Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

Solid demand building on monday accrossboard...and not yet q3 numbers...i feel like urinating in town streets. "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Hello Joined: 10/5/2013 Posts: 4

|

ericnyamufx wrote:inspectordanger wrote:Ericsson wrote:When KCB trades at a constant price of ksh.46.50 for 7 consecutive days the NSE has bottomed out sources tells me KCB will hit 60 next year hehhehe.   i amnot belittling you but NOBODY can dictate the price of any stock...The market has its own mind to think whats the fair value of any stock so go and tell those who said KCB will hit 60 bob next year to shut up ! well this is based on good company fundamentals, good economic outlook and the good books Kenya is in with IMF.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

When Kenya re which makes double the profit of ARM and is at par with Nation Media is trading at market cap of; 1/3 of ARM market cap 1/6 of NMG market capitalisation Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Ericsson wrote:When Kenya re which makes double the profit of ARM and is at par with Nation Media is trading at market cap of;

1/3 of ARM market cap

1/6 of NMG market capitalisation What makes it lag? "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

@murchr the market stupid is what makes it lag. Fundamentals of some companies are not taken into consideration in the NSE Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

KRA has released the collection for the first quarter of the 2013/2014.KENGEN,KPLC and East Africa Portland Cement are yet to release their full year results. Ahhhaaaa shame on you/them Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Rink for KRA; http://www.nation.co.ke/.../-/113ftmrz/-/index.htmlWealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

USD/KES cross is threatening to break below 85/- handle. KES muscular having broken below 87 and 86 handles with ease. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 9/29/2010 Posts: 679 Location: nairobi

|

hisah wrote:USD/KES cross is threatening to break below 85/- handle. KES muscular having broken below 87 and 86 handles with ease. was surprised at how fast the 200dma capitulated, i gues we may see a re test of the year high, whats your take hisah?

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

I dont know when i lastly witnessed the volumes moving in the nse across very many counters...mongolia could have started. "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,161 Location: nairobi

|

obiero wrote:hahaha. @all. i made my money from hfck and now im invested elsewhere i.e kcb @23.25, kq @10.95, bk @17 and coop @ 16.85.. sio kuringa/kuwaudhi, but ever since i alighted, the bus has not moved anywhere, naiona tu around the corner and i can even jog towards it, if i decide to proceed with the journey :) Im still in the money.. However, I have lost about KES 150,000 potential gain in Safaricom having sold a bit too early. You win some, you loose some

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

@hisah. kk has been trading very high volumes and defending or breaking down 8.00. something is clearly happening here. question is what? I'm not one to chase the overvalued foreign darlings. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Aguytrying wrote:@hisah. kk has been trading very high volumes and defending or breaking down 8.00. something is clearly happening here. question is what? I'm not one to chase the overvalued foreign darlings. I've noted this too as it lags the market. 8/- has held so far contrary to my expectations of a likely breakdown as per the chart pattern. The wedge is very tight now and a breakout either way below 7.90 or above 8.25 will confirm the direction. Wait for that break instead of guessing which side the price will head. NBK too is back testing 20. What a laggard bankster.

My lepers list still reads KK, MSC and KQ. And now NBK. KK and KQ want to ditch the list. NBK and MSC still sickly.

HAFR is too oversold, will likely bounce to 8 supported by the latest volume spike. Hard bounce, but caution with penny stocks since volatility can be crazy as @guru has experienced.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

kizee1 wrote:hisah wrote:USD/KES cross is threatening to break below 85/- handle. KES muscular having broken below 87 and 86 handles with ease. was surprised at how fast the 200dma capitulated, i gues we may see a re test of the year high, whats your take hisah? I have doubts KES will sustain these gains. GDP growth is already lagging. Eurobond has yet to be floated and declared successful. Once the current US shutdown issue is resolved as well as the debt ceiling issue, KES will definitely erase all those gains. Right now US bond CDS have spiked like when S&P downgraded the US debt rating back in Aug 2011.

Same script different time...$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 6/23/2011 Posts: 1,740 Location: Nairobi

|

The question is how to tell NSE has reached saturation levels

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

All this crazy volumes are high networth investors seeing more headroom and expect to reap profits above current prices. "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

streetwise wrote:The question is how to tell NSE has reached saturation levels Simple. When your local shopkeeper tells you that the stock market is the place to be. When normal chit chat with relatives or friends happens to mention how stocks have done wonders for them. When wazua forgets about land deals for a year plus. When wazua sees a flood of threads on various stocks being bullish with unrealistic targets without fundamental support. When your local broker issues several buy recos each month and severally emails/calls you to buy not to miss the opportunities.

And the clincher, when IPOs become the hottest thing in town. Just run... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

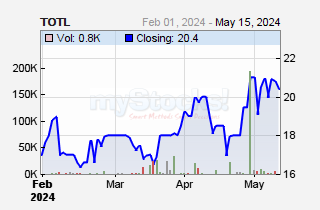

Total gone total parabolic... very bullish after the 18/- breakout. Only thin volumes (illiquid) keeps it out of my play list.  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 3/26/2012 Posts: 985 Location: Dar es salaam,Tanzania

|

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Sadly market psychology is not taught anywhere. So emotions will always bite hard. Also the markets must be fed losers in order to survive. Otherwise these markets would collapse like ponzi schemes which don't dish out losers i.e. bullish & bearish cycles.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|