Wazua

»

Investor

»

Stocks

»

Playing the market 2014 - 2016

Rank: Elder Joined: 2/10/2007 Posts: 1,587

|

stocksmaster wrote:murchr wrote:stocksmaster wrote:Metasploit wrote:Metasploit wrote:[quote=dunkang]I am thinking of picking KPLC (~13) or KenGen (~12), but am worried about the GoK anti-business inteference in the energy sector. it worries alot. Too political. http://allafrica.com/stories/201401030404.html[/quote] For trading,Kengen is good.It always swings and now it is really oversold.Rebound in the offing.Just like Safcom,it doesnt disappoint traders With a forthcoming 1:1 rights issue within the next 3-6 months, it will be interesting to see if the government will take up its rights. If it doesn't, then its 70% shareholding should reduce to 35% and a reorganisation of the mainly politically appointed board of directors should follow. Kengen needs a serious anchor shareholder with expertise In energy sector (equivalent of Vodafone in Safaricom). Before the rights are done and dusted, the share should be available at the Ksh 10 price levels as the market waits to see the governments move as concerns the rights (hopefully it will sell its rights to an anchor shareholder) in addition to the rights pricing. Happy hunting. I believe so too about GOK and KENGEN tho the Gov is keen on the sector so they will make sure they are the major shareholder tho diluted. I think there is a reason why GE is here...am watching I suspect GE wants in. The investments projected do need the stewardship of such a player. However, i doubt GE would invest without Board control. Happy hunting. @Stockmaster, Many thanks for your great analysis and this time in coming for along haul. Even though everyone seems to agree with you except on TPS, I do agree that TPS will deliver good results over the said period. Regional diversification is key and it is likely that tourism growth will be quite good in the region. Despite the terrorists events in Kenya, peace in Somalia will ultimately yield dividends. Already, Tanzania has overtaken Kenya in terms of tourist numbers. The potential in the region is huge. Within the 3 year time horizon, me thinks, industrial stocks will play a key role. On this front, i pick KPLC and Kengen to lead the front. The government focus in increasing electricity generation by almost 400% within four years should surely spur growth in these sectors. Many players will be involved including GE as mentioned, but also traditional players who form the chain of geothermal developments. On the banking sector, in auditioned to the aforementioned banks by Stockmaster, I front NBK to perform well. If government decides to divest, especially after the restructuring, NBK should yield fantastic capital appreciation. The other sleeping giant is COOP. The LAPSSET project is now a reality and together with associated infrastructure should drive the construction industry. Beneficiaries should be cement companies mainly. If BOC repositions itself well, it's should be a major player in the railway construction industry by supplying oxygen for welding works. Happy New Year and great investment results to Wazuans.

|

|

|

Rank: Member Joined: 9/26/2006 Posts: 454 Location: CENTRAL PROVINCE

|

VituVingiSana wrote:stocksmaster wrote:Metasploit wrote:Metasploit wrote:[quote=dunkang]I am thinking of picking KPLC (~13) or KenGen (~12), but am worried about the GoK anti-business inteference in the energy sector. it worries alot. Too political. http://allafrica.com/stories/201401030404.html[/quote] For trading,Kengen is good.It always swings and now it is really oversold.Rebound in the offing.Just like Safcom,it doesnt disappoint traders With a forthcoming 1:1 rights issue within the next 3-6 months, it will be interesting to see if the government will take up its rights. If it doesn't, then its 70% shareholding should reduce to 35% and a reorganisation of the mainly politically appointed board of directors should follow. Kengen needs a serious anchor shareholder with expertise In energy sector (equivalent of Vodafone in Safaricom). Before the rights are done and dusted, the share should be available at the Ksh 10 price levels as the market waits to see the governments move as concerns the rights (hopefully it will sell its rights to an anchor shareholder) in addition to the rights pricing. Happy hunting. Too many contracts up for grabs for GoK to let their shareholding fall below 50% + 1 My thoughts exactly. Too much money at play for this company to remain a parastatal. That board needs a moderating influence of a strong corporate entity like GE. Happy Hunting.

