Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

FUNKY wrote:The signing ceremony of the Memorandum of Understanding (MoU) between the Nairobi Securities Exchange (NSE) and the Shanghai Stock Exchange (SSE) was held today, at The Sarova Stanley Hotel. The two Exchanges have entered into a collaboration that will benefit the financial services industry in Kenya and the People’s Republic of China.

The MoU outlines the Exchanges’ areas for future collaboration that includes training of human capital, technology development, product development, mutual sharing of information and undertaking joint research projects. Yuan au RMB flood coming soon. MSCI then FTSE now SSE...$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

hisah wrote:FUNKY wrote:The signing ceremony of the Memorandum of Understanding (MoU) between the Nairobi Securities Exchange (NSE) and the Shanghai Stock Exchange (SSE) was held today, at The Sarova Stanley Hotel. The two Exchanges have entered into a collaboration that will benefit the financial services industry in Kenya and the People’s Republic of China.

The MoU outlines the Exchanges’ areas for future collaboration that includes training of human capital, technology development, product development, mutual sharing of information and undertaking joint research projects. Yuan au RMB flood coming soon. MSCI then FTSE now SSE...

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

Pow! WPP to acquire majority stake in Scangroup | 12 August 2013 | http://www.stockmarketwi...-stake-in-Scangroup.html

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

[quote=Cde Monomotapa]Pow! WPP to acquire majority stake in Scangroup | 12 August 2013 | http://www.stockmarketwi...stake-in-Scangroup.html[/quote]

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

|

|

|

Rank: Veteran Joined: 4/30/2010 Posts: 1,635

|

Some 15M shares valued at Kes.231M were traded in 1,400 deals, down from 28M shares that were valued at Kes.517M posted last Thursday.

The NSE 20 Share Index was up 12.47 points to stand at 4805.34.

All Share Index (NASI) closed 0.70 points higher to stand at 125.39.

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

Rich Today wrote:

We remain in a Bull Market.

The Fundamentals, the spike in Buy Outs and the charts are all bullish.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

mwekez@ji wrote:Rich Today wrote:

We remain in a Bull Market.

The Fundamentals, the spike in Buy Outs and the charts are all bullish.

Ride the bulls, when the bears show up, hug them "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Veteran Joined: 4/30/2010 Posts: 1,635

|

Turnover rose to Kes.327M from the previous session’s Kes.231M, the number of shares traded stood at 14M against 15M posted yesterday.

The NSE 20 Share Index was up 4.95 points to stand at 4810.29.

All share Index (NASI) eased 0.57 points to stand at 124.82.

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

@hisah. with most companies at one year/all time highs. are there any good(sound) companies to buy, not overvalued+cartoons in agreement. or is this the time to sit out of the market. oh I miss the bear. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Aguytrying wrote:@hisah. with most companies at one year/all time highs. are there any good(sound) companies to buy, not overvalued+cartoons in agreement. or is this the time to sit out of the market. oh I miss the bear. This is what TA is suggesting...

If it's a bullish break, then 5000 will get broken down towards 5200 - 5300. Otherwise 4400 then 4000 are the down targets.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

|

|

|

Rank: Veteran Joined: 4/30/2010 Posts: 1,635

|

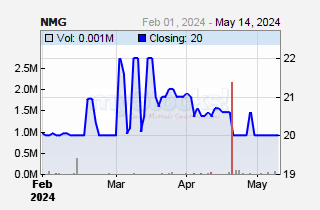

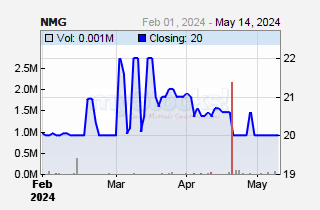

Buoyed by the sale of Nation Media Group shares, turnover soared to an all-time high of Kes.6.65bn on a hefty tally of 57M shares, up from Kes.327M on 14M shares posted yesterday.

