Wazua

»

Investor

»

Stocks

»

Elliott Wave Analysis Of The NSE 20

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

sparkly wrote:mnandii wrote:mkeiy wrote:sparkly wrote:Jaina wrote:@ Mnandii whats the conclusion to your analysis in layman terms Sell your holdings and wait for the prices we last saw in March 2009. In other words the nse will fall by 47%. Are you guys saying regardless of how the economy is managed,the Nse will always stick to that script? I don't think so. There will be a correction but not as significant as 2009. Yes. The script is waves of emotion. You see, all financial markets follow the pattern of human social mood. When people acting collectively have a positive mood, the same is reflected in how they act. So they push the price of the market up. When social mood becomes negative the price of financial iinstruments fall. So the stock market is a gauge of social mood. And this discussion brings us to social causality. Events outside the market (interest rates, wars etc ) do not determine the path of the market. When CB change rates they are only REACTING to the market! E.G. How comes CB forecasts of the rate of growth are never met? And we continue to trust their ability to determine how the economy fairs? Social mood determine the direction of the market. Socionomics Explained @Mnandii this is a theory and i am sure there are critiques to the theory. My theory is that the so called boom & bust economic cycles are not inevitable paths but are triggered by the financial industry through monetary expansion & contraction cycles. No problem. But I believe in order to get the best perspective, you should at least do more research on the subject. At that point then you will be in a very good position to state the merits and demerits. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

The Financial/Economic Dichotomy in Social Behavioral Dynamics: The Socionomic Perspective Robert R. Prechter, Jr. and Wayne D. Parker Neoclassical economics does not offer a useful model of finance, because economic and financial behavior have different motivational dynamics. The law of supply and demand operates among rational valuers to produce equilibrium in the marketplace for utilitarian goods and services. The efficient market hypothesis (EMH) is a related model applied to financial markets. The socionomic theory of finance (STF) posits that contextual differences between economics and finance produce different behavior, so that in finance the law of supply and demand is irrelevant, and EMH is inappropriate. In finance, uncertainty about valuations by other homogeneous agents induces

unconscious, non-rational herding, which follows endogenously regulated fluctuations in social

mood, which in turn determine financial fluctuations. This dynamic produces non-mean-reverting dynamism in financial markets, not equilibrium. linkConventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

mnandii wrote:The Financial/Economic Dichotomy in Social Behavioral Dynamics: The Socionomic Perspective Robert R. Prechter, Jr. and Wayne D. Parker Neoclassical economics does not offer a useful model of finance, because economic and financial behavior have different motivational dynamics. The law of supply and demand operates among rational valuers to produce equilibrium in the marketplace for utilitarian goods and services. The efficient market hypothesis (EMH) is a related model applied to financial markets. The socionomic theory of finance (STF) posits that contextual differences between economics and finance produce different behavior, so that in finance the law of supply and demand is irrelevant, and EMH is inappropriate. In finance, uncertainty about valuations by other homogeneous agents induces

unconscious, non-rational herding, which follows endogenously regulated fluctuations in social

mood, which in turn determine financial fluctuations. This dynamic produces non-mean-reverting dynamism in financial markets, not equilibrium. link When a person buys bread, he derives immediate utility from it i.e he can EAT the bread and satisfy his hunger. When you buy shares, you get a share certificate. There is nothing that you can do with the share certificate which can provide immediate utility (i.e you can't EAT it, you can't LIVE in it etc). Your only hope is that someone else will be able to buy the shares from you at a higher price. And that's why the valuations in Financial markets differ from, say, the value of a car. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Veteran Joined: 2/10/2010 Posts: 1,001 Location: River Road

|

Good stuff @mnadii, as a fundamentals I don't rely on the cartoons but I moved out of the equities into the money markets as the general economic mood didn't look good for equities. In my view equities will generally be flat market over the next two years, but all the same a significant correction is welcome

|

|

|

Rank: New-farer Joined: 11/17/2013 Posts: 80 Location: Juja

|

Technically if you are bullish safcom you should be bullish NSE20, the two track each other because of the weighted average. On a long enough timeline, the life expectancy of everyone drops to zero.

|

|

|

Rank: New-farer Joined: 11/17/2013 Posts: 80 Location: Juja

|

EABL Bullish set-up On a long enough timeline, the life expectancy of everyone drops to zero.

|

|

|

Rank: Elder Joined: 5/25/2012 Posts: 4,105 Location: 08c

|

mchambuzi wrote: EABL Bullish set-up C&P  Pesa Nane plans to be shilingi when he grows up.

|

|

|

Rank: New-farer Joined: 11/15/2013 Posts: 34

|

Pesa Nane wrote:mchambuzi wrote: EABL Bullish set-up C&P  Thanks. That's a beautiful strong rejection

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

Get free two weeks trial of Elliott Wave International Publications. The Financial Forecast service costs USD 59 per month. If, toward the end of the two weeks you feel the subscriptions are not for you,, then you can e-mail Elliott Wave International (EWI) to cancel your subscription. You will not be charged a dime. linkFinancial Forecast Service gives you: The Elliott Wave Financial Forecast The Elliott Wave Theorist (Monthly)Once per month, you get Bob Prechter's legendary insights into when, where and why the waves are unfolding in the markets and throughout society. Each Theorist provides unparalleled insight into sociological and psychological signals in various arenas. Read for yourself to see why so many influential thinkers and market-watchers consider The Theorist a must-read publication each month. Short Term Update The Elliott Wave Financial Forecast (Monthly) Tracks intermediate-term patterns in the U.S. markets and forecasts upcoming price movements. You get monthly wave analysis of stocks, bonds, metals and the U.S. dollar, plus economic and social trends. Short Term Update The Short Term Update (Mon, Wed, Fri) Each Mon, Wed, Fri, you get forecasts and analysis for the next day's market trends and turns. You get Elliott wave charts and commentary for stocks, bonds, metals and the U.S. dollar. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