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

VituVingiSana wrote:stocksmaster wrote:Metasploit wrote:Metasploit wrote:[quote=dunkang]I am thinking of picking KPLC (~13) or KenGen (~12), but am worried about the GoK anti-business inteference in the energy sector. it worries alot. Too political. http://allafrica.com/stories/201401030404.html[/quote] For trading,Kengen is good.It always swings and now it is really oversold.Rebound in the offing.Just like Safcom,it doesnt disappoint traders With a forthcoming 1:1 rights issue within the next 3-6 months, it will be interesting to see if the government will take up its rights. If it doesn't, then its 70% shareholding should reduce to 35% and a reorganisation of the mainly politically appointed board of directors should follow. Kengen needs a serious anchor shareholder with expertise In energy sector (equivalent of Vodafone in Safaricom). Before the rights are done and dusted, the share should be available at the Ksh 10 price levels as the market waits to see the governments move as concerns the rights (hopefully it will sell its rights to an anchor shareholder) in addition to the rights pricing. Happy hunting. Too many contracts up for grabs for GoK to let their shareholding fall below 50% + 1 I doubt GOK will provide the necessary 21Billion... I also suspect a big player might be coming in! Unlike power distribution GOK has no problem liberalizing power production! That is one of the reasons I prefer Kengen to KPL! Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

My NSE portfolio looks a little like this... 1. HFCK - 25% 2. Co op - 20% 3. Bamburi - 15% 4. Kenya re - 8% 5. Scangroup - 8% 6. C & G - 6% 7. Unga - 5% 8. Standard Group - 5% 9. Home Afrika - 4% 10. EA Cables - 4% I do not intend to add/subtract any stocks in 2014 but I will increase on the current positions! Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

If GE and Gov invest together, is the best we can expect like KQ=Gov+klm? lets hope not. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

Aguytrying wrote:If GE and Gov invest together, is the best we can expect like KQ=Gov+klm? lets hope not. I dont think the same will happen because the airline industry is just a bad investment anywhere in the world! Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Member Joined: 9/26/2006 Posts: 454 Location: CENTRAL PROVINCE

|

guru267 wrote:Aguytrying wrote:If GE and Gov invest together, is the best we can expect like KQ=Gov+klm? lets hope not. I dont think the same will happen because the airline industry is just a bad investment anywhere in the world! True...the problem is the business not the partnership. Airline industry is struggling but energy is big business especially in a developing economy. Happy Hunting.

|

|

|

Rank: New-farer Joined: 9/20/2010 Posts: 79

|

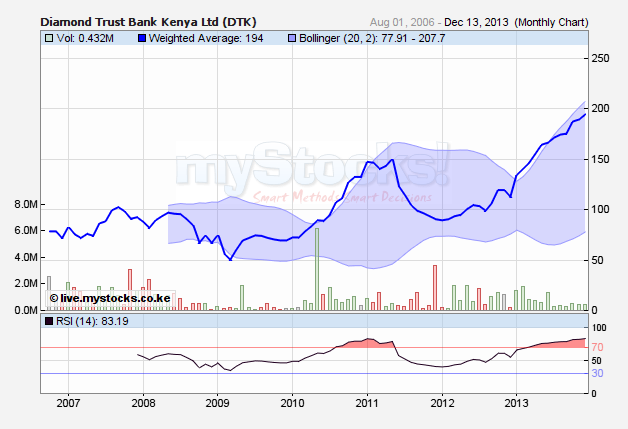

@stocksm bold of yu playing DTB once again.Wish yu well.Will yu be playing KK as back then?nice of yu maintaining the tradition of your yearly picks.

Wonder what @deal has to say this time on your picks.

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

scouting for dtb when it’s at an all time high

|

|

|

Rank: Hello Joined: 1/6/2014 Posts: 1

|

Hello Wazuans, Thanks @Stocksmaster for your commentary. I have been following you passively for the past one year and hope to invest as per your guidance in this new year! Psalm 90: 17 May your favor be on us, Lord our God; make our endeavors successful; yes, make our endeavors secure!

|

|

|

Rank: Member Joined: 3/26/2012 Posts: 830

|

Mirena wrote:Hello Wazuans,

Thanks @Stocksmaster for your commentary. I have been following you passively for the past one year and hope to invest as per your guidance in this new year! What happened to independent thinking? A successful man is not he who gets the best, it is he who makes the best from what he gets.