The NSE 20 Share Index shed 11.24 points to stand at 4799.06.

All Share Index (NASI) was up 0.49 points to stand at 125.31.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

I'm putting this stock here to keep tabs of the crazy volume spike seen today as it moved 19.15M shares with a turnover of approx KES 6B with VWAP unchanged at 313.  Is this a swap deal? $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 3/26/2012 Posts: 985 Location: Dar es salaam,Tanzania

|

hisah wrote:I'm putting this stock here to keep tabs of the crazy volume spike seen today as it moved 19.15M shares with a turnover of approx KES 6B with VWAP unchanged at 313.  Is this a swap deal? And 99.92% of 19.15M was local(sale)-foreign( Buy)

“The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.”

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Watching this one too. Final support @12.90 or 2009 GFC low... KK has nosedived, KQ, then MSC and now KPLC is looking similar. All on the back of heavy volumes. Should the NSE flip the bull trend, the above counters will be in a serious winter blitz... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

hisah wrote: Watching this one too. Final support @12.90 or 2009 GFC low... KK has nosedived, KQ, then MSC and now KPLC is looking similar. All on the back of heavy volumes. Should the NSE flip the bull trend, the above counters will be in a serious winter blitz... The NSE 20 looks set to under perform the All share index in the short term! Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: New-farer Joined: 6/7/2010 Posts: 20 Location: Nairobi

|

hisah wrote:Aguytrying wrote:@hisah. with most companies at one year/all time highs. are there any good(sound) companies to buy, not overvalued+cartoons in agreement. or is this the time to sit out of the market. oh I miss the bear. This is what TA is suggesting...

If it's a bullish break, then 5000 will get broken down towards 5200 - 5300. Otherwise 4400 then 4000 are the down targets. But with interest rates rising and fed nearing tapering my bet is break lower.... Beautiful chart.. Which platform u took the screen shot? Would love to use it....

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Kenyanhustler wrote:hisah wrote:Aguytrying wrote:@hisah. with most companies at one year/all time highs. are there any good(sound) companies to buy, not overvalued+cartoons in agreement. or is this the time to sit out of the market. oh I miss the bear. This is what TA is suggesting...

If it's a bullish break, then 5000 will get broken down towards 5200 - 5300. Otherwise 4400 then 4000 are the down targets. But with interest rates rising and fed nearing tapering my bet is break lower.... Beautiful chart.. Which platform u took the screen shot? Would love to use it.... Free NSE20 chart by Bloomberg. Before making a call lower remember that yesterday witnessed a record single day turnover. I'm sure if one was to plot the turnover over a 5 or 10yr series, the call will lean on the bullish side. Note that volume spike...$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: New-farer Joined: 6/7/2010 Posts: 20 Location: Nairobi

|

hisah wrote:Kenyanhustler wrote:hisah wrote:Aguytrying wrote:@hisah. with most companies at one year/all time highs. are there any good(sound) companies to buy, not overvalued+cartoons in agreement. or is this the time to sit out of the market. oh I miss the bear. This is what TA is suggesting...

If it's a bullish break, then 5000 will get broken down towards 5200 - 5300. Otherwise 4400 then 4000 are the down targets. But with interest rates rising and fed nearing tapering my bet is break lower.... Beautiful chart.. Which platform u took the screen shot? Would love to use it.... Free NSE20 chart by Bloomberg. Before making a call lower remember that yesterday witnessed a record single day turnover. I'm sure if one was to plot the turnover over a 5 or 10yr series, the call will lean on the bullish side. Note that volume spike... Yesterday was 10.10% of all listed sharesblock trade on nmg.. Worthy 6b I agree we are in bull trend but with d Safcom almost closing books.. I wouldn't be much a bull here.. Mpesa bank and nse20 highly correlated.. So as it goes down so will nse.. But 4300 to 4500 zone will provide support for bargains going to Q3 results season...

|

|

|

Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|