector but prices still high!! so many supermarkets but prices of commodities relatively same..........A stronger tussle will see establishment of a regulatory authority just like energy then KBRR which brings us back to where we started. "reduced rates " mimi sioni. Everybody STEALS, a THIEF is one who's CAUGHT stealing something of LITTLE VALUE. !!!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Signs off topping out are now evident... I'm very keen with mpesa bank since it's an elephant part of the index weight. If the elephant falls, so does the index.  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

At 11.50 the div yield will be 4% At 9.40 the div yield will be 5% The above is pegged on cum dividend of 47cts. The query now is will mpesa bank maintain div pay above 47cts this yr and going forward? If not, the strong base at 7.50 will not sustain selling pressure if profit dips. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,800 Location: NAIROBI

|

It should come down to 7.50 or the whereabouts of 8 Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

At 5.00 i would buy. I know this may never happen in our lifetime but that's my price for it at this time. Like many people, i should've bought at 3.00 and never sold if performance maintained The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: New-farer Joined: 12/27/2013 Posts: 87

|

When you see the cloud dont conclude it must rain. This elephant has laid serious strategy that will shock may as it maintain position. GOOD TO GREAT. KINGOTORE

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

hisah wrote:Signs off topping out are now evident... I'm very keen with mpesa bank since it's an elephant part of the index weight. If the elephant falls, so does the index.  As per script. @SufficientlyP

|

|

|

Wazua

»

Investor

»

Stocks

»

Safaricom FY 2014 results +31% profit after tax

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|