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

S.Mutaga III wrote:Mirena wrote:Hello Wazuans,

Thanks @Stocksmaster for your commentary. I have been following you passively for the past one year and hope to invest as per your guidance in this new year! What happened to independent thinking? Another Hello starting by saying "hello wazuans". No disrespect @Mirena, just driving home a point. Life is short. Live passionately.

|

|

|

Rank: Member Joined: 1/1/2010 Posts: 518 Location: kandara, Murang'a

|

sparkly wrote:S.Mutaga III wrote:Mirena wrote:Hello Wazuans,

Thanks @Stocksmaster for your commentary. I have been following you passively for the past one year and hope to invest as per your guidance in this new year! What happened to independent thinking? Another Hello starting by saying "hello wazuans". No disrespect @Mirena, just driving home a point. You were never nice to monos in high School, were you Sparks? Foresight..

|

|

|

Rank: Member Joined: 5/8/2007 Posts: 709

|

guru267 wrote:My NSE portfolio looks a little like this...

1. HFCK - 25%

2. Co op - 20%

3. Bamburi - 15%

4. Kenya re - 8%

5. Scangroup - 8%

6. C & G - 6%

7. Unga - 5%

8. Standard Group - 5%

9. Home Afrika - 4%

10. EA Cables - 4%

I do not intend to add/subtract any stocks in 2014 but I will increase on the current positions! HFCK- wish i got this share instead of Kenya Power,Either way Feb i will purchase a chunk.

|

|

|

Rank: Member Joined: 9/14/2011 Posts: 864 Location: nairobi

|

who understands the behaviour of Kenya Re price

Based on the book value the price is very undervalued but it seems its not going up

Anyone with updates on their performance for 2013?

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

heri wrote:who understands the behaviour of Kenya Re price

Based on the book value the price is very undervalued but it seems its not going up

Anyone with updates on their performance for 2013? The market is jittery about 2013 results because of Westgate, JKIA, South Sudan etc.. Its still the perfect long term play! Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Elder Joined: 6/2/2011 Posts: 4,818 Location: -1.2107, 36.8831

|

heri wrote:who understands the behaviour of Kenya Re price

Based on the book value the price is very undervalued but it seems its not going up

Anyone with updates on their performance for 2013? It looks very good on previous year financial data, but the JKIA fire and West Gate Terrorism Compensations MAY make it cheaper during this year's FY reporting. So am staying out for now. Receive with simplicity everything that happens to you.” ― Rashi

|

|

|

Rank: Member Joined: 2/16/2013 Posts: 123 Location: MSA

|

In the spirit of disclosure!! My 2013 closing Portfolio: Coop: 29% EQTy: 12% NIC: 22% SAFC: 21% KK: 16% A bag of mixed results. A return of 20.97% I was and am still a novice, much thanks to @Hisah, @Obiero and @Stockmaster. Influenced almost 99% of my purchases. For 2014: Safc: Hold Long Term Coop: Hold Long Term KK: Hold not sure for how long NIC& EQTY: Sell after results Kengen: Buy before and accumulate after rights issue, with any new cash for long long term. Timely advice is as lovely as golden apples in a silver basket. Proverbs 25:11

|

|

|

Rank: New-farer Joined: 4/6/2013 Posts: 95

|

SittingPretty wrote:In the spirit of disclosure!!

My 2013 closing Portfolio:

Coop: 29%

EQTy: 12%

NIC: 22%

SAFC: 21%

KK: 16%

A bag of mixed results. A return of 20.97%

I was and am still a novice, much thanks to @Hisah, @Obiero and @Stockmaster. Influenced almost 99% of my purchases.

For 2014:

Safc: Hold Long Term

Coop: Hold Long Term

KK: Hold not sure for how long

NIC& EQTY: Sell after results

Kengen: Buy before and accumulate after rights issue, with any new cash for long long term.

I do not get how wazua ignore Carbacid, kenokobil, Equity and Williamson tea. These counters will pull a surprise to many in 2014 by H1. Monopoly was the industrial age money game and the name of the new game of money today in the information age is CASHFLOW

|

|

|

Rank: Member Joined: 9/16/2006 Posts: 234

|

i agree with you on kenol kobil. “I don’t regret the things I’ve done, I regret the things I didn’t do when I had the chance.”

|

|

|

Wazua

»

Investor

»

Stocks

»

Playing the market 2014 - 2016

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|