Wazua

»

Investor

»

Economy

»

Investors Lounge

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

hisah wrote:[quote=Cde Monomotapa]As the (economic) world turns...Chinese Yuan Surpasses Euro, Becomes Second Most Used Currency In Trade Finance http://tinyurl.com/l4ho4c2[/quote] The yuan growth as per SWIFT statistics is a parabolic! From 1.69% share of trade finance in Jan 2012 to 8.66% in Oct 2013.

Top 5 nations using the yuan are China, HongKong, Singapore, Germany and Australia. Yes, ze Germans that are ze pillar of ze euro...!. Is this why they're asking for their gold reserves from the USD vault masters...

It'll be interesting to watch how the BRICs bank will pan out vs WB/IMF...

This crossroad must be resolved soon...

#Greatest wealth transfer episode. Can't miss it, won't miss it

Interesting! "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

There's a £60m Bitcoin heist going down right now, and you can watch in real-time"There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

A decade* later... MEIKLES, ZW, says close to debt resolution, profit up to $37 mln from $767 000 - "The group is owed $76, 5 million by the central bank which was seized from its Foreign Currency Account over a decade ago and Moxon said the money could retire its local short-term borrowings..." See more at: http://source.co.zw/2013...0/#sthash.2oSsN4lS.dpuf

Investor Relations page: www.meiklesinvestor.com [We need more of us such for NSE stocks]

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Russia Debates Outlawing US Federal Reserve Notes!? It doesn't get crazier than this... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

A nice article here on bubbles http://www.economist.com...-there-little-sign-mania"There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Volker rule vote .... Keep watching "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

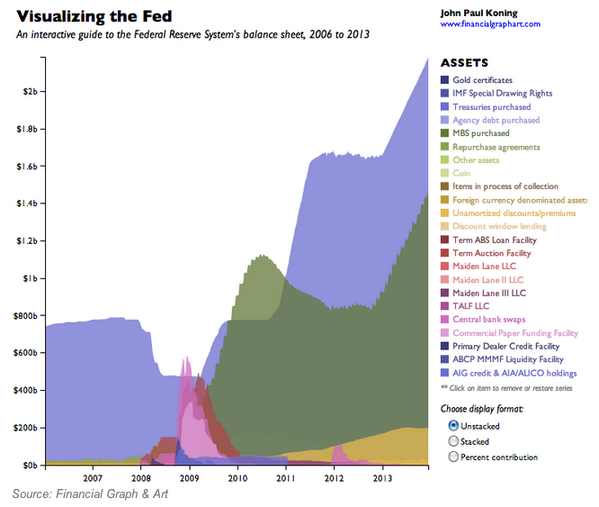

The FED now owns a third of the entire US bond market "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

murchr wrote: The FED now owns a third of the entire US bond market And the ponzi continues... But the day is fast approaching when the musical chairs game will stop. What will the world choose, crisis or opportunity?$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Dec 23rd 1913 - http://en.wikipedia.org/wiki/Federal_Reserve_Act

100yrs on this incredible ponzi. The game is unwinding beyond the masters control... This time the planet will wake up from the illusion  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

hisah wrote:Cde Monomotapa wrote:As the (economic) world turns...Chinese Yuan Surpasses Euro, Becomes Second Most Used Currency In Trade Finance http://tinyurl.com/l4ho4c2

The yuan growth as per SWIFT statistics is a parabolic! From 1.69% share of trade finance in Jan 2012 to 8.66% in Oct 2013.

Top 5 nations using the yuan are China, HongKong, Singapore, Germany and Australia. Yes, ze Germans that are ze pillar of ze euro...!. Is this why they're asking for their gold reserves from the USD vault masters...

It'll be interesting to watch how the BRICs bank will pan out vs WB/IMF...

This crossroad must be resolved soon...

#Greatest wealth transfer episode. Can't miss it, won't miss it

Hong Kong and Singapore the twin Asian financial centres have signed an MoU to rollout more yuan based financial products.

