Wazua

»

Investor

»

Stocks

»

KenolKobil & Total-Kenya Valuation and Recommendation

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Very likely to see 7.95 break down... Also watching HAFR, MSC and KQ.Paka too is acting up.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

I thot people believed in KK? "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

@murchr, its buy time for KK. Breakdown welcomed

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

mwekez@ji wrote:@murchr, its buy time for KK. Breakdown welcomed this is true. a return to the pyschological 10.00 will be a bus stop on the way back up. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Veteran Joined: 3/26/2012 Posts: 1,182

|

Aguytrying wrote:mwekez@ji wrote:@murchr, its buy time for KK. Breakdown welcomed this is true. a return to the pyschological 10.00 will be a bus stop on the way back up. In the old KK thread, 2014 was billed to be THE year. With all the water under bridge, which is THE new KK year? 2015? That would sound like a lifetime.

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

mkeiyd wrote:Aguytrying wrote:mwekez@ji wrote:@murchr, its buy time for KK. Breakdown welcomed this is true. a return to the pyschological 10.00 will be a bus stop on the way back up. In the old KK thread, 2014 was billed to be THE year. With all the water under bridge, which is THE new KK year? 2015? That would sound like a lifetime. 2013 is the year of recovery. 2014 the company will be dazzling. Capital gains will be made in this year of recovery and similarly in 2014 when all will be taking attention on the company. Choose is yours on when to buy. We choose to buy now

|

|

|

Rank: Veteran Joined: 3/26/2012 Posts: 1,182

|

mwekez@ji wrote:

2013 is the year of recovery. 2014 the company will be dazzling. Capital gains will be made in this year of recovery and similarly in 2014 when all will be taking attention on the company. Choose is yours on when to buy. We choose to buy now

@mwekez@ji, Any significant capital gains this year will be Christmas bonus for me, i'm not counting on any. Daylight will come after April 2014 [my hunch]. I too see blue. Which reminds me of the Tecno song by that title "Blue"

|

|

|

Rank: Veteran Joined: 3/26/2012 Posts: 1,182

|

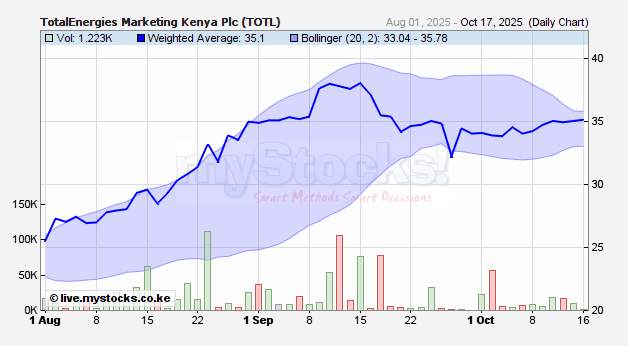

mwekez@ji wrote:Total Kenya

We have upgraded our estimates on Total Kenya and upgraded our recommendation from a SELL to a BUY and revised our fair value upwards to KES 37.68

(Source: Standard Investment Bank, 30.07.2013)

I don't think it will get to 37 as projected,overbought.

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

Raising 1.7b is a confidence tick for kk,if the big boys have faith,who am i to be left out by the discounted share price? "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

why is kenol trading very huge hidden volumes? "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Veteran Joined: 3/26/2012 Posts: 1,182

|

mlennyma wrote:why is kenol trading very huge hidden volumes? Ground shift? With Essar exiting Kprl for another strategic investor, kk's commercial paper & out of court settlements.

|

|

|

Rank: Elder Joined: 8/16/2011 Posts: 2,364

|

Total Kenya is totalling and when I recall 24/8= 3, I wonder if total is 3 times better than KK as of todate. KK a sister, No, Brother to Total is trading at 8 while Total is at 24. Which will way do you think the siblings must go to be together again? Has KK taken a vacation leaving the total to move alone on the wide berth or is total being aided by wind that may change direction? 24=8*3!!!!!!!!!!

|

|

|

Rank: Veteran Joined: 2/10/2010 Posts: 1,001 Location: River Road

|

Realtreaty wrote: Total Kenya is totalling and when I recall 24/8= 3, I wonder if total is 3 times better than KK as of todate. KK a sister, No, Brother to Total is trading at 8 while Total is at 24. Which will way do you think the siblings must go to be together again? Has KK taken a vacation leaving the total to move alone on the wide berth or is total being aided by wind that may change direction? 24=8*3!!!!!!!!!! Total was the first to heal its wounds by taking a loan from the mother company to clear the expensive bank debts. Total's normal price is 30-33/= KK on the hand realized its mistake a bit late and it may take time to get its groove back

|

|

|

Rank: Veteran Joined: 3/26/2012 Posts: 1,182

|

mkonomtupu wrote:Realtreaty wrote: Total Kenya is totalling and when I recall 24/8= 3, I wonder if total is 3 times better than KK as of todate. KK a sister, No, Brother to Total is trading at 8 while Total is at 24. Which will way do you think the siblings must go to be together again? Has KK taken a vacation leaving the total to move alone on the wide berth or is total being aided by wind that may change direction? 24=8*3!!!!!!!!!! Total was the first to heal its wounds by taking a loan from the mother company to clear the expensive bank debts. Total's normal price is 30-33/= KK on the hand realized its mistake a bit late and it may take time to get its groove back Even so,looking Total cartoon,it suggests overbought position on thin volumes. On Kk,people are digging their heels n the cartoon ain't bad.

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

Have you noticed that the big men are buying at strictly 8 and small men above 8? "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 9/15/2006 Posts: 3,907

|

KenolKobil paper raises Sh1.7 billion for operations http://www.businessdailyafrica....8/-/ldh5joz/-/index.htmlFinancing cost HY 2013 was 801m for Kenol, 154m for Total. A little wary with the improving USD/KES exchange rate - today at 84.90; it always seems to catch KenolKobil, KQ, Total, a little flat footed.

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

muganda wrote:A little wary with the improving USD/KES exchange rate - today at 84.90; it always seems to catch KenolKobil, KQ, Total, a little flat footed.

I actually thought a strengthening USD/KES is good for oil importers?? Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

Has kk hedged and if yes at what rate? "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Wazua

»

Investor

»

Stocks

»

KenolKobil & Total-Kenya Valuation and Recommendation

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|