What Are Elliott Waves?For over a century, keen market observers have noted that the financial markets tend to follow patterns. In the 1930s an accountant named R.N. Elliott discovered and chronicled the definitive list. Across the generations since, many of the financial industry's most successful strategists and traders have used "Elliott's waves" to predict the markets' moves. Today the Elliott Wave Principle is one of the most established forms of technical analysis in the world. With its analysts covering every major financial market around the globe, Elliott Wave International is the most recognized name in its field and its work is prized by both professionals in the largest financial firms and individual investors alike. About Your AnalystsWhen you become a subscriber to the Financial Forecast Service, you put these guys - and their unique insights - to work for you. ROBERT PRECHTERis a legendary market theorist and one of the most prolific financial and economic authors alive today, having published 14 books. His ideas and insights are among the most discussed and recognized by industry and financial media professionals today. Bob has been writing The Elliott Wave Theorist continuously since 1979, making it one of the longest-running and best-known market publications in the business. STEVEN HOCHBERGbecame co-editor of The Elliott Wave Financial Forecast with its inaugural issue in July 1999. Steve also edits the M-W-F Short Term Update and is a recognized speaker at major news outlets and financial conferences. He features regularly on CNBC, CNN, Fox News, the Wall Street Journal, and USA today PETER KENDALLjoined EWI as a researcher in 1992 and has contributed to The Elliott Wave Theorist since 1995. He has been co-editor of The Elliott Wave Financial Forecast since its inception in July 1999. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

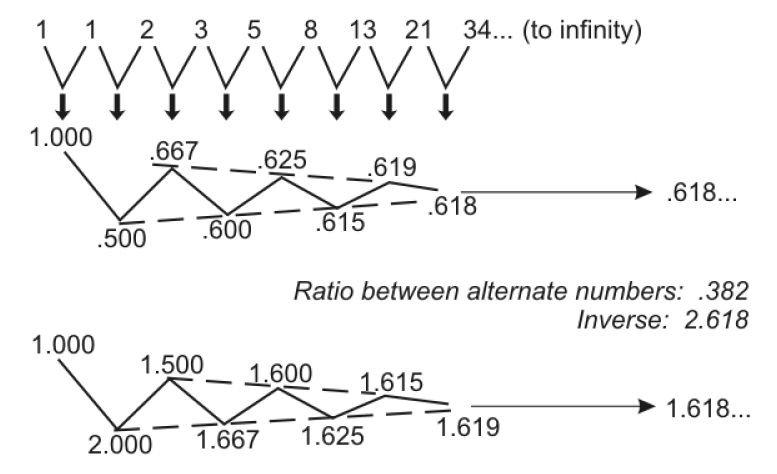

Golden Ratio in Human Being  Golden Ratio in DNA  Fibonacci Mathematics  Human Body and the Golden Ratio Human Body and the Golden RatioConventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

Applying Fibonacci to Stock Market PatternsConventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

mkonomtupu wrote:Good stuff @mnadii, as a fundamentals I don't rely on the cartoons but I moved out of the equities into the money markets as the general economic mood didn't look good for equities. In my view equities will generally be flat market over the next two years, but all the same a significant correction is welcome Good for you. I think it is the better at the moment especially with Kenya where you can't short the market. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Hello Joined: 3/25/2014 Posts: 1

|

My theory is that the so called boom & bust economic funny gifs

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

In Elliot Wave Analysis there are only three RULES to keep in mind. Rules should never be broken. RULE 1: The second wave never retraces more than 100% of the first wave. RULE 2: The third wave is never the shortest wave among waves one, three and five. RULE 3: The fourth wave should not enter the territory of the first wave. Let's see a Safcom chart:  In this safcom chart: Wave i = (6.10 - 2.50) = 3.60 Wave ii = (6.10 - 2.70) = 3.40 Wave iii = (11.20 - 2.70)= 8.50 Applying Golden Ratio in Wave iii Wave iii @11.20 =(Wave i X 1.618)+2.70 100% ACCURACY!!! Wave iv = (11.20-9.60)= 1.60 Therefore, Wave iv is approximately half of Wave ii. Wave v = 12.80-9.60 = 3.20 Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

Quote:In a move to encourage foreign investor trading, the CMA master plan proposes removing the requirement for pre-funding, which can then allow short selling. Direct Trading WindowConventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Member Joined: 2/16/2013 Posts: 123 Location: MSA

|

@Mnandii how about extrapolating the same with KenyaRe see if the same holds! Timely advice is as lovely as golden apples in a silver basket. Proverbs 25:11

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

SittingPretty wrote:@Mnandii how about extrapolating the same with KenyaRe see if the same holds! You mean applying Elliott Waves to the Kenya Re share? Ok. Give me alittle time. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

Just like the other counters in NSE it appears Kenya Re has also done five waves up (i.e from the 19/12/2011 low of 5.83). Therefore, a large correction is due whcih should take the share to at least 13.10 level (wave 4). Notice that the share has been making new highs yet RSI has been diverging. NB: Considering the almost vertical move to the 20.75 level and then the sideways move of late, wave 5 may not be complete yet. So a small move above 20.75 is still in the cards. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,931

|

Ati a correction to 13 bob, you will kill some of us! :  -)  In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Wazua

»

Investor

»

Stocks

»

Elliott Wave Analysis Of The NSE 20

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|