The sequence of events from the Asian tigers is accelerating negatively for the USD hegemony

#This crossroad must be resolved. Most will see crisis, few see the opportunity presented...

http://www.sovereignman....e-dollars-coffin-13241/

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

hisah wrote:hisah wrote:Cde Monomotapa wrote:As the (economic) world turns...Chinese Yuan Surpasses Euro, Becomes Second Most Used Currency In Trade Finance http://tinyurl.com/l4ho4c2

The yuan growth as per SWIFT statistics is a parabolic! From 1.69% share of trade finance in Jan 2012 to 8.66% in Oct 2013.

Top 5 nations using the yuan are China, HongKong, Singapore, Germany and Australia. Yes, ze Germans that are ze pillar of ze euro...!. Is this why they're asking for their gold reserves from the USD vault masters...

It'll be interesting to watch how the BRICs bank will pan out vs WB/IMF...

This crossroad must be resolved soon...

#Greatest wealth transfer episode. Can't miss it, won't miss it

Hong Kong and Singapore the twin Asian financial centres have signed an MoU to rollout more yuan based financial products.

The sequence of events from the Asian tigers is accelerating negatively for the USD hegemony

#This crossroad must be resolved. Most will see crisis, few see the opportunity presented...

http://www.sovereignman....e-dollars-coffin-13241/

BEIJING, Dec. 16 (Xinhua) -- The Ministry of Commerce (MOC) announced on Monday that it will further loosen control on cross-border yuan direct investment in an effort to facilitate investment. Under the new MOC regulation, approval procedures for yuan-denominated direct investment from overseas investors will be further simplified. The new regulation takes effect on Jan. 1, 2014. http://news.xinhuanet.co...13-12/16/c_132972346.htm

|

|

|

Rank: Member Joined: 4/14/2011 Posts: 639

|

hisah wrote:hisah wrote:Cde Monomotapa wrote:As the (economic) world turns...Chinese Yuan Surpasses Euro, Becomes Second Most Used Currency In Trade Finance http://tinyurl.com/l4ho4c2

The yuan growth as per SWIFT statistics is a parabolic! From 1.69% share of trade finance in Jan 2012 to 8.66% in Oct 2013.

Top 5 nations using the yuan are China, HongKong, Singapore, Germany and Australia. Yes, ze Germans that are ze pillar of ze euro...!. Is this why they're asking for their gold reserves from the USD vault masters...

It'll be interesting to watch how the BRICs bank will pan out vs WB/IMF...

This crossroad must be resolved soon...

#Greatest wealth transfer episode. Can't miss it, won't miss it

Hong Kong and Singapore the twin Asian financial centres have signed an MoU to rollout more yuan based financial products.

The sequence of events from the Asian tigers is accelerating negatively for the USD hegemony

#This crossroad must be resolved. Most will see crisis, few see the opportunity presented...

http://www.sovereignman....e-dollars-coffin-13241/

@Hisah,How will the eventual dollar collapse affect NSE ?

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

@hunderwear - a $ devaluation would rattle all markets. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

@hisah. Thought this could be of interest: Commodity Price Outlook & Risks - IMF http://www.imf.org/exter...f/cpor/2013/CPOR1213.pdf

|

|

|

Rank: Elder Joined: 12/2/2009 Posts: 2,458 Location: Nairobi

|

Yap! Lets open up the Yuan.. and see how it unravels with the whole currency control thing..

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Visualizing the fed's balance sheet  "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

[quote=Cde Monomotapa]@hisah. Thought this could be of interest: Commodity Price Outlook & Risks - IMF http://www.imf.org/exter.../cpor/2013/CPOR1213.pdf[/quote] Interesting it is...$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Ireland then Rome - http://www.independent.i...-in-court-29850636.html The confessions and the lawsuits... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Fed up? Nice headline that captures the mood - http://rt.com/op-edge/fe...s-dollar-manipulate-049/$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

[quote=hisah]Fed up? Nice headline that captures the mood - http://rt.com/op-edge/fe...-dollar-manipulate-049/[/quote] Nice read about the owners of this world. ....oh when the Fed..comes marching in  @SufficientlyP

|

|

|

Wazua

»

Investor

»

Economy

»

Investors Lounge